Securities Lawsuit Targets BigBear.ai Holdings, Inc.

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

Allegations of Misleading Statements and Omissions

The securities lawsuit against BigBear.ai alleges that the company made misleading statements and omissions in its financial reporting and public communications. These alleged misrepresentations concern several key areas:

- Overstated Capabilities: Plaintiffs claim BigBear.ai exaggerated its technological capabilities and the effectiveness of its solutions in securing government contracts. Specific examples cited in the lawsuit's filings include claims regarding the company's AI and data analytics platforms exceeding their actual performance.

- Understated Risks: The lawsuit further alleges that BigBear.ai failed to adequately disclose significant risks associated with its business model, including potential delays in contract execution, and challenges related to integrating acquired companies.

- Financial Reporting Issues: The complaint also points to alleged discrepancies and inaccuracies in the company's financial reporting, suggesting potential violations of SEC regulations. This includes concerns around the accuracy of revenue recognition and the disclosure of material financial information.

The plaintiff(s), [insert name(s) of plaintiff(s) if known, otherwise remove this sentence], claim that these actions constitute securities fraud and have caused significant financial harm to investors. Keywords relevant to this section include allegations, misrepresentation, omission, financial reporting, fraud, SEC filing.

Impact on BigBear.ai's Stock Price

The announcement of the securities lawsuit had an immediate and significant impact on BigBear.ai's stock price. [Insert data/chart here showing the stock price movement following the announcement. If data is unavailable, remove this sentence and the following one]. The stock experienced considerable volatility in the days following the news, reflecting investor uncertainty and concern. This volatility underscores the significant market impact of the lawsuit and the erosion of investor confidence in the company. Keywords: stock price, volatility, market impact, investor confidence.

Potential Legal Ramifications and Outcomes

The potential legal ramifications of this lawsuit are substantial for BigBear.ai. Possible outcomes include:

- Settlement: BigBear.ai might attempt to settle the lawsuit out of court, potentially resulting in significant financial penalties and legal fees.

- Judgment: If the case goes to trial and the plaintiffs prevail, the company could face a substantial monetary judgment, impacting its financial stability.

- Increased Regulatory Scrutiny: Regardless of the lawsuit's outcome, BigBear.ai is likely to face increased regulatory scrutiny from the SEC and other relevant agencies. This could lead to further investigations, fines, and restrictions on its operations.

BigBear.ai will likely employ various legal defenses, arguing that its statements were not misleading and that it acted within the bounds of applicable laws and regulations. However, the outcome remains uncertain and could significantly impact the company's operations and future prospects. Keywords: legal ramifications, settlement, judgment, penalty, legal defense, litigation process.

Investor Actions and Considerations

What Investors Should Do

Investors holding BigBear.ai stock are facing a difficult decision. Their options include:

- Hold: Holding onto the stock involves accepting the risk associated with the ongoing litigation. This strategy might be appropriate for long-term investors with a high risk tolerance.

- Sell: Selling the stock minimizes potential further losses. However, this decision should be made carefully, considering the possibility of a future recovery in stock price if the lawsuit is resolved favorably for the company.

It is crucial for investors to seek independent financial advice before making any decisions regarding their BigBear.ai investments. If applicable, investors might also consider exploring their options to join the class action lawsuit. Keywords: investor action, financial advice, class action lawsuit, legal recourse.

Monitoring the Legal Proceedings

Staying informed about the progress of the lawsuit is critical for investors. This involves:

- Monitoring Court Filings: Regularly checking for updates and new filings related to the lawsuit can provide valuable insights into its development.

- Following Reputable News Sources: Staying up-to-date on news reports from reputable financial news outlets will help investors track the case's trajectory.

By proactively monitoring the legal proceedings, investors can make more informed decisions about their investments and adjust their strategies as needed. Keywords: legal updates, court filings, news sources, investor resources.

Conclusion: Understanding the BigBear.ai Securities Lawsuit and its Implications

The securities lawsuit against BigBear.ai presents significant challenges for the company and its investors. The allegations of misleading statements and omissions, the impact on the stock price, and the potential legal ramifications highlight the seriousness of the situation. Investors must carefully consider their options, seek independent financial advice, and actively monitor the developments in the case. Stay informed about the ongoing BigBear.ai securities lawsuit and its impact by regularly checking reputable news sources and consulting with a financial advisor. [Insert link to a relevant resource, e.g., BigBear.ai's investor relations page, here]. Keywords: BigBear.ai, securities lawsuit, investor update, legal proceedings, next steps.

Featured Posts

-

The Traverso Family A Cannes Photography Legacy

May 21, 2025

The Traverso Family A Cannes Photography Legacy

May 21, 2025 -

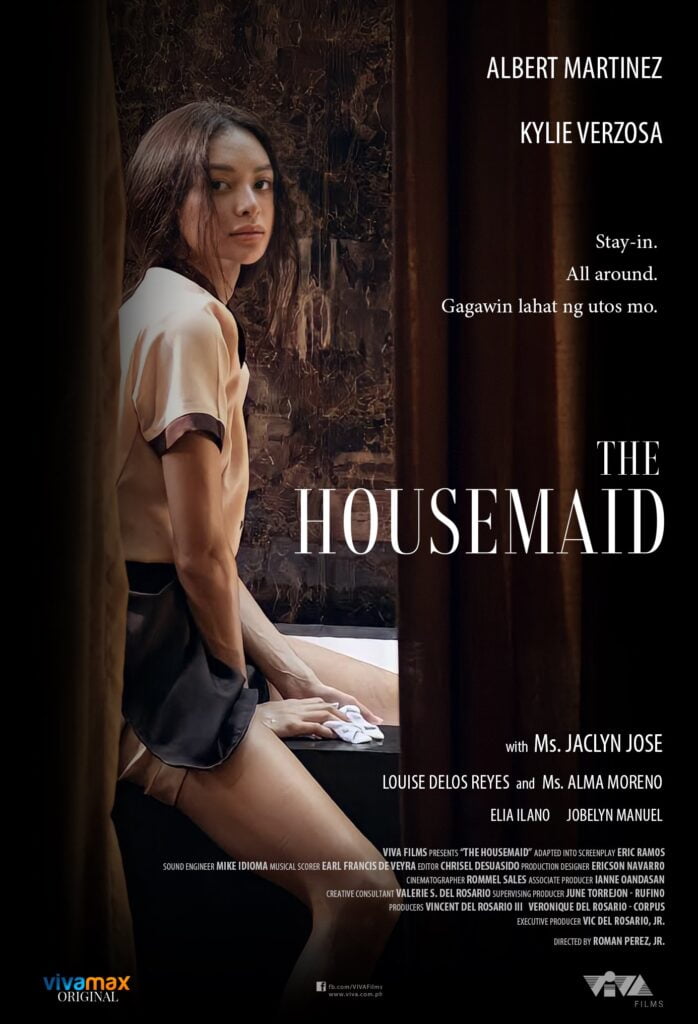

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Her Next Film Role

May 21, 2025

Sydney Sweeneys Post Echo Valley And The Housemaid Projects Her Next Film Role

May 21, 2025 -

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025

Record Breaking Run Man Fastest To Cross Australia On Foot

May 21, 2025 -

Clisson Et Moncoutant Sur Sevre Une Histoire De Diversification Centenaire

May 21, 2025

Clisson Et Moncoutant Sur Sevre Une Histoire De Diversification Centenaire

May 21, 2025 -

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025