Security Lapse At Deutsche Bank: Contractor Compromises Data Center Access

Table of Contents

The Extent of the Data Center Access Compromise

This Deutsche Bank data center breach represents a serious incident with far-reaching implications. The severity of the data breach is still under investigation, but initial reports suggest a concerning level of access granted to the contractor. The compromised data includes sensitive information that presents a significant risk to Deutsche Bank, its clients, and potentially to the global financial system.

- Level of Access: The contractor reportedly obtained physical access to the data center, allowing them to bypass network security measures. The extent of their network access and specific server access is still being determined, but initial indications suggest significant potential for data exfiltration.

- Types of Data Compromised: The compromised data potentially includes customer financial records, personal identifiable information (PII), internal documents containing sensitive financial strategies, and confidential transaction details. This represents a significant violation of data protection laws and poses severe reputational and financial risks to Deutsche Bank.

- Timeframe of Unauthorized Access: The duration of unauthorized access is currently unknown but is under investigation. Determining the exact timeframe is crucial to assessing the full extent of the breach and identifying any potentially compromised data.

- Evidence of Data Exfiltration: While the investigation is ongoing, there is currently no public confirmation of data exfiltration. However, the potential for data theft is a serious concern, given the level of access obtained by the contractor.

The potential impact of this compromised data is immense. The sensitivity of the information involved, coupled with the potential for identity theft and financial fraud, poses a significant threat to both customers and the bank's reputation. The long-term consequences for Deutsche Bank could include substantial financial losses, legal battles, and a severe erosion of customer trust.

Failure of Deutsche Bank's Security Protocols

The Deutsche Bank security lapse points to critical weaknesses in the bank's security protocols and third-party risk management. A comprehensive review of the incident is necessary to identify and rectify these failings, which include:

- Insufficient Background Checks: Reports suggest inadequate background checks and verification processes for the contractor, failing to identify potential risks before granting access to critical systems. This highlights a critical failure in the bank's due diligence procedures.

- Access Control Failures: The lack of robust access control mechanisms, such as multi-factor authentication and stringent access logs, allowed the contractor to gain unauthorized access with relative ease. This underscores a critical gap in the bank’s IT security strategy.

- Deficiencies in Security Audits and Vulnerability Assessments: The apparent failure to conduct regular security audits and vulnerability assessments allowed this vulnerability to remain undetected. A more proactive approach to identifying and addressing security risks is clearly needed.

The confluence of these failures enabled the contractor to compromise the bank's security. The consequences of these oversights demonstrate the critical need for proactive and comprehensive security measures within the financial industry.

The Response and Remediation Efforts

Deutsche Bank's response to the incident is currently underway. The bank has launched a full investigation to determine the extent of the breach and identify the necessary remediation steps.

- Incident Response: The bank has engaged cybersecurity experts to conduct a thorough investigation, contain the breach, and secure its systems. This response demonstrates a commitment to addressing the security lapse.

- Security Remediation: The bank is taking steps to remediate the identified vulnerabilities, including enhancing access control measures, implementing stronger background check procedures, and strengthening its overall cybersecurity posture.

- Legal and Regulatory Ramifications: Deutsche Bank is likely to face legal and regulatory scrutiny, potentially including hefty fines and legal actions from affected customers. Compliance with data protection regulations will be paramount in the coming months.

- Compensation and Support: While details remain unclear, the bank may be obligated to offer compensation or support to affected individuals, depending on the extent of the data breach and the legal implications.

The effectiveness of Deutsche Bank's response will be crucial in determining the long-term impact of this breach. Transparency and proactive communication with affected parties and regulators will be key to mitigating the damage.

Lessons Learned and Best Practices

The Deutsche Bank security lapse provides invaluable lessons for financial institutions and organizations worldwide. Key takeaways and best practices include:

- Thorough Background Checks: Implementing rigorous background checks for all contractors and third-party vendors is paramount. This includes verifying identities, employment history, and criminal records.

- Robust Access Control Systems: Investing in robust access control systems, including multi-factor authentication, access logs, and granular permissions, is crucial to limiting unauthorized access.

- Regular Security Audits and Vulnerability Assessments: Conducting regular security audits and vulnerability assessments is essential for proactively identifying and addressing potential weaknesses before they can be exploited.

- Strong Data Encryption: Implementing strong data encryption measures protects sensitive data, even if a breach occurs. This minimizes the impact of a potential data exfiltration event.

- Comprehensive Incident Response Plan: Developing and regularly testing a comprehensive incident response plan ensures a swift and effective response to security incidents, minimizing their impact.

Financial institutions and organizations must prioritize the implementation of these best practices to strengthen their cybersecurity posture and prevent similar incidents. Proactive cybersecurity measures are not just a good practice; they are a necessity in today's increasingly complex threat landscape.

Conclusion

The Deutsche Bank security lapse serves as a stark reminder of the critical need for robust security protocols and vigilant third-party risk management. The incident underscores the potential consequences of failing to adequately protect sensitive data and the importance of learning from past mistakes to prevent future breaches. The failure in data protection highlights the need for continuous improvement in information security practices.

Don't let your organization become the next victim of a data center breach. Strengthen your data center security today by implementing stringent access control measures, performing regular security audits, and employing a robust third-party vendor management strategy. Proactive cybersecurity measures are essential for protecting your valuable data and maintaining customer trust. Learn more about preventing Deutsche Bank-style security lapses and enhancing your organization’s overall security posture by investing in comprehensive cybersecurity solutions and training.

Featured Posts

-

Regional Coach Of The Year Valley High Schools Coaching Excellence Recognized

May 30, 2025

Regional Coach Of The Year Valley High Schools Coaching Excellence Recognized

May 30, 2025 -

The Future Of Manila Bay Can Its Vibrancy Be Sustained

May 30, 2025

The Future Of Manila Bay Can Its Vibrancy Be Sustained

May 30, 2025 -

Thlyl Adae Awstabynkw Ela Almlaeb Altrabyt Shyft Alshrq Alawst

May 30, 2025

Thlyl Adae Awstabynkw Ela Almlaeb Altrabyt Shyft Alshrq Alawst

May 30, 2025 -

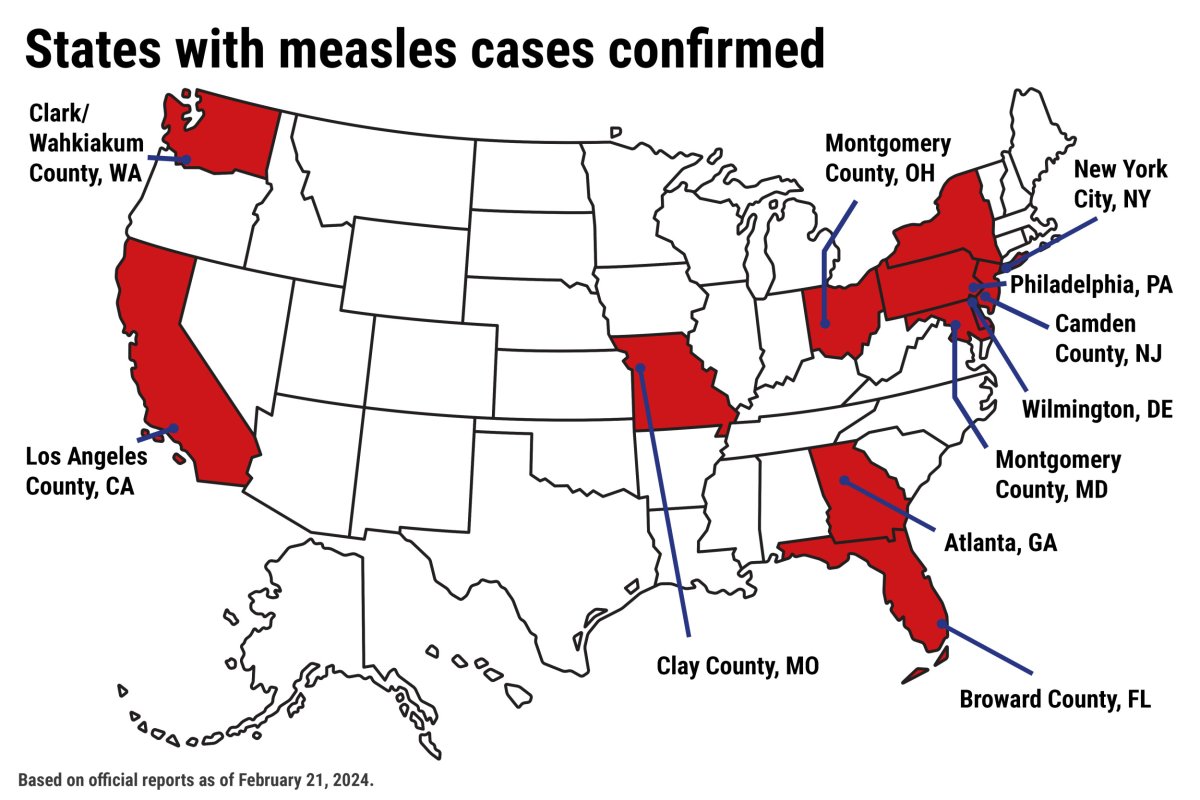

Kansas Measles Outbreak Expands Six New Cases Reported

May 30, 2025

Kansas Measles Outbreak Expands Six New Cases Reported

May 30, 2025 -

Bruno Fernandes Analisando A Luta Por Justica

May 30, 2025

Bruno Fernandes Analisando A Luta Por Justica

May 30, 2025