Ryanair: Tariff Wars Pose Biggest Growth Threat, Stock Buyback Planned

Table of Contents

Tariff Wars: A Major Obstacle to Ryanair's Growth

The escalating global trade tensions and resulting tariff wars present a formidable challenge to Ryanair's continued success. These tariffs impact the airline in several key areas:

Impact of Increased Fuel Costs

One of the most immediate and significant impacts is the increase in fuel costs. Aviation fuel is a major operational expense for any airline, and tariffs on imported fuel or related products directly translate to higher operational costs for Ryanair. This necessitates either absorbing these increased costs, which would severely impact profitability, or passing them on to consumers through higher ticket prices. A substantial increase in ticket prices could diminish Ryanair's competitive advantage in the already fiercely competitive low-cost airline market. For example, a 10% increase in fuel prices could translate to millions of euros in added expenses annually. This puts pressure on Ryanair’s ability to maintain its low-cost pricing strategy and could drive passengers to competitors. Keywords: Fuel costs, airline fuel prices, operational costs, ticket prices, price competitiveness, low-cost airlines.

Disruptions to Supply Chains

Tariffs also disrupt supply chains, impacting the procurement of vital components. From aircraft parts and engines to essential maintenance services, delays and cost increases are inevitable. This affects not only the smooth functioning of Ryanair's existing fleet but also delays and complicates its fleet management and expansion plans. Difficulties in securing aircraft parts in a timely and cost-effective manner could lead to grounded planes and operational inefficiencies. Keywords: Supply chain disruptions, aircraft parts, maintenance, fleet management, aircraft procurement.

Geopolitical Instability and its Effect on Travel Demand

Finally, the uncertainty stemming from trade wars and geopolitical instability can significantly dampen travel demand. Passengers may postpone or cancel travel plans due to economic uncertainty or fear of travel disruptions. This directly impacts route profitability and overall revenue. Regions experiencing significant political instability or economic downturn are particularly vulnerable, resulting in lower passenger numbers and reduced revenue streams for specific Ryanair routes. Keywords: Geopolitical risk, travel demand, route profitability, revenue, passenger numbers.

Ryanair's Stock Buyback Strategy: A Response to Challenges

In the face of these challenges, Ryanair has announced a significant stock buyback program.

Rationale Behind the Buyback

The rationale behind this move is likely twofold. Firstly, it aims to boost shareholder value by returning capital to investors. By reducing the number of outstanding shares, Ryanair aims to increase earnings per share (EPS), signaling confidence in its long-term prospects, despite the external pressures. Secondly, the buyback represents a strategic capital allocation decision, potentially indicating that Ryanair sees limited compelling investment opportunities elsewhere at this time given the market uncertainties. Keywords: Stock buyback, shareholder value, financial strategy, balance sheet, capital allocation.

Potential Benefits and Risks

The potential benefits of the stock buyback include a higher EPS and a boost in investor confidence. However, there are also inherent risks. By repurchase shares, Ryanair forgoes the opportunity to invest in other growth initiatives, such as new routes, fleet expansion, or technological upgrades. This trade-off requires careful consideration and risk management. Keywords: Earnings per share, return on investment, risk management, investment opportunities.

Alternative Strategies and Future Outlook for Ryanair

To mitigate the effects of tariff wars, Ryanair may explore several alternative strategies. This might include hedging strategies to mitigate fuel price volatility, diversifying its supply chain to reduce reliance on specific suppliers, and a focus on operational efficiencies to minimize costs. The long-term growth prospects for Ryanair depend significantly on its ability to adapt to and overcome these challenges. Expansion into new, less volatile markets, or the development of new revenue streams, could offer a path toward sustained growth. Keywords: Business strategy, diversification, market expansion, long-term growth, competitive advantage.

Conclusion: Navigating the Turbulence: Ryanair's Path Forward

The impact of tariff wars on Ryanair's growth is undeniable. Increased fuel costs, supply chain disruptions, and reduced travel demand pose significant challenges. The planned stock buyback represents a strategic response aimed at boosting shareholder value in the face of uncertainty. However, long-term success will depend on Ryanair's agility in adapting to the changing global landscape, exploring alternative strategies, and effectively managing risk. Stay informed about Ryanair's performance and the ongoing impact of tariff wars on the airline industry. Follow our updates for the latest news on Ryanair's strategies and future prospects.

Featured Posts

-

Analyse Abn Amro Heffingen Drukken Nederlandse Voedselexport Naar De Vs

May 21, 2025

Analyse Abn Amro Heffingen Drukken Nederlandse Voedselexport Naar De Vs

May 21, 2025 -

Outrun Movie Michael Bay Directs Sydney Sweeney Cast

May 21, 2025

Outrun Movie Michael Bay Directs Sydney Sweeney Cast

May 21, 2025 -

Big Bear Ai Holdings Inc Sued Details Of The Securities Law Case

May 21, 2025

Big Bear Ai Holdings Inc Sued Details Of The Securities Law Case

May 21, 2025 -

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025

Un Siecle De Diversification A Moncoutant Sur Sevre Et Clisson

May 21, 2025 -

A Family Legacy The Traversos At The Cannes Film Festival

May 21, 2025

A Family Legacy The Traversos At The Cannes Film Festival

May 21, 2025

Latest Posts

-

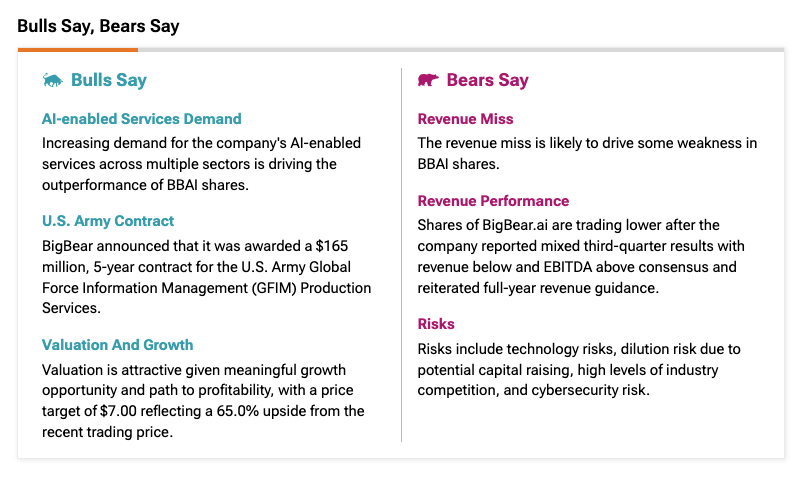

Investing In Big Bear Ai A Current Market Evaluation

May 21, 2025

Investing In Big Bear Ai A Current Market Evaluation

May 21, 2025 -

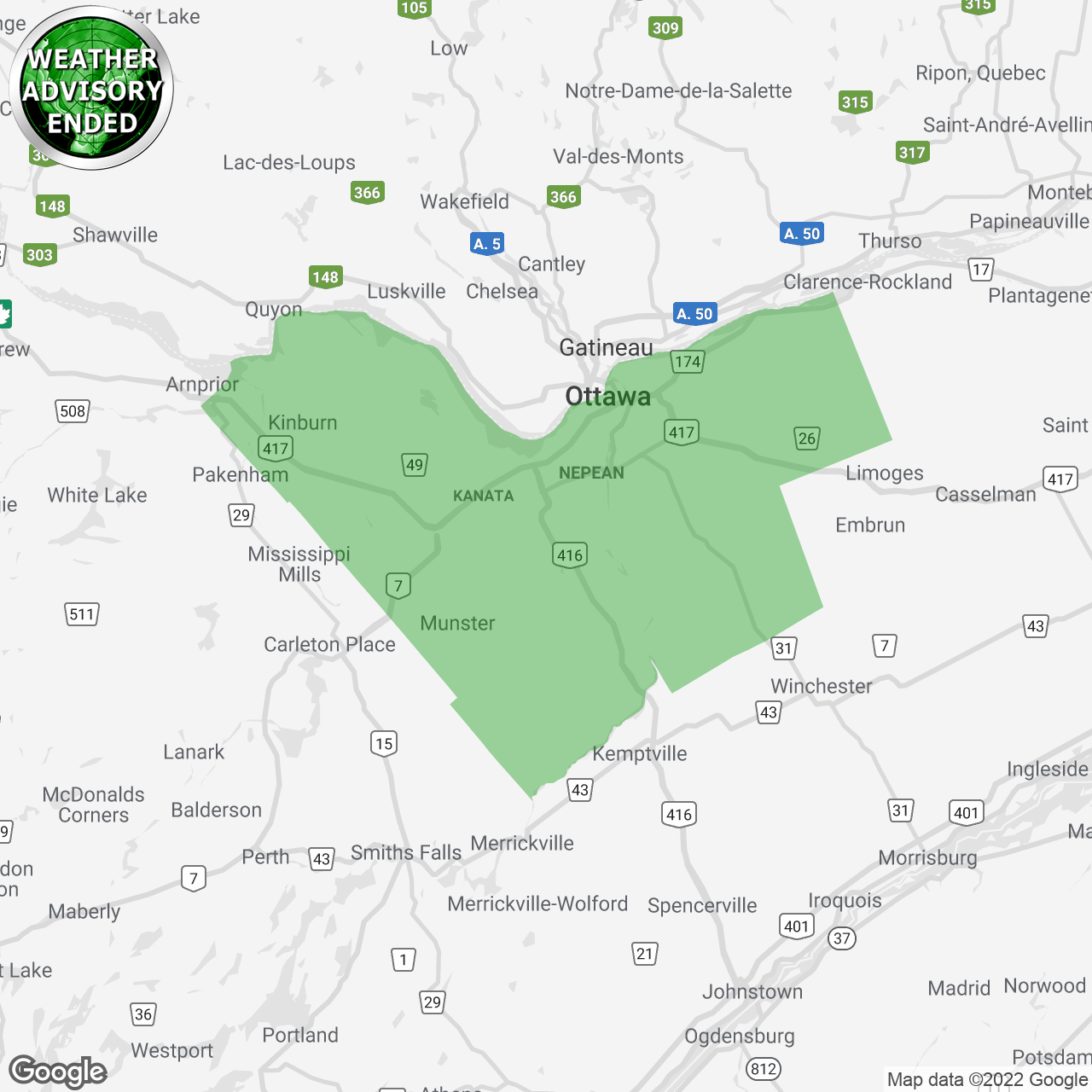

Winter Weather Advisory Impacts On School Transportation And Delays

May 21, 2025

Winter Weather Advisory Impacts On School Transportation And Delays

May 21, 2025 -

Investigating Big Bear Ai Bbai Contact Gross Law Firm For Legal Options

May 21, 2025

Investigating Big Bear Ai Bbai Contact Gross Law Firm For Legal Options

May 21, 2025 -

Big Bear Ai Stock Buy Sell Or Hold An In Depth Look

May 21, 2025

Big Bear Ai Stock Buy Sell Or Hold An In Depth Look

May 21, 2025 -

12 Ai Stocks To Watch Reddit User Recommendations And Analysis

May 21, 2025

12 Ai Stocks To Watch Reddit User Recommendations And Analysis

May 21, 2025