Riot Platforms Stock: What's Happening With RIOT And COIN?

Table of Contents

Recent Performance of Riot Platforms Stock (RIOT)

Analyzing RIOT's Stock Price Trends

Riot Platforms Stock (RIOT) has experienced significant price swings reflecting the volatile nature of the cryptocurrency market. Understanding these trends requires analyzing various factors influencing the stock.

- Q4 2022: RIOT's stock price saw a decline, mirroring the overall downturn in the cryptocurrency market. The price fell from approximately $12 to $6 per share.

- Q1 2023: A slight recovery was observed, with the price increasing to around $10 per share, driven partly by increased Bitcoin mining activity.

- Q2 2023: The price experienced further volatility, impacted by various factors including Bitcoin's price fluctuations and regulatory uncertainty.

These price fluctuations are influenced by:

- Bitcoin's price movements: As a Bitcoin mining company, RIOT's profitability is directly tied to Bitcoin's price. A rise in Bitcoin's price generally leads to higher revenue and stock prices, while a decline has the opposite effect.

- Regulatory changes: Government regulations concerning cryptocurrency mining significantly impact the operational landscape and investor sentiment. Stringent regulations can negatively impact stock prices.

- Mining difficulty: Increased mining difficulty reduces the profitability of Bitcoin mining, affecting RIOT's revenue and ultimately its stock price.

- Energy costs: Energy is a significant operating expense for Bitcoin mining. Fluctuations in energy prices directly influence RIOT's profitability and share price.

RIOT's Financial Health and Performance

Analyzing RIOT's financial health provides a deeper understanding of its performance. Key indicators include:

- Revenue growth: RIOT's revenue is directly correlated with Bitcoin's price and mining output. Analyzing revenue growth over several quarters provides insight into its operational efficiency.

- Operating margins: This metric indicates the profitability of RIOT's mining operations after deducting operating expenses. Higher margins suggest greater efficiency and profitability.

- Debt levels: High debt levels can increase financial risk, impacting investor confidence and potentially affecting the stock price. Examining RIOT's debt-to-equity ratio provides valuable information.

Comparing RIOT's financial performance to other publicly traded miners like Marathon Digital Holdings (MARA) and others allows for a relative assessment of its financial health and market positioning.

Marathon Digital Holdings (MARA) Stock: A Comparative Analysis

MARA's Stock Performance and Comparison to RIOT

Marathon Digital Holdings (MARA), or COIN as it's sometimes referred to, offers a valuable benchmark for comparing performance with RIOT. A direct comparison of their stock price trends reveals similarities and differences.

- Price Correlation: Both RIOT and MARA generally show a positive correlation with Bitcoin's price, but the extent of this correlation can vary.

- Performance Divergence: Although both stocks move in tandem with Bitcoin's price, the magnitude of their price movements might differ due to varying operational efficiencies, cost structures, and management strategies.

Key Differences and Similarities Between RIOT and MARA Business Models

Understanding the nuances of their business models helps interpret their stock performance:

- Mining Capacity: Comparing their total mining capacity, measured in terms of hash rate, helps assess their relative mining power and potential Bitcoin generation.

- Hashing Power: A higher hashing power increases the likelihood of successfully mining Bitcoins, impacting profitability and stock prices.

- Bitcoin Holdings: The amount of Bitcoin held by each company impacts their balance sheet strength and potential for future revenue.

- Strategies: Diversification strategies, such as exploring alternative revenue streams beyond Bitcoin mining, can influence the resilience of their businesses.

Factors Influencing RIOT and COIN Stock Prices

The Impact of Bitcoin's Price Volatility

Bitcoin's price is the primary driver of RIOT and MARA's stock performance.

- Price Increases: A surge in Bitcoin's price directly increases the profitability of mining operations, boosting the stock prices of both companies.

- Price Decreases: Conversely, a drop in Bitcoin's price reduces profitability, potentially leading to lower stock prices.

Regulatory Landscape and its Effect on Mining Stocks

The regulatory environment plays a crucial role in the success of cryptocurrency mining companies.

- Favorable Regulations: Supportive regulations can attract investment and facilitate business growth, positively impacting stock prices.

- Stringent Regulations: Conversely, restrictive regulations can limit operations, increase costs, and negatively impact stock prices.

Energy Costs and Their Influence

Energy costs are a significant factor impacting profitability in Bitcoin mining.

- Renewable Energy Adoption: Companies utilizing renewable energy sources can gain a cost advantage, improving profitability and potentially boosting stock prices.

- Energy Efficiency: Employing energy-efficient mining equipment contributes to lower operational costs and enhanced profitability.

Future Outlook for Riot Platforms Stock (RIOT) and Marathon Digital Holdings (MARA)

Analyst Predictions and Future Growth Potential

Analyst predictions on RIOT and MARA vary, reflecting the inherent uncertainties in the cryptocurrency market.

- Positive Outlook: Some analysts project strong growth potential based on increasing Bitcoin adoption and technological advancements in mining.

- Cautious Outlook: Others express caution due to factors like regulatory risks and Bitcoin's volatility.

Potential Risks and Challenges

Investing in RIOT and MARA carries inherent risks:

- Regulatory Uncertainty: Changes in regulatory landscapes could negatively impact profitability and stock prices.

- Bitcoin Price Volatility: The inherent volatility of Bitcoin makes these stocks inherently risky investments.

- Competition: Increased competition from other mining companies could pressure profit margins.

Conclusion: Investing in Riot Platforms Stock and the Crypto Mining Sector

Investing in Riot Platforms Stock (RIOT) and Marathon Digital Holdings (MARA) requires a thorough understanding of the cryptocurrency market, Bitcoin's price volatility, and the regulatory landscape. While both companies offer exposure to the potentially lucrative Bitcoin mining industry, they also carry significant risks. Their stock prices are closely tied to Bitcoin's price, making them volatile investments. Before making any investment decisions, conduct thorough due diligence, reviewing their financial reports and investor relations materials. Continue learning about Riot Platforms Stock and other Bitcoin mining stocks to stay informed and make well-considered investment choices.

Featured Posts

-

The Christina Aguilera Photoshoot Controversy Reality Vs Retouching

May 02, 2025

The Christina Aguilera Photoshoot Controversy Reality Vs Retouching

May 02, 2025 -

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025 -

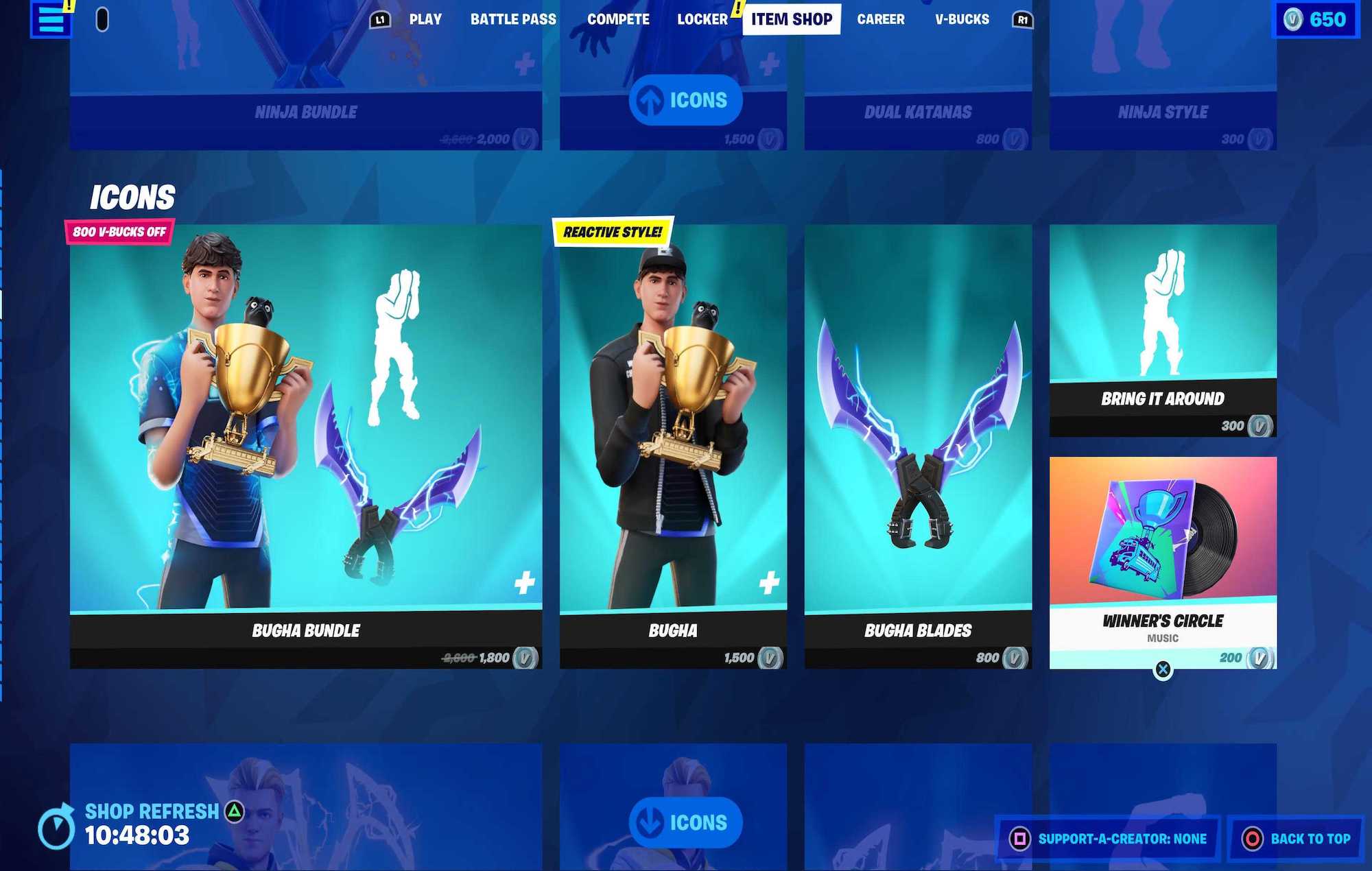

Highly Demanded Fortnite Skins Return To Item Shop

May 02, 2025

Highly Demanded Fortnite Skins Return To Item Shop

May 02, 2025 -

Arsenals Title Failure Souness Pinpoints The Culprit

May 02, 2025

Arsenals Title Failure Souness Pinpoints The Culprit

May 02, 2025 -

A List Celebrity Craves Invite To Melissa Gorgas Exclusive New Jersey Beach House

May 02, 2025

A List Celebrity Craves Invite To Melissa Gorgas Exclusive New Jersey Beach House

May 02, 2025