SEC Crypto Broker Rules Face Overhaul: Chairman Atkins' Announcement

Table of Contents

Key Changes Proposed in the SEC Crypto Broker Rule Overhaul

The proposed overhaul of SEC crypto broker rules introduces substantial changes aimed at enhancing investor protection and market integrity. These alterations represent a significant departure from the previous, relatively less defined regulatory landscape. The SEC aims to bring greater clarity and consistency to how cryptocurrency platforms are regulated. Some of the most impactful proposed changes include:

-

Increased Regulatory Scrutiny of Crypto Trading Platforms: The SEC plans to increase oversight of all aspects of crypto trading platforms, including their operations, financial health, and internal controls. This involves stricter reporting requirements and more frequent audits.

-

New Requirements for Customer Asset Protection: The proposed rules emphasize robust customer asset protection measures. This could involve stricter segregation of customer funds, increased transparency regarding custody arrangements, and possibly even insurance requirements. The focus is on preventing the misuse or loss of customer assets.

-

Stricter Anti-Money Laundering (AML) and Know-Your-Customer (KYC) Compliance Measures: The SEC is likely to enforce stricter AML and KYC regulations to curb illicit activities within the cryptocurrency market. This involves implementing more rigorous identity verification processes and transaction monitoring systems.

-

Clarification on the Definition of a "Crypto Broker" and its Implications: The revised rules will aim to provide a more precise definition of what constitutes a "crypto broker," clarifying which platforms fall under the SEC's jurisdiction. This will address ambiguity and ensure consistent application of the regulations.

-

Potential Implications for Staking Services and Lending Platforms: The proposed changes will likely extend to platforms offering staking services and crypto lending, subjecting these activities to greater regulatory scrutiny. This could impact the services offered and the operational models of these platforms. The SEC is focusing on classifying these services as securities offerings in many cases, thus requiring registration and compliance.

Impact on Crypto Brokerages and the Industry

The impact of the new SEC crypto broker rules on the cryptocurrency industry will be far-reaching. Existing brokerages face significant challenges, but also some opportunities.

-

Increased Operational Costs for Compliance: Meeting the stricter regulatory requirements will undoubtedly increase operational costs for crypto brokerages. This includes investments in new technology, compliance personnel, and legal expertise.

-

Potential Consolidation within the Industry: Smaller brokerages may find it difficult to meet the heightened compliance standards, leading to consolidation and a smaller number of larger, more established players.

-

Improved Investor Protection: The stricter regulations will likely lead to improved investor protection, reducing the risk of fraud and mismanagement.

-

Enhanced Market Integrity and Stability: The increased regulatory oversight aims to enhance market integrity and stability, potentially attracting more institutional investors.

-

Potential for Decreased Innovation due to Stricter Regulations: Some argue that stricter regulations could stifle innovation within the cryptocurrency industry, as smaller startups might find it harder to compete. The balance between investor protection and fostering innovation will be a key consideration.

Reaction from the Crypto Community and Industry Stakeholders

The proposed SEC crypto broker rules have elicited mixed reactions from the crypto community and industry stakeholders.

-

Support for Increased Investor Protection: Many investors and industry participants support the increased focus on investor protection, recognizing the need for better safeguards in this rapidly evolving market.

-

Concerns about the Impact on Innovation and Competition: Concerns have been raised that the stricter regulations could stifle innovation and reduce competition within the industry. Smaller companies might struggle to comply with the new rules.

-

Debate Surrounding the Definition of a "Crypto Broker": The definition of a "crypto broker" remains a point of contention, with some platforms arguing that the SEC's interpretation is too broad.

-

Calls for More Clarity and Transparency in the Regulatory Framework: Many stakeholders advocate for greater clarity and transparency in the regulatory framework to ensure fair and equitable application of the rules.

The Path Forward: Next Steps and Potential Timeline

The implementation of the new SEC crypto broker rules will likely unfold over several stages.

-

Timeline for Rule Implementation: The SEC will likely publish a detailed timeline for the implementation of the new rules once the final version is approved.

-

Public Comment Period Details: A public comment period will be crucial for industry stakeholders to voice their concerns and suggestions. Careful review of any proposed rule changes is needed.

-

Potential Legal Challenges and Their Implications: The new rules are likely to face legal challenges from various parties, potentially delaying or altering their implementation.

-

Opportunities for Industry Feedback and Engagement: Industry participants will have opportunities to provide feedback and engage with the SEC throughout the rulemaking process.

SEC Crypto Broker Rules Face Overhaul: Chairman Atkins' Announcement – What's Next?

Chairman Atkins' announcement signals a pivotal moment for the cryptocurrency industry. The proposed overhaul of SEC crypto broker rules aims to significantly increase regulatory scrutiny, enhance investor protection, and promote market integrity. While the changes present challenges for brokerages, they also offer the potential for greater market stability and trust. The impact will be profound, affecting operational costs, industry structure, and the pace of innovation. Staying informed about the ongoing changes to SEC crypto broker rules is crucial for navigating this evolving regulatory landscape effectively. Actively participate in the public comment periods to ensure your voice is heard and the final rules are balanced and fair. Learn more about the impact of the updated SEC crypto broker rules on your business by [link to relevant resource].

Featured Posts

-

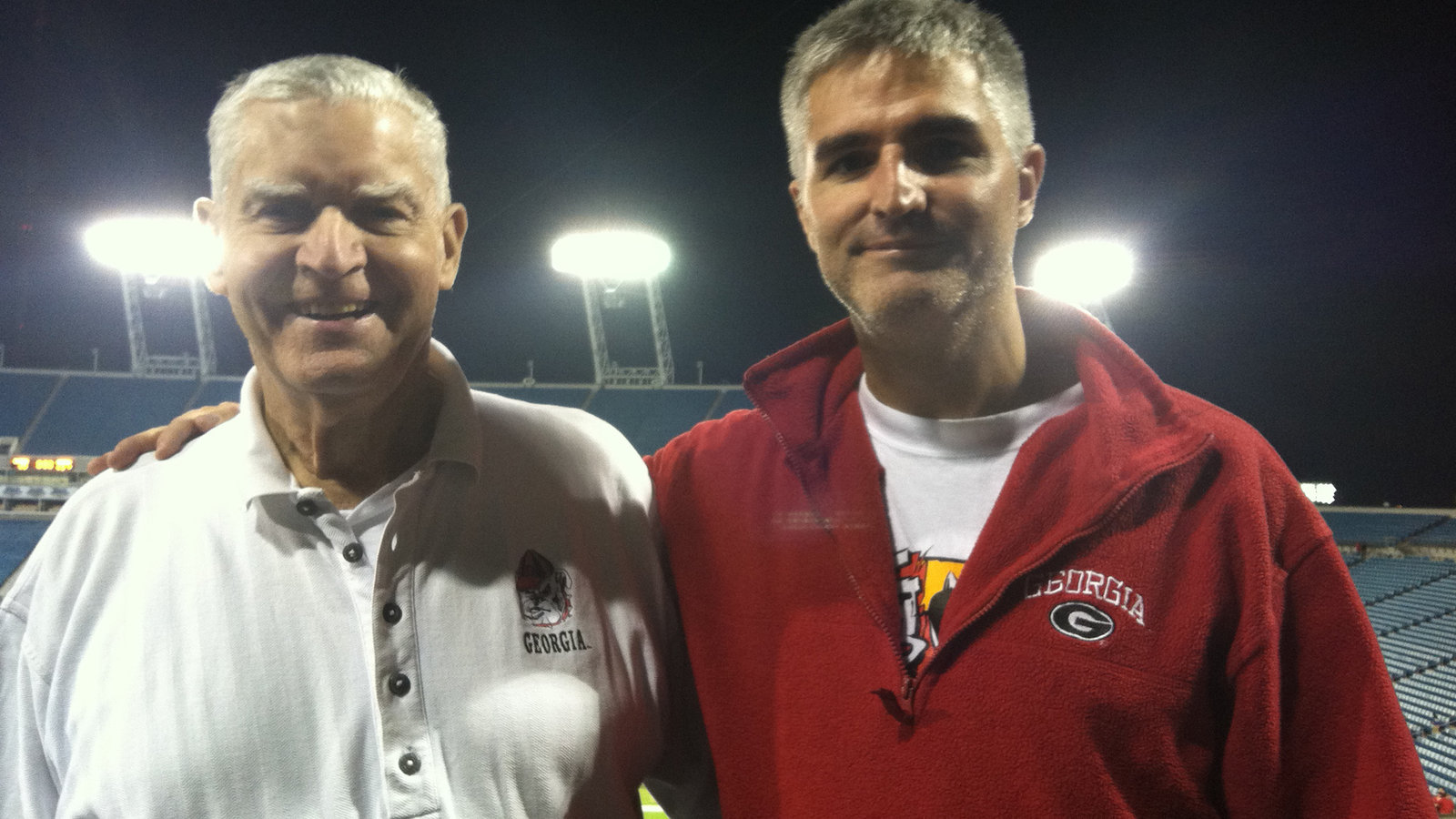

Cp Music Productions A Father Son Legacy In Music

May 13, 2025

Cp Music Productions A Father Son Legacy In Music

May 13, 2025 -

Over The Counter Birth Control Redefining Reproductive Healthcare After Roe

May 13, 2025

Over The Counter Birth Control Redefining Reproductive Healthcare After Roe

May 13, 2025 -

Muslim Mega City Development Plan Under Scrutiny Following Mosque Police Raid

May 13, 2025

Muslim Mega City Development Plan Under Scrutiny Following Mosque Police Raid

May 13, 2025 -

Hbybt Lywnardw Dy Kabryw Aljdydt Mn Hy Wkyf Ksrt Alqaedt

May 13, 2025

Hbybt Lywnardw Dy Kabryw Aljdydt Mn Hy Wkyf Ksrt Alqaedt

May 13, 2025 -

Aryna Sabalenka Triumphs Over Jessica Pegula At Miami Open

May 13, 2025

Aryna Sabalenka Triumphs Over Jessica Pegula At Miami Open

May 13, 2025