Ripple (XRP): A 15,000% Rally – Is It Too Late To Invest?

Table of Contents

Understanding Ripple (XRP) and its Technology

Ripple is a real-time gross settlement system (RTGS), currency exchange, and remittance network that operates on a distributed open-source network, facilitating international money transfers. XRP, Ripple's native cryptocurrency, plays a crucial role in this network, enabling faster and cheaper transactions compared to traditional banking systems. It's vital to distinguish between Ripple (the company) and XRP (the cryptocurrency). Ripple Labs, the company, developed the RippleNet platform, while XRP is the digital asset that powers many of its transactions.

- Benefits of XRP for Cross-Border Payments: XRP offers significantly faster transaction speeds and lower fees compared to traditional methods like SWIFT, making international transfers more efficient and cost-effective.

- Scalability and Efficiency of the XRP Ledger: The XRP Ledger boasts impressive scalability and transaction throughput, capable of processing thousands of transactions per second, unlike some slower blockchain networks.

- Partnerships and Collaborations: Ripple has forged strategic partnerships with numerous financial institutions globally, bolstering its adoption and credibility within the traditional financial sector. These partnerships significantly influence the XRP price and market sentiment.

XRP's Price History and Market Sentiment

XRP's price journey has been characterized by significant volatility. From its initial low price to its peak, it has experienced dramatic fluctuations. The 15,000% rally was fueled by several factors, including increasing adoption by financial institutions, strategic partnerships, and positive market sentiment. However, the price has also experienced sharp corrections due to market-wide downturns and regulatory uncertainty.

- Key Events Impacting XRP's Price: The ongoing SEC lawsuit against Ripple, as well as positive announcements concerning new partnerships and technological advancements, has greatly influenced XRP's price.

- Market Capitalization and Trading Volume: Monitoring XRP's market cap and trading volume provides insights into its overall market strength and investor interest. High trading volume often correlates with increased price volatility.

- Social Media Sentiment and News Coverage: Analyzing social media trends and news coverage can offer a glimpse into overall public sentiment toward XRP, although it's essential to critically evaluate this information and avoid FOMO-driven decisions. (Insert relevant chart or graph here showing XRP price history)

The Risks Involved in Investing in XRP

Investing in XRP, like any cryptocurrency, involves substantial risk. The cryptocurrency market is inherently volatile, and XRP's price can experience sudden and significant swings. The ongoing SEC lawsuit against Ripple poses a significant legal risk, potentially impacting the future price of XRP.

- Importance of Diversification: Never invest more than you can afford to lose, and always diversify your investment portfolio across various asset classes to mitigate risk.

- Risk Tolerance: Understanding your risk tolerance is crucial before investing in high-risk assets like XRP. If you're risk-averse, XRP might not be a suitable investment for you.

- Avoiding FOMO: Avoid making investment decisions based on fear of missing out (FOMO). Thorough research and a well-defined investment strategy are far more crucial than reacting to short-term price fluctuations.

Potential Future Growth and Investment Strategies

Despite the risks, XRP's long-term potential remains a subject of ongoing discussion. Its technology could potentially revolutionize cross-border payments, and increased adoption by financial institutions could further drive price appreciation. However, regulatory hurdles and competition from other cryptocurrencies present challenges.

- Potential Scenarios for XRP's Future Price: Several scenarios are possible depending on the outcome of the SEC lawsuit, the rate of adoption by financial institutions, and broader market trends.

- Responsible Investment Strategies: Dollar-cost averaging (DCA) can help mitigate risk by spreading out your investment over time. Long-term holding is another common strategy, but it demands patience and a tolerance for volatility.

- Reputable Research Resources: Before investing, research thoroughly using reputable sources like financial news outlets, cryptocurrency analysis websites, and whitepapers to gain a comprehensive understanding of XRP and the cryptocurrency market.

Conclusion: Is XRP Still a Viable Investment Opportunity?

While the 15,000% rally in Ripple (XRP) is impressive, its future remains uncertain. The potential for growth is counterbalanced by significant risks, including the ongoing SEC lawsuit and the inherent volatility of the cryptocurrency market. Before investing in Ripple (XRP) or any cryptocurrency, conduct thorough research, understand your risk tolerance, and develop a well-defined investment strategy. Remember, only invest what you can afford to lose. Weigh the potential rewards against the significant risks associated with XRP before deciding if it's right for your portfolio.

Featured Posts

-

Lars Klingbeil Neuer Vorsitzender Der Spd Bundestagsfraktion

May 01, 2025

Lars Klingbeil Neuer Vorsitzender Der Spd Bundestagsfraktion

May 01, 2025 -

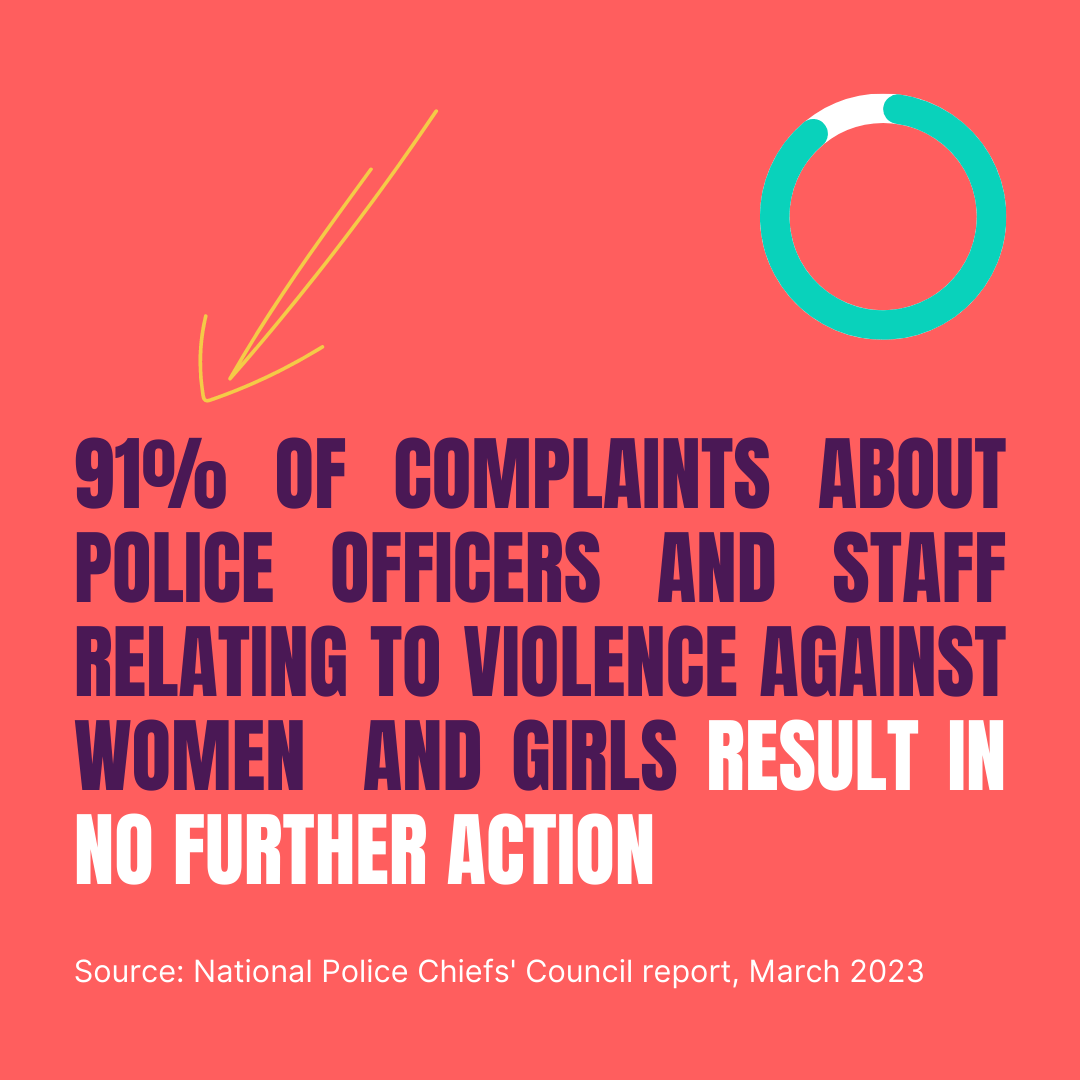

Lack Of Police Accountability Campaigners Voice Strong Concerns

May 01, 2025

Lack Of Police Accountability Campaigners Voice Strong Concerns

May 01, 2025 -

Jokic I Jovic Na Evrobasketu Sedlacekev Komentar Za Insajder

May 01, 2025

Jokic I Jovic Na Evrobasketu Sedlacekev Komentar Za Insajder

May 01, 2025 -

Key Facts About Michael Jordan His Rise To Basketball Superstardom

May 01, 2025

Key Facts About Michael Jordan His Rise To Basketball Superstardom

May 01, 2025 -

Legendary Actress Priscilla Pointer Passes Away At Age 100

May 01, 2025

Legendary Actress Priscilla Pointer Passes Away At Age 100

May 01, 2025