Sensex And Nifty: Real-time Stock Market Data And Analysis

Table of Contents

Understanding the Sensex and Nifty Indices

The Sensex and Nifty are the two most important stock market indices in India, reflecting the overall health and performance of the Indian economy. Understanding their movements is paramount for any investor.

What is the Sensex?

The BSE SENSEX, or simply Sensex, is a benchmark index of the Bombay Stock Exchange (BSE). It represents the performance of 30 of the largest and most actively traded companies in India, often referred to as blue-chip stocks. These companies represent a broad cross-section of major sectors in the Indian economy.

- Number of constituent stocks: 30

- Calculation methodology: A free-float market capitalization-weighted index.

- Historical performance highlights: The Sensex has shown significant growth over the years, reflecting the expansion of the Indian economy. However, it is important to remember past performance is not indicative of future results.

- Blue-chip stocks: These are large, well-established companies with a history of consistent profitability and strong financial performance. Their inclusion in the Sensex signifies their importance and influence on the overall market.

What is the Nifty?

The Nifty 50, or simply Nifty, is the benchmark index of the National Stock Exchange of India (NSE). Similar to the Sensex, it tracks the performance of 50 of the largest and most liquid companies listed on the NSE.

- Number of constituent stocks: 50

- Calculation methodology: A free-float market capitalization-weighted index.

- Historical performance highlights: The Nifty 50, like the Sensex, exhibits strong long-term growth trends. It’s important to conduct thorough research before making any investment decisions.

- Differences from the Sensex: While both indices represent the top Indian companies, they differ in their constituent companies and the weighting methodologies used in their calculation. The companies and their weightings can vary, leading to slight discrepancies in their performance.

Accessing Real-time Sensex and Nifty Data

Reliable access to real-time data is crucial for effective stock market trading and investment analysis.

Reliable Data Sources

Several reputable sources provide real-time Sensex and Nifty data:

-

NSE India website (www.nseindia.com): Offers official, real-time data directly from the source.

-

BSE India website (www.bseindia.com): Provides official Sensex data and related information.

-

Reputable financial news websites: Many websites such as Google Finance, Yahoo Finance, and Bloomberg provide real-time quotes and charts. However, always verify information from multiple sources.

-

Financial data providers: Companies like Refinitiv and Bloomberg offer comprehensive data packages, often used by professional traders and analysts. These usually come with a subscription fee.

-

APIs: Application Programming Interfaces (APIs) allow developers to directly integrate real-time Sensex and Nifty data into their applications or trading platforms.

-

Advantages and Disadvantages: While official sources are accurate, they may lack user-friendly interfaces. News websites offer convenience but might have slight delays. Paid data providers offer speed and breadth but require subscriptions.

Interpreting Real-time Data

Understanding the various data points is critical:

- Opening Price: The price of the index at the start of the trading day.

- Closing Price: The price at the end of the trading day.

- High: The highest price reached during the day.

- Low: The lowest price reached during the day.

- Volume: The number of shares traded. High volume often indicates significant market activity.

- Percentage Change: The percentage increase or decrease in the index's value compared to the previous day's closing price.

Understanding these values helps you gauge market sentiment and the overall direction of the market. For example, a significant drop in price coupled with high volume might signal a bearish trend.

Analyzing Sensex and Nifty Movements

Analyzing the movements of these indices requires a combination of macro and micro-level analysis.

Factors Influencing Market Fluctuations

Numerous factors impact Sensex and Nifty:

- Global Economic Events: International events (e.g., global recessions, geopolitical tensions) can significantly influence investor sentiment.

- Government Policies: Changes in government policies, such as tax reforms or monetary policy decisions, have a direct impact on market movements.

- Company Performance: Individual company earnings announcements and news directly affect the index if the company is a major constituent.

- Investor Sentiment: Overall market confidence and investor behavior play a major role in driving index movements.

Technical Analysis Techniques

Technical analysis uses historical price data to predict future trends. Basic tools include:

- Moving Averages: Calculate the average price over a specific period, smoothing out price fluctuations to identify trends.

- Support and Resistance Levels: Identify price levels where the market has historically struggled to break through, offering potential buying or selling opportunities.

- Charting Software: Specialized software enhances technical analysis, allowing for advanced chart patterns and indicator studies.

Remember, technical analysis should be used in conjunction with fundamental analysis for a holistic view.

Fundamental Analysis for Informed Decisions

Fundamental analysis focuses on evaluating the intrinsic value of underlying companies:

- Financial Statements: Analyzing financial reports (balance sheets, income statements, cash flow statements) helps assess a company’s financial health.

- Industry Analysis: Understanding the industry landscape and competitive dynamics is crucial.

Fundamental analysis helps in making long-term investment decisions, considering factors beyond short-term price fluctuations.

Conclusion

Understanding the Sensex and Nifty, accessing reliable real-time data, and applying both technical and fundamental analysis are crucial for successful investing in the Indian stock market. Real-time data provides a dynamic view of market sentiment and allows for quick reactions to changing market conditions. Continuously monitoring the Sensex and Nifty, utilizing reliable sources, and employing sound analytical techniques are essential steps in building a robust investment strategy. Regularly review your strategy and stay updated on market trends related to the Sensex and Nifty to make the most informed decisions. Start monitoring the Sensex and Nifty today to enhance your investment journey!

Featured Posts

-

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025 -

Watch Pam Bondis Remarks On Eliminating American Citizens Draw Criticism

May 09, 2025

Watch Pam Bondis Remarks On Eliminating American Citizens Draw Criticism

May 09, 2025 -

Edmonton Oilers Draisaitl Hart Trophy Finalist And A Season For The Books

May 09, 2025

Edmonton Oilers Draisaitl Hart Trophy Finalist And A Season For The Books

May 09, 2025 -

Ukrainskiy Aspekt Oboronnogo Soglasheniya Makrona I Tuska 9 Maya

May 09, 2025

Ukrainskiy Aspekt Oboronnogo Soglasheniya Makrona I Tuska 9 Maya

May 09, 2025 -

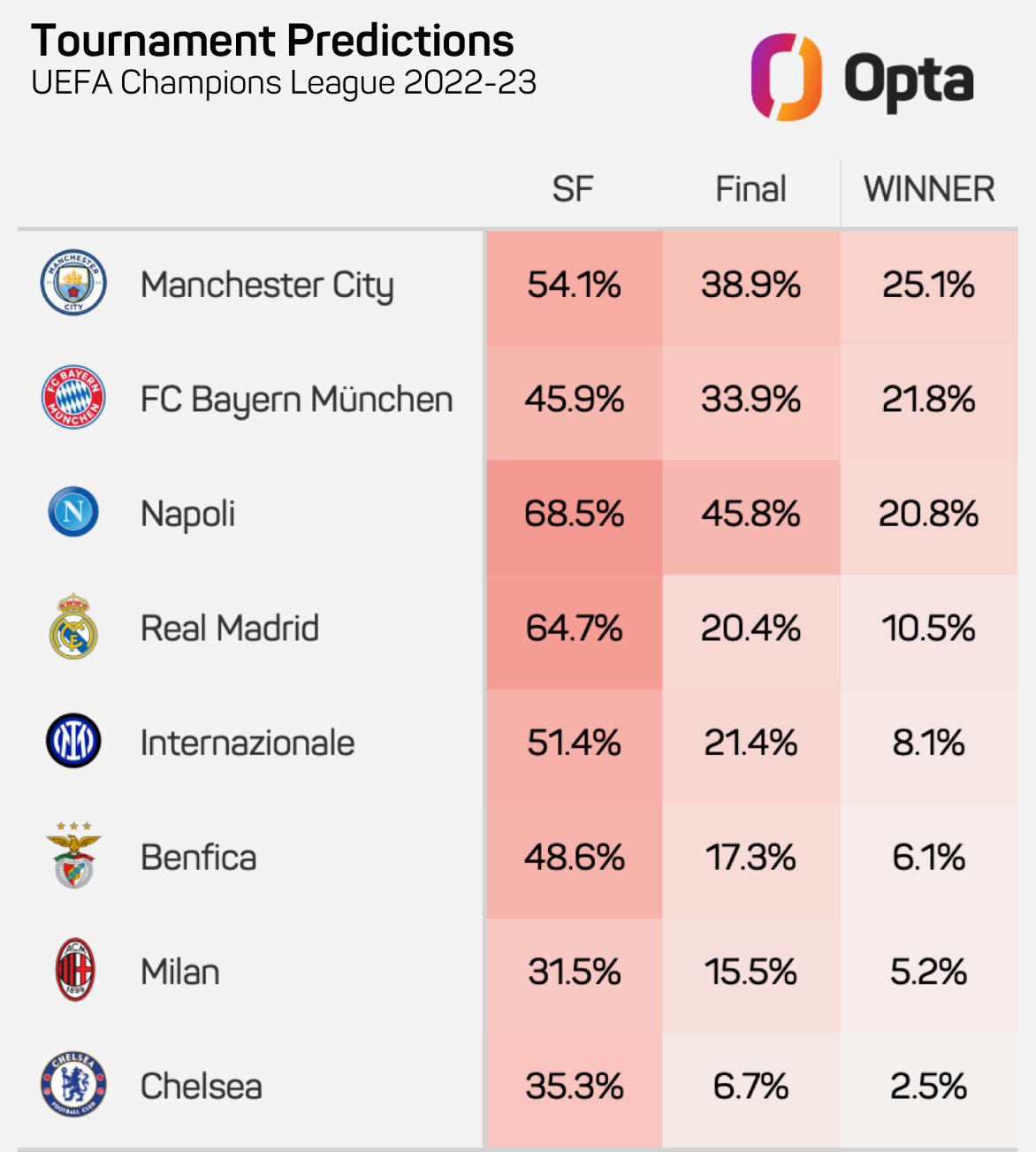

Rio Ferdinands Champions League Winner Prediction Arsenal Or Psg

May 09, 2025

Rio Ferdinands Champions League Winner Prediction Arsenal Or Psg

May 09, 2025