Schroders' First Quarter Losses: Client Withdrawals Hit Assets

Table of Contents

Significant Decline in Assets Under Management (AUM)

Schroders experienced a considerable drop in its Assets Under Management (AUM) during the first quarter. While the exact figures require reference to Schroders' official financial reports, preliminary reports suggest a percentage decrease significantly impacting their revenue and profitability. This decline is noteworthy when compared to both previous quarters' performance and the overall performance of competing asset management firms. The impact extends beyond simple financial figures; it potentially affects employee compensation, strategic investments, and future expansion plans. The reduction in Funds Under Management (FUM) directly translates to decreased fees and potentially necessitates cost-cutting measures or restructuring initiatives.

- Specific figures on AUM decrease: (Insert percentage decrease from official Schroders' report). This represents a substantial decline compared to Q4 2022 and the industry average.

- Comparison with competitor performance: (Compare Schroders' AUM decrease to competitors like BlackRock, Vanguard, or Fidelity). This comparative analysis highlights Schroders' relative standing within the industry.

- Impact on employee compensation or restructuring: A significant decrease in AUM might necessitate adjustments to employee compensation or even lead to restructuring efforts to improve efficiency and control costs.

The Role of Client Withdrawals

A significant contributor to Schroders' Q1 losses was a notable increase in client withdrawals. Several factors likely influenced this outflow of funds. Negative investor sentiment, stemming from global macroeconomic uncertainty and geopolitical instability, played a crucial role. Concerns over inflation, rising interest rates, and the ongoing war in Ukraine undoubtedly impacted investor confidence. Furthermore, the performance of specific Schroders investment products or strategies may have fallen short of expectations, leading to client dissatisfaction and subsequent withdrawals.

- Percentage of withdrawals from different investment categories: (Insert data showing the proportion of withdrawals from various investment categories, e.g., equities, bonds, alternatives). This breakdown reveals which asset classes faced the most significant outflows.

- Analysis of investor behavior and trends: Understanding investor behavior is crucial. Analyzing trends helps pinpoint reasons for withdrawals, allowing Schroders to adapt strategies to retain clients and attract new investment.

- Mention any regulatory changes impacting client decisions: Regulatory shifts, like increased compliance requirements or changes in tax laws, could also have influenced client investment decisions.

Impact of Market Conditions on Schroders' Performance

Global macroeconomic factors significantly impacted Schroders' investment performance during Q1. The challenging market environment, characterized by high inflation, rising interest rates, and geopolitical uncertainty, adversely affected the value of many asset classes. The war in Ukraine, for instance, introduced significant geopolitical risk, creating market volatility and impacting investor sentiment. The performance of Schroders' various investment funds and strategies reflected this challenging environment.

- Specific examples of market events impacting Schroders' performance: (Cite specific market events, such as changes in interest rates or significant geopolitical developments, and their direct impact on Schroders' investments.)

- Analysis of different asset classes' performance within Schroders' portfolio: (Analyze the performance of different asset classes within Schroders' portfolio, highlighting those most affected by market conditions.)

- Discussion of any hedging strategies employed by Schroders: (Discuss the effectiveness of any hedging strategies implemented by Schroders to mitigate losses during market volatility.)

Schroders' Response to Q1 Losses and Future Outlook

In response to the Q1 losses, Schroders is likely implementing various strategies to mitigate future losses and attract new clients. This might involve cost-cutting measures, restructuring initiatives to enhance operational efficiency, and a renewed focus on specific investment strategies showing stronger potential. Schroders' future outlook will depend on their ability to adapt to shifting market conditions, attract new clients, and demonstrate consistent investment performance.

- Specific initiatives to attract new clients and retain existing ones: (Detail any announced initiatives like new product launches, improved client services, or enhanced marketing campaigns.)

- Details on cost-cutting measures or restructuring plans: (Discuss any publicly announced cost-cutting measures or restructuring plans aimed at improving profitability.)

- Management's outlook for future performance and growth: (Summarize the management's stated expectations for future performance, growth prospects, and strategic direction.)

Conclusion: Analyzing Schroders' First Quarter Performance and What Lies Ahead

Schroders' first-quarter losses underscore the challenges facing asset managers in a volatile global market. The significant decline in AUM, largely attributed to client withdrawals and unfavorable market conditions, poses a substantial challenge. The company's response and future performance hinge on its ability to effectively navigate these challenges. Schroders' ability to adapt its investment strategies, manage costs, and attract new clients will be crucial in determining its future success. To stay updated on Schroders' investment performance and the evolving asset management landscape, subscribe to our newsletter or follow us on social media. Understanding Schroders' asset management strategies is crucial in navigating the complexities of the current market.

Featured Posts

-

Fortnite Matchmaking Error 1 A Troubleshooting Guide

May 02, 2025

Fortnite Matchmaking Error 1 A Troubleshooting Guide

May 02, 2025 -

Robust Poll Data System Preventing Election Errors And Fraud

May 02, 2025

Robust Poll Data System Preventing Election Errors And Fraud

May 02, 2025 -

Kampen Dagvaardt Enexis Probleem Met Stroomnetaansluiting Leidt Tot Kort Geding

May 02, 2025

Kampen Dagvaardt Enexis Probleem Met Stroomnetaansluiting Leidt Tot Kort Geding

May 02, 2025 -

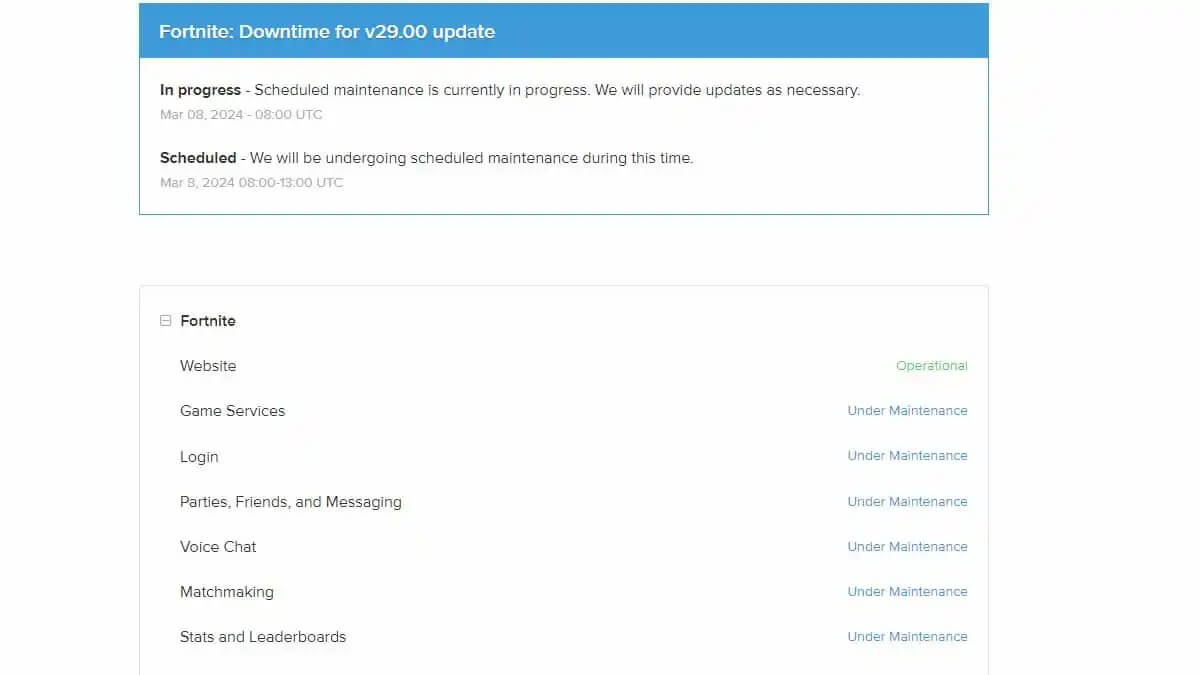

Fortnite Downtime Update 34 21 Server Status And New Content

May 02, 2025

Fortnite Downtime Update 34 21 Server Status And New Content

May 02, 2025 -

Bbc Two Hd Full Newsround Programme Details

May 02, 2025

Bbc Two Hd Full Newsround Programme Details

May 02, 2025