SEC Considers XRP A Commodity: Implications Of Ripple Settlement Talks

Table of Contents

Potential Outcomes of the Ripple Settlement and their Impact on XRP

The Ripple-SEC lawsuit could conclude in several ways, each with significant consequences for XRP and the cryptocurrency market as a whole.

A Favorable Settlement for Ripple

A favorable settlement, whether through a win in court or a negotiated agreement, could be incredibly bullish for XRP.

-

Impact on XRP's Price and Market Capitalization: A positive outcome would likely trigger a surge in XRP's price and market capitalization. Investors who had previously been hesitant due to regulatory uncertainty would regain confidence.

-

Increased Trading Volume and Investor Confidence: Trading volume would likely increase dramatically as investors rush to buy XRP. This renewed confidence could lead to significant price appreciation.

-

Positive Regulatory Clarity: A favorable outcome could provide much-needed regulatory clarity, paving the way for broader adoption.

-

Bullet points:

- Increased XRP adoption by exchanges and institutions.

- Positive regulatory clarity leading to more institutional investment.

- Improved market sentiment and a boost in investor confidence.

An Unfavorable Outcome for Ripple

Conversely, an unfavorable settlement could severely damage XRP's price and market standing.

-

Negative Impact on XRP's Price and Market Standing: A loss could lead to a significant drop in XRP's value, potentially wiping out a substantial portion of investor holdings.

-

Regulatory Hurdles and Investor Uncertainty: An unfavorable ruling would exacerbate regulatory uncertainty and likely deter further investment in XRP.

-

Potential Delisting from Exchanges: Some exchanges might delist XRP, reducing its accessibility and liquidity.

-

Bullet points:

- Decreased XRP value, potentially leading to significant losses for investors.

- Negative market sentiment and a loss of investor confidence.

- Potential delisting from major cryptocurrency exchanges.

The Impact on Other Cryptocurrencies

The Ripple-SEC case has broad implications that extend far beyond XRP.

-

Increased Regulatory Scrutiny: The SEC's actions have set a precedent, potentially increasing regulatory scrutiny across the entire cryptocurrency market. Other cryptocurrencies could face similar legal challenges.

-

Ripple Effect on the Crypto Landscape: The outcome will significantly impact investor behavior and the overall crypto market sentiment. Uncertainty could lead to market volatility.

-

Bullet points:

- Increased regulatory clarity (or uncertainty) for other crypto assets.

- Potential for similar lawsuits against other cryptocurrency projects.

- Impact on altcoin prices and market capitalization.

Implications of XRP's Commodity Classification

The SEC's potential reclassification of XRP as a commodity carries significant implications.

Regulatory Clarity and Future of XRP

Classifying XRP as a commodity would provide much-needed regulatory clarity.

-

Benefits of Clear Regulatory Classification: Clear rules would simplify compliance, attract institutional investment, and protect investors.

-

Future Development and Adoption: Reduced regulatory risk could accelerate XRP's development and adoption.

-

Bullet points:

- Increased transparency and reduced legal risk for XRP.

- Potential for increased institutional investment in XRP.

- Easier regulatory compliance for businesses using XRP.

Impact on the DeFi Ecosystem

XRP's classification as a commodity could significantly impact its role in decentralized finance (DeFi).

-

Integration with DeFi Protocols: Whether its use in DeFi applications increases or decreases depends on the specifics of the regulatory framework.

-

Liquidity and Accessibility: Changes in regulatory status could influence liquidity and accessibility within DeFi.

-

Bullet points:

- Changes in XRP's usage in various DeFi applications (e.g., lending, borrowing, yield farming).

- Potential for new opportunities or limitations in the DeFi space for XRP.

The Ongoing Debate on Security vs. Commodity Classification in Crypto

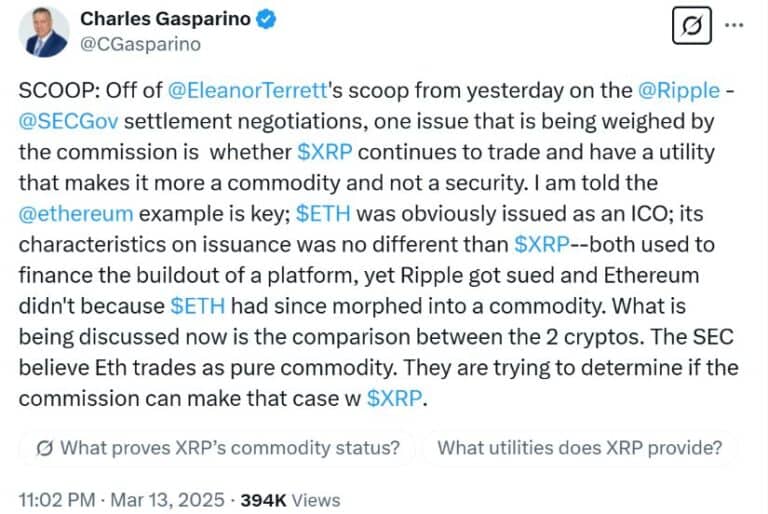

The core of the Ripple-SEC dispute lies in the debate over whether XRP is a security or a commodity.

The Howey Test and its Applicability to XRP

The Howey Test is a crucial legal standard used to determine whether an investment contract qualifies as a security.

-

Explanation of the Howey Test: This test examines whether an investment involves an investment of money, a common enterprise, an expectation of profit, and reliance on the efforts of others.

-

Arguments from the SEC and Ripple: The SEC argues that XRP sales constituted an investment contract, fulfilling the Howey Test criteria. Ripple counters that XRP is a decentralized digital asset, not a security offered by a central entity.

-

Legal Complexities of Classifying Crypto Assets: Applying traditional securities laws to novel crypto assets presents significant challenges, highlighting the need for clear regulatory frameworks.

-

Bullet points:

- A detailed explanation of the Howey Test and its application to investment contracts.

- Key arguments presented by the SEC and Ripple regarding the applicability of the Howey Test to XRP.

- Discussion of the inherent legal complexities involved in classifying crypto assets.

Conclusion: Navigating the Future of XRP After the Ripple Settlement

The Ripple settlement and the SEC's stance on XRP's classification will significantly impact XRP's price, market position, and the broader cryptocurrency landscape. The outcome will shape the future of crypto regulation and investor confidence. Staying informed about regulatory developments and their effect on the crypto space is crucial. Continue to follow updates on the Ripple, XRP, and SEC case and research the implications for your investments. Understanding the nuances of XRP commodity classification is vital for navigating the evolving crypto market.

Featured Posts

-

Investing In Mental Health The Key To A Productive Workforce

May 02, 2025

Investing In Mental Health The Key To A Productive Workforce

May 02, 2025 -

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension By Nrc

May 02, 2025

Warri Itakpe Rail Line Shut Down Engine Failure Causes Suspension By Nrc

May 02, 2025 -

The Concerning Trend Of Fortnite Game Mode Shutdowns

May 02, 2025

The Concerning Trend Of Fortnite Game Mode Shutdowns

May 02, 2025 -

Fortnites Item Shop Gets A Helpful New Update

May 02, 2025

Fortnites Item Shop Gets A Helpful New Update

May 02, 2025 -

Rossiya I Chekhiya Obsuzhdenie Perspektiv Ekonomicheskogo Partnerstva

May 02, 2025

Rossiya I Chekhiya Obsuzhdenie Perspektiv Ekonomicheskogo Partnerstva

May 02, 2025