Ripple (XRP) And The $3.40 Price Point: A Technical Analysis

Table of Contents

Historical Price Performance and Trends

Analyzing past XRP price movements is crucial for any Ripple XRP price prediction. Identifying significant support and resistance levels helps us understand potential price ceilings and floors. Past performance, however, is not indicative of future results.

-

Past Bull and Bear Cycles: XRP, like other cryptocurrencies, has experienced periods of intense growth (bull markets) followed by significant corrections (bear markets). Examining these cycles reveals patterns and potential turning points. The 2017 bull run, for instance, saw XRP reach an all-time high, followed by a prolonged bear market.

-

Impact of Major News Events: News significantly impacts XRP's price. The ongoing SEC lawsuit against Ripple Labs has been a major factor affecting XRP's price volatility. Conversely, positive news such as partnerships and technological advancements can fuel price increases. Analyzing these events and their impact is vital for accurate XRP price analysis.

-

Key Price Patterns: Technical analysis often identifies patterns like head and shoulders or double tops/bottoms which may signal future price movements. Identifying such patterns requires careful observation of price charts and understanding of candlestick patterns. (Relevant charts and graphs would be inserted here.)

Technical Indicators Suggesting a Potential Rise to $3.40

Several technical indicators can help predict potential XRP price movements. While not foolproof, these tools offer valuable insights when used in conjunction with other forms of analysis.

-

Relative Strength Index (RSI): The RSI gauges the strength of upward or downward momentum. An RSI above 70 suggests overbought conditions, potentially indicating a price correction. Conversely, an RSI below 30 might signal oversold conditions, hinting at a potential price rebound. Analyzing the current RSI for XRP is crucial in an XRP technical analysis.

-

Moving Average Convergence Divergence (MACD): The MACD identifies bullish or bearish crossovers, which can signal potential price trends. A bullish crossover (MACD line crossing above the signal line) often suggests an upward trend, while a bearish crossover suggests the opposite. Monitoring the MACD can help refine an XRP price prediction.

-

Moving Averages: Simple Moving Averages (SMAs) and Exponential Moving Averages (EMAs) smooth out price fluctuations, providing clearer trend identification. A price crossing above a key moving average can be a bullish signal, while crossing below can be bearish.

Factors That Could Hinder XRP Reaching $3.40

Despite potential bullish signals, several factors could prevent XRP from reaching $3.40. A comprehensive XRP price analysis must account for these obstacles.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving. Continued regulatory uncertainty, especially concerning the SEC lawsuit against Ripple, could negatively impact XRP's price.

-

Bitcoin's Influence: Bitcoin's price movements often influence the altcoin market, including XRP. A significant Bitcoin price drop could trigger a broader market correction, impacting XRP's price regardless of its individual indicators.

-

Competition: The cryptocurrency market is highly competitive. The emergence of new cryptocurrencies and blockchain technologies could divert investor attention and capital away from XRP.

Trading Strategies and Risk Management for XRP Investment

Investing in XRP, or any cryptocurrency, involves significant risk. Effective trading strategies and robust risk management are crucial for mitigating potential losses.

-

Entry and Exit Points: Identify clear entry and exit points based on technical analysis and risk tolerance. Avoid impulsive trading decisions based solely on short-term price fluctuations.

-

Stop-Loss Orders and Position Sizing: Utilize stop-loss orders to limit potential losses. Position sizing, or determining the amount to invest, is equally important. Never invest more than you can afford to lose.

-

Diversification: Diversifying your cryptocurrency portfolio reduces overall risk. Don't put all your eggs in one basket.

Conclusion

This technical analysis explores the potential for XRP to reach $3.40, examining both bullish and bearish indicators. While technical indicators suggest a potential rise, significant risks and uncertainties remain, particularly regarding regulatory issues and overall market sentiment. A successful Ripple XRP price prediction requires a holistic approach, considering historical trends, technical indicators, and external factors.

Conduct thorough research and consider your own risk tolerance before investing in Ripple (XRP). Remember that this analysis is for informational purposes only and should not be considered financial advice. Stay informed about the latest developments in the XRP market and continue your own Ripple XRP price analysis.

Featured Posts

-

Ryan Gentry Honored For 29 Years Of U S Coast Guard Service

May 08, 2025

Ryan Gentry Honored For 29 Years Of U S Coast Guard Service

May 08, 2025 -

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 08, 2025

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 08, 2025 -

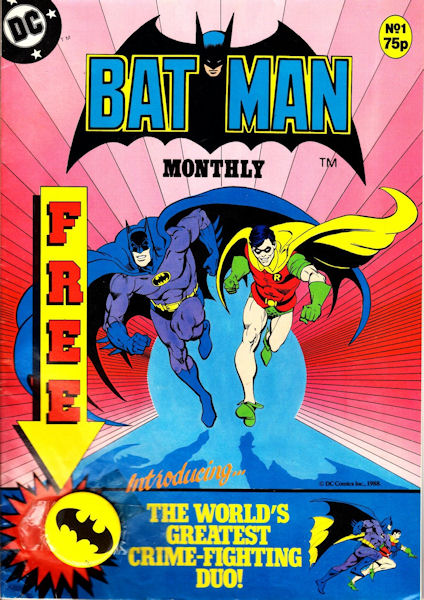

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025

Batman Relaunched New 1 Issue And Costume Unveiled

May 08, 2025 -

Understanding Pro Shares Xrp Etfs What Investors Need To Know

May 08, 2025

Understanding Pro Shares Xrp Etfs What Investors Need To Know

May 08, 2025 -

January 6th Falsehoods Trump Supporter Ray Epps Files Defamation Lawsuit Against Fox News

May 08, 2025

January 6th Falsehoods Trump Supporter Ray Epps Files Defamation Lawsuit Against Fox News

May 08, 2025