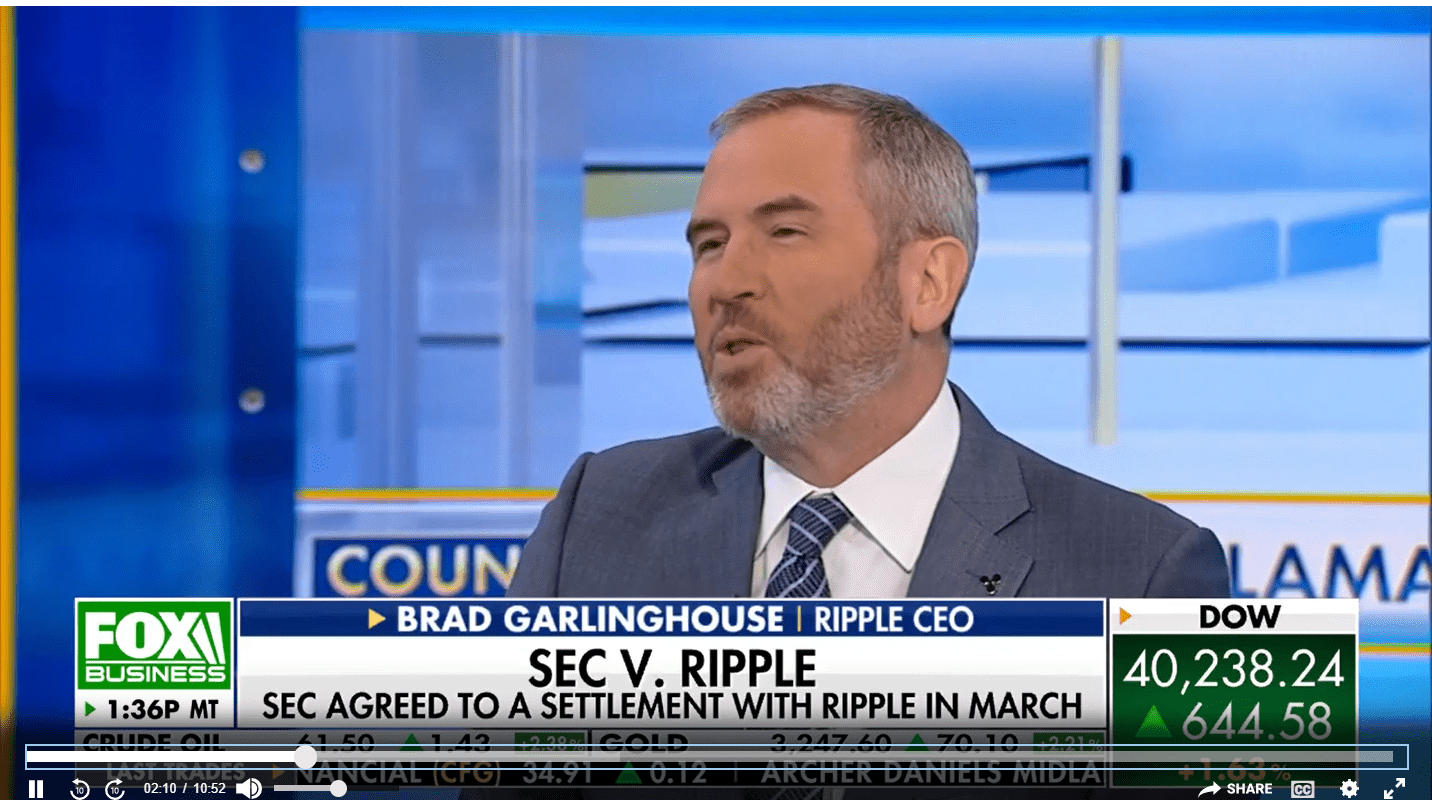

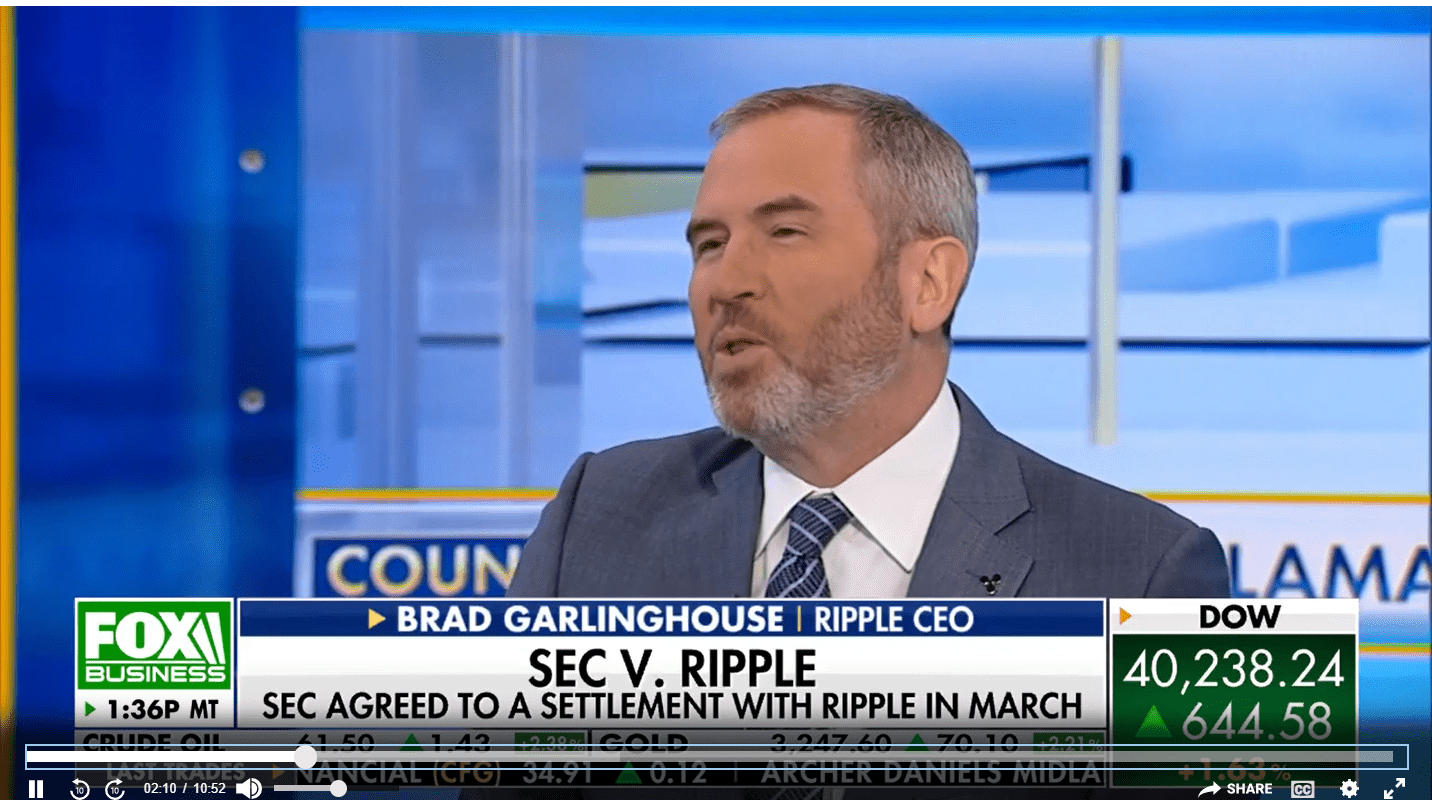

Ripple Vs. SEC: The $50M Settlement And Its Implications For XRP Investors

Table of Contents

The Key Terms of the Ripple Settlement

The Ripple-SEC settlement, while ending the lengthy litigation, involved several key components. Crucially, it avoided a full admission of guilt by Ripple, but resulted in significant financial penalties. Understanding these terms is vital for grasping the settlement’s wider implications.

-

Financial Penalties: Ripple paid a $50 million penalty to the SEC, settling allegations that the company had offered unregistered securities in the form of XRP. This substantial fine represents a considerable cost for Ripple, but significantly less than potential penalties if the case had gone to trial and Ripple had lost.

-

No Admission of Guilt: It's crucial to note that Ripple did not admit guilt or wrongdoing in the sale of XRP. The settlement avoids a potentially damaging court judgment that could have defined XRP as a security with far-reaching consequences. This nuance is often overlooked in discussions surrounding the settlement.

-

Future Compliance: The settlement includes stipulations regarding Ripple's future compliance with securities laws. This implies ongoing monitoring and adherence to SEC regulations to prevent future accusations of unregistered securities offerings.

-

Restrictions on XRP Sales: While the settlement doesn't completely restrict Ripple's sale of XRP, it likely introduces more stringent compliance procedures and oversight. This means greater transparency and potentially slower XRP distribution than before the settlement.

Impact on XRP's Price and Market Sentiment

The Ripple vs. SEC settlement had an immediate and noticeable impact on XRP's price and overall market sentiment. While the initial reaction was positive, the long-term effects are still unfolding.

-

Price Fluctuations: Before the settlement, XRP's price was highly volatile, reflecting the uncertainty surrounding the case. Following the announcement, the price experienced a surge, showing initial investor relief. However, subsequent price movements have been less dramatic, hinting at a period of consolidation. [Include a relevant chart/graph here showing price fluctuations].

-

Trading Volume and Market Cap: The trading volume of XRP increased substantially post-settlement as investors reacted to the news. The market capitalization of XRP also saw a corresponding change, though it remains important to monitor for sustained growth.

-

Investor Sentiment: While the settlement brought some clarity, investor sentiment remains mixed. Some investors are optimistic, viewing the settlement as a positive step towards regulatory clarity. Others remain cautious, aware of the ongoing regulatory uncertainties surrounding cryptocurrencies.

-

Price Predictions: Predicting XRP's future price is challenging. However, analysts point to the settlement as a potential catalyst for growth if Ripple successfully navigates the regulatory landscape. Conversely, prolonged regulatory uncertainty could dampen investor enthusiasm.

Regulatory Implications and Future of XRP

The Ripple-SEC settlement has significant implications for the future of cryptocurrency regulation, particularly concerning how the SEC defines securities.

-

Legal Classification of XRP: The settlement offers a partial resolution on XRP's legal classification. While not explicitly declaring XRP a security, the settlement’s terms impose conditions on Ripple's future sales, suggesting a degree of regulatory scrutiny.

-

Implications for Other Cryptocurrencies: The case serves as a precedent, impacting other cryptocurrencies potentially facing similar regulatory scrutiny from the SEC. Projects with similar tokenomics may face increased regulatory attention.

-

Clarity or Uncertainty?: The settlement provides a degree of clarity for Ripple, but the broader crypto regulatory landscape remains uncertain. The SEC's interpretation of what constitutes a security remains subject to debate.

-

Impact on Exchanges: The settlement directly affects exchanges listing XRP. Many exchanges had delisted XRP during the uncertainty of the legal proceedings, but some have now begun to reinstate it, depending on their risk assessment of compliance.

Navigating the Regulatory Landscape for XRP Investors

The regulatory environment for XRP remains complex, demanding careful consideration from investors.

-

Diversification: A diversified investment portfolio is crucial to mitigating risk. Don't put all your eggs in one basket. Diversify across various asset classes, including stocks, bonds, and other cryptocurrencies.

-

Risk Management: Adopt a thorough risk management strategy. Understand your personal risk tolerance and only invest an amount you can afford to lose. Stay informed about regulatory developments and market trends.

-

Staying Informed: Follow reputable news sources and regulatory updates to stay abreast of any changes affecting XRP. Understanding the evolving legal landscape is vital for making informed decisions.

-

Risk Tolerance: Honest self-assessment of your risk tolerance is essential. Investing in cryptocurrencies like XRP carries inherent risks; make sure your investment strategy matches your comfort level.

The Ripple vs. SEC Case: A Turning Point for Crypto Regulation?

The Ripple vs. SEC case stands as a significant event in shaping the future of cryptocurrency regulation. Its impact extends beyond just XRP.

-

Comparison to Other Cases: This case differs from other significant crypto regulatory cases due to its scale and the specifics of Ripple’s business model. It could influence future legal interpretations of decentralized and centralized crypto projects.

-

Long-Term Implications for Innovation: The outcome can influence innovation and adoption in the cryptocurrency industry. Clearer regulations could foster growth, while continued uncertainty could stifle it.

-

Impact on Cross-Border Payments: The case has global implications, particularly impacting cross-border payments and financial technology. Regulatory changes could affect the accessibility and efficiency of these services.

-

Global Regulatory Landscape: The Ripple case highlights the evolving and fragmented global regulatory landscape for crypto assets. Different jurisdictions adopt different approaches, creating complexity for international cryptocurrency businesses.

Conclusion

The Ripple vs. SEC settlement marks a significant turning point in the cryptocurrency industry. While the $50 million penalty concludes one chapter, its implications for XRP, investors, and the broader regulatory landscape remain profound. The settlement offers some clarity, but the future of XRP and crypto regulation remains dynamic and requires continuous monitoring. The SEC’s interpretation of how it will apply these rulings to other cryptocurrencies remains a significant question.

Call to Action: Stay informed on the evolving regulatory environment for XRP and other cryptocurrencies. Understanding the implications of the Ripple vs. SEC settlement is crucial for making informed investment decisions. Learn more about the ongoing developments in the Ripple vs. SEC case and its impact on XRP investment. Continuous research and a careful understanding of your risk tolerance are key to navigating this evolving landscape.

Featured Posts

-

Sabrina Carpenter Fortnite Skin Confirmed Date And Time

May 02, 2025

Sabrina Carpenter Fortnite Skin Confirmed Date And Time

May 02, 2025 -

Goedkoop Elektrisch Rijden In Noord Nederland Optimaal Laden Met Enexis

May 02, 2025

Goedkoop Elektrisch Rijden In Noord Nederland Optimaal Laden Met Enexis

May 02, 2025 -

Justice Departments Decision The Fallout From Ending School Desegregation

May 02, 2025

Justice Departments Decision The Fallout From Ending School Desegregation

May 02, 2025 -

Analyzing The China Market Case Studies Of Bmw Porsche And Their Competitors

May 02, 2025

Analyzing The China Market Case Studies Of Bmw Porsche And Their Competitors

May 02, 2025 -

Windstar Cruises Exceptional Cuisine And Unforgettable Experiences

May 02, 2025

Windstar Cruises Exceptional Cuisine And Unforgettable Experiences

May 02, 2025