Saudi Arabia Investment Push: Deutsche Bank's Global Outreach

Table of Contents

Deutsche Bank's Strategic Partnerships in Saudi Arabia

Key Players and Agreements

Deutsche Bank's engagement in Saudi Arabia is characterized by strategic partnerships with both governmental entities and leading private sector companies. These collaborations are vital in driving investment across various sectors and underpinning the Kingdom's economic diversification goals.

- Public Investment Fund (PIF): Deutsche Bank has established significant relationships with the PIF, assisting in managing investments and advising on strategic portfolio allocations. This collaboration helps channel capital towards high-growth sectors and supports the PIF's global investment strategy.

- Ministry of Investment: The bank works closely with the Ministry of Investment to attract foreign direct investment (FDI) and facilitate the entry of international companies into the Saudi market. This involves providing advisory services, structuring investment deals, and managing risk.

- Saudi Aramco: Deutsche Bank has been involved in several significant projects related to the energy sector, supporting Saudi Aramco's international expansion and strategic initiatives.

- Other Private Sector Partnerships: The bank engages with numerous private sector companies across diverse sectors, including technology, infrastructure, and real estate, providing financing and advisory services to support their growth strategies. These Saudi Arabian partnerships are crucial for driving economic diversification.

Focus Sectors for Investment

Energy Transition and Renewable Energy

Saudi Arabia is committed to transitioning towards a greener economy, and Deutsche Bank plays a significant role in financing renewable energy projects. The bank's expertise in sustainable finance is instrumental in supporting the Kingdom's ambitious targets for renewable energy capacity.

- Solar and Wind Power Projects: Deutsche Bank is actively involved in financing large-scale solar and wind farms, contributing to the expansion of renewable energy infrastructure.

- Energy Efficiency Initiatives: The bank supports projects aimed at improving energy efficiency across various sectors, reducing carbon emissions and promoting sustainable development.

- Green Bonds and Sustainable Financing: Deutsche Bank facilitates the issuance of green bonds to fund renewable energy projects, attracting both domestic and international investors. This focus on renewable energy investment and green energy showcases the bank's commitment to supporting Saudi Arabia's energy transition.

Technology and Digital Transformation

Deutsche Bank is a key facilitator of Saudi Arabia's ambitious digital transformation agenda. The bank's involvement spans various technological sectors, bolstering the growth of the Kingdom's digital economy.

- Fintech Investments: Deutsche Bank supports the burgeoning Fintech sector in Saudi Arabia, providing financing and expertise to innovative startups and established companies.

- E-commerce and Digital Infrastructure: The bank invests in projects designed to enhance digital infrastructure, supporting the growth of e-commerce and other digital platforms.

- NEOM and Smart City Initiatives: Deutsche Bank's involvement extends to the development of smart cities such as NEOM, providing financing and advisory services for cutting-edge technological projects. This participation in technology investment and digital transformation strengthens Saudi Arabia's digital economy.

Global Outreach and International Investment

Attracting Foreign Direct Investment (FDI)

Deutsche Bank utilizes its extensive global network to attract significant Foreign Direct Investment (FDI) into Saudi Arabia. The bank's international reach and expertise are instrumental in promoting Saudi Arabia as an attractive investment destination.

- Global Investor Relations: Deutsche Bank actively engages with international investors, showcasing Saudi Arabia's investment opportunities and facilitating investment flows.

- Cross-border Transactions: The bank assists in structuring and managing cross-border investment transactions, enabling international companies to establish a presence in Saudi Arabia.

- Case Studies of Successful FDI: Several international companies have successfully invested in Saudi Arabia with the assistance of Deutsche Bank, demonstrating the bank's effective FDI attraction strategies. This focus on international investment and access to global capital markets is vital for Saudi Arabia's economic development.

Challenges and Future Outlook

Navigating the Geopolitical Landscape

The global investment landscape is dynamic, with geopolitical uncertainties and economic fluctuations potentially influencing investment flows.

- Risk Mitigation Strategies: Deutsche Bank employs robust risk mitigation strategies to navigate geopolitical challenges and protect investments.

- Impact of Global Events: The bank continually assesses the potential impact of global events on investment decisions, ensuring a balanced approach to risk management. Addressing geopolitical risk and maintaining a clear understanding of the global economic outlook is crucial for long-term success.

Long-Term Growth Potential

The collaboration between Saudi Arabia and Deutsche Bank presents significant long-term growth potential. The partnership is poised to contribute substantially to Saudi Arabia's economic diversification and the achievement of Vision 2030 goals.

- Future Projections: The partnership is expected to continue expanding, contributing significantly to Saudi Arabia's economic growth and creating long-term value.

- Areas for Expansion: Further opportunities exist in sectors like sustainable tourism, healthcare, and advanced manufacturing. This focus on long-term investment, economic diversification, and sustainable growth contributes significantly to Vision 2030 progress.

Conclusion: The Future of Saudi Arabia Investment and Deutsche Bank's Continued Involvement

The collaboration between Saudi Arabia and Deutsche Bank is a pivotal element in the Kingdom's ambitious economic transformation. Deutsche Bank's strategic partnerships, expertise in various sectors, and global outreach are instrumental in attracting foreign investment and driving sustainable economic growth. This partnership underscores the importance of international collaboration in achieving Vision 2030 and creating a diversified and prosperous Saudi Arabian economy. To learn more about Saudi Arabia investment opportunities and the role of Deutsche Bank, visit [insert relevant links here]. The future of Saudi Arabia's economy is bright, and Deutsche Bank's continued involvement will be crucial in shaping its success. Explore the exciting Vision 2030 investment landscape today.

Featured Posts

-

Insufficient Rainfall In March Water Deficit Remains

May 30, 2025

Insufficient Rainfall In March Water Deficit Remains

May 30, 2025 -

Amber Heards Twins Separating Fact From Fiction In The Musk Fatherhood Debate

May 30, 2025

Amber Heards Twins Separating Fact From Fiction In The Musk Fatherhood Debate

May 30, 2025 -

Mercado Agente De Bruno Fernandes Se Reune Com O Al Hilal Na Arabia Saudita

May 30, 2025

Mercado Agente De Bruno Fernandes Se Reune Com O Al Hilal Na Arabia Saudita

May 30, 2025 -

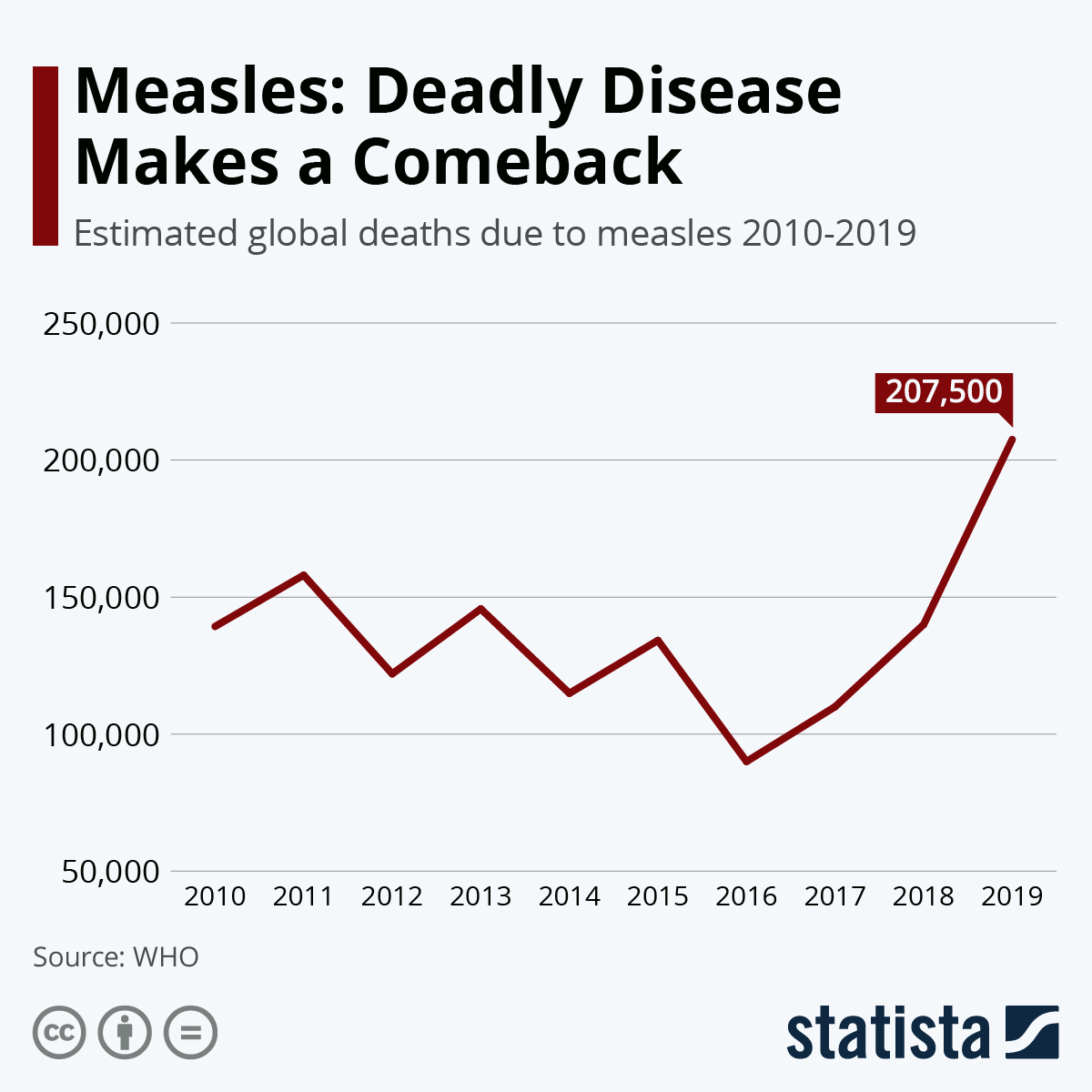

Texas Measles Outbreak Unlinked Cases Surge

May 30, 2025

Texas Measles Outbreak Unlinked Cases Surge

May 30, 2025 -

Tileoptiko Programma Savvatoy 15 Martioy

May 30, 2025

Tileoptiko Programma Savvatoy 15 Martioy

May 30, 2025