Ripple (XRP) Rally: Factors Influencing A Potential Rise To $3.40

Table of Contents

The cryptocurrency market is notoriously volatile, but recent developments surrounding Ripple (XRP) have sparked intense speculation about a potential price surge to $3.40. This article delves into the key factors that could contribute to such a significant rally, examining both the optimistic and realistic scenarios. We'll explore the ongoing legal battle, technological innovations within the XRP Ledger, and the broader cryptocurrency market conditions to assess the likelihood of XRP reaching this ambitious price target.

The Ripple (XRP) Lawsuit and its Impact on Price

The ongoing SEC lawsuit against Ripple Labs has significantly impacted XRP's price. The outcome of this legal battle will likely play a crucial role in determining XRP's future trajectory.

Positive Developments in the SEC Lawsuit

Recent court filings have offered glimmers of hope for Ripple. Several key developments suggest a potential positive outcome:

- Favorable Judgements on Certain Arguments: The court has ruled in Ripple's favor on specific aspects of the SEC's case, potentially weakening their overall argument.

- Growing Support from Legal Experts: Several legal experts have voiced opinions leaning towards a favorable outcome for Ripple, boosting investor confidence.

- Programmatic Sales Distinction: The court's focus on distinguishing between programmatic and institutional sales of XRP could significantly limit the SEC's reach.

Detail: The SEC argues that XRP is an unregistered security, while Ripple counters that XRP is a digital currency with inherent utility. The court's interpretation of "investment contract" under the Howey Test will be crucial. A favorable ruling could remove the regulatory uncertainty surrounding XRP, potentially unlocking significant price appreciation.

Market Sentiment and Investor Confidence

Positive developments in the lawsuit directly correlate with positive shifts in market sentiment.

- Increased Social Media Engagement: Positive news triggers increased discussion and engagement on social media platforms, indicating growing investor interest.

- Surge in Trading Volume: Favorable updates are often followed by increased trading volume, reflecting a higher level of buying activity.

- Growing Institutional Holdings: Some institutional investors are reportedly accumulating XRP, anticipating a potential price increase following a positive legal resolution.

Detail: Investor confidence is directly tied to the perceived risk associated with XRP. A positive resolution to the lawsuit significantly reduces this risk, leading to increased demand and, consequently, a potential price surge.

Technological Advancements and XRP Ledger Utility

Beyond the legal battles, XRP's utility and the ongoing development of the XRP Ledger contribute significantly to its potential.

Adoption of XRP by Financial Institutions

Several financial institutions are already utilizing XRP for cross-border payments through RippleNet.

- Faster and Cheaper Transactions: XRP's speed and low transaction costs make it an attractive alternative to traditional payment systems.

- Growing RippleNet Network: The continuous expansion of RippleNet suggests a growing acceptance of XRP within the financial industry.

- Strategic Partnerships: Strategic partnerships between Ripple and various financial institutions further cement XRP's position in the global payments landscape.

Detail: The broader adoption of XRP by financial institutions can significantly increase demand and drive up its price. Increased usage leads to higher transaction volume and reinforces its value proposition.

Development and Upgrades to the XRP Ledger

Continuous improvements to the XRP Ledger enhance its functionality and efficiency.

- Enhanced Scalability: Upgrades focus on improving the XRP Ledger's ability to handle a growing number of transactions.

- Improved Security: Regular updates enhance the security and reliability of the XRP Ledger, mitigating potential risks.

- Increased Developer Engagement: Improvements attract more developers, fostering innovation and creating a more robust ecosystem.

Detail: These technological advancements contribute to XRP's overall appeal, attracting more users and developers, which in turn supports price growth.

Macroeconomic Factors and the Broader Crypto Market

External factors also play a crucial role in XRP's price performance.

Overall Cryptocurrency Market Trends

XRP's price is often influenced by the overall cryptocurrency market.

- Bitcoin's Dominance: Bitcoin's price movements tend to affect the performance of other cryptocurrencies, including XRP.

- Regulatory Landscape: Regulatory changes in the cryptocurrency space can impact the entire market, including XRP.

- General Market Sentiment: Positive overall sentiment in the crypto market generally supports price increases across the board.

Detail: A bull market in cryptocurrencies typically creates a positive environment for XRP, while bearish market conditions can exert downward pressure.

Inflation and Investor Diversification

Macroeconomic factors like inflation can drive investors towards alternative assets.

- Inflation Hedge Potential: Some investors see cryptocurrencies, including XRP, as a potential hedge against inflation.

- Institutional Investor Interest: Institutional investors are increasingly considering cryptocurrencies as part of their portfolio diversification strategies.

- Increased Demand: Increased demand driven by inflation hedging and diversification strategies can push prices higher.

Detail: High inflation rates and economic uncertainty could make XRP a more attractive investment option, leading to increased demand and potential price appreciation.

Conclusion

The potential for a Ripple (XRP) rally to $3.40 is contingent upon several factors. A positive resolution to the SEC lawsuit, coupled with increased adoption of XRP within the financial industry and further technological advancements within the XRP Ledger, could significantly boost its price. However, it's crucial to consider the broader macroeconomic environment and overall cryptocurrency market trends. While reaching $3.40 presents a significant challenge, the factors discussed demonstrate a pathway to substantial growth. Stay informed about Ripple (XRP) news and developments to make informed decisions regarding this intriguing cryptocurrency. Continue your research and learn more about the potential of Ripple (XRP) and its role in the future of finance.

Featured Posts

-

Cobra Kai Ep Hurwitz Reveals Original Mock Trailer Pitch

May 07, 2025

Cobra Kai Ep Hurwitz Reveals Original Mock Trailer Pitch

May 07, 2025 -

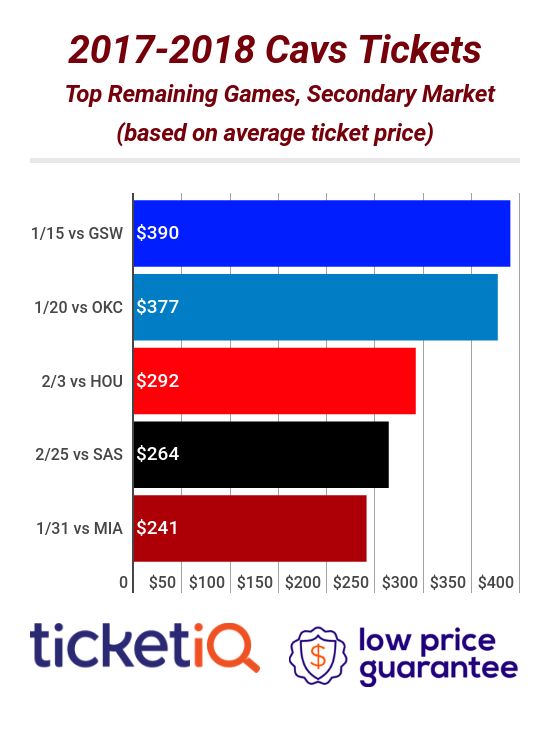

Round 2 Cavs Tickets Purchase Information And Details

May 07, 2025

Round 2 Cavs Tickets Purchase Information And Details

May 07, 2025 -

Cobra Kais Connection To The Karate Kid A Continuity Guide

May 07, 2025

Cobra Kais Connection To The Karate Kid A Continuity Guide

May 07, 2025 -

Alex Ovechkins Advisory Role At Dynamo Moscow Presidents Statement

May 07, 2025

Alex Ovechkins Advisory Role At Dynamo Moscow Presidents Statement

May 07, 2025 -

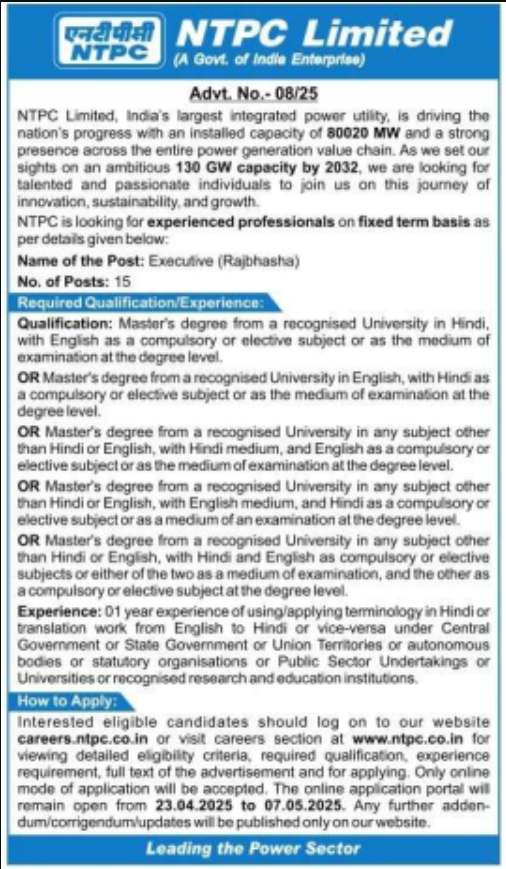

Rsmssb Exam Calendar 2025 26 Released Check The Complete Schedule Here

May 07, 2025

Rsmssb Exam Calendar 2025 26 Released Check The Complete Schedule Here

May 07, 2025