Sensex And Nifty 50 Soar: Understanding The 5 Drivers Of Today's Market Surge

Table of Contents

Global Positive Sentiment and Foreign Institutional Investor (FII) Influx

Positive global economic indicators have played a pivotal role in the recent Sensex and Nifty 50 surge. A wave of optimism is sweeping across global markets, significantly impacting the Indian stock market. This positive sentiment is largely fueled by a substantial influx of Foreign Institutional Investor (FII) investments.

- Increased FII investments and their contribution to the surge: FIIs have shown increased confidence in the Indian economy, pouring billions into the market, directly contributing to the rise in Sensex and Nifty 50.

- Positive global cues from major markets (US, Europe, etc.): Strong performance in major global markets, such as the US and Europe, has created a ripple effect, boosting investor confidence and encouraging further investment in India. The easing of certain global uncertainties has also played a role.

- Impact of reduced global uncertainty on investor confidence: Decreases in geopolitical tensions and improved economic forecasts globally have lessened anxieties among investors, leading to a more risk-on appetite and increased investment in emerging markets like India.

- Specific examples of positive global news: [Insert specific examples of positive global news impacting the market, e.g., positive US jobs report, easing of trade tensions, etc.].

Strong Corporate Earnings and Positive Future Outlook

Robust corporate earnings have further solidified the upward trajectory of the Sensex and Nifty 50. Many key Indian companies have reported exceptionally strong financial results, exceeding expectations and boosting investor confidence in the long-term prospects of the Indian market.

- Highlight strong performance by key sectors (e.g., IT, Banking, FMCG): Sectors like IT, Banking, and FMCG have shown particularly impressive earnings, significantly contributing to the overall market rally.

- Mention specific companies that have reported positive earnings: [Insert examples of specific companies with strong earnings reports, including sector and percentage growth].

- Discuss positive future growth projections by analysts: Analysts are projecting continued growth for many companies, fueling investor optimism and encouraging further investments.

- Explain the impact of positive earnings on stock valuations: Strong earnings have led to increased stock valuations, further contributing to the upward trend in the Sensex and Nifty 50.

Government Policies and Infrastructure Spending

Government initiatives and substantial infrastructure spending have created a positive environment for market growth. Several strategic policies are driving investment and fostering economic expansion, impacting investor sentiment positively.

- Mention specific government policies (e.g., PLI schemes, infrastructure projects): Policies like the Production-Linked Incentive (PLI) schemes and large-scale infrastructure projects are attracting significant investments and stimulating economic activity.

- Discuss the positive impact of these policies on various sectors: These policies are fostering growth across various sectors, contributing to improved overall market performance.

- Highlight the long-term growth potential driven by government initiatives: Government initiatives are paving the way for sustained long-term growth, attracting both domestic and foreign investments.

- Explain the effect on investor sentiment and market confidence: These pro-growth policies enhance investor confidence in the future of the Indian economy, directly contributing to the market surge.

Easing Inflation and Stable Interest Rates

The cooling inflation and relatively stable interest rates are also key factors supporting the current market rally. These macroeconomic indicators significantly impact investor decisions and market sentiment.

- Explain the relationship between inflation, interest rates and market performance: Lower inflation and stable interest rates create a more predictable and favorable environment for investment.

- Mention recent inflation data and its impact on the market: Recent data showing easing inflation has boosted market sentiment and encouraged investment.

- Explain how stable interest rates encourage investment: Stable interest rates reduce uncertainty and encourage investments, as investors are more confident in their return projections.

- Discuss the potential for further rate cuts and their impact: The possibility of future interest rate cuts could further stimulate the market and boost investor confidence.

Sector-Specific Growth Drivers

The current market surge is not uniform across all sectors. Specific sectors have outperformed others, significantly contributing to the overall Sensex and Nifty 50 rally.

- Identify the top-performing sectors (e.g., technology, pharmaceuticals): Sectors such as technology and pharmaceuticals have witnessed exceptional growth, outpacing other sectors.

- Explain the reasons behind the growth in these sectors: Technological advancements, increased demand, and global market dynamics have driven growth in these sectors.

- Discuss the future outlook for these high-performing sectors: The outlook for these high-performing sectors remains positive, continuing to contribute to the overall market optimism.

- Mention any emerging trends or disruptions within these sectors: [Mention any disruptive technologies or emerging trends driving the growth within the high-performing sectors].

Conclusion

The recent surge in the Sensex and Nifty 50 is a result of a confluence of positive factors. The influx of FII investments fueled by global positive sentiment, robust corporate earnings, supportive government policies, easing inflation, and the exceptional performance of specific sectors have all contributed significantly to this market rally. These factors paint a promising picture for the future performance of the Indian stock market. This strong growth is a testament to the resilience and potential of the Indian economy.

Stay tuned for further updates on the Sensex and Nifty 50 and their performance. Understanding these market movements is crucial for informed investment decisions. Learn more about investing in the Indian stock market and understanding Sensex and Nifty 50 movements.

Featured Posts

-

Makron Starmer Merts I Tusk Propustyat Kievskie Torzhestva 9 Maya

May 09, 2025

Makron Starmer Merts I Tusk Propustyat Kievskie Torzhestva 9 Maya

May 09, 2025 -

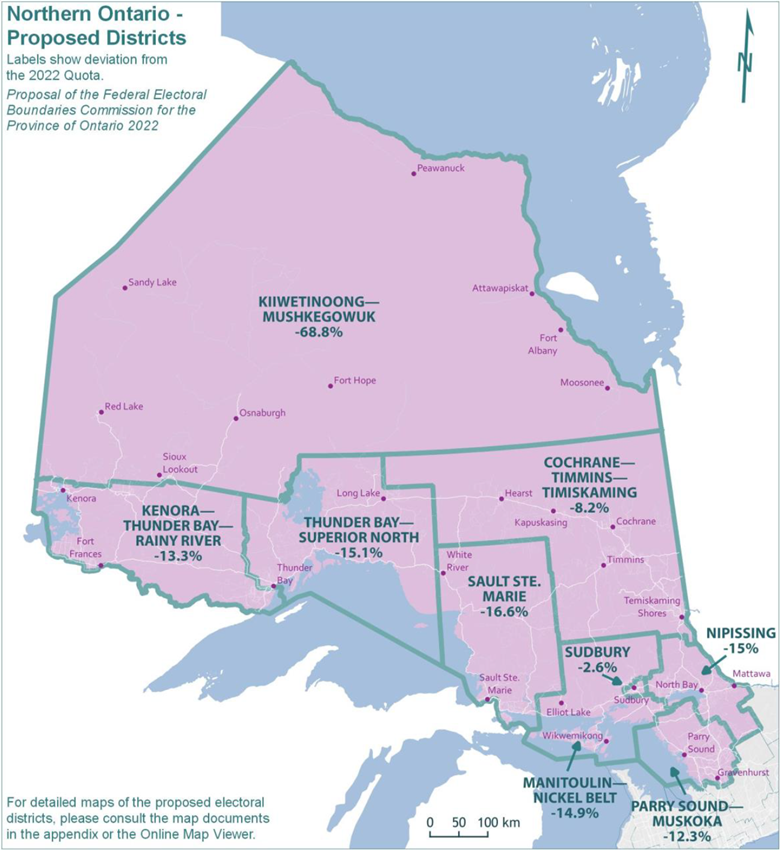

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 09, 2025

Federal Electoral Boundaries Understanding The Changes In Edmonton

May 09, 2025 -

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025 -

Vinterferie I Sor Norge Sno Vaer Og Kjoresikkerhet

May 09, 2025

Vinterferie I Sor Norge Sno Vaer Og Kjoresikkerhet

May 09, 2025 -

Edmonton Unlimiteds Tech And Innovation Scaling Strategy Achieving Global Impact

May 09, 2025

Edmonton Unlimiteds Tech And Innovation Scaling Strategy Achieving Global Impact

May 09, 2025