Schroders Q1 Asset Drop: Client Stock Exodus

Table of Contents

Market Volatility and its Impact on Schroders' Performance

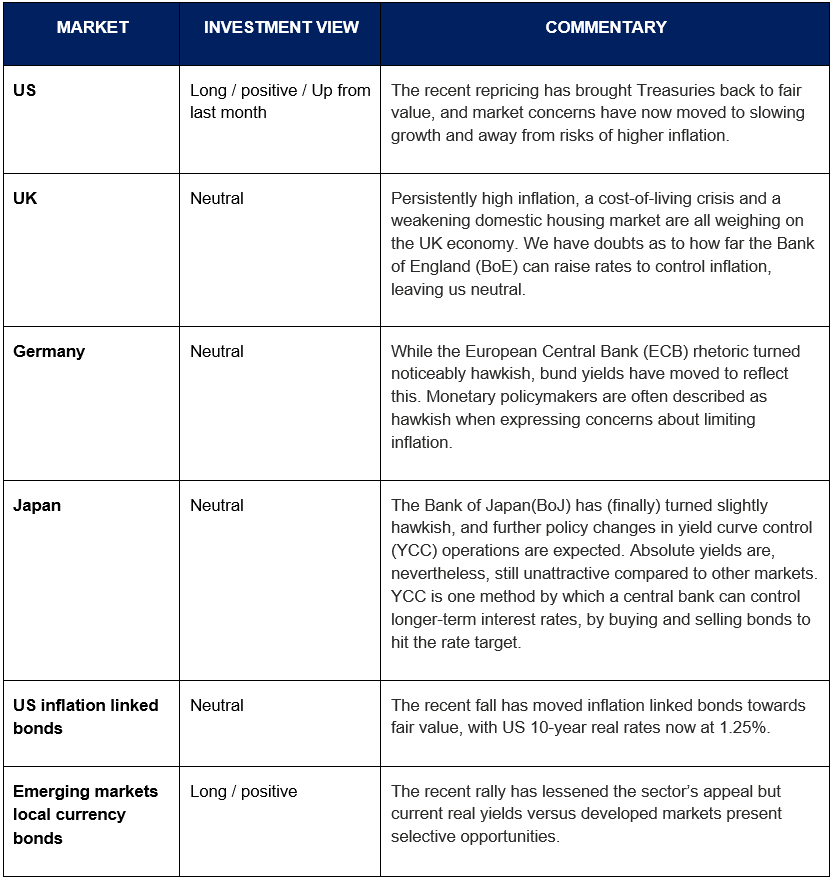

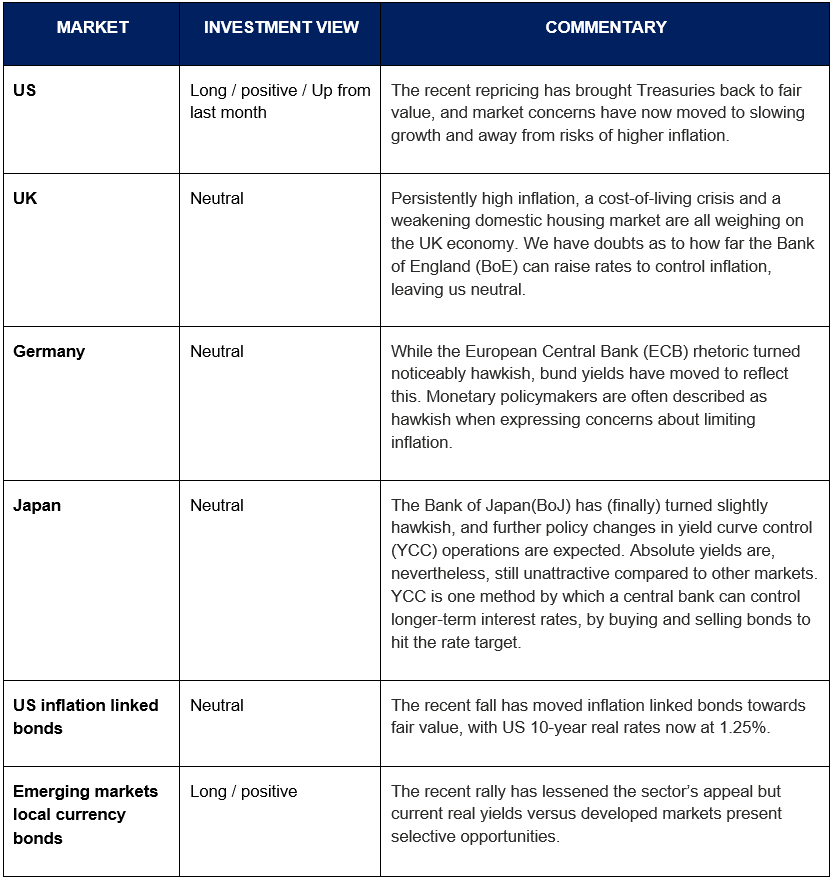

The first quarter of 2024 witnessed considerable market volatility, significantly impacting Schroders' investment performance and contributing to the observed client stock exodus. Several factors fueled this instability:

-

Fluctuating Global Markets: Global markets experienced heightened uncertainty due to a confluence of macroeconomic factors. Geopolitical tensions, particularly the ongoing conflict in Ukraine, created significant headwinds for investor confidence. The ripple effect was felt across various asset classes, impacting Schroders' portfolio diversification strategies.

-

Rising Interest Rates and Inflation: The persistent inflationary pressures prompted central banks worldwide to implement aggressive interest rate hikes. This monetary tightening policy, while intended to curb inflation, created a challenging environment for investment returns, impacting the performance of many investment funds, including those managed by Schroders. Higher interest rates increased borrowing costs for businesses and reduced the attractiveness of certain asset classes.

-

Geopolitical Risks: The war in Ukraine, coupled with escalating tensions in other regions, significantly impacted investor sentiment. Geopolitical uncertainty creates unpredictable market conditions, leading to increased risk aversion among investors and prompting capital flight from riskier assets. This uncertainty directly affected Schroders' investment strategies and their ability to generate positive returns for clients.

-

Q1 2024 Performance Data: While specific figures may not be publicly available immediately following the quarter's close, comparing Schroders' Q1 2024 performance to previous quarters, especially Q4 2023 and Q1 2023, will reveal the extent of the downturn and its deviation from historical trends. This comparison will help to quantify the impact of market volatility on Schroders’ bottom line.

Analysis of Client Stock Exodus: Identifying the Key Drivers

The significant client stock exodus experienced by Schroders in Q1 2024 can be attributed to a combination of market-driven factors and firm-specific issues. Understanding these drivers is crucial for assessing Schroders' future prospects:

-

Shift from Active to Passive Investing: The ongoing trend towards passive investment strategies, such as index funds and ETFs, has presented a significant challenge for active fund managers like Schroders. Passive investing offers lower fees and often tracks market benchmarks, making it an increasingly attractive alternative for cost-conscious investors.

-

Competitive Landscape: The asset management industry is fiercely competitive. Schroders faces competition from numerous established firms and newer entrants, each vying for a share of investor capital. This competition intensifies pressure on performance and pricing, making it challenging for Schroders to maintain its market share.

-

Fund Underperformance: Specific underperformance in certain Schroders funds may have triggered significant redemptions. Investors often react swiftly to poor performance, leading to capital outflows from underperforming funds. An analysis of individual fund performance within Schroders' portfolio is necessary to pinpoint potential problem areas.

-

Investor Concerns about Long-Term Strategy: Investor concerns regarding Schroders' long-term strategic direction might have also contributed to the asset drop. A lack of clear communication or perceived vulnerabilities in their investment strategy could erode investor confidence, prompting withdrawals.

Schroders' Response and Future Outlook

In response to the Q1 asset drop and client stock exodus, Schroders is likely undertaking several strategies to address the situation and restore investor confidence:

-

Cost-Cutting Measures: Implementing cost-cutting measures is a common response to periods of financial strain. This might involve streamlining operations, reducing staff, or renegotiating contracts to improve profitability and efficiency.

-

Regaining Investor Confidence: Schroders will need to actively work to regain investor confidence through improved communication, highlighting the strengths of their investment strategies, and demonstrating a clear path to future success. This might involve adjusting investment strategies to better align with current market conditions.

-

Risk Management Strategies: A thorough review and potential adjustments to Schroders’ risk management strategies are crucial. This involves enhancing processes to mitigate future losses and proactively identify potential threats to the firm’s portfolio performance. Strengthened risk management is key to building investor trust.

-

Future Prospects: The outlook for Schroders in the coming quarters depends on several factors, including market conditions, the success of their implemented strategies, and their ability to adapt to evolving investor preferences. A comprehensive analysis of these factors is crucial to forecasting their performance.

Conclusion

The Schroders Q1 2024 asset drop, characterized by a significant client stock exodus, resulted from a complex interplay of market volatility, shifting investor preferences towards passive strategies, and the firm’s own performance challenges. The analysis highlights the significant headwinds faced by active fund managers in a rapidly changing investment landscape. Understanding the dynamics behind this downturn is vital for investors seeking to navigate the current market effectively. Stay informed on Schroders' performance and broader market trends to make informed investment decisions. Follow our updates for further analysis of Schroders and similar asset management firms experiencing stock exodus, and gain a deeper understanding of the evolving investment landscape.

Featured Posts

-

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025 -

Trump Urged By Nvidia Ceo To Alter Ai Chip Export Policies

May 02, 2025

Trump Urged By Nvidia Ceo To Alter Ai Chip Export Policies

May 02, 2025 -

Understanding The Impact Of Trumps Tariffs On Automakers

May 02, 2025

Understanding The Impact Of Trumps Tariffs On Automakers

May 02, 2025 -

Fixing Fortnite Matchmaking Error 1 A Power Up Gaming Guide

May 02, 2025

Fixing Fortnite Matchmaking Error 1 A Power Up Gaming Guide

May 02, 2025 -

Is This Facelift A Disaster Public Outcry Over Dramatic Change

May 02, 2025

Is This Facelift A Disaster Public Outcry Over Dramatic Change

May 02, 2025