SEC's Potential XRP Commodity Designation: Ripple Settlement Update

Table of Contents

The Ripple-SEC Settlement: A Summary

The long-running legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) concluded with a settlement in late 2023 (adjust date as needed). While not an outright victory for either party, the settlement offered a degree of clarity regarding the SEC’s position on XRP and other cryptocurrencies.

- Key terms of the agreement: The settlement involved a significant financial penalty for Ripple, but crucially, it avoided a formal admission of guilt regarding XRP being an unregistered security. The exact financial penalties and terms should be referenced from official sources for accuracy.

- Ripple's admission (or lack thereof) of guilt: Ripple did not admit that XRP was a security, a key point that has significant implications for the future of the cryptocurrency and similar assets.

- Financial penalties imposed: The settlement involved a substantial financial penalty paid by Ripple, the exact amount of which should be verified from official sources.

- Impact on Ripple's operations: While the settlement impacted Ripple financially, it also allowed the company to continue its operations, albeit under a new regulatory scrutiny.

XRP's Potential Commodity Designation: Implications for Investors

The SEC's case against Ripple focused on whether XRP should be classified as a security or a commodity. A commodity classification would have significantly different regulatory implications compared to a securities classification.

- Regulatory uncertainty surrounding cryptocurrencies: The cryptocurrency market is characterized by significant regulatory uncertainty. The Ripple case highlighted the challenges regulators face in classifying digital assets.

- How commodity classification differs from security classification: Commodity classification generally means XRP would be subject to different regulatory frameworks, potentially reducing the stringent requirements associated with securities offerings.

- Potential impact on XRP price and trading volume: The settlement’s impact on XRP's price and trading volume has been mixed, with initial uncertainty giving way to a more stable (or volatile, depending on the actual market reaction), but ultimately, the long-term impact remains to be seen.

- Effect on investor confidence and market sentiment: Investor confidence in XRP and the broader cryptocurrency market was significantly impacted by the SEC case. The settlement has had a mixed effect on market sentiment.

- Tax implications for holders of XRP: The commodity classification could alter the tax implications for XRP holders. Tax laws vary greatly by jurisdiction and seeking professional tax advice is crucial.

The Broader Impact on the Crypto Regulatory Landscape

The Ripple-SEC settlement has far-reaching implications for the entire cryptocurrency market and regulatory environment.

- Precedents set by the settlement: The settlement sets a crucial precedent for future SEC actions against other cryptocurrency projects. The absence of a clear-cut definition of a security remains a key challenge.

- Potential for future SEC actions against other crypto projects: Other crypto projects with similar structures to XRP might face increased scrutiny from the SEC.

- The evolving regulatory landscape for digital assets: The settlement is a step in the ongoing evolution of the regulatory landscape for digital assets. More clarity is needed for a healthy crypto ecosystem.

- Calls for clearer regulatory frameworks for cryptocurrencies: The case has intensified calls for clearer and more comprehensive regulatory frameworks for cryptocurrencies.

- Potential impact on innovation in the crypto space: Regulatory uncertainty can stifle innovation. Clearer regulations are crucial to fostering responsible innovation in the cryptocurrency space.

How the Settlement Affects Other Cryptocurrencies

The Ripple-SEC settlement has raised concerns among developers and investors of other cryptocurrencies, particularly those with token distribution models resembling XRP's initial offering. Projects with similar structures or unclear legal status might experience increased regulatory pressure or even legal challenges from the SEC. This could lead to increased legal costs and potentially reduced investor confidence.

Navigating the Uncertainty: Advice for Investors

The ongoing regulatory uncertainty presents challenges for investors in the cryptocurrency market.

- Importance of diversification in cryptocurrency investments: Diversifying your cryptocurrency portfolio helps to mitigate risk associated with regulatory changes or market volatility.

- Strategies for mitigating risk in the volatile crypto market: Implementing risk management strategies, such as dollar-cost averaging and setting stop-loss orders, can minimize potential losses.

- Staying informed about regulatory developments: Staying updated on regulatory developments related to cryptocurrencies is crucial for making informed investment decisions.

- Consulting with financial advisors before making investment decisions: Before making any investment decisions, it is highly recommended to consult with a financial advisor who understands the complexities of the cryptocurrency market and regulatory landscape.

Conclusion

The Ripple-SEC settlement and the potential commodity designation of XRP mark a significant moment in the development of cryptocurrency regulation. While the settlement provides some clarity, much uncertainty remains. Understanding the implications of this decision is crucial for investors to make informed choices. The long-term effects of the settlement remain to be seen, but it undoubtedly highlights the need for clear and comprehensive regulatory frameworks within the cryptocurrency space.

Call to Action: Stay informed about the latest developments concerning the SEC's stance on XRP and other cryptocurrencies. Continue to research and learn about the evolving regulatory landscape to make informed decisions about your XRP investments and other digital assets. Understanding the potential implications of XRP's commodity designation is vital for navigating this evolving market.

Featured Posts

-

Toxic Chemicals From Ohio Train Derailment Building Contamination For Months

May 01, 2025

Toxic Chemicals From Ohio Train Derailment Building Contamination For Months

May 01, 2025 -

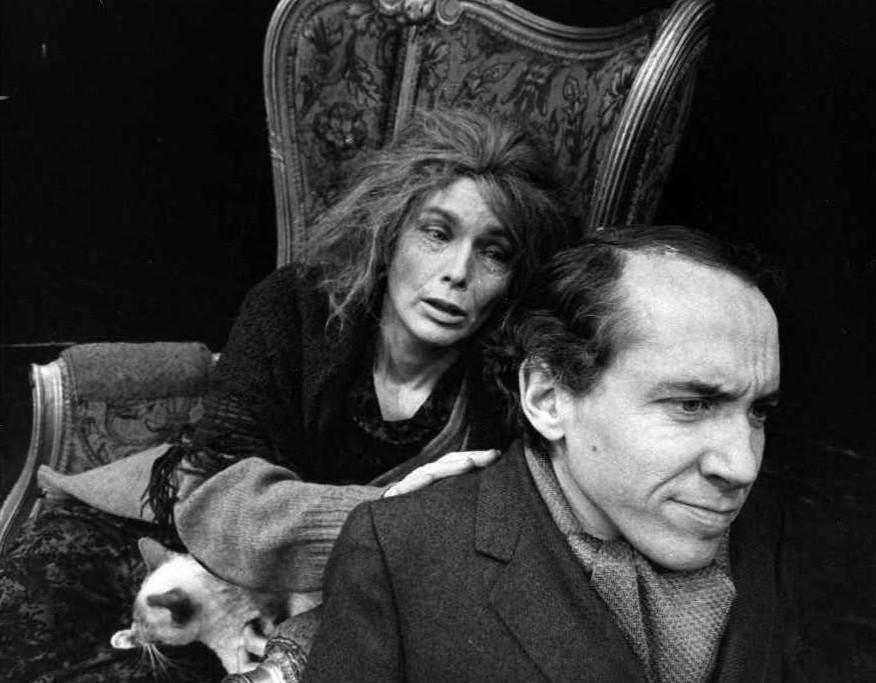

Obituary Priscilla Pointer Actress And Mother Of Amy Irving Dies At 100

May 01, 2025

Obituary Priscilla Pointer Actress And Mother Of Amy Irving Dies At 100

May 01, 2025 -

Ywm Ykjhty Kshmyr Kshmyry Ewam Ky Jdwjhd Awr Ealmy Hmayt

May 01, 2025

Ywm Ykjhty Kshmyr Kshmyry Ewam Ky Jdwjhd Awr Ealmy Hmayt

May 01, 2025 -

Mercedes Mones Tbs Championship Plea To Momo Watanabe

May 01, 2025

Mercedes Mones Tbs Championship Plea To Momo Watanabe

May 01, 2025 -

Dosarele X Noi Dovezi Ar Putea Duce La Redeschiderea Cazului Viata Libera Galati

May 01, 2025

Dosarele X Noi Dovezi Ar Putea Duce La Redeschiderea Cazului Viata Libera Galati

May 01, 2025