Rio Tinto's Dual Listing Survives Activist Investor Challenge

Table of Contents

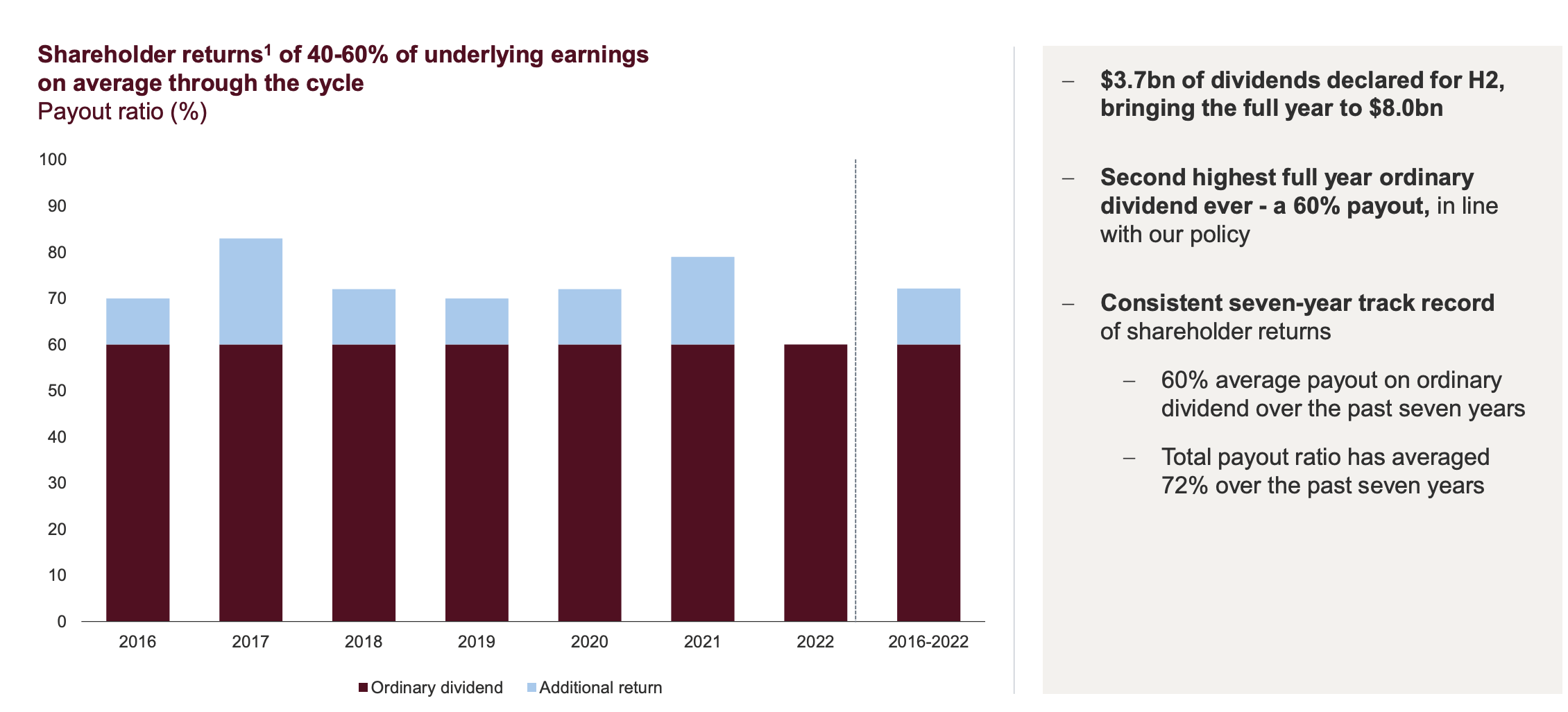

Rio Tinto, the global mining giant, recently faced a significant challenge to its long-standing dual listing on both the London Stock Exchange and the Australian Securities Exchange. An activist investor campaign threatened to disrupt this established structure, raising questions about its efficiency and shareholder value. However, the dust has settled, and Rio Tinto's dual listing has survived, prompting a closer look at the arguments, the outcome, and the broader implications for the mining industry.

The Activist Investor's Argument Against Rio Tinto's Dual Listing

The activist investor(s) – [Insert Name(s) of Activist Investor(s) and any relevant background information here] – argued that Rio Tinto's dual listing was inefficient and detrimental to shareholder value. Their primary concerns revolved around several key points:

-

High Costs and Inefficiencies: Maintaining two separate listings on different exchanges incurs significant administrative and compliance costs, the activists claimed. This diverted resources from core business operations and ultimately reduced profitability. They likely pointed to the duplication of reporting requirements, investor relations efforts, and shareholder communication as key areas of unnecessary expense.

-

Diluted Shareholder Value: The argument suggested that the dual listing structure led to a less focused management team and potentially diluted shareholder value compared to a single-listing structure. The activists might have highlighted complexities in share price synchronisation and potential arbitrage opportunities as evidence of this dilution.

-

Regulatory Complexities and Compliance Burdens: Navigating the differing regulatory environments of the UK and Australia added complexity and compliance burdens, according to the activist investor's case. They likely cited the potential for conflicting regulations and increased legal risks as reasons to simplify the listing structure. Specific examples of regulatory differences and their associated costs would strengthen this argument.

Rio Tinto's Defense of its Dual Listing Strategy

Rio Tinto countered the activist arguments with a strong defense of its dual listing strategy, emphasizing several key benefits:

-

Broader Investor Base and Access to Capital: The company highlighted the strategic advantage of having access to two distinct and substantial pools of investors – the UK and Australian markets. This broader investor base allowed Rio Tinto to raise capital more easily and at potentially more favorable terms, fueling growth and investment in key projects.

-

Strategic Advantages of a Dual Presence: Maintaining listings on both exchanges enhanced Rio Tinto's global profile and facilitated its interactions with key stakeholders in both regions. This strengthened its reputation and provided invaluable connections to major clients and potential partners worldwide.

-

Addressing Cost and Efficiency Concerns: Rio Tinto likely provided detailed data to refute the claims of excessive costs. This would have included a breakdown of costs associated with the dual listing, comparing them to the potential drawbacks of a single listing and the benefits achieved through access to diverse capital markets. This data-driven response is crucial for effectively countering activist claims.

The Outcome of the Activist Investor Challenge

[Insert the actual outcome of the challenge here. Did the activist investor succeed? What was the final decision regarding the dual listing?]

-

Success or Failure of Activist Demands: [Clearly state whether the activist investor achieved their goals. ]

-

Consequences of the Challenge: [Describe the immediate consequences, such as share price fluctuations, if any. Were there any board changes or policy shifts within Rio Tinto?]

-

Concessions Made by Rio Tinto (if any): [Did Rio Tinto make any concessions in response to the activist pressure? This might include improved transparency measures or commitments to cost-cutting.]

The long-term implications for Rio Tinto will depend on how effectively the company addresses the concerns raised by the activist investors, while maintaining the benefits of its dual listing. [Analyze the potential long-term effects on the company's strategy and market performance.]

Implications for Future Dual Listings in the Mining Sector

The Rio Tinto case sets a significant precedent for other mining companies with dual listings or those considering them.

-

Future Challenges for Mining Companies: This case highlights the increasing scrutiny facing multinational mining companies regarding their corporate structures and shareholder value. Other companies with dual listings may anticipate facing similar challenges from activist investors in the future.

-

Influence on Activist Investor Strategies: The outcome of this challenge will likely influence future activist investor strategies in the mining sector. They may refine their approach, focusing on more specific targets and employing more sophisticated arguments to challenge corporate structures.

-

Long-Term Implications for Corporate Governance: This event underscores the evolving landscape of corporate governance and shareholder activism within the mining industry. It highlights the need for mining companies to proactively address shareholder concerns and maintain robust communication strategies. Expert opinions on the evolving relationship between mining companies and activist investors should be included to bolster this section.

Conclusion:

Rio Tinto's successful defense of its dual listing demonstrates the ongoing relevance and potential benefits of this structure for major mining companies. While the challenge highlighted legitimate concerns regarding costs and efficiency, it also underscored the strategic advantages of access to diverse capital markets and a broader investor base. The outcome significantly influences the future of dual listings within the mining sector, signaling a need for increased transparency and proactive engagement with shareholders. Stay informed about Rio Tinto's dual listing strategy and other key developments in corporate governance and shareholder activism within the mining industry. Follow our updates for further analysis on Rio Tinto’s dual listing and similar cases.

Featured Posts

-

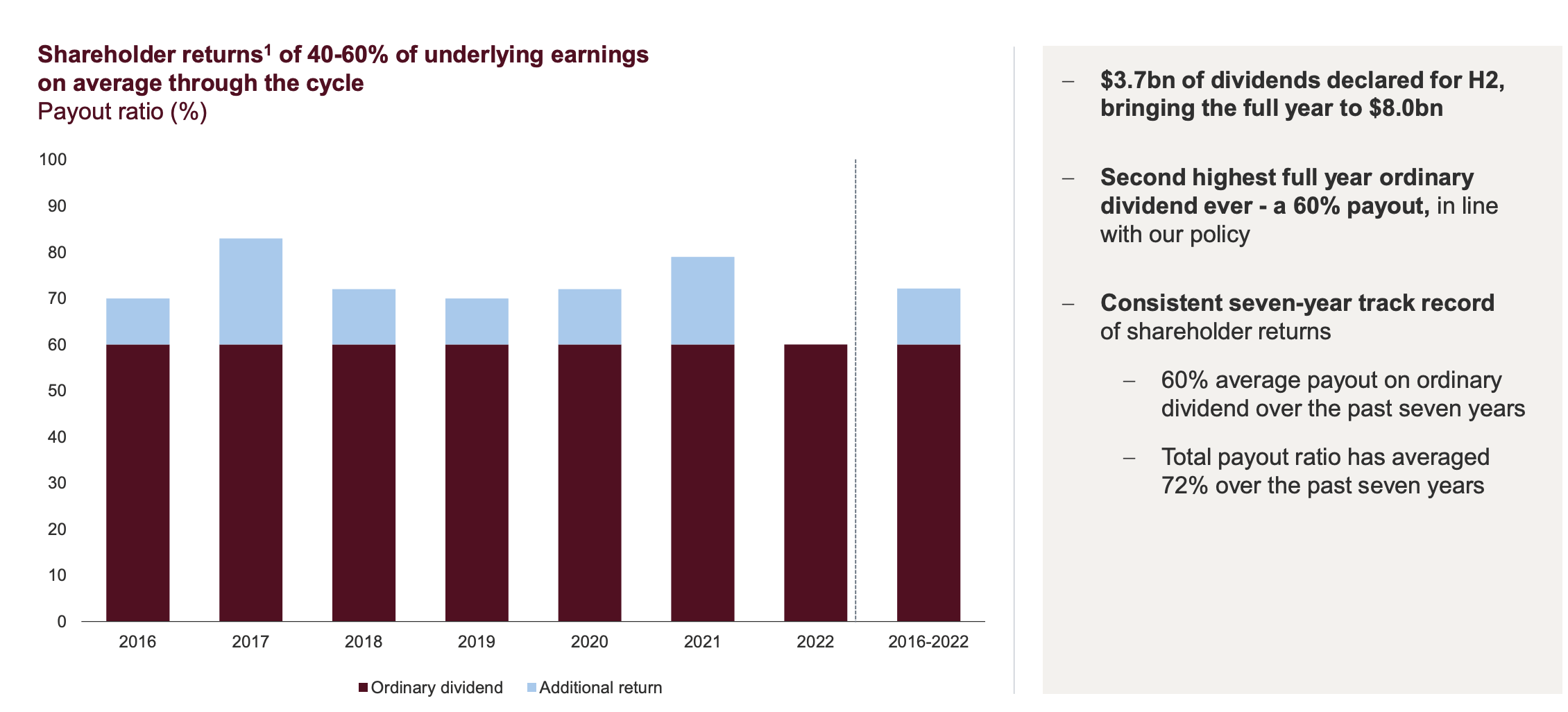

Michael Sheens 100 K Donation Paying Off 1 Million Debt For 900 People

May 02, 2025

Michael Sheens 100 K Donation Paying Off 1 Million Debt For 900 People

May 02, 2025 -

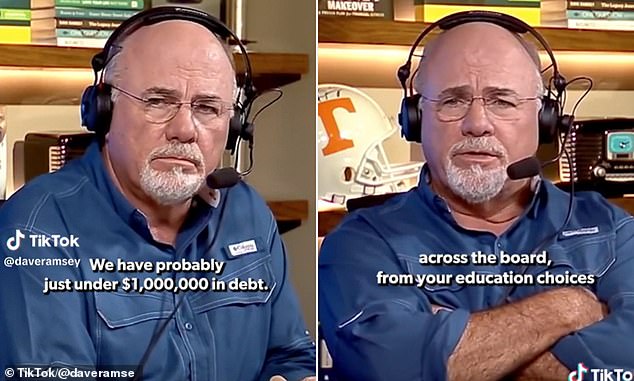

Hospitalization Follows Fans Fall At Wrigley Field

May 02, 2025

Hospitalization Follows Fans Fall At Wrigley Field

May 02, 2025 -

Fortnite Server Downtime How Long Will Chapter 6 Season 2 Maintenance Last

May 02, 2025

Fortnite Server Downtime How Long Will Chapter 6 Season 2 Maintenance Last

May 02, 2025 -

Southern Californias Annual Donkey Roundup A Local Tradition

May 02, 2025

Southern Californias Annual Donkey Roundup A Local Tradition

May 02, 2025 -

Smart Rings And Fidelity A New Era Of Relationship Trust

May 02, 2025

Smart Rings And Fidelity A New Era Of Relationship Trust

May 02, 2025