Sensex Gains Over 700 Points, Nifty Above 18,800: Today's Market Summary

Table of Contents

Sensex's Stellar Performance

The Sensex delivered a stellar performance, gaining a phenomenal 715 points today. This represents a significant percentage increase, closing at 66,583. This impressive jump signifies strong investor confidence in the Indian economy. Several sectors contributed significantly to this robust growth.

-

Sector-Specific Gains:

- IT Sector: The IT sector experienced a remarkable surge, boosted by positive global cues and strong quarterly earnings reports, with a percentage increase of approximately 3%.

- Banking Sector: The banking sector also performed exceptionally well, gaining around 2.5%, fueled by positive regulatory announcements and improving credit growth.

- FMCG Sector: The FMCG sector saw a modest but steady rise, reflecting sustained consumer demand and positive market sentiment, with a gain of approximately 1.8%.

-

Key Events Impacting Sensex:

- Positive global cues from major international markets played a significant role in boosting investor sentiment.

- Recent announcements from the Reserve Bank of India (RBI) regarding monetary policy also contributed to the positive market trend.

Nifty's Surge Above 18,800

The Nifty 50 index mirrored the Sensex's impressive rally, surging past the 18,800 mark. It gained X points (replace X with the actual number), closing at 18,830, representing a Y% increase (replace Y with the actual percentage). This signifies broad-based market strength across diverse sectors.

-

Top Nifty 50 Gainers:

- Company A: +Z% (replace Z with the percentage increase)

- Company B: +W% (replace W with the percentage increase)

- Company C: +V% (replace V with the percentage increase)

-

Top Nifty 50 Losers:

- Company D: -X% (replace X with the percentage decrease)

- Company E: -Y% (replace Y with the percentage decrease)

- Company F: -Z% (replace Z with the percentage decrease)

-

Significant Nifty-Related News: (Mention any significant news affecting the Nifty 50 index)

Sector-Wise Analysis

A detailed sector-wise analysis reveals a mixed performance, with some sectors outperforming others.

-

Top Performing Sectors: The IT, Banking, and FMCG sectors were the standout performers, driven by factors such as robust earnings, positive regulatory changes, and favorable global trends.

-

Lagging Sectors: (Mention sectors that underperformed and provide reasons) For example, the Auto sector experienced a relatively subdued performance, potentially due to concerns about rising input costs.

-

Key Performance Indicators:

- IT: +3%

- Banking: +2.5%

- FMCG: +1.8%

- Auto: +0.5%

- Pharma: +1% (Example data - replace with actual figures)

Global Market Influences

Global market trends played a significant role in shaping today's Indian stock market performance. Positive sentiment in major international markets, particularly in the US and Europe, infused optimism among investors.

-

Impact of Global Events: The positive performance of major global indices like the Dow Jones and Nasdaq provided a tailwind for the Indian markets, boosting investor confidence. (Specify the impact of any specific global events)

-

Performance of Major Global Indices: (Mention the performance of major global indices like the Dow Jones, Nasdaq, etc.)

Conclusion: Understanding Today's Market Summary and Future Outlook

Today's market witnessed a remarkable surge, with the Sensex gaining over 700 points and the Nifty surpassing 18,800. The IT, Banking, and FMCG sectors were key drivers of this positive performance, influenced significantly by positive global cues and domestic factors. While today's gains are encouraging, it's crucial to maintain a cautious outlook for the coming days. Market volatility is inherent, and factors like global economic conditions and geopolitical events can impact future performance.

Stay informed on future Sensex and Nifty movements with our daily market summaries! Subscribe to our newsletter for the latest updates and in-depth analysis of the Indian stock market. Get tomorrow's market summary, including Sensex and Nifty analysis, here!

Featured Posts

-

Falling Iron Ore Prices A Result Of Reduced Chinese Steel Production

May 09, 2025

Falling Iron Ore Prices A Result Of Reduced Chinese Steel Production

May 09, 2025 -

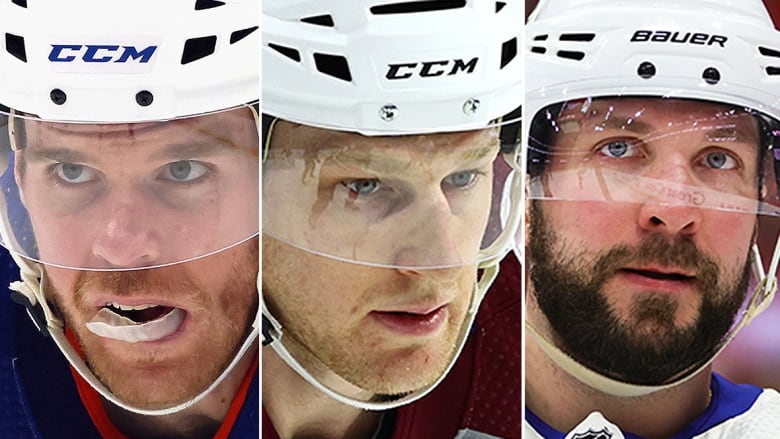

Draisaitl Hellebuyck And Kucherov Vie For The 2023 Hart Trophy

May 09, 2025

Draisaitl Hellebuyck And Kucherov Vie For The 2023 Hart Trophy

May 09, 2025 -

Inters Stunning Champions League Victory Over Bayern

May 09, 2025

Inters Stunning Champions League Victory Over Bayern

May 09, 2025 -

Palantir Stock Investment Before May 5th Considerations

May 09, 2025

Palantir Stock Investment Before May 5th Considerations

May 09, 2025 -

Increased Disney Profits Theme Parks And Streaming Services Deliver

May 09, 2025

Increased Disney Profits Theme Parks And Streaming Services Deliver

May 09, 2025