Sasol (SOL): A Deep Dive Into The Post-2021 Strategic Shift

Table of Contents

Sasol (SOL), a major South African chemical and energy company, underwent a significant strategic shift post-2021. This comprehensive analysis delves into the challenges that preceded the change, the key pillars of the new strategy, the subsequent performance, and the future outlook for Sasol stock and its investors. Understanding this transformation is crucial for anyone interested in Sasol's future and the potential of their investments.

The Pre-2021 Landscape: Understanding Sasol's Challenges

Before 2021, Sasol faced a confluence of challenges that significantly impacted its financial stability and long-term prospects. The company's reliance on fossil fuels, coupled with increasing pressure for ESG (Environmental, Social, and Governance) improvements, created a precarious situation. Furthermore, the ambitious Lake Charles Chemicals Project in Louisiana, USA, experienced substantial cost overruns, adding to the company's already high debt burden.

- High debt levels impacting financial stability: The significant debt accumulated, partly due to the Lake Charles project, constrained Sasol's financial flexibility and increased its vulnerability to market fluctuations.

- Lake Charles expansion project cost overruns: The project's ballooning costs far exceeded initial projections, placing immense strain on the company's finances and raising concerns about its capital allocation capabilities.

- Volatility in global energy markets: Fluctuations in oil and gas prices directly impacted Sasol's profitability, making long-term financial planning challenging.

- Increasing pressure for ESG improvements: Growing investor and societal concern over environmental impact pushed Sasol to address its carbon footprint and align with global sustainability goals.

- Dependence on fossil fuels in a changing energy landscape: The global shift towards renewable energy sources posed a significant threat to Sasol's long-term viability if it failed to adapt.

The 2021 Strategic Shift: Key Pillars and Initiatives

In response to these challenges, Sasol announced a comprehensive strategic shift in 2021, focused on debt reduction, operational efficiency, and a transition towards a more sustainable business model. This involved a series of key initiatives designed to restructure the business and enhance shareholder value.

- Asset disposals to reduce debt and strengthen the balance sheet: Sasol embarked on a program of asset sales to generate cash and alleviate its debt burden, strengthening its financial position.

- Focus on core businesses with higher profitability and growth potential: The company prioritized its most profitable and growth-oriented businesses, divesting from non-core assets to optimize resource allocation.

- Investment in low-carbon technologies and sustainable solutions: Recognizing the importance of the energy transition, Sasol committed to investing in research and development of low-carbon technologies and sustainable solutions.

- Emphasis on operational efficiency and cost optimization: Improving operational efficiency across all business segments became a core focus, aimed at reducing costs and improving profitability.

- Enhanced ESG performance and reporting: Sasol significantly improved its ESG reporting and implemented measures to enhance its environmental and social performance.

Performance and Financial Results Post-Strategic Shift

Since implementing its new strategy, Sasol has shown some improvement in its financial performance. While the full impact may take time to materialize, certain positive trends are emerging.

- Review of key financial ratios: Analysis of key ratios such as Debt-to-Equity and profit margins reveals a gradual improvement, indicating progress in debt reduction and profitability enhancement.

- Analysis of revenue streams across different business segments: Performance varies across segments, with some demonstrating stronger growth than others, highlighting the success of focusing on core businesses.

- Assessment of the success of asset divestitures: The asset disposal program has contributed significantly to debt reduction, strengthening the company's financial foundation.

- Comparison to industry peers and benchmarks: Comparing Sasol's performance to its industry peers provides valuable context, allowing for a better understanding of its relative progress.

- Impact of global economic factors on Sasol’s performance: Macroeconomic factors, such as commodity price fluctuations and global demand, continue to influence Sasol's financial results.

Future Outlook and Investment Considerations for Sasol (SOL)

The long-term success of Sasol's strategic shift depends on several factors. While the company has made strides in improving its financial health and pursuing sustainability goals, significant challenges remain.

- Potential for growth in key markets: Growth opportunities exist in key markets, particularly in regions experiencing economic expansion and increased demand for Sasol's products.

- Risks associated with energy transition and climate change policies: Stringent climate change policies and the accelerated energy transition present both risks and opportunities for Sasol.

- Opportunities in the development of low-carbon technologies: Investment in low-carbon technologies could provide significant long-term growth opportunities, but also requires substantial upfront investment and carries inherent risks.

- Assessment of the company's competitive landscape: Competition within the chemical and energy sectors is fierce, demanding ongoing innovation and adaptation from Sasol.

- Considerations for investors and potential future share price performance: Investors should carefully consider the risks and opportunities associated with Sasol's transformation before making investment decisions.

ESG Factors and Sasol's Sustainability Commitments

Sasol's commitment to ESG factors is integral to its long-term strategy and increasingly relevant to investors. The company has set ambitious targets for reducing its carbon footprint and improving its social and governance practices.

- Sasol's commitment to reducing its carbon footprint: Sasol has publicly committed to significant reductions in its greenhouse gas emissions.

- Specific targets and timelines for emissions reduction: The company has set specific targets and timelines for achieving its emissions reduction goals.

- Initiatives to improve social and governance practices: Sasol is actively working to improve its social and governance practices, enhancing transparency and accountability.

- Stakeholder engagement and reporting: Effective stakeholder engagement and transparent reporting are crucial for building trust and demonstrating progress on ESG goals.

- Alignment with global sustainability standards: Sasol aims to align its practices with internationally recognized sustainability standards and frameworks.

Conclusion

Sasol's post-2021 strategic shift represents a significant attempt to address past challenges and adapt to the evolving energy landscape. While the journey towards a sustainable and financially robust future is ongoing, the company has demonstrated a commitment to change. Understanding the nuances of this strategic shift, the financial performance post-implementation, and the company's ESG initiatives are crucial for evaluating the potential of Sasol (SOL) as an investment. Stay informed on the latest developments in Sasol's (SOL) strategic shift. Continue researching Sasol (SOL) and its ongoing transformation to make informed investment decisions. Follow our blog for further updates on Sasol stock and the energy sector.

Featured Posts

-

49 Dogs Seized From Washington County Breeder Investigation Details

May 20, 2025

49 Dogs Seized From Washington County Breeder Investigation Details

May 20, 2025 -

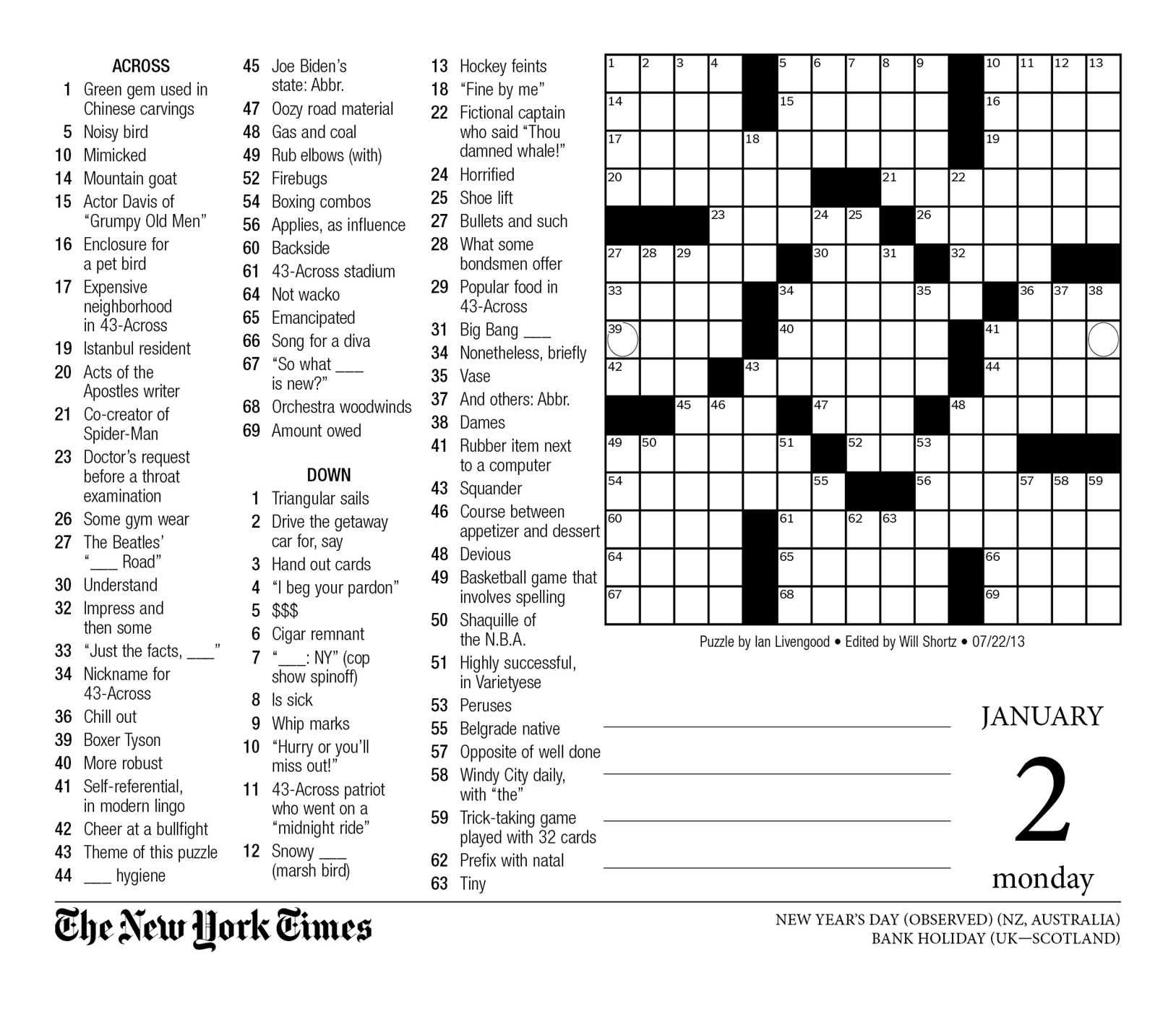

Nyt Mini Crossword Answers For Today March 13 2025

May 20, 2025

Nyt Mini Crossword Answers For Today March 13 2025

May 20, 2025 -

Mikhael Shumakher Obzavelsya Vnukom Ili Vnuchkoy

May 20, 2025

Mikhael Shumakher Obzavelsya Vnukom Ili Vnuchkoy

May 20, 2025 -

Agatha Christies Influence On M Night Shyamalans The Village

May 20, 2025

Agatha Christies Influence On M Night Shyamalans The Village

May 20, 2025 -

Nyt Mini Crossword May 1 Solving The Marvel The Avengers Clue

May 20, 2025

Nyt Mini Crossword May 1 Solving The Marvel The Avengers Clue

May 20, 2025