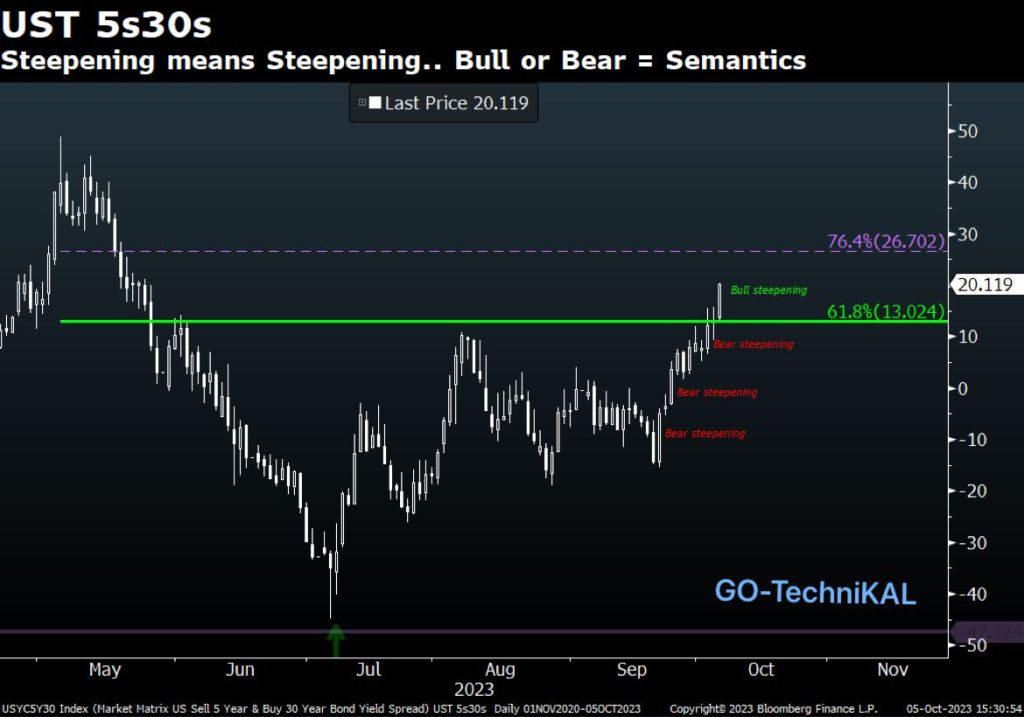

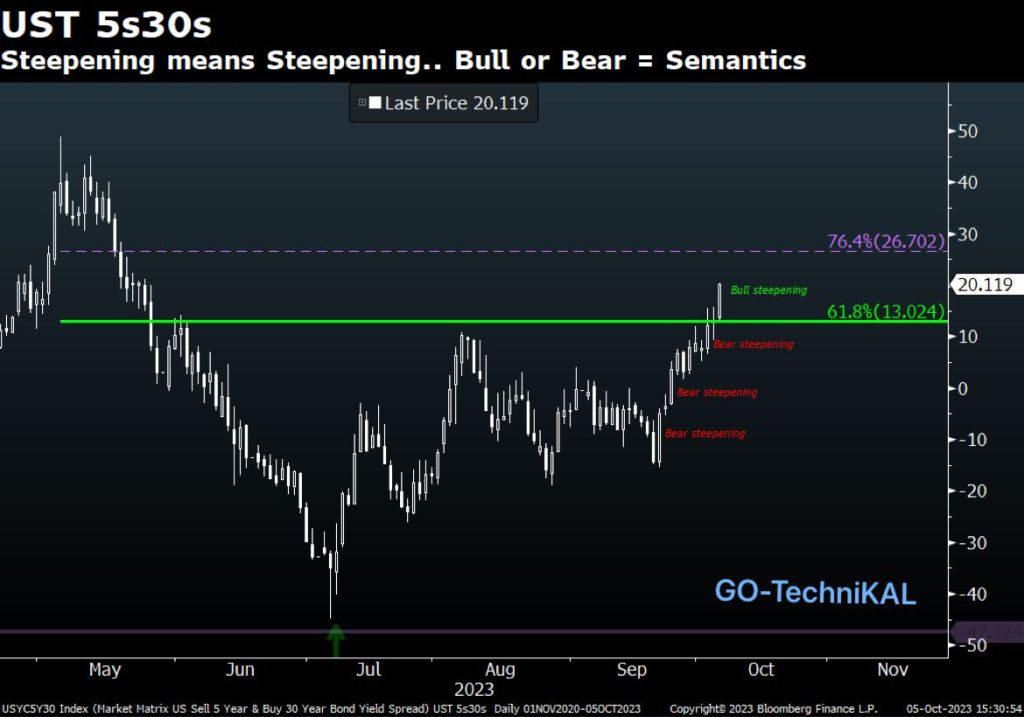

'Sell America' Returns As 30-Year Treasury Yield Hits 5%

Table of Contents

The 5% 30-Year Treasury Yield: A Catalyst for "Sell America"?

The 5% threshold for the 30-year Treasury yield is a significant psychological marker. It represents a considerable increase in borrowing costs for the US government and, by extension, influences the cost of borrowing for businesses and consumers. This yield reflects investor sentiment regarding the US economy's stability and future growth potential. For bond investors, a 5% yield on a long-term, relatively safe asset like a 30-year Treasury is undeniably attractive. However, this attractiveness comes at a cost – potentially dampening economic growth.

- Increased borrowing costs for businesses: Higher yields translate to more expensive loans, potentially hindering business investment and expansion.

- Potential slowdown in economic growth: Increased borrowing costs can lead to reduced consumer spending and overall economic activity, potentially triggering a recession.

- Attractiveness of US treasuries to foreign investors: High yields draw foreign investment into US treasuries, strengthening the US dollar but also potentially diverting capital from other sectors.

- Impact on the US dollar: The influx of foreign investment strengthens the dollar, which can hurt US exporters and further complicate the economic picture.

Economic Factors Fueling "Sell America" Concerns

Several macroeconomic indicators are contributing to the negative sentiment surrounding US assets and fueling the "Sell America" narrative. These factors paint a complex picture, making it difficult to definitively endorse or reject the strategy.

- Persistent inflation and the Fed's response: Stubborn inflation and the Federal Reserve's aggressive interest rate hikes to combat it are creating uncertainty and volatility in the market. Higher interest rates increase borrowing costs, impacting both businesses and consumers.

- Geopolitical instability and its impact on the US economy: Ongoing geopolitical tensions, such as the war in Ukraine and rising tensions with China, introduce significant uncertainty and risks to the global economy, impacting US growth.

- Supply chain issues and their lingering effects: While supply chain disruptions are easing, their lingering effects continue to contribute to inflationary pressures and economic uncertainty.

- Potential for a looming recession: The combination of high inflation, rising interest rates, and geopolitical uncertainty raises concerns about a potential recession in the US, further fueling the "Sell America" sentiment.

Alternative Investment Strategies to "Sell America"

A "Sell America" strategy isn't the only approach. Investors concerned about the US market's current trajectory should explore alternative strategies emphasizing diversification and risk management.

- Investing in international markets: Diversifying into international markets can reduce exposure to US-specific risks and potentially offer better returns. Emerging markets, in particular, may present attractive opportunities.

- Exploring alternative asset classes: Consider diversifying into real estate, commodities (gold, oil), or private equity to reduce dependence on traditional stock and bond markets.

- Focusing on defensive stocks: Defensive stocks, such as those in the consumer staples or healthcare sectors, are typically less sensitive to economic downturns and can provide stability during periods of uncertainty.

- Rebalancing portfolios: Regularly rebalancing your portfolio to maintain your target asset allocation can help mitigate risks and capitalize on market fluctuations.

Analyzing the Validity of the "Sell America" Strategy

The "Sell America" strategy is not without its complexities. While the current economic climate presents valid concerns, a blanket "Sell America" approach may be overly simplistic and potentially risky.

- Historical performance of the "Sell America" strategy: Historical data suggests that "Sell America" strategies can yield short-term gains during specific market conditions, but they don't guarantee consistent profitability.

- Current economic outlook and its potential impact: The current economic picture is complex and uncertain; predicting its trajectory is challenging, making it difficult to assess the long-term viability of a "Sell America" strategy.

- Risks associated with short-selling US assets: Short-selling involves significant risks, potentially leading to substantial losses if the market moves against your position.

- Long-term growth potential of the US economy: Despite current headwinds, the US economy possesses considerable long-term growth potential, and a complete exit might miss future gains.

Conclusion: Navigating the "Sell America" Narrative in a High-Yield Environment

The 5% 30-year Treasury yield is a significant factor influencing current market sentiment, fueling the "Sell America" debate. However, the decision to adopt a "Sell America" strategy requires careful consideration of numerous intertwined economic factors and individual risk tolerance. There is no one-size-fits-all answer. Before jumping to conclusions about adopting a "Sell America" approach, carefully consider the multifaceted factors at play and seek professional financial advice to create a personalized investment strategy tailored to your risk tolerance and financial goals. Remember that diversification is key in navigating the complexities of the current market environment. Thorough research and professional guidance are vital before implementing any significant investment changes.

Featured Posts

-

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025

L Essor Des Tours Nantaises Et L Activite Croissante Des Cordistes

May 21, 2025 -

Reactia Publicului La Aparitia Fratilor Tate In Centrul Bucurestiului

May 21, 2025

Reactia Publicului La Aparitia Fratilor Tate In Centrul Bucurestiului

May 21, 2025 -

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025 -

Analyzing Liverpools Win Arne Slot And Luis Enriques Perspectives

May 21, 2025

Analyzing Liverpools Win Arne Slot And Luis Enriques Perspectives

May 21, 2025 -

Efimeries Giatron Patra 12 13 Aprilioy 2024

May 21, 2025

Efimeries Giatron Patra 12 13 Aprilioy 2024

May 21, 2025