Scrutiny Of Thames Water Executive Bonuses: Were They Justified?

Table of Contents

The awarding of substantial executive bonuses at Thames Water, amidst a backdrop of widespread criticism regarding its performance, particularly concerning sewage discharges and water quality, has ignited a firestorm of public debate. This article scrutinizes the justification for these bonuses, analyzing various perspectives and the complex factors involved. We'll delve into the company's financial performance, environmental record, and regulatory oversight to determine whether these payouts were ethically and financially sound. The scrutiny of executive bonuses at Thames Water raises crucial questions about corporate responsibility and environmental stewardship.

Thames Water's Financial Performance & Bonus Structure

Profitability and Shareholder Returns

Were Thames Water's financial achievements sufficient to warrant the substantial executive bonuses awarded? Analyzing the company's financial statements reveals a complex picture. While profitability and shareholder returns are key indicators of success, their interpretation in this context requires careful consideration of the company's environmental performance and regulatory context.

- Examine profit margins compared to industry averages: A comparison of Thames Water's profit margins against its competitors within the UK water industry is essential to determine whether its performance was exceptional enough to justify the bonus payouts. Industry benchmarks provide a crucial context for evaluating profitability.

- Analyze shareholder dividends and capital appreciation: The impact of the bonus payments on shareholder dividends and capital appreciation needs to be assessed. Did these bonuses detract from returns to shareholders, raising concerns about equitable distribution of profits?

- Consider the impact of regulatory changes on profitability: Changes in Ofwat's regulatory framework can significantly influence a water company's profitability. Did these regulatory changes impact Thames Water's financial performance, and should this be factored into an evaluation of the bonus structure?

Bonus Scheme Details

Understanding the specifics of Thames Water's bonus scheme is crucial to assessing the justification of the payouts. Transparency and alignment with company goals are paramount.

- Analyze the bonus structure’s weighting of short-term versus long-term targets: A heavy weighting towards short-term targets might incentivize executives to prioritize immediate gains over long-term sustainability and environmental responsibility. The balance between short-term and long-term incentives is critical.

- Identify key performance indicators (KPIs) used in bonus calculations: Examining the KPIs used reveals what aspects of the business were prioritized. Were environmental performance indicators given sufficient weight? A lack of environmental KPIs raises serious ethical questions.

- Assess the transparency and accessibility of the bonus scheme details: The transparency of the bonus scheme is crucial. Were the details readily available to shareholders and the public, allowing for scrutiny and accountability?

Environmental Performance and Regulatory Scrutiny

Sewage Discharges and Water Quality

Thames Water's record on sewage discharges and water quality has been a major source of public criticism. The scale and frequency of these incidents directly impact public trust and environmental sustainability.

- Quantify the number and scale of sewage discharge incidents: A detailed analysis of the number, duration, and volume of sewage discharges is necessary to assess the severity of the environmental impact. This data should be compared to regulatory limits and industry standards.

- Assess the impact on water quality and aquatic ecosystems: The consequences of sewage discharges on water quality and aquatic ecosystems need to be carefully assessed. This includes the impact on biodiversity and human health.

- Analyze the regulatory fines and penalties imposed on the company: Examining the fines and penalties imposed by Ofwat highlights the severity of the regulatory response and the potential disconnect between environmental transgressions and financial consequences for executives.

Regulatory Oversight and Accountability

The effectiveness of Ofwat's oversight of Thames Water is paramount in ensuring environmental responsibility. The regulatory framework's capacity to prevent and address environmental damage needs careful evaluation.

- Evaluate Ofwat's regulatory framework and enforcement mechanisms: Ofwat’s regulatory framework must be robust enough to hold water companies accountable for environmental performance. An assessment of its effectiveness is essential.

- Examine the level of fines imposed in relation to the scale of infractions: Are the fines levied sufficient deterrents? A significant disparity between the scale of environmental damage and the financial penalties raises questions about the effectiveness of the regulatory system.

- Discuss the potential for regulatory reforms to enhance accountability: Are reforms needed to strengthen regulatory oversight and enhance accountability within the water industry? This is a crucial aspect of the discussion surrounding executive compensation.

Public Opinion and Ethical Considerations

Public Outrage and Media Coverage

Public reaction to the executive bonuses has been strongly negative, largely due to Thames Water's environmental record. This negative sentiment significantly impacts the company’s reputation.

- Summarize public sentiment via social media, news articles, and public opinion polls: Analyzing public sentiment across various platforms gives a comprehensive understanding of the public response to the bonuses.

- Analyze the impact of negative media coverage on the company's reputation: The negative media coverage has undoubtedly tarnished Thames Water's image, affecting its relationship with customers and stakeholders.

- Discuss the ethical implications of awarding large bonuses amid environmental concerns: Awarding substantial bonuses while facing criticism for environmental failings raises serious ethical questions about corporate responsibility and leadership.

Corporate Social Responsibility (CSR)

Thames Water's commitment to Corporate Social Responsibility (CSR) is essential in assessing whether the bonuses align with its values. A discrepancy between stated goals and actions further fuels public criticism.

- Analyze the company's stated CSR goals and initiatives: Examining Thames Water's published CSR goals and initiatives reveals their commitment to sustainability and community engagement.

- Evaluate the alignment between stated goals and actions: A critical analysis of the gap between stated goals and actual actions is vital. Inconsistency undermines the company's credibility.

- Assess the transparency and accountability of CSR initiatives: Transparency and accountability are key to effective CSR. Public access to information regarding CSR initiatives is crucial for effective scrutiny.

Conclusion

This article explored the contentious issue of Thames Water executive bonuses, analyzing the company’s financial performance, environmental record, regulatory oversight, and public perception. We weighed the arguments for and against the justification of these payouts. A comprehensive analysis necessitates a careful consideration of all factors involved. The scrutiny of Thames Water’s executive compensation demonstrates a critical need for greater alignment between financial success and environmental responsibility.

Call to Action: The scrutiny of Thames Water executive bonuses highlights the need for greater transparency and accountability in corporate governance, especially within environmentally sensitive sectors. Further debate and regulatory action are needed to ensure that future executive compensation aligns with both financial success and environmental responsibility. Let's continue the discussion about the scrutiny of executive bonuses in the water industry and demand greater corporate responsibility. We must hold companies accountable for their environmental impact and ensure that executive compensation reflects responsible business practices.

Featured Posts

-

Two Israeli Embassy Staff Members Killed In Washington Dc Shooting Ap Images

May 22, 2025

Two Israeli Embassy Staff Members Killed In Washington Dc Shooting Ap Images

May 22, 2025 -

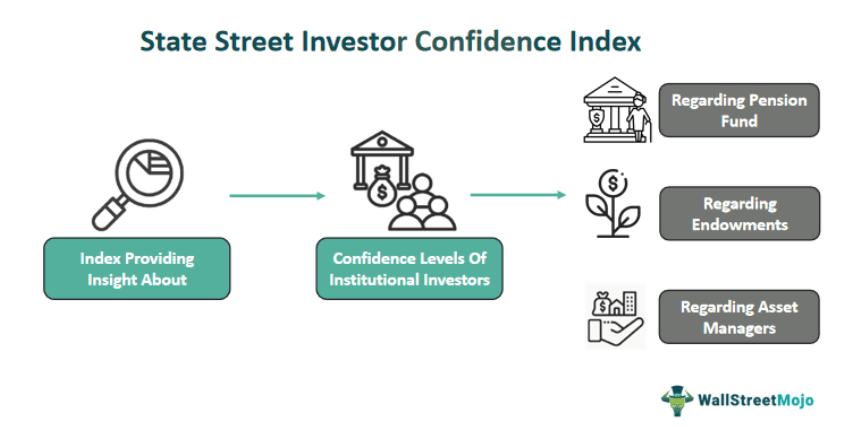

Assessing Googles Ai Capabilities A Look At Investor Confidence

May 22, 2025

Assessing Googles Ai Capabilities A Look At Investor Confidence

May 22, 2025 -

Early Exit For Aruna At Wtt Chennai Table Tennis

May 22, 2025

Early Exit For Aruna At Wtt Chennai Table Tennis

May 22, 2025 -

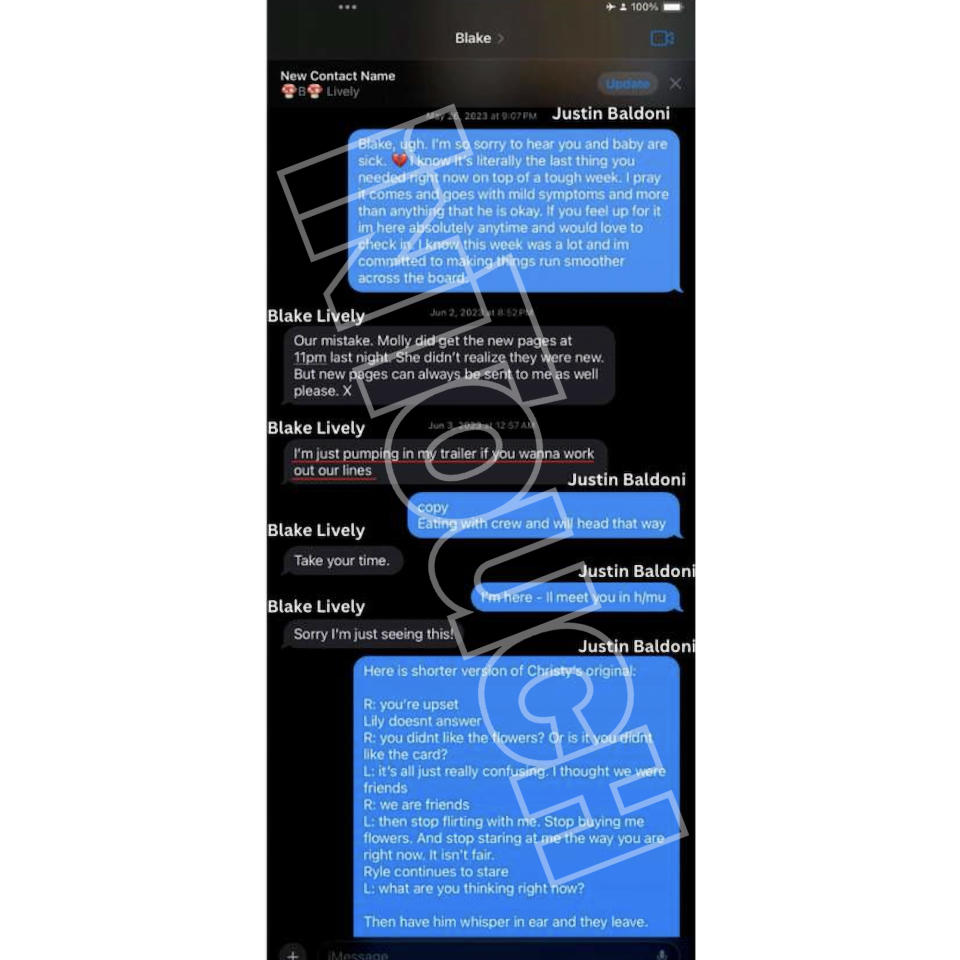

Blake Livelys Alleged Actions A Comprehensive Look At Recent Reports

May 22, 2025

Blake Livelys Alleged Actions A Comprehensive Look At Recent Reports

May 22, 2025 -

Cyberattack On Marks And Spencer Results In 300 Million Loss

May 22, 2025

Cyberattack On Marks And Spencer Results In 300 Million Loss

May 22, 2025