Sabadell's Approach To Unicaja Investors: Potential Merger Deal

Table of Contents

Sabadell's Proposed Terms and Conditions

Sabadell's offer to Unicaja investors hinges on several key terms and conditions, the most crucial being the share exchange ratio and the projected synergies.

Share Exchange Ratio

The proposed share exchange ratio between Sabadell and Unicaja shares is a critical determinant of the deal's success. This ratio dictates how many Sabadell shares Unicaja shareholders will receive in exchange for their existing shares. Understanding the share valuation and the implications for existing equity is paramount.

- Analysis of Fairness: The fairness of the proposed ratio is being closely scrutinized against current market valuations of both banks. Independent financial analysts are weighing in, comparing the offer price to Unicaja's recent performance and future growth prospects.

- Potential Premiums: Sabadell may offer a premium to incentivize Unicaja shareholders to accept the offer. The magnitude of this premium will heavily influence investor sentiment and acceptance rates.

- Dissenting Opinions: It's anticipated that some Unicaja shareholders might express dissent, believing the offered exchange ratio undervalues their holdings. These dissenting voices could potentially influence the outcome of the merger.

Synergies and Cost Savings

The merger's justification rests heavily on the anticipated synergies and cost savings. Combining operations promises significant efficiency gains and revenue synergy.

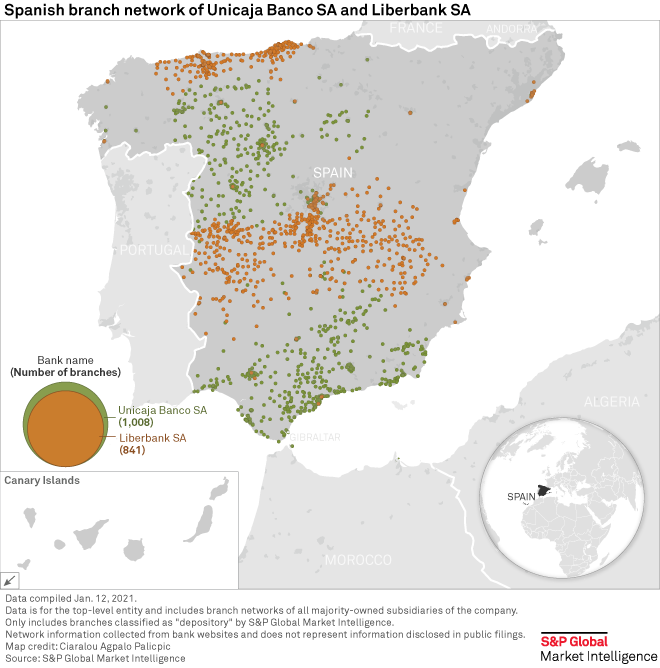

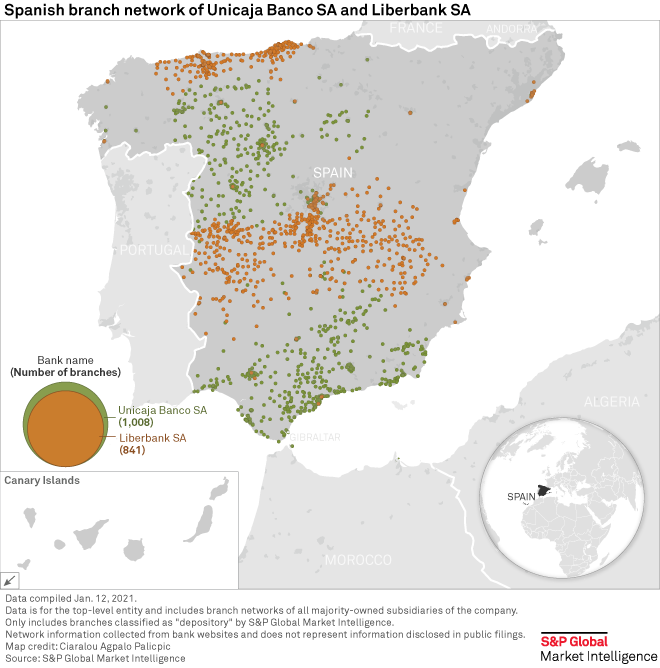

- Operational Cost Reduction: The combined entity is expected to achieve substantial reductions in operational costs through streamlining processes, consolidating branches, and optimizing technology.

- Revenue Enhancement: A larger combined market share will allow the merged entity to leverage its expanded customer base and cross-selling opportunities, leading to increased revenue streams.

- Branch Network and Employee Impact: While cost savings are projected, the merger will likely lead to adjustments in the branch network and potential workforce reductions. This aspect is likely to face scrutiny from labor unions and the public.

Investor Reactions and Concerns

Understanding the sentiment of Unicaja investors is crucial in assessing the likelihood of the merger's success. The market response will depend on several factors.

Unicaja Investor Sentiment

Investor sentiment toward the proposed merger is mixed, with some expressing enthusiasm for the potential benefits and others voicing concerns.

- Shareholder Support/Opposition: The percentage of Unicaja shareholders who have publicly declared their support or opposition provides a valuable indication of the deal's trajectory.

- Institutional Investor Decisions: Institutional investors, owning a significant stake in Unicaja, will likely play a decisive role in determining the outcome of the merger, influencing smaller shareholders' decisions.

- Public Statements and Press Releases: Close monitoring of public statements from Unicaja investor groups, as well as official press releases, offers valuable insights into prevailing sentiment and concerns.

Potential Risks and Challenges

Despite the potential benefits, significant risks and challenges could jeopardize the merger's success.

- Regulatory Approval: Securing regulatory approval from the relevant authorities is a time-consuming process, subject to potential delays. Any regulatory hurdles could significantly impact the timeline and the overall feasibility of the deal.

- Integration Challenges: Merging two distinct corporate cultures and operational systems can prove challenging. Successful integration requires careful planning and execution to mitigate potential disruptions.

- Market Risk and Macroeconomic Factors: Market volatility and broader macroeconomic conditions could negatively impact the deal's success, impacting valuations and overall investor confidence. Due diligence on these factors is crucial.

Future Outlook and Strategic Implications

The successful completion of this merger will dramatically alter the Spanish banking landscape.

Combined Bank's Market Position

The merged entity will occupy a significantly stronger market position, enjoying increased market share and enhanced competitiveness.

- Size and Reach: The combined bank will be a much larger and more geographically diverse entity within the Spanish banking sector.

- Competitive Advantage: This strengthened market presence will provide a significant competitive advantage against other major players in the sector.

- Long-Term Growth: The projected growth potential of the merged entity will depend on its ability to effectively leverage its expanded scale and market reach.

Implications for Sabadell's Growth Strategy

The merger directly aligns with Sabadell's broader strategic objectives and long-term growth strategy.

- Market Expansion: The merger could facilitate expansion into new market segments, leveraging the combined bank's enhanced resources and capabilities.

- Technological Advancements: The merger offers opportunities for accelerated digital transformation, increasing efficiency and customer service.

- Profitability and Shareholder Value: Ultimately, the success of the merger will be judged by its impact on profitability and shareholder value creation.

Conclusion

Sabadell's approach to Unicaja investors centers on a strategic merger proposal offering significant potential benefits but also presenting substantial challenges. The proposed share exchange ratio, anticipated synergies, and investor reactions will all play crucial roles in determining the deal's fate. The potential for enhanced market position and long-term growth is undeniable, but regulatory hurdles, integration complexities, and market risks must be carefully managed. To stay informed about the latest developments in this significant Sabadell-Unicaja merger, and the impact on the Spanish banking sector, follow reputable financial news sources for continuous updates.

Featured Posts

-

Untapped Potential Identifying Autism And Adhd In 3 Million Brits

May 13, 2025

Untapped Potential Identifying Autism And Adhd In 3 Million Brits

May 13, 2025 -

Britaniya I Es Peregovory O Novom Soglashenii Po Bezopasnosti

May 13, 2025

Britaniya I Es Peregovory O Novom Soglashenii Po Bezopasnosti

May 13, 2025 -

Cassie Ventura Pregnant Expecting Baby No 3 With Alex Fine

May 13, 2025

Cassie Ventura Pregnant Expecting Baby No 3 With Alex Fine

May 13, 2025 -

Decoding The Nba Draft Lottery Rules And Procedures

May 13, 2025

Decoding The Nba Draft Lottery Rules And Procedures

May 13, 2025 -

Kyle Tucker Trade Cubs Fans React To Report

May 13, 2025

Kyle Tucker Trade Cubs Fans React To Report

May 13, 2025