Sell America Bonds Now? Moody's Rating And Market Volatility

Table of Contents

Understanding Moody's Recent Rating Actions and Their Implications

Moody's Rating History and Methodology

Moody's Investors Service is a leading credit rating agency that assesses the creditworthiness of issuers, including governments. Their ratings reflect the likelihood of repayment of debt obligations. The US Treasury bonds have historically enjoyed a top-tier rating, signifying minimal risk of default. However, recent economic events have prompted increased scrutiny.

- Rating Levels: Moody's uses letter grades (Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C) to assess credit quality, with Aaa being the highest and C the lowest. US Treasury bonds have historically held a Aaa rating.

- Rating Factors: Moody's considers various factors when assigning ratings, including the issuer's fiscal strength, economic outlook, political stability, and debt levels. Changes in these factors can lead to rating adjustments.

- Rating History: While the US has maintained a top rating for an extended period, concerns regarding rising debt levels and political gridlock have led to increased speculation about potential future rating downgrades.

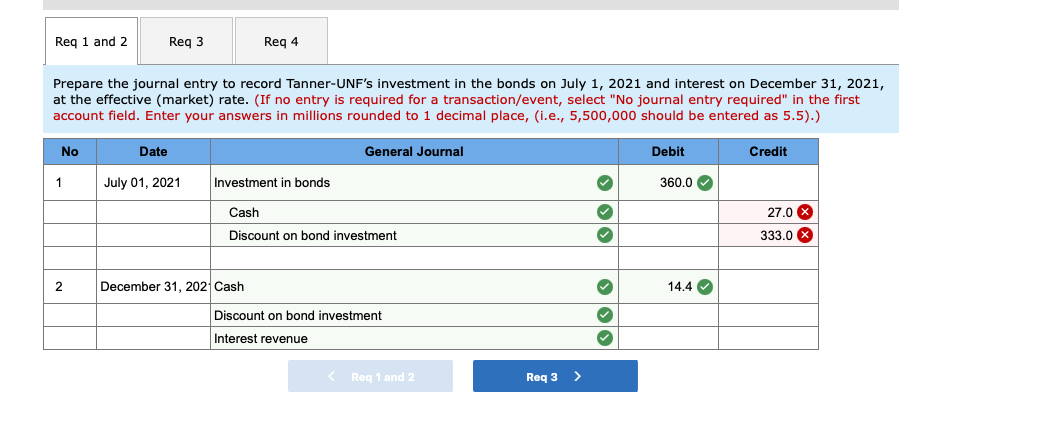

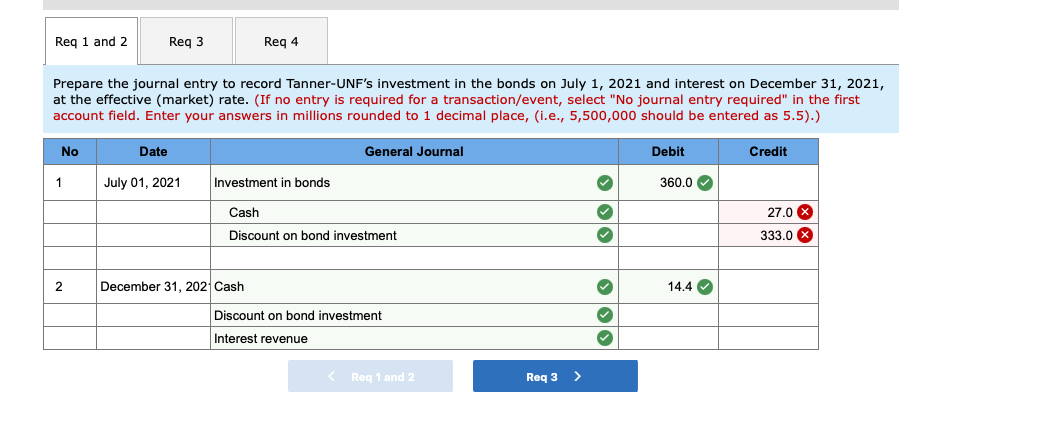

Analyzing the Current Rating and its Impact on Bond Yields

Currently, while Moody's maintains a high rating for US government bonds, the outlook may have changed and this naturally affects bond yields. Bond yields and prices have an inverse relationship. When yields rise, bond prices generally fall and vice-versa. Concerns about a potential downgrade, even if not immediate, can increase bond yields as investors demand higher returns to compensate for perceived increased risk.

- Downgrade Impact: A Moody's downgrade, even a slight one, sends a ripple effect through the market. Investor confidence can diminish, leading to increased selling pressure and higher yields on existing bonds.

- Higher Yields and Existing Bondholders: For existing bondholders, higher yields can represent both an opportunity and a challenge. While the increased yield on new bonds may be attractive, existing bonds will likely see their prices fall. The impact depends on the bond's maturity date and the investor's investment horizon.

Considering Alternative Investment Options

Given the uncertainty surrounding America bonds, exploring alternative investment options is prudent. Diversification is key to managing risk.

- Corporate Bonds: Offer higher yields compared to government bonds, but carry greater default risk.

- Municipal Bonds: Provide tax advantages but may have liquidity constraints.

- Other Asset Classes: Stocks, real estate, and commodities offer diversification benefits but involve different levels of risk. Always assess your own risk tolerance before making any investment changes.

Assessing Market Volatility and its Effect on Bond Prices

Current Market Conditions and Their Influence

Market volatility is significantly influenced by several economic factors. Currently, the market faces several challenges that could impact bond prices.

- Inflationary Pressure: High inflation erodes the purchasing power of fixed-income investments like bonds. Central banks often raise interest rates to combat inflation, impacting bond prices.

- Interest Rate Hikes: Rising interest rates make newly issued bonds more attractive, thus decreasing the value of existing bonds with lower yields.

- Geopolitical Risks: Global geopolitical events can significantly impact investor sentiment and market volatility, triggering shifts in bond prices.

Short-Term vs. Long-Term Bond Strategies

Navigating volatile markets requires considering your investment horizon.

- Short-Term Bonds: Less sensitive to interest rate changes and offer greater stability in volatile markets. However, they may yield lower returns.

- Long-Term Bonds: Offer higher potential returns but are more susceptible to interest rate risk and market fluctuations.

The Role of Diversification in Mitigating Risk

Diversification is a crucial element of mitigating risk within any portfolio, including one focused on bonds.

- Diversify Maturities: Spread investments across bonds with different maturity dates to reduce the impact of interest rate changes.

- Diversify Issuers: Hold a mix of government, corporate, and municipal bonds to reduce dependence on a single issuer's creditworthiness.

- Diversify Asset Classes: Allocate a portion of your portfolio to other asset classes like stocks or real estate to further reduce risk.

Conclusion: Making Informed Decisions About Your America Bonds Portfolio

In conclusion, the decision of whether to sell your America bonds is complex, depending on a variety of factors. Moody's rating, while currently high, is subject to change based on economic conditions, while market volatility presents additional challenges. The key is to understand your risk tolerance, investment horizon, and financial goals.

This article highlights the interplay between Moody's rating actions, market volatility, and the potential impact on your America bonds holdings. While this information offers valuable insight, it's vital to consult with a qualified financial advisor to create a personalized strategy tailored to your specific needs and circumstances before making any significant changes to your U.S. government bonds or Treasury bonds portfolio. Remember to conduct thorough research and carefully consider all factors before making any investment decisions.

Featured Posts

-

Bbai Stockholders Deadline For Legal Action Is June 10 2025

May 20, 2025

Bbai Stockholders Deadline For Legal Action Is June 10 2025

May 20, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025 -

Planning Your Day Mild Temperatures Minimal Rain

May 20, 2025

Planning Your Day Mild Temperatures Minimal Rain

May 20, 2025 -

Marvel The Avengers Crossword Clue Explained May 1 Nyt Mini

May 20, 2025

Marvel The Avengers Crossword Clue Explained May 1 Nyt Mini

May 20, 2025 -

Jennifer Lawrence Potvrda O Drugom Djetetu

May 20, 2025

Jennifer Lawrence Potvrda O Drugom Djetetu

May 20, 2025