Risk Mitigation In Financing A 270MWh BESS Project Within The Belgian Energy Market

Table of Contents

- Regulatory and Policy Risks

- Navigating Belgian Energy Regulations

- Policy Stability and Future Regulatory Changes

- Technological and Operational Risks

- Battery Technology Selection and Lifespan

- Grid Integration and System Reliability

- Market Risks and Revenue Streams

- Price Volatility and Energy Market Fluctuations

- Competition and Market Entry Barriers

- Financial Risks and Funding Strategies

- Securing Project Financing

- Managing Debt and Equity

- Conclusion

Regulatory and Policy Risks

Successfully financing a BESS project in Belgium hinges on understanding and mitigating regulatory and policy risks. These risks stem from the evolving nature of the Belgian energy market and its regulatory framework.

Navigating Belgian Energy Regulations

Compliance with Belgian grid codes, permitting processes, and renewable energy support schemes is paramount. Understanding these regulations is crucial for the feasibility of your 270MWh BESS project.

- Grid connection agreements: Securing a grid connection agreement with Elia (the Belgian transmission system operator) is a critical first step. This requires detailed planning and adherence to their technical requirements.

- Licensing and permitting: Navigating the licensing and permitting processes, which vary at regional and national levels, requires expert legal and regulatory advice. This includes environmental impact assessments and other relevant approvals.

- Renewable energy support schemes: Understanding and leveraging any applicable renewable energy support schemes or incentives can significantly improve project economics and investor appeal.

Policy Stability and Future Regulatory Changes

The Belgian energy market is subject to ongoing policy adjustments. Assessing the long-term stability and potential shifts in policy is vital for mitigating risk.

- Scenario planning: Developing multiple scenarios to account for potential regulatory changes is critical. This includes changes to feed-in tariffs, market rules, and environmental regulations.

- Contractual safeguards: Incorporating contractual safeguards into agreements (e.g., force majeure clauses) provides protection against unforeseen policy alterations that negatively impact project profitability.

- Political risk analysis: Conducting a thorough political risk analysis helps identify and assess potential political or governmental changes that could affect the project's long-term viability.

Technological and Operational Risks

Technological and operational risks associated with the 270MWh BESS project demand careful evaluation and mitigation.

Battery Technology Selection and Lifespan

Choosing the right battery technology is crucial. Different battery chemistries (e.g., Lithium-ion, flow batteries) offer varying performance characteristics, lifespans, and costs.

- Technology assessment: A comprehensive assessment of the suitability of different battery technologies for a 270MWh system is essential. Factors to consider include energy density, power output, lifespan, and environmental impact.

- Degradation and maintenance: Planning for battery degradation, including maintenance schedules and replacement costs, is critical for long-term operational efficiency and financial planning.

- Warranties and guarantees: Negotiating robust warranties and performance guarantees from battery suppliers is vital for mitigating technological risks and securing investor confidence.

Grid Integration and System Reliability

Seamless grid integration and system reliability are crucial for a successful BESS project.

- Grid integration studies: Conducting detailed grid integration studies to ensure the 270MWh BESS system operates smoothly and reliably within the Belgian grid infrastructure is paramount.

- Power outage mitigation: Implementing measures to mitigate the risks associated with power outages and grid instability is crucial for ensuring the project's resilience and maintaining operational performance.

- Monitoring and control systems: Investing in robust monitoring and control systems ensures optimal BESS performance, early detection of potential issues, and minimized downtime.

Market Risks and Revenue Streams

Market risks significantly impact BESS project profitability. Understanding and mitigating these risks is essential.

Price Volatility and Energy Market Fluctuations

Electricity price volatility in the Belgian market presents a significant challenge.

- Price risk analysis: Conducting thorough price risk analysis and modeling potential price fluctuations is vital for accurate financial forecasting and risk management.

- Hedging strategies: Employing hedging strategies, such as utilizing financial derivatives, can mitigate price risks and enhance the predictability of project revenue streams.

- Revenue diversification: Diversifying revenue streams by participating in ancillary services markets (frequency regulation, peak shaving) and exploring energy arbitrage opportunities reduces reliance on pure electricity price exposure.

Competition and Market Entry Barriers

The Belgian energy storage market is becoming increasingly competitive.

- Competitive analysis: A detailed competitive analysis helps identify existing players, their strategies, and potential market saturation.

- Market entry barriers: Identifying and addressing potential barriers to market entry, such as regulatory hurdles or limited access to grid connections, is vital for successful project development.

- Competitive advantage: Developing a robust business plan that highlights the project's unique selling points and competitive advantage is crucial for attracting investment.

Financial Risks and Funding Strategies

Securing project financing requires a well-defined strategy and a comprehensive understanding of financial risks.

Securing Project Financing

Exploring diverse financing options is essential.

- Financing options: Evaluating various financing options, including bank loans, equity investment, green bonds, and public funding schemes (e.g., European Union grants), allows for optimization of the capital structure.

- Financial modeling: Developing a robust financial model demonstrating project viability, strong ROI, and sound risk management strategies is crucial for attracting investors.

- Negotiating financing terms: Negotiating favorable financing terms, including interest rates, repayment schedules, and covenants, is essential for minimizing financial risk.

Managing Debt and Equity

Balancing debt and equity financing requires careful consideration.

- Capital structure optimization: Determining the optimal capital structure that balances debt and equity financing to minimize risk and maximize investor returns.

- Financial risk mitigation: Implementing strategies to mitigate risks such as interest rate fluctuations and currency exchange rate changes is vital.

- Insurance coverage: Securing appropriate insurance coverage against unforeseen financial losses, such as equipment failure or regulatory changes, provides an added layer of risk protection.

Conclusion

Successfully financing a large-scale BESS project in Belgium necessitates a proactive approach to risk mitigation. By addressing regulatory, technological, market, and financial risks through meticulous planning, comprehensive due diligence, robust contracts, and diversified revenue streams, developers significantly increase their chances of securing funding and achieving a successful project outcome. Understanding and effectively implementing these risk mitigation strategies are vital for navigating the complexities of the Belgian energy market and capitalizing on the significant opportunities within the BESS sector. Start mitigating risks in your own BESS financing strategy today by researching Belgian energy regulations and exploring various financing options.

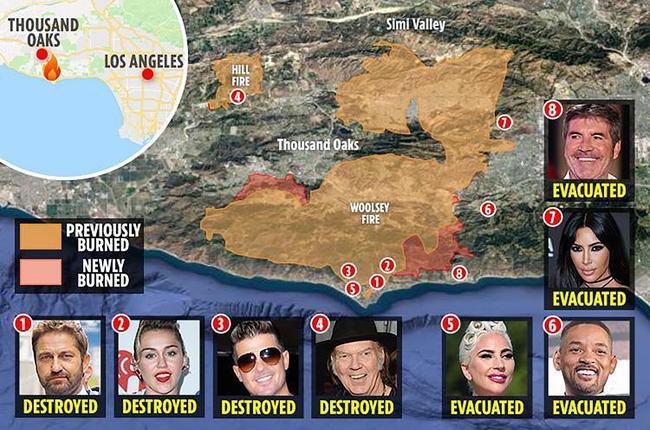

Impact Of La Palisades Fires Celebrities Affected And Home Losses

Impact Of La Palisades Fires Celebrities Affected And Home Losses

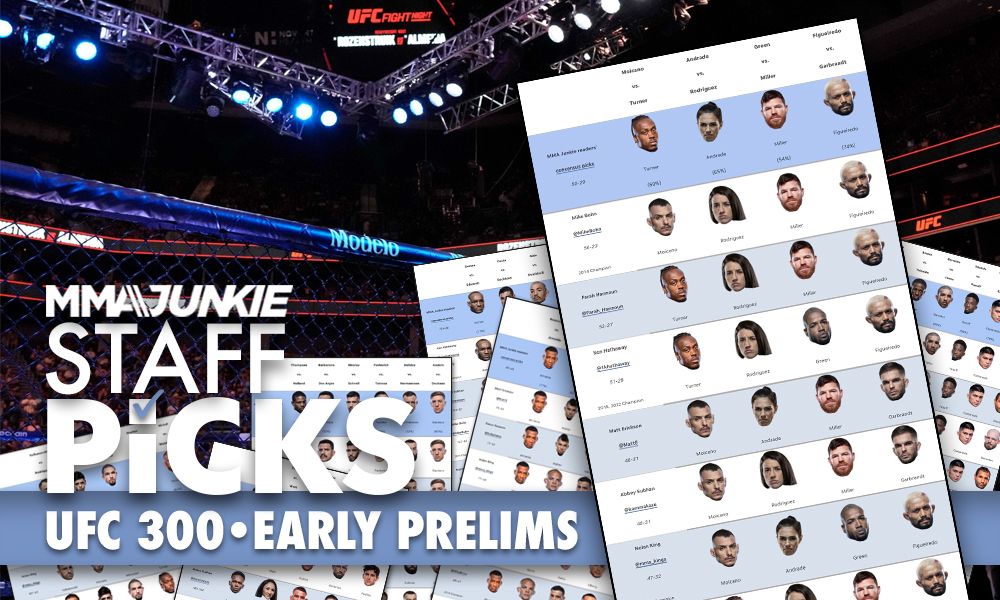

Ufc Des Moines Predictions And Analysis For The Upcoming Fights

Ufc Des Moines Predictions And Analysis For The Upcoming Fights

Analysis Golds First Double Week Loss In 2025

Analysis Golds First Double Week Loss In 2025

Behind The Scenes Look At Bradley Cooper Directing Will Arnett For Is This Thing On

Behind The Scenes Look At Bradley Cooper Directing Will Arnett For Is This Thing On

Gigi Hadid And Bradley Coopers Relationship Goes Public Instagram Post Shows Pda

Gigi Hadid And Bradley Coopers Relationship Goes Public Instagram Post Shows Pda