Schroders Reports First Quarter Decline: Stock Market Outflows

Table of Contents

Key Factors Contributing to Schroders' Q1 Decline

Several interconnected factors contributed to Schroders' disappointing first-quarter performance and the wider trend of stock market outflows.

Global Economic Uncertainty and Geopolitical Risks

Global economic uncertainty played a major role. High inflation rates, aggressive interest rate hikes by central banks aiming to curb inflation, and the ongoing geopolitical instability stemming from the war in Ukraine significantly impacted investor sentiment.

- Inflationary Pressures: Inflation remained stubbornly high in many countries throughout Q1, eroding purchasing power and increasing the cost of borrowing. This uncertainty led to decreased consumer spending and business investment.

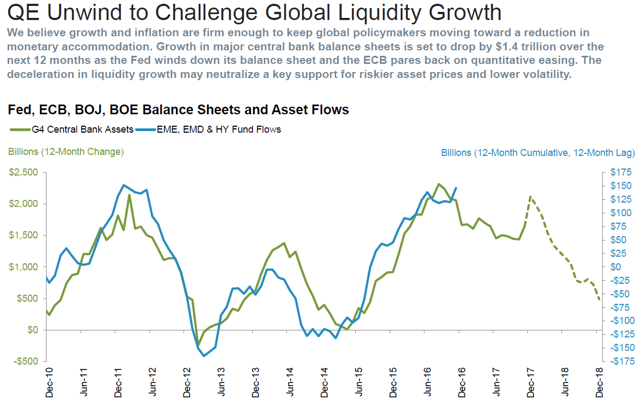

- Rising Interest Rates: Central banks worldwide increased interest rates to combat inflation, leading to higher borrowing costs for businesses and consumers. This dampened economic activity and negatively affected corporate profits.

- Geopolitical Instability: The ongoing conflict in Ukraine created significant uncertainty in global energy markets and supply chains, further contributing to economic volatility.

Increased Market Volatility and Investor Risk Aversion

The combination of these factors resulted in increased market volatility. Investors, facing significant uncertainty, adopted a risk-averse approach, moving away from riskier assets like equities.

- Market Volatility: Stock markets experienced heightened volatility during Q1, with significant daily price swings. This made investors hesitant to hold onto their equity investments.

- Flight to Safety: Risk-averse investors sought refuge in safer assets like government bonds and cash, leading to significant outflows from equity markets. This is reflected in the decreased AUM (Assets Under Management) figures reported by Schroders.

- Reduced Investor Confidence: Negative news cycles surrounding inflation, interest rates, and geopolitical events significantly reduced investor confidence, leading to further market declines.

Specific Performance of Schroders' Investment Strategies

While the broader market downturn impacted many asset managers, the specific performance of Schroders' various investment strategies also contributed to the decline.

- Underperforming Sectors: Certain sectors within Schroders' portfolio, such as technology and real estate, experienced particularly weak performance during Q1. This was partially due to rising interest rates impacting growth stocks and increased concerns over property valuations.

- Strategic Asset Allocation: Schroders' specific asset allocation strategies may have also contributed to underperformance compared to some competitors. A deeper analysis of their portfolio composition is needed to understand this aspect fully.

- Official Statements: Schroders' official reports and press releases offered further insight into the specific challenges they faced during the quarter, highlighting the impact of these market dynamics on their investment performance.

Broader Stock Market Outflows and Industry Trends

Schroders' Q1 decline wasn't an isolated incident. The trend of declining AUM was prevalent across the global asset management industry.

Global Asset Management Industry Performance

Many asset management firms reported lower AUM in Q1 2024, indicating a widespread trend of investor caution and market uncertainty.

- Industry-Wide Decline: A comparison of Schroders' performance to that of its competitors reveals a similar pattern of declining AUM across the board. This highlights the systemic nature of the market downturn.

- Data Analysis: Analyzing industry-wide data on AUM provides a clearer picture of the overall market conditions and the challenges faced by the asset management industry.

Investor Behavior and Shifting Investment Preferences

Investor behavior shifted significantly in Q1, with a noticeable trend towards safer, more conservative investments.

- Shift from Equities: The flight to safety led to a considerable shift away from equities and towards fixed-income assets and cash equivalents.

- Emerging Trends: While conservative investments gained favor, there was also increased interest in sustainable and ESG (environmental, social, and governance) focused investments. This reflects a long-term shift in investor priorities.

Schroders' Response and Outlook for the Future

Schroders is actively addressing the challenges posed by the market downturn and is implementing strategies to navigate the current environment.

Schroders' Strategies to Address the Decline

Schroders is likely taking a multi-pronged approach to mitigate the impact of the decline.

- Cost-Cutting Measures: To improve profitability, Schroders may implement cost-cutting measures, including streamlining operations and potentially reducing headcount in certain areas.

- Strategic Shifts: The firm may adjust its investment strategies to better align with the current market conditions, focusing on opportunities in less volatile sectors.

- Investor Engagement: Schroders might intensify investor communication and engagement efforts to maintain client relationships and attract new investors.

Schroders' Outlook and Predictions for the Remainder of the Year

Schroders' official outlook for the remainder of the year, available through press releases and investor statements, will offer valuable insights into their expectations for market performance. This information is crucial for investors to make informed decisions.

Conclusion: Understanding Schroders' Q1 Decline and Stock Market Trends

Schroders' first-quarter decline underscores the impact of global economic uncertainty, geopolitical risks, and increased market volatility on investor behavior. This decline mirrors broader trends of stock market outflows across the asset management industry. Understanding these trends and Schroders' response is critical for investors to make informed decisions and adapt their investment strategies accordingly. Stay informed about market trends and Schroders' Q1 performance by regularly checking their website and financial news sources for updates on Schroders Reports First Quarter Decline: Stock Market Outflows and related asset management trends.

Featured Posts

-

Agreement Signed Grant Funding For Development Projects In Mauritius

May 03, 2025

Agreement Signed Grant Funding For Development Projects In Mauritius

May 03, 2025 -

Canadian Dollar Rises Following Trump Carney Deal Hints

May 03, 2025

Canadian Dollar Rises Following Trump Carney Deal Hints

May 03, 2025 -

Daily Lotto Thursday 17th April 2025 Winning Numbers

May 03, 2025

Daily Lotto Thursday 17th April 2025 Winning Numbers

May 03, 2025 -

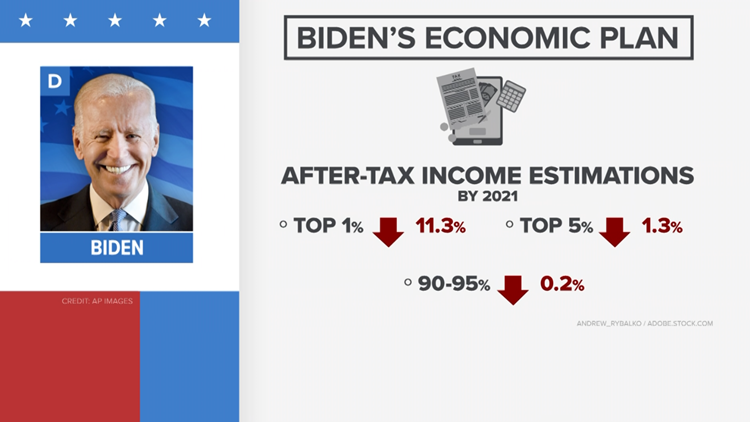

Assessing President Bidens Economic Policies Causes And Consequences Of The Slowdown

May 03, 2025

Assessing President Bidens Economic Policies Causes And Consequences Of The Slowdown

May 03, 2025 -

La Nouvelle Loi Sur Les Partis En Algerie Positions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

La Nouvelle Loi Sur Les Partis En Algerie Positions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025