Restoring Fiscal Responsibility In Canada: An Alternative Vision

Table of Contents

Reforming Government Spending

Restoring fiscal responsibility in Canada necessitates a comprehensive review of government spending. This involves both reducing inefficiencies and prioritizing essential services.

Targeting Inefficiencies

Eliminating wasteful spending is crucial. This requires a multi-pronged approach:

- Independent Audits: Regular, independent audits of all government programs are needed to identify areas of inefficiency and duplication. These audits should be publicly accessible, promoting transparency and accountability in government spending.

- Performance-Based Budgeting: Shifting from line-item budgeting to performance-based budgeting ensures that funds are allocated to programs that demonstrably deliver results. This requires clear metrics and regular evaluations to measure the effectiveness of government initiatives. This approach directly impacts Canada's fiscal health.

- Streamlining Bureaucracy: Reducing bureaucratic red tape and streamlining administrative processes can significantly reduce costs. This includes leveraging technology to improve efficiency and eliminate redundant tasks, all contributing to improved fiscal management in Canada.

Prioritizing Essential Services

While reducing unnecessary spending is vital, essential services like healthcare and education must remain adequately funded. Strategic investments are key to long-term fiscal sustainability:

- Preventative Healthcare: Investing in preventative healthcare measures can significantly reduce long-term healthcare costs. This includes promoting healthy lifestyles, early disease detection, and improved access to primary care. This is a crucial aspect of long-term fiscal planning in Canada.

- Educational Investment: Improving educational outcomes through targeted funding and innovative teaching methods yields a more productive workforce and a stronger economy, positively impacting Canada's fiscal future.

- Public-Private Partnerships: Exploring effective public-private partnerships for large-scale infrastructure projects can leverage private sector expertise and reduce the upfront financial burden on the government, improving the long-term fiscal outlook for Canada.

Increasing Revenue Generation

Simply cutting spending isn't enough; Canada needs to increase revenue sustainably and responsibly. This requires a multifaceted approach:

Tax Reform

A thorough review of the Canadian tax system is essential to address loopholes and ensure fairness. Key areas for reform include:

- Closing Tax Loopholes: Addressing tax loopholes exploited by corporations and high-income earners will generate significant additional revenue. This requires careful consideration of tax policy and international tax regulations.

- Revenue-Neutral Carbon Tax: Implementing a carbon tax with revenue recycling can both address climate change and generate revenue. Revenue from the carbon tax should be reinvested in green initiatives and support for affected industries.

- Progressive Taxation: Revisiting tax brackets to ensure a more progressive taxation system can generate more revenue from higher-income earners while easing the burden on low and middle-income Canadians.

Economic Growth Initiatives

Stimulating economic growth naturally increases tax revenue. Key strategies include:

- Strategic Infrastructure Investment: Investing in key infrastructure projects creates jobs, boosts productivity, and stimulates economic growth, leading to increased tax revenue and improved fiscal health.

- Innovation and R&D: Supporting innovation and technological advancements through increased funding for research and development fosters a more competitive economy and generates long-term economic growth.

- Business-Friendly Environment: Creating a business-friendly environment attracts foreign investment, encourages entrepreneurship, and stimulates job creation, all contributing to increased tax revenue and improved fiscal responsibility in Canada.

Enhancing Transparency and Accountability

Canadians deserve to know how their tax dollars are spent. Strengthening transparency and accountability is crucial for restoring trust and ensuring responsible fiscal management:

Open Government Data

Making government data publicly accessible allows citizens to scrutinize spending decisions and hold the government accountable. This improves transparency and strengthens public trust.

Independent Oversight Bodies

Strengthening the role of independent oversight bodies to monitor government spending and ensure compliance with fiscal rules is critical. These bodies should have the authority to investigate potential wrongdoing and make recommendations for improvement.

Public Engagement

Actively engaging the public in discussions about fiscal policy fosters greater understanding and support for responsible spending decisions. Public consultations and town halls can help shape fiscal policy and ensure it reflects the needs and priorities of Canadians.

Conclusion

Restoring fiscal responsibility in Canada requires a multifaceted approach encompassing responsible spending, increased revenue generation, and enhanced transparency and accountability. This alternative vision moves beyond simple austerity, focusing on sustainable, long-term solutions. By implementing the strategies outlined above – reforming government spending, increasing revenue generation, and enhancing transparency and accountability – Canada can secure its fiscal future and build a more prosperous nation. Let's work together to champion fiscal responsibility in Canada and build a brighter future for all.

Featured Posts

-

Analyzing Hegseths Actions Trumps Agenda And The Signal App Issue

Apr 24, 2025

Analyzing Hegseths Actions Trumps Agenda And The Signal App Issue

Apr 24, 2025 -

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025

Sophie Nyweide Child Actor In Mammoth And Noah Dies At 24

Apr 24, 2025 -

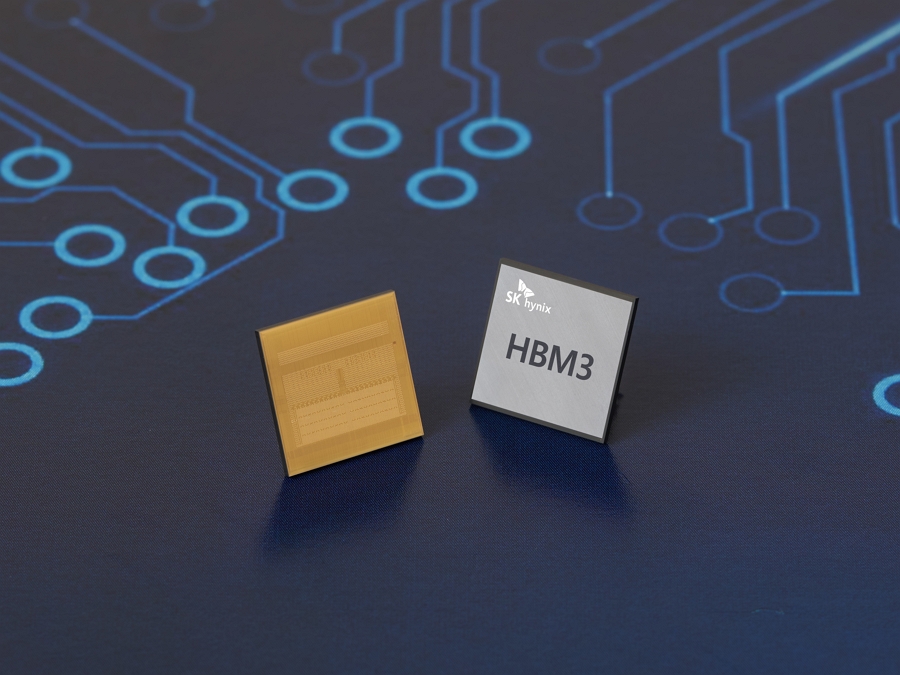

Dram Market Shift Sk Hynixs Ai Powered Lead Over Samsung

Apr 24, 2025

Dram Market Shift Sk Hynixs Ai Powered Lead Over Samsung

Apr 24, 2025 -

Indias Nifty Index Analyzing Recent Market Growth And Trends

Apr 24, 2025

Indias Nifty Index Analyzing Recent Market Growth And Trends

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025