Sabadell Reportedly Seeks Unicaja Acquisition: Investor Discussions Underway

Table of Contents

The Rationale Behind Sabadell's Pursuit of Unicaja

The rumored acquisition of Unicaja by Sabadell is driven by several strategic objectives aimed at enhancing the acquiring bank's position within the competitive Spanish banking sector. Key motivations include:

- Increased Market Share and Regional Dominance: A successful merger would significantly boost Sabadell's market share, particularly in key regions where Unicaja holds a strong presence. This expanded footprint would translate to greater influence and customer reach.

- Significant Cost Synergies: Combining operations would unlock substantial cost savings. Consolidating branches, streamlining back-office functions, and eliminating redundancies could lead to significant efficiency gains and improved profitability. Estimates of potential savings are already being discussed among financial analysts.

- Improved Competitive Positioning: The Spanish banking sector remains fiercely competitive. By merging with Unicaja, Sabadell aims to strengthen its competitive position against larger rivals like Santander and BBVA, better equipping it to navigate future challenges.

- Business Portfolio Diversification: The acquisition would diversify Sabadell's business portfolio, reducing reliance on specific market segments and mitigating risk. Unicaja's strengths in certain areas could complement Sabadell’s existing offerings.

- Enhanced Financial Strength and Stability: A larger, more diversified bank is generally perceived as more financially stable, improving access to capital and reducing vulnerability to economic shocks. This improved financial standing could attract further investment.

The current challenges faced by both banks individually, including increased competition and pressure from regulatory changes, further underscore the rationale behind this potential merger. A combined entity would be better equipped to weather these headwinds.

Investor Reactions and Market Analysis

News of the potential Sabadell-Unicaja acquisition has triggered significant market activity and a range of investor reactions.

- Stock Price Movements: Since the initial reports, both Sabadell and Unicaja's stock prices have experienced volatility, reflecting investor sentiment and speculation surrounding the deal's likelihood. Close monitoring of these price fluctuations is crucial for understanding market confidence.

- Financial Analyst Opinions: Financial analysts offer varied perspectives, with some expressing optimism about the potential synergies and increased shareholder value, while others raise concerns about potential integration challenges and regulatory hurdles. Their analyses provide vital insights into the deal's potential success.

- Impact on Shareholder Value: The ultimate impact on shareholder value remains uncertain and depends heavily on the final terms of the acquisition, integration success, and the broader economic environment. Shareholders are likely to closely scrutinize the proposed deal structure.

- Regulatory Hurdles and Approvals: Securing necessary regulatory approvals from the European Central Bank (ECB) and Spanish authorities will be a crucial step. Antitrust concerns and compliance with banking regulations will significantly influence the deal's feasibility.

Several financial analysts have already issued reports providing their insights and predictions, offering a mixed bag of opinions regarding the deal's ultimate success. Charts illustrating the stock price movements of both Sabadell and Unicaja since the news broke would provide valuable visual data for a better understanding of the market's reaction.

Potential Challenges and Obstacles

While the Sabadell-Unicaja merger presents significant opportunities, it also faces potential challenges:

- Regulatory Approvals and Antitrust Concerns: Securing regulatory approvals is paramount. Antitrust concerns could arise if the merger significantly reduces competition within specific market segments. The authorities will carefully examine the deal’s potential impact on the Spanish banking landscape.

- Integration Difficulties: Integrating two large banking institutions is a complex undertaking. Merging IT systems, aligning operational procedures, and harmonizing corporate cultures present significant logistical and technical challenges.

- Potential Job Losses and Employee Unrest: Overlapping roles and streamlining operations could lead to job losses, potentially resulting in employee unrest and impacting morale. Careful management of this sensitive aspect is crucial for a successful merger.

- Cultural Clashes: Differences in organizational cultures between Sabadell and Unicaja could hinder smooth integration. Addressing these cultural differences and fostering a unified corporate culture will be vital.

Alternatives Considered by Sabadell

Should the Unicaja acquisition prove unsuccessful, Sabadell might explore alternative strategic options, including other potential mergers or acquisitions, focusing on organic growth initiatives, or divesting non-core assets. These alternatives will be weighed based on their potential to achieve similar strategic objectives.

Conclusion

The reported pursuit of Unicaja by Sabadell represents a significant development in the Spanish banking sector. While the acquisition offers substantial potential benefits in terms of increased market share and cost synergies, it also presents considerable challenges regarding regulatory approvals, integration, and potential job losses. The success of this potential merger hinges on meticulous planning, effective execution, and favorable regulatory decisions. The impact on the wider Spanish banking sector and individual investors will be significant, requiring continued observation and analysis.

Stay tuned for further updates on the potential Sabadell-Unicaja acquisition. We will continue to monitor the situation and provide comprehensive coverage of this evolving story, including the impact of investor discussions and potential regulatory hurdles. For more in-depth financial news and analysis of the Spanish banking sector, be sure to subscribe to our newsletter.

Featured Posts

-

Persipura Butuh Kamu Kakanwil Papua Ajak Dukung Tim Mutiara Hitam

May 13, 2025

Persipura Butuh Kamu Kakanwil Papua Ajak Dukung Tim Mutiara Hitam

May 13, 2025 -

Elsbeth Season 2 Episode 15 Preview I See Murder

May 13, 2025

Elsbeth Season 2 Episode 15 Preview I See Murder

May 13, 2025 -

Bar Roma Toronto What To Expect At This Popular Spot

May 13, 2025

Bar Roma Toronto What To Expect At This Popular Spot

May 13, 2025 -

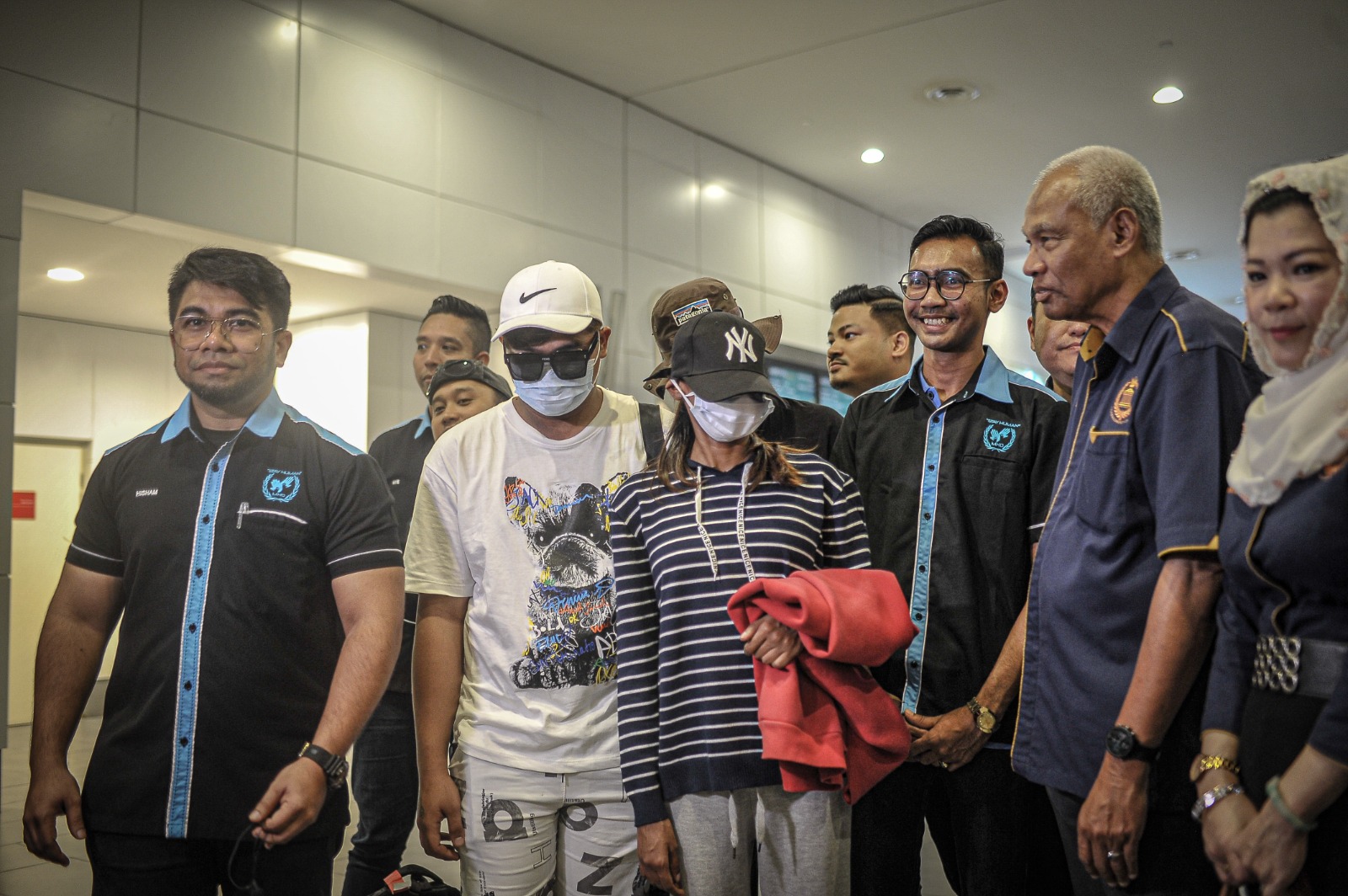

Myanmar Memperkuat Upaya Pemberantasan Judi Online Dan Penipuan Telekomunikasi

May 13, 2025

Myanmar Memperkuat Upaya Pemberantasan Judi Online Dan Penipuan Telekomunikasi

May 13, 2025 -

The Ftcs Case Against Meta Whats App Instagram And The Implications For Competition

May 13, 2025

The Ftcs Case Against Meta Whats App Instagram And The Implications For Competition

May 13, 2025