Retail Sales Growth: A Setback For Expected Bank Of Canada Rate Decrease

Table of Contents

Unexpected Strength in Retail Sales Figures

July 2024's retail sales data surprised analysts, showcasing a significant 1.2% increase compared to June. This figure surpasses expectations and marks a substantial uptick in consumer spending. Several factors contributed to this unexpected strength:

- Increased Consumer Spending: Consumers demonstrated a willingness to spend despite persistent inflationary pressures. This could be attributed to pent-up demand following the pandemic or increased confidence in the economy.

- Impact of Inflation on Purchasing Habits: While inflation remains a concern, consumers may be adjusting their spending habits rather than drastically cutting back. This shift involves prioritizing essential goods and services while potentially delaying or forgoing discretionary purchases.

- Government Stimulus Programs: While no major new stimulus programs were launched in July, the lingering effects of past initiatives could be contributing to consumer spending. Further research is needed to quantify this impact.

- Seasonal Factors: While July typically sees some increase in retail sales due to summer spending, the magnitude of the increase was unexpected.

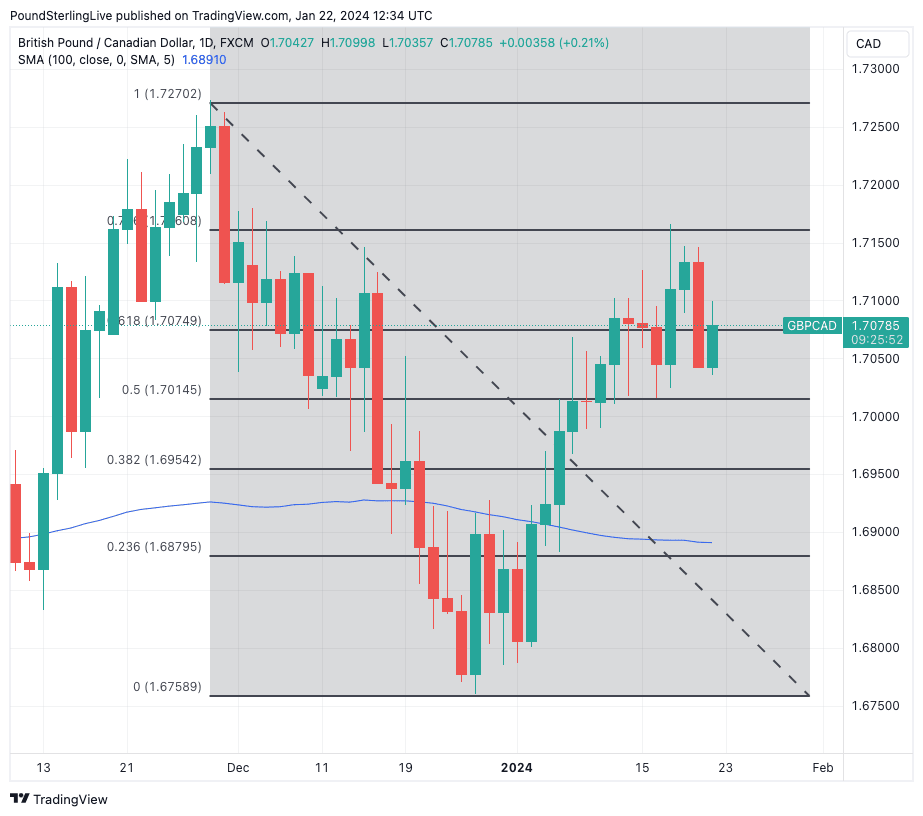

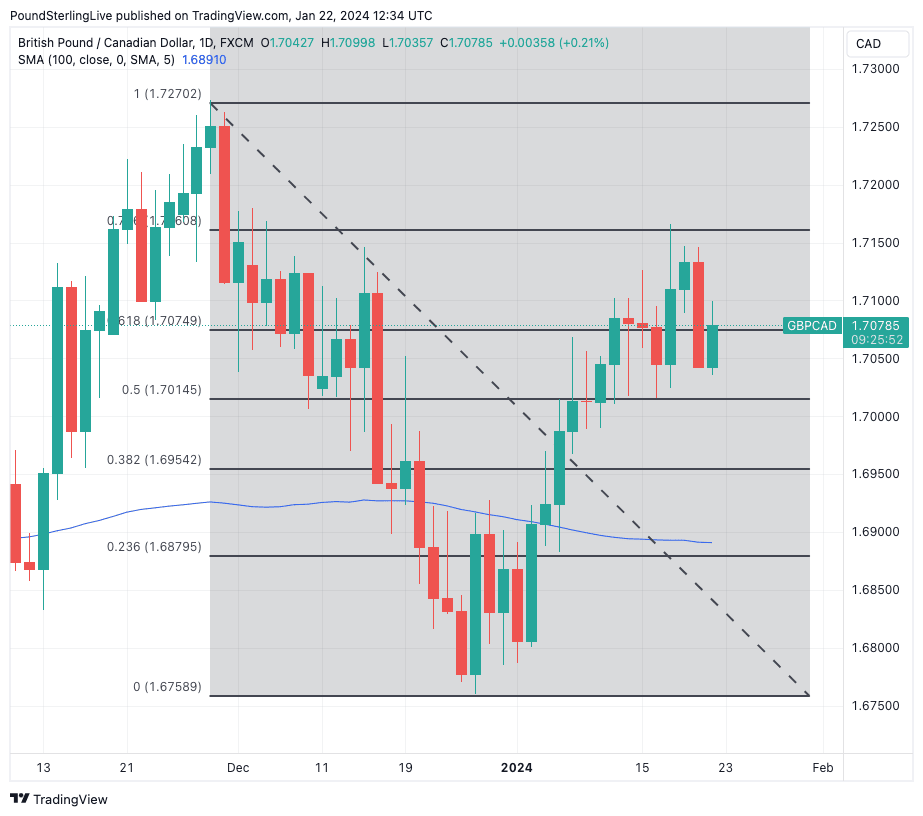

[Insert Chart/Graph here showing Retail Sales Growth data for the past few months. Alt text: "Chart depicting Canadian retail sales growth from [Start Date] to [End Date], highlighting the unexpected surge in July 2024."]

Implications for the Bank of Canada's Monetary Policy

The Bank of Canada's mandate is to maintain price stability and full employment. Strong retail sales figures, however, fuel inflation expectations, directly impacting the central bank's decision-making process. The robust Retail Sales Growth in July complicates the anticipated interest rate decrease.

- Increased Likelihood of Holding Rates Steady: The unexpected surge in retail sales increases the probability that the Bank of Canada will hold interest rates steady at their current level during their next meeting. This is a direct response to the inflationary pressures implied by the strong consumer spending.

- Possibility of Further Interest Rate Hikes: If the trend of strong retail sales continues, the Bank of Canada might even consider further interest rate hikes to curb inflation and prevent it from spiralling out of control. This would be a significant shift from the previously anticipated rate decrease.

- Economic Consequences: Maintaining or increasing interest rates could stifle economic growth, potentially leading to job losses. However, allowing inflation to accelerate unchecked could also have severe long-term consequences.

Analyzing Consumer Behavior and Spending Patterns

Understanding the underlying drivers of this unexpected Retail Sales Growth is crucial. Shifts in consumer behavior are evident:

- Consumer Confidence: Increased consumer confidence, perhaps fueled by a stronger-than-expected labor market, might be driving spending. This requires further investigation to confirm this correlation.

- Rising Wages & Debt Levels: The interplay between rising wages and increasing debt levels is a key factor. Are consumers borrowing more to maintain their spending levels, or are wage increases outpacing inflation, allowing for increased disposable income?

- Household Savings: Analyzing household savings rates will provide insight into whether consumers are dipping into savings or relying on credit. This data is vital in assessing the sustainability of the current spending levels.

Alternative Perspectives and Forecasting Future Trends

Not all economists agree on the interpretation of the recent retail sales data. Some argue that the surge is temporary and influenced by external factors, while others believe it reflects a more sustainable shift in consumer behavior.

- Future Scenarios: Forecasting future trends requires considering various economic indicators, including inflation rates, employment data, and consumer confidence indices.

- Influencing Factors: The impact of global events, such as geopolitical instability or changes in commodity prices, can also significantly influence future Bank of Canada decisions and retail sales growth.

- Expert Opinions: Analyzing expert opinions and forecasts from reputable economic institutions provides valuable insights and context for understanding the potential future trajectory of Retail Sales Growth and its impact on interest rates.

Retail Sales Growth and the Bank of Canada's Next Move

The unexpected strength of July's retail sales figures significantly impacts the Bank of Canada's anticipated interest rate decrease. The robust Retail Sales Growth suggests a stronger economy than previously predicted, potentially leading to a hold or even a rate hike. The connection between strong consumer spending and inflationary pressures is undeniable. The Bank of Canada will carefully consider these factors when determining its next move. The overall economic outlook remains uncertain, with potential future scenarios ranging from sustained growth to a potential slowdown.

Stay informed about the impact of retail sales growth on the Bank of Canada's interest rate decisions. Subscribe to our newsletter for the latest updates on retail sales growth and Bank of Canada policy!

Featured Posts

-

Selling Sunset Star Accuses Landlords Of Price Gouging After La Fires

May 26, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging After La Fires

May 26, 2025 -

Moskva Nazvany Pobediteli 47 Go Mmkf

May 26, 2025

Moskva Nazvany Pobediteli 47 Go Mmkf

May 26, 2025 -

Mertsedes So Kazni Pred Startot Na Sezonata Vo Bakhrein

May 26, 2025

Mertsedes So Kazni Pred Startot Na Sezonata Vo Bakhrein

May 26, 2025 -

What To Watch On Monday Top 10 Tv And Streaming Suggestions

May 26, 2025

What To Watch On Monday Top 10 Tv And Streaming Suggestions

May 26, 2025 -

2025s Best Office Chairs A Comprehensive Guide

May 26, 2025

2025s Best Office Chairs A Comprehensive Guide

May 26, 2025