RTL Group's Streaming Ambitions: A Realistic Assessment Of Profitability

Table of Contents

- RTL Group's Content Strategy: A Key Factor in Streaming Success

- Subscriber Acquisition and Retention: The Challenge of Market Penetration

- Monetization Strategies: Beyond Subscription Revenue

- Financial Performance and Investment: Assessing the Path to Profitability

- Conclusion: The Future of RTL Group's Streaming Ambitions

RTL Group's Content Strategy: A Key Factor in Streaming Success

RTL Group's content strategy is crucial to its streaming success. They offer a mix of local programming, tailored to specific regional markets, and internationally acquired content. While strong local content provides a solid foundation in key European markets, contributing significantly to RTL Group revenue, the lack of globally recognized, exclusive content presents a significant challenge. This contrasts sharply with the massive libraries held by competitors like Netflix.

- Strengths: Strong local content in key markets like Germany, France, and the Netherlands offers a competitive advantage, driving subscriber acquisition in those regions. This localized approach is a key aspect of their RTL Group content strategy.

- Weaknesses: Limited global appeal compared to established streaming giants. The absence of widely recognized original content hinders broader subscriber acquisition and international expansion. They need more exclusive content to compete effectively.

- Opportunity: Strategic partnerships for co-productions offer a pathway to reduce production costs while simultaneously expanding the reach of their streaming services. Collaborations with other production companies could unlock access to higher-quality, globally appealing content. This could significantly impact RTL Group streaming revenue in the long term.

Subscriber Acquisition and Retention: The Challenge of Market Penetration

Attracting and retaining subscribers in the saturated streaming market is a major hurdle for RTL Group. Their subscriber acquisition tactics, including marketing campaigns and pricing strategies, must be highly effective to compete with established players.

- Challenges: The high customer acquisition cost (CAC) in the streaming market poses a significant financial burden. Competition from established players with deep pockets and extensive content libraries makes subscriber acquisition exceptionally difficult.

- Opportunities: Bundling their streaming service with other services, like telecommunications packages, offers potential for increased subscriber acquisition. Targeted marketing campaigns tailored to specific demographics and interests can boost efficiency and lower the CAC. Moreover, focusing on improving user experience through better app design and functionality can significantly improve subscriber retention.

- Analysis: Comparing RTL Group's subscriber growth against competitors reveals the steep climb they face. Closely monitoring key metrics like churn rate and average revenue per user (ARPU) is vital for assessing the effectiveness of their strategy.

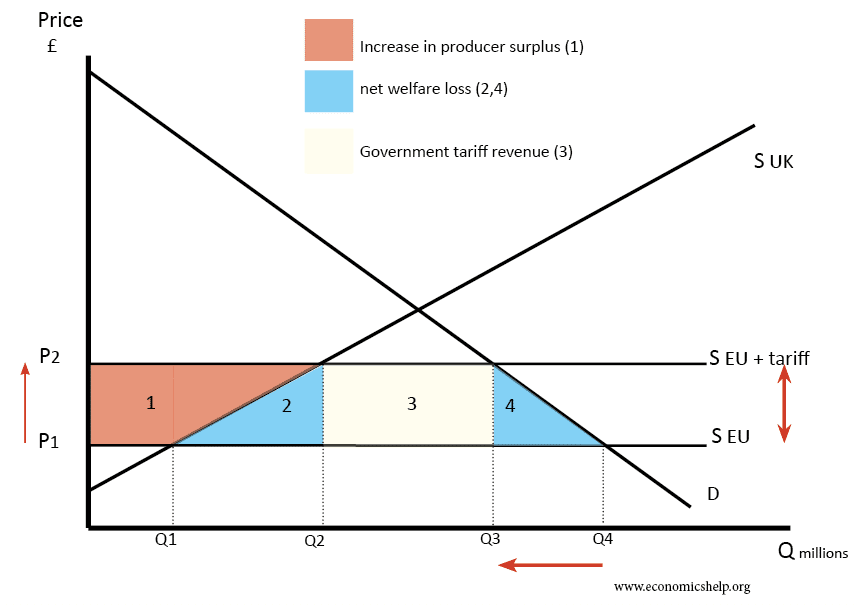

Monetization Strategies: Beyond Subscription Revenue

RTL Group's revenue streams shouldn't rely solely on subscriptions. They need to leverage advertising revenue and transactional video-on-demand (TVOD) models.

- Advertising revenue potential: Targeted advertising, leveraging data-driven models, offers a significant opportunity to generate additional revenue. This approach can be more effective than blanket advertising and tailored to specific viewer profiles.

- TVOD potential: Offering high-demand content on a pay-per-view basis can generate significant additional income, particularly for exclusive movies or special events.

- Challenges: Balancing advertising revenue with a positive user experience is a delicate act. Too many ads can drive subscribers away, while insufficient advertising limits revenue potential. The fierce competition for advertising dollars also makes securing lucrative deals challenging.

Financial Performance and Investment: Assessing the Path to Profitability

Analyzing RTL Group's financial reports related to their streaming investments is essential to understand their path to profitability.

- Investment levels: Comparing the investment in streaming with other areas of the business reveals the company's commitment and priorities. Understanding the allocation of resources can indicate their long-term outlook on streaming.

- Projected profitability: Analyzing analyst predictions and company statements provides insights into the anticipated timeline for achieving profitability in their streaming ventures. These projections should be viewed with caution, however, considering the volatile nature of the streaming market.

- Risks: Market volatility and changes in consumer behavior (such as cord-cutting trends) represent significant financial risks. The competitive landscape continues to evolve, requiring constant adaptation and innovation to remain profitable.

Conclusion: The Future of RTL Group's Streaming Ambitions

RTL Group's journey to profitability in the streaming market presents a complex mix of challenges and opportunities. Success hinges on a robust content strategy that balances local appeal with global reach, effective subscriber acquisition and retention tactics, and diversified monetization strategies. While the investment in streaming is substantial, the path to profitability remains uncertain. The competitive landscape necessitates continuous innovation and adaptation.

Stay tuned for further analysis of RTL Group's streaming profitability and how their strategic decisions impact their future success in the competitive streaming market. [Link to RTL Group's financial reports] [Link to industry analysis on streaming profitability] The future of RTL Group's streaming ambitions will depend on its ability to navigate these challenges and capitalize on emerging opportunities within the dynamic streaming ecosystem.

Walliams And Cowells Fallout Celebrity Rift Deepens

Walliams And Cowells Fallout Celebrity Rift Deepens

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

David Walliams And Simon Cowell Britains Got Talent Feud Explodes

David Walliams And Simon Cowell Britains Got Talent Feud Explodes

The Big Reveal Peppa Pigs Mum Shares Babys Gender

The Big Reveal Peppa Pigs Mum Shares Babys Gender

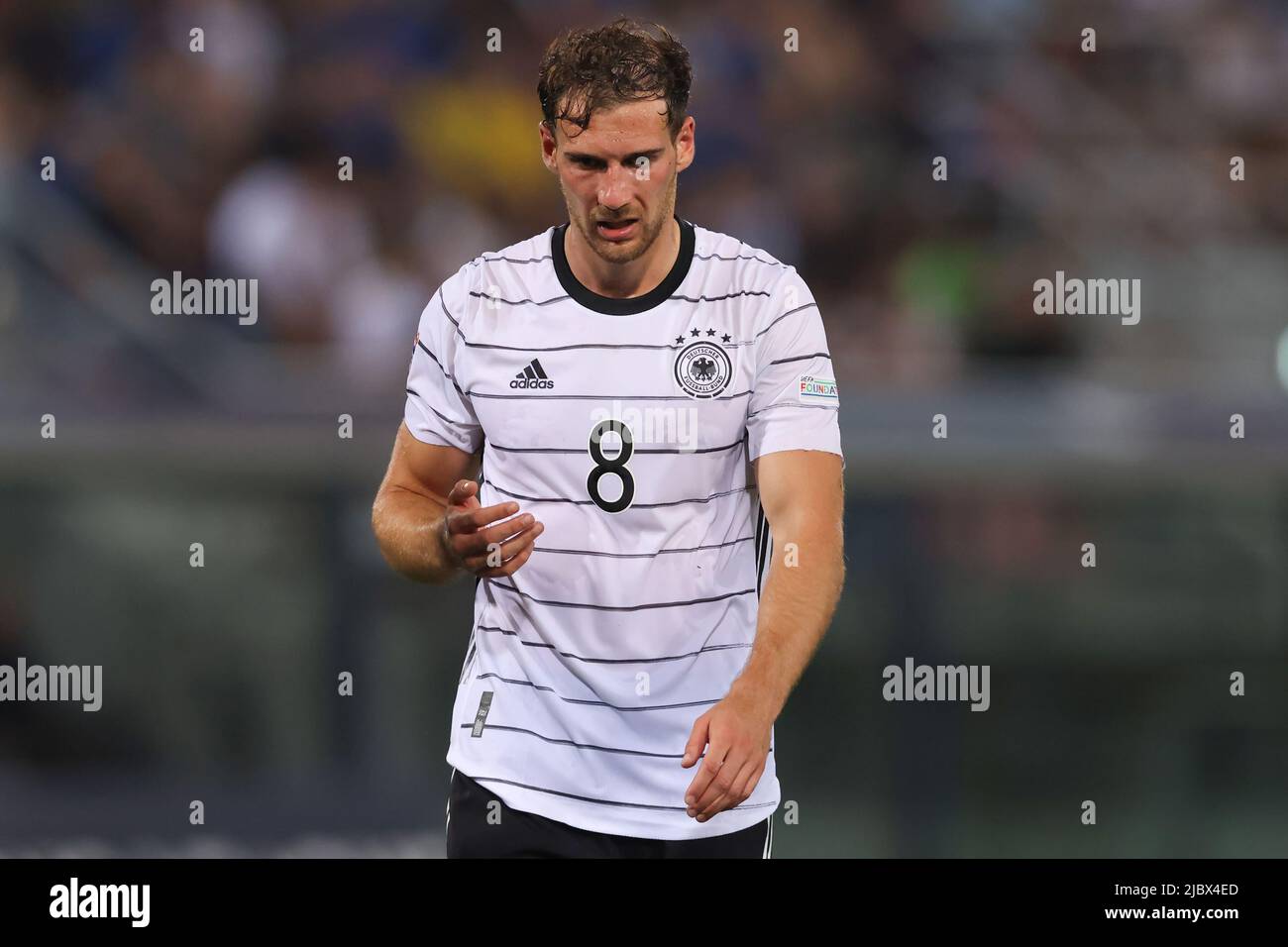

Nations League Goretzka Selected By Nagelsmann For Germany

Nations League Goretzka Selected By Nagelsmann For Germany