Sell America Bonds: Moody's 30-Year Yield Surge To 5%

Table of Contents

Understanding the 5% Yield Surge and its Implications

The 5% yield on 30-year Treasury bonds is a noteworthy event, representing a substantial increase from recent lows. Several factors have contributed to this surge:

- Inflationary Pressures: Persistent inflation has prompted the Federal Reserve to raise interest rates, making newly issued bonds more attractive compared to older, lower-yielding bonds. This impacts the price of existing bonds, including America bonds.

- Federal Reserve Monetary Policy: The Fed's aggressive tightening of monetary policy to combat inflation directly influences bond yields. Higher interest rates increase the opportunity cost of holding lower-yielding bonds.

- Increased Investor Demand for Riskier Assets: As yields rise on safer assets like government bonds, some investors may seek higher returns in riskier asset classes, such as stocks or corporate bonds. This shift in demand can further impact bond prices.

- Global Economic Uncertainties: Geopolitical events and global economic instability can lead investors to seek the safety of US Treasury bonds, potentially driving up demand and yields.

Historically, 5% yields on 30-year Treasuries have been relatively high. Comparing this to previous periods of low yields reveals a significant shift in the bond market landscape. This means that existing bonds, including many America bonds, are likely trading at a discount to their face value, potentially resulting in capital losses if sold before maturity. Investors holding America bonds need to carefully evaluate the potential impact on their portfolio value.

Strategies for Investors Considering Selling America Bonds

The decision of whether to sell America bonds is highly individual and depends on your risk tolerance, investment horizon, and financial goals. Several strategies are available:

- Diversification into Other Asset Classes: Reducing your exposure to bonds by diversifying into stocks, real estate, or other asset classes can help mitigate risk. This strategy is particularly relevant for investors nearing retirement.

- Shifting to Shorter-Term Bonds: To reduce exposure to interest rate risk, consider shifting to shorter-term bonds, which are less sensitive to yield fluctuations. This minimizes potential capital losses.

- Holding onto Bonds Until Maturity: If you can afford to wait, holding onto your America bonds until maturity guarantees you'll receive their face value, eliminating capital loss concerns. However, you will forgo the opportunity to reinvest at higher yields.

- Tax Implications of Selling Bonds: Remember to factor in the tax implications of selling bonds, as capital gains are taxable income. Consult a tax advisor to understand your potential tax liability.

For example, an investor with a high risk tolerance and a long time horizon might choose to diversify aggressively. Conversely, an investor nearing retirement might prefer to shift to shorter-term bonds or hold until maturity to avoid capital losses.

Alternatives to Selling America Bonds: Rebalancing Your Portfolio

Completely selling America bonds might not be necessary. Consider these alternatives:

- Dollar-Cost Averaging: Instead of selling all at once, consider gradually selling a portion of your holdings over time to mitigate potential losses and average your sale price.

- Rebalancing Your Portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets (potentially America bonds) that have outperformed and buying others that have underperformed.

- Investing in Bond ETFs or Mutual Funds: Diversify your bond holdings by investing in bond ETFs or mutual funds that offer exposure to a broader range of bonds, reducing your dependence on individual America bonds.

These approaches allow for a more gradual adjustment to your investment strategy, minimizing the impact of market fluctuations while maintaining diversification.

Moody's Rating and its Influence on Bond Market Sentiment

Moody's, a leading credit rating agency, plays a crucial role in assessing the creditworthiness of various debt instruments, including U.S. Treasury bonds. Moody's rating directly impacts investor confidence and, consequently, bond yields. A higher rating signifies lower risk, leading to lower yields, while a lower rating increases risk and yields.

A potential downgrade by Moody's could negatively impact investor sentiment, potentially leading to higher yields and lower prices for U.S. Treasury bonds. This underscores the importance of monitoring Moody's ratings and their potential impact on your America bond holdings.

Conclusion: Making Informed Decisions About Selling America Bonds

The 5% yield surge on 30-year Treasury bonds presents a significant challenge for investors considering selling America bonds. Understanding the underlying factors, evaluating your risk tolerance, and exploring various strategies—including diversification, shifting to shorter-term bonds, holding until maturity, or rebalancing your portfolio—is crucial. Remember to consider the impact of Moody's rating on market sentiment.

Before deciding to sell America bonds, carefully weigh the potential risks and rewards. It's strongly recommended to consult a qualified financial advisor to develop a personalized investment strategy that aligns with your financial goals and risk tolerance. Utilize resources like the Federal Reserve website and financial news outlets for up-to-date information on bond market trends and America bond yields before making any major investment decisions. Don't hesitate to seek professional advice regarding the best approach for managing your America bond holdings in this evolving market environment.

Featured Posts

-

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 20, 2025

Efimereyontes Giatroi Patras 12 And 13 Aprilioy Odigos Eyresis

May 20, 2025 -

The Schumacher Comeback Debacle A Case Study Of Ignored Expert Opinion Red Bull

May 20, 2025

The Schumacher Comeback Debacle A Case Study Of Ignored Expert Opinion Red Bull

May 20, 2025 -

Dusan Tadic Transferi Fenerbahce Icin Yeni Bir Cag

May 20, 2025

Dusan Tadic Transferi Fenerbahce Icin Yeni Bir Cag

May 20, 2025 -

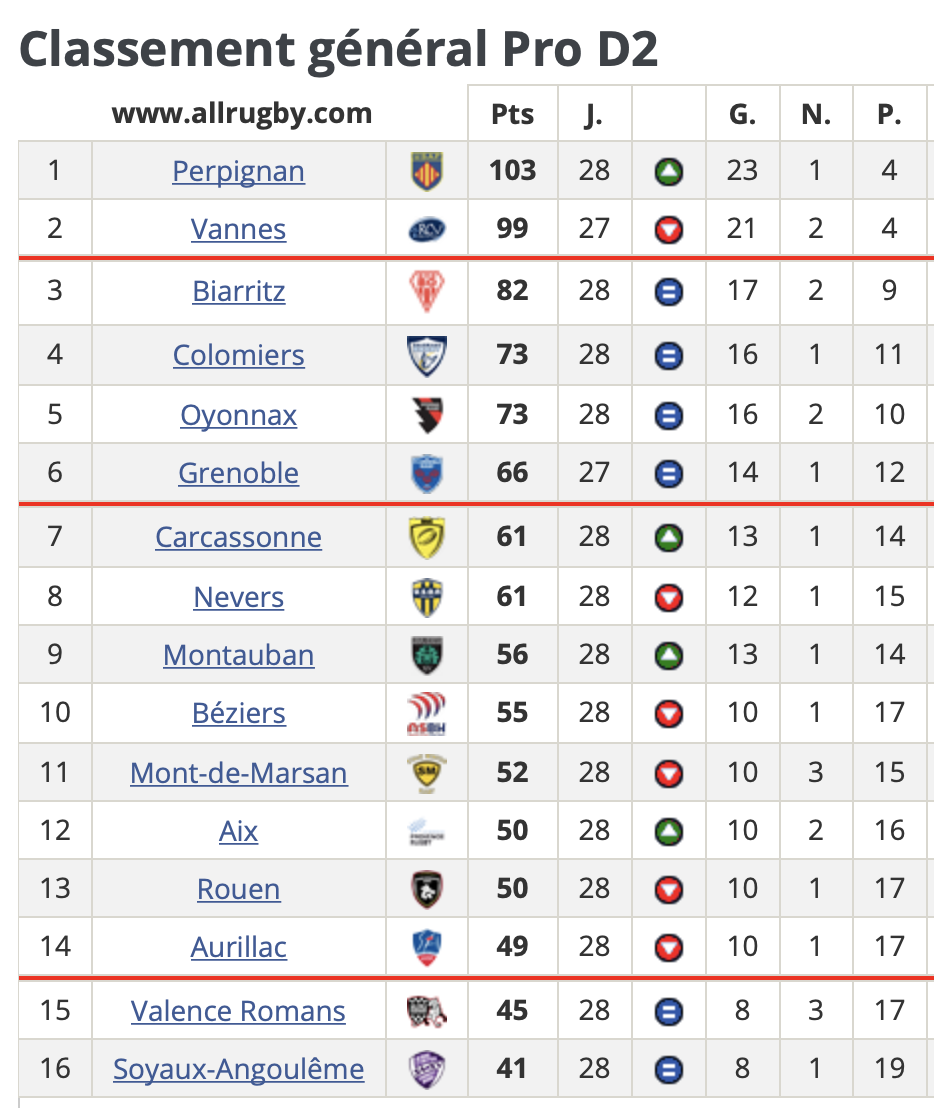

Pro D2 Le Maintien En Jeu Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025

Pro D2 Le Maintien En Jeu Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025 -

Is Amorims Latest Forward Signing A Success For Man Utd

May 20, 2025

Is Amorims Latest Forward Signing A Success For Man Utd

May 20, 2025