SEC Vs. XRP: Analyzing The Regulatory Uncertainty Surrounding Ripple's Cryptocurrency

Table of Contents

The SEC's Case Against Ripple

The Allegation of Unregistered Securities Offering

The SEC's core argument centers on the claim that Ripple's sales of XRP constituted an unregistered securities offering, violating federal securities laws. They argue that Ripple engaged in a continuous offering of XRP, raising billions of dollars without registering the digital asset with the SEC. This alleged violation is a significant concern for regulators, as it potentially undermines investor protection mechanisms designed to prevent fraud and manipulation in securities markets.

-

Key evidence presented by the SEC includes:

- Internal Ripple communications suggesting an expectation of profit for XRP investors.

- Details of Ripple's sales strategies targeting institutional investors.

- Evidence suggesting that Ripple actively promoted XRP to increase its value.

-

The Howey Test: The SEC's case heavily relies on the Howey Test, a legal framework used to determine whether an investment is a security. The test considers whether there's an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC argues that XRP satisfies all these criteria. The concept of an "investment contract" is central to their argument, asserting that XRP purchasers reasonably anticipated profits based on Ripple's efforts to develop and promote the cryptocurrency.

Ripple's Defense Strategy

Ripple vehemently denies the SEC's allegations, arguing that XRP is a decentralized digital asset, functioning as a currency and not a security. Their defense strategy hinges on highlighting XRP's distinct characteristics compared to other cryptocurrencies the SEC has classified as securities.

-

Ripple's key arguments include:

- XRP's decentralized nature and lack of centralized control. They emphasize the distributed ledger technology behind XRP and the absence of a central authority dictating its value or operations.

- XRP's established use as a payment facilitator in various international transactions. Ripple highlights the real-world utility of XRP, contrasting it with assets lacking tangible use cases.

- The absence of an express or implied promise of profits from Ripple to XRP purchasers.

-

Ripple's legal team differentiates XRP from other cryptocurrencies deemed securities by the SEC by emphasizing its broader usage and decentralized structure. They argue that the Howey Test shouldn't apply to XRP given its distinct functionality and market dynamics.

Impact on the Cryptocurrency Market

Price Volatility and Investor Sentiment

The SEC vs. XRP lawsuit has significantly impacted XRP's price and the overall sentiment towards the cryptocurrency market. The uncertainty surrounding XRP's regulatory status has created considerable volatility.

-

Key moments of significant price changes:

- The initial SEC announcement caused a sharp drop in XRP's price.

- Positive developments in the legal proceedings have occasionally led to price increases.

- Overall, XRP's price has remained highly susceptible to news and developments in the case.

-

Investor confidence in the broader cryptocurrency market has also been affected by the SEC vs. XRP case, with ripple effects felt across multiple digital assets. The ongoing legal uncertainty creates a chilling effect, making investors hesitant to invest in cryptocurrencies that might face similar regulatory scrutiny.

Regulatory Clarity and Future of Crypto Regulation

The SEC vs. XRP case holds significant implications for the future of cryptocurrency regulation in the United States. The outcome will set a precedent for how regulators approach the classification of digital assets.

-

Potential impacts on other cryptocurrencies and the broader crypto industry:

- A ruling against Ripple could lead to increased regulatory scrutiny of other cryptocurrencies.

- It might encourage stricter regulations for the entire cryptocurrency industry in the US.

- Conversely, a victory for Ripple might lead to greater regulatory clarity and a more favorable regulatory environment for the crypto industry.

-

The ruling could significantly influence the development of future regulatory frameworks for digital assets, impacting how crypto projects are structured, marketed, and sold. The case raises questions about the SEC's approach to regulating decentralized technologies and its interpretation of the Howey Test in the context of blockchain-based assets. Other projects facing similar regulatory challenges will keenly watch this case for its implications.

Potential Outcomes and Their Implications

Scenario 1: SEC Victory

If the SEC wins, XRP would likely be classified as a security, subjecting Ripple to significant penalties and potentially impacting XRP holders.

- Potential consequences:

- Ripple could face substantial fines and legal repercussions.

- XRP trading on major exchanges might be restricted or halted in the US.

- The ruling would establish a legal precedent, potentially impacting other cryptocurrency projects.

Scenario 2: Ripple Victory

A Ripple victory would bring much-needed regulatory clarity and potentially boost XRP's price and the overall confidence in the cryptocurrency market.

- Potential consequences:

- XRP's price could see a significant surge.

- It might establish a legal precedent favoring the classification of certain cryptocurrencies as non-securities.

- This could influence the SEC's future enforcement actions against other cryptocurrency projects.

Conclusion

The SEC vs. XRP case remains a pivotal moment in the history of cryptocurrency regulation. The outcome will significantly impact not only Ripple and XRP but also the future of the entire crypto industry. Understanding the complexities of this legal battle and its potential ramifications is crucial for anyone involved in or following the cryptocurrency market. Stay informed about developments in the SEC vs. XRP case to navigate the ongoing regulatory uncertainty surrounding XRP and other digital assets. Continue to research and follow the evolution of the SEC vs. XRP legal battle for the latest updates and analysis.

Featured Posts

-

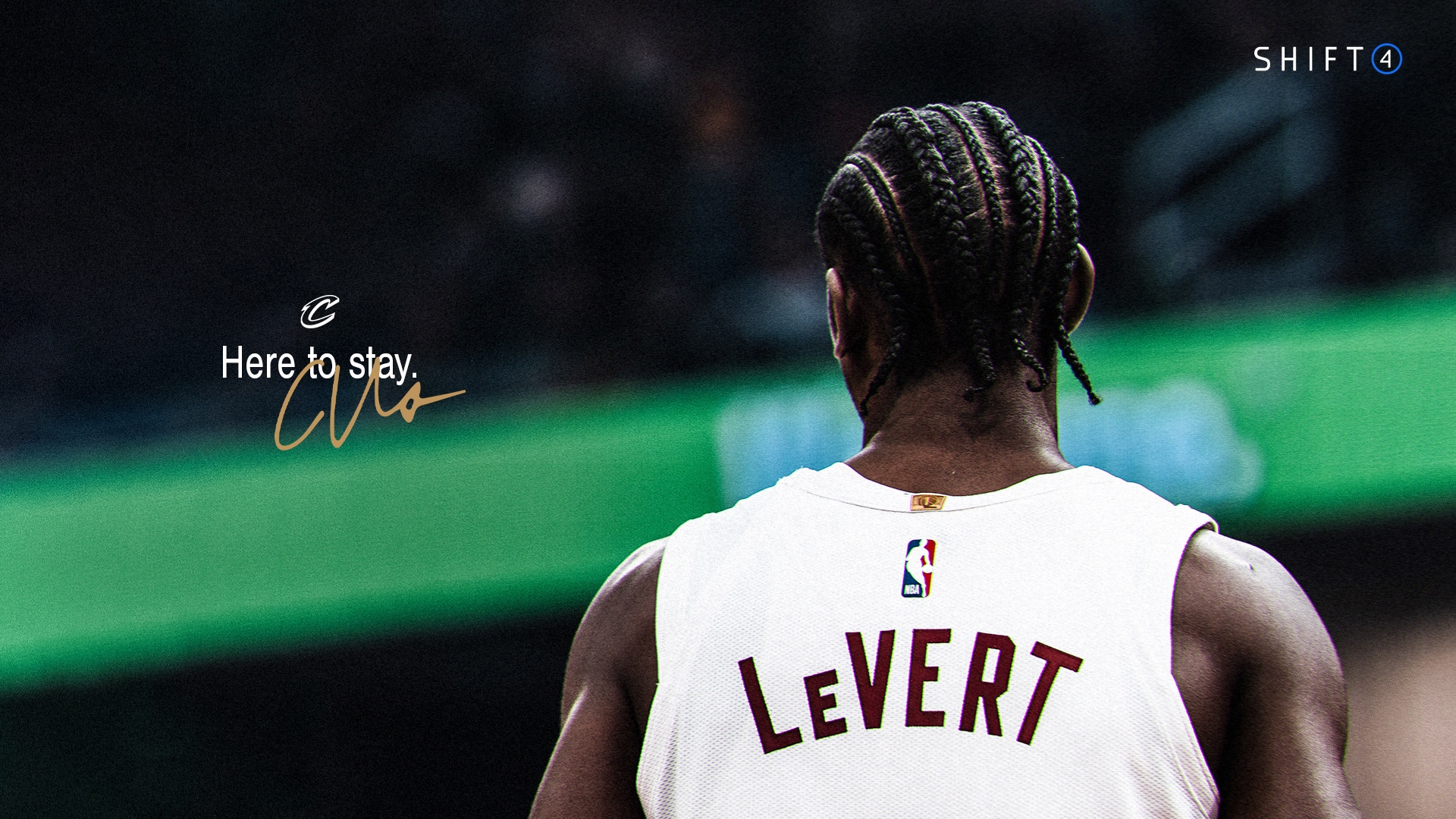

Cavaliers Le Vert Free Agency Concerns And The Risk Of Losing A Key Player

May 07, 2025

Cavaliers Le Vert Free Agency Concerns And The Risk Of Losing A Key Player

May 07, 2025 -

Cleveland Cavaliers Rookie Car Prank And Mitchells Foresight

May 07, 2025

Cleveland Cavaliers Rookie Car Prank And Mitchells Foresight

May 07, 2025 -

Onet Premium Z Faktem Korzystna Cena I Dostep Do Calosci

May 07, 2025

Onet Premium Z Faktem Korzystna Cena I Dostep Do Calosci

May 07, 2025 -

Anthony Edwards 50 K Nba Fine For Inappropriate Fan Comment Response

May 07, 2025

Anthony Edwards 50 K Nba Fine For Inappropriate Fan Comment Response

May 07, 2025 -

Le Systeme Electoral Du Conclave Au Vatican Histoire Et Modernite

May 07, 2025

Le Systeme Electoral Du Conclave Au Vatican Histoire Et Modernite

May 07, 2025