Retirement Of CFP Board CEO: Implications For The Financial Planning Profession

Table of Contents

Leadership Transition and its Potential Impact

The smooth transition of leadership is paramount for maintaining the CFP Board's effectiveness and upholding its rigorous standards. The new CEO's appointment will inevitably bring changes, impacting various aspects of the organization and the financial planning profession.

Succession Planning and Continuity

A successful succession plan ensures minimal disruption to the CFP Board's operations. Several key questions arise:

- Will the new CEO maintain the current strategic direction? Will they continue existing initiatives or introduce a new vision for the organization? Maintaining consistency is crucial for upholding the value of the CFP® certification.

- What are the potential changes in leadership style and priorities? A new CEO may prioritize different aspects of the CFP Board's responsibilities, potentially shifting the focus on certain areas. This could influence resource allocation and the overall direction of the organization.

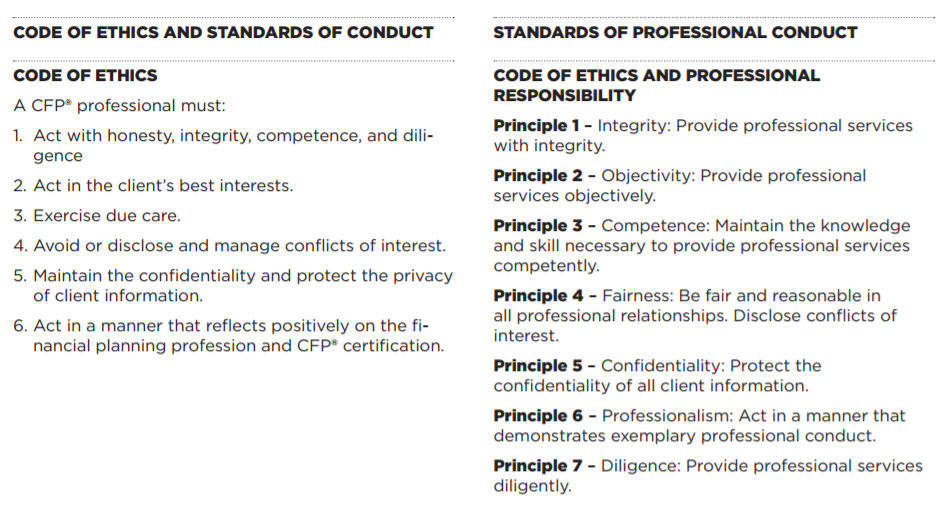

- How will the transition affect ongoing initiatives like exam revisions and enforcement actions? Ongoing projects, such as updates to the CFP® exam and enforcement of the Code of Ethics, need seamless continuity to avoid any setbacks or inconsistencies.

Impact on CFP Certification and Standards

The CEO's retirement could subtly or significantly influence the future of CFP certification. This includes the examination process, continuing education requirements, and the ethical standards that CFP® professionals must uphold.

- Will there be a shift in emphasis on specific areas of financial planning? The curriculum and exam may evolve to reflect emerging trends, such as sustainable investing or financial technology.

- Could we see changes in the required continuing education credits? The continuing education requirements might be updated to better address the evolving needs of financial planners and the changing financial landscape.

- How might the enforcement of the CFP Board's Code of Ethics evolve? A new CEO might bring a different approach to enforcing ethical standards, potentially impacting the disciplinary process and its outcomes.

Opportunities for Growth and Change within the Profession

A new CEO often brings fresh perspectives and innovative ideas. This presents a unique opportunity for growth and positive change within the financial planning profession.

New Strategies and Initiatives

A fresh perspective could lead to several positive developments:

- Could we see increased focus on technology and digital tools? The adoption of FinTech solutions and digital financial planning tools might become a priority, improving efficiency and client experience.

- Will there be new initiatives to improve financial literacy among consumers? The CFP Board might launch initiatives to promote financial literacy, expanding access to quality financial advice and education.

- Might the CFP Board pursue collaborations with other professional organizations? Strategic alliances with other organizations could expand the reach and influence of the CFP® certification and the broader financial planning profession.

Addressing Emerging Challenges

The financial planning landscape is constantly evolving. The new leadership must effectively address significant challenges:

- How will the CFP Board address the increasing complexity of financial regulations? Navigating the intricate web of financial regulations is critical, requiring proactive adaptation and guidance for CFP® professionals.

- What strategies will be employed to adapt to the changing technological landscape? Embracing technology and adapting to the evolving digital environment will be crucial for the CFP Board and financial advisors alike.

- How will the CFP Board support CFP professionals in navigating these challenges? Providing resources, training, and support will be essential to help CFP® professionals adapt and thrive in this changing environment.

Implications for CFP Professionals and Consumers

The transition at the CFP Board will undoubtedly have far-reaching consequences for both CFP® professionals and their clients.

Impact on CFP Professional Practices

Changes within the CFP Board can significantly alter the working lives of financial advisors:

- How might changes in certification requirements affect CFP professionals' practices? New requirements might necessitate additional training, impacting time and resource allocation.

- Could there be a greater emphasis on specific areas of expertise? A shift in focus could lead to increased specialization within the field of financial planning.

- How might these changes impact client relationships and service delivery? Adaptations might necessitate adjustments to client communication strategies and service models.

Consumer Confidence and Protection

Maintaining consumer trust and protecting investors is a paramount concern:

- Will the transition impact the level of consumer protection provided by the CFP certification? Ensuring continued robust consumer protection is essential for maintaining the credibility of the CFP® mark.

- How will the CFP Board continue to uphold its commitment to ethical conduct? The CFP Board must continue to enforce its Code of Ethics rigorously to maintain high standards within the profession.

- How will this transition affect the public perception of financial planners? Maintaining a positive public image is crucial for attracting new clients and sustaining the growth of the profession.

Conclusion

The retirement of the CFP Board CEO presents a pivotal moment for the financial planning profession. The success of this transition hinges on effective succession planning, a firm commitment to maintaining the highest standards, and a proactive approach to tackling future challenges. The new CEO's leadership will significantly shape the future of CFP certification and the broader financial planning landscape. It’s crucial for CFP professionals to stay informed about these developments and adapt to any changes to continue providing high-quality services to their clients. Understanding the implications of this CFP Board CEO retirement is vital for navigating the evolving financial planning profession successfully.

Featured Posts

-

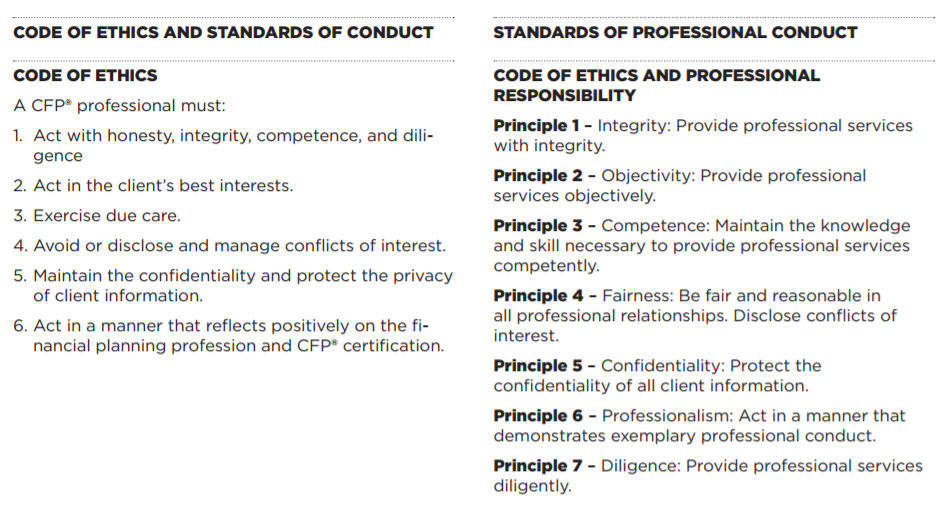

New Economic Deal Ukraine And The U S Collaborate On Rare Earth Minerals

May 02, 2025

New Economic Deal Ukraine And The U S Collaborate On Rare Earth Minerals

May 02, 2025 -

Where To Watch Newsround Bbc Two Hd Tv Schedule

May 02, 2025

Where To Watch Newsround Bbc Two Hd Tv Schedule

May 02, 2025 -

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025

Riot Fest 2025 Green Day Blink 182 And Weird Al Yankovic Headline

May 02, 2025 -

Rolls Royce Confirms 2025 Projections Despite Tariff Challenges

May 02, 2025

Rolls Royce Confirms 2025 Projections Despite Tariff Challenges

May 02, 2025 -

Is Ripple Xrp The Next Cryptocurrency Millionaire Maker

May 02, 2025

Is Ripple Xrp The Next Cryptocurrency Millionaire Maker

May 02, 2025