Retail Sales Slump: Implications For Bank Of Canada Interest Rates

Table of Contents

Weakening Consumer Spending and the Retail Sales Slump

The recent decline in retail sales reflects a weakening in consumer spending, a critical component of Canada's GDP. Understanding the causes of this slump is crucial to predicting its impact and the Bank of Canada's response.

Causes of the Decline:

Several factors have contributed to the current retail sales slump:

- Inflation exceeding wage growth: Persistent inflation, currently hovering around [Insert Current Inflation Rate]%, has eroded purchasing power, leaving consumers with less disposable income. This is especially true for low- and middle-income households.

- Increased borrowing costs impacting affordability: The Bank of Canada's previous interest rate hikes, aimed at curbing inflation, have significantly increased borrowing costs for consumers. This makes purchasing big-ticket items like cars and houses less affordable.

- High debt levels: Canadian households carry a considerable amount of debt, limiting their ability to increase spending even if they wanted to. High debt servicing costs further constrain consumer spending.

- Changing consumer behaviour: Shifting consumer preferences, influenced by economic uncertainty and a potential recession, lead to more cautious spending habits and a focus on essential goods.

- Global economic uncertainty: Global economic headwinds, including geopolitical instability and potential recessions in major economies, contribute to a sense of uncertainty affecting consumer confidence and spending.

Impact on GDP Growth:

Falling retail sales directly impact GDP growth. Retail sales represent a substantial portion of consumer spending, which itself accounts for a significant part of Canada's GDP. A decline in retail sales signifies a contraction in economic activity. For example, [cite statistic showing correlation between retail sales and GDP growth]. Industries particularly hard-hit include [list specific examples: e.g., auto sales, furniture retail, etc.].

The Bank of Canada's Response to the Retail Sales Slump

The Bank of Canada's response to this retail sales slump will be crucial in navigating the delicate balance between controlling inflation and fostering economic growth.

Monetary Policy Tools:

The Bank of Canada primarily uses the following tools to influence interest rates:

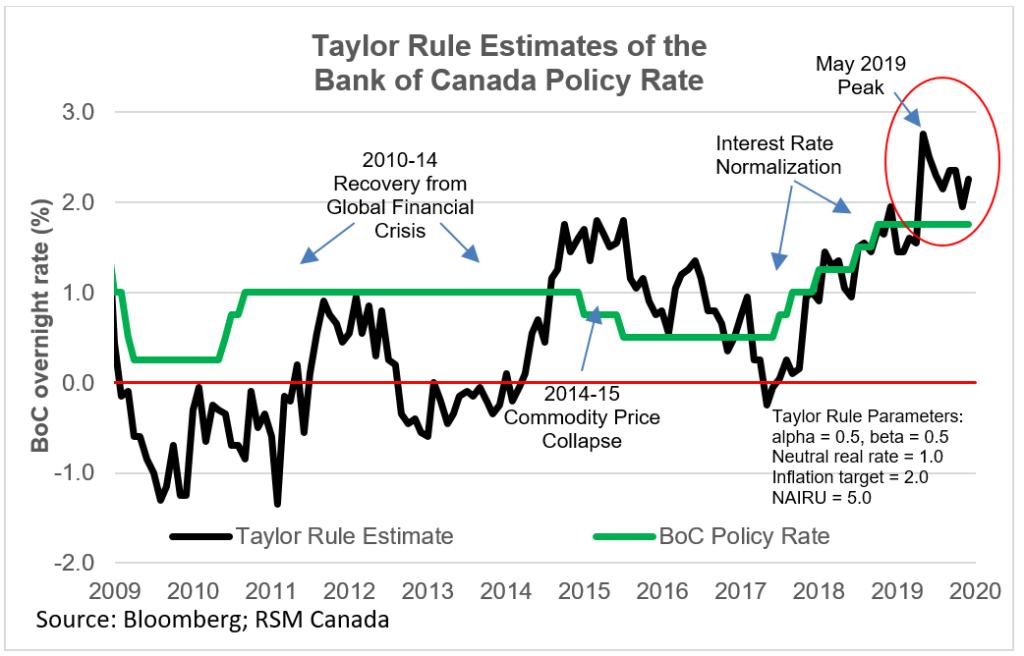

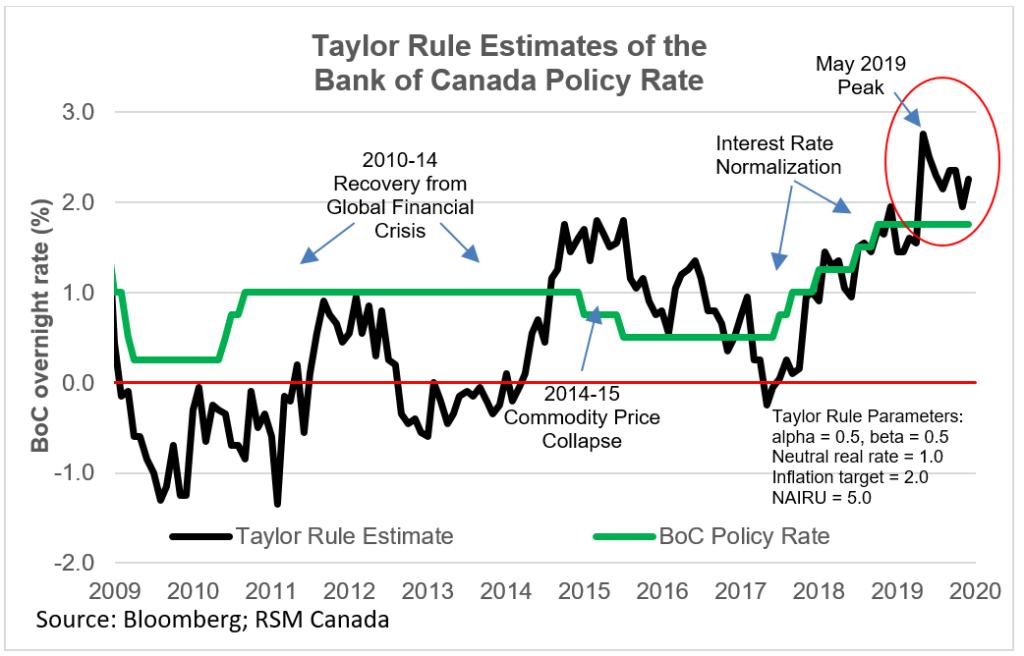

- Overnight rate: This is the target rate the Bank sets for overnight lending between banks. Changes in the overnight rate ripple through the entire financial system, affecting borrowing costs for consumers and businesses.

- Quantitative easing (QE): In periods of economic weakness, the Bank may use QE to inject liquidity into the financial system by purchasing government bonds.

Potential Interest Rate Adjustments:

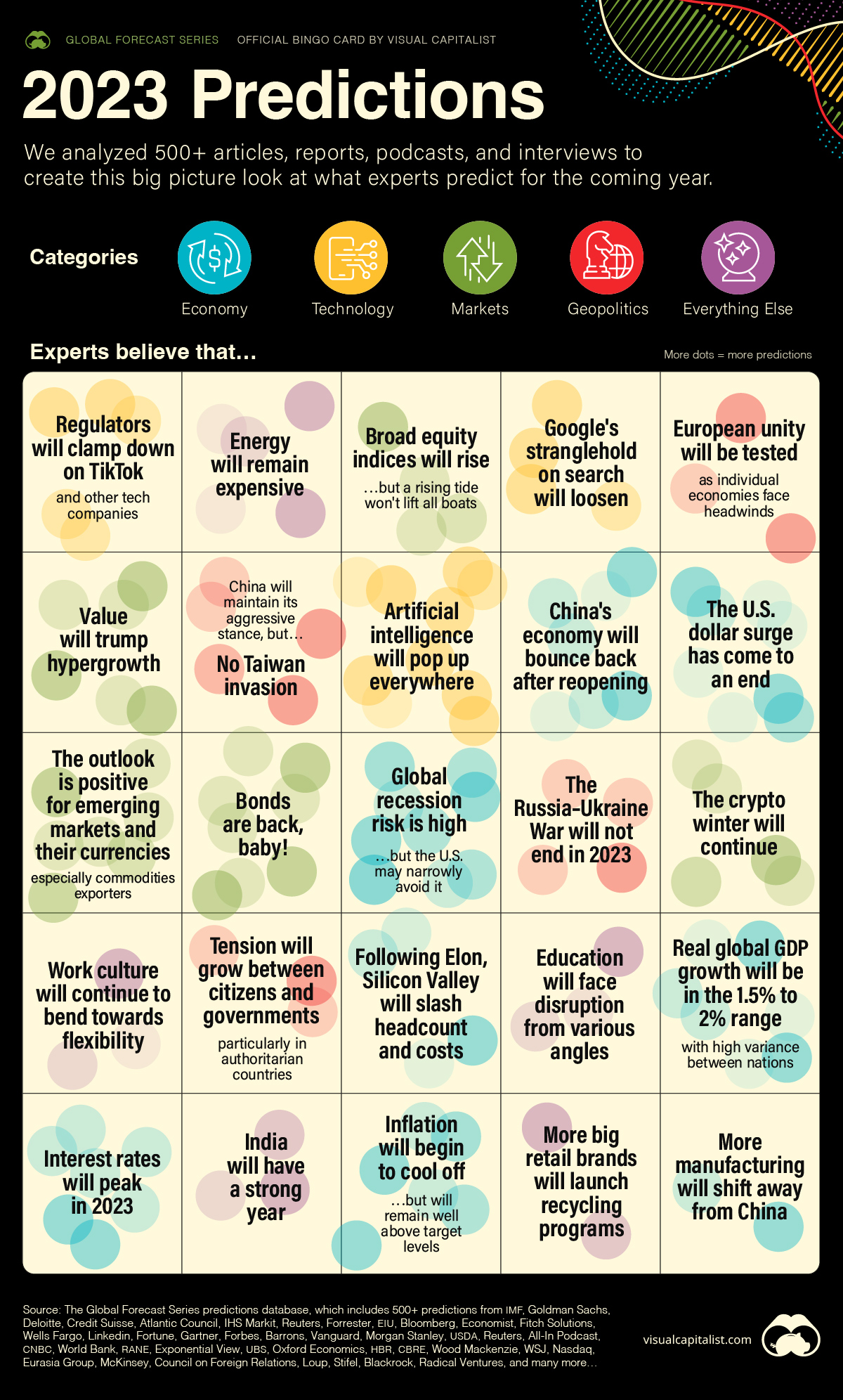

The Bank of Canada faces a difficult decision. Several scenarios are possible:

- Maintaining current rates: If inflation shows signs of moderating despite the retail sales slump, the Bank might choose to hold interest rates steady, allowing time to assess the economic impact of previous hikes.

- Increasing rates to combat inflation: If inflation remains stubbornly high, the Bank might continue raising interest rates despite the weakened retail sales, prioritizing inflation control over immediate economic growth.

- Considering rate cuts to stimulate the economy: If the retail sales slump deepens and signals a broader economic slowdown, the Bank may consider cutting interest rates to stimulate economic activity and consumer spending. This, however, carries the risk of reigniting inflationary pressures.

The trade-off between controlling inflation and supporting economic growth is central to the Bank's decision-making process.

Analyzing Past Responses:

Historically, the Bank of Canada has responded to economic downturns with interest rate cuts. [Cite examples of past interest rate adjustments in response to similar economic situations]. However, the current inflationary environment adds a layer of complexity not present in previous instances.

Alternative Economic Indicators and Their Influence

The Bank of Canada will also consider other economic indicators when making its interest rate decisions.

Employment Data:

A decline in retail sales often precedes job losses. High unemployment rates would strengthen the case for interest rate cuts to stimulate the economy. The Bank will closely monitor employment figures (e.g., unemployment rate, job creation numbers) to gauge the overall health of the labour market.

Inflation Rates:

Persistent inflation remains a major concern. Even with a retail sales slump, the Bank may be hesitant to cut interest rates if inflation remains above its target range. The Bank's primary mandate is price stability.

Housing Market Trends:

The health of the housing market is interconnected with the retail sector. A struggling retail sector can negatively impact the housing market, reducing consumer confidence and affecting home sales. The Bank will consider the overall health of the housing market as part of its comprehensive assessment.

Conclusion

The recent retail sales slump in Canada presents a complex challenge for the Bank of Canada. The decline in consumer spending, driven by inflation, rising interest rates, and global uncertainty, has significant implications for overall economic growth. The Bank will need to carefully weigh the risks of further interest rate increases against the need to support economic growth. The decision will depend on a multitude of factors, including inflation rates, employment data, and the overall health of the housing market. A range of scenarios, from maintaining current rates to potential cuts, are possible. To stay informed about the evolving situation regarding the impact of retail sales and its effect on Bank of Canada interest rates, regularly check reputable financial news sources. Understanding this retail sector downturn and its implications is crucial for individuals and businesses alike.

Featured Posts

-

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025 -

Aaron Judges Push Ups And The 2025 Prediction A Deeper Look

Apr 28, 2025

Aaron Judges Push Ups And The 2025 Prediction A Deeper Look

Apr 28, 2025 -

Red Sox Offseason Strategy Addressing The Loss Of Tyler O Neill

Apr 28, 2025

Red Sox Offseason Strategy Addressing The Loss Of Tyler O Neill

Apr 28, 2025 -

Cocaine Found At White House Secret Service Investigation Results

Apr 28, 2025

Cocaine Found At White House Secret Service Investigation Results

Apr 28, 2025 -

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025