Sensex LIVE: Market Soars, All Sectors In Green

Table of Contents

The Sensex, a key indicator of the Indian stock market's health, plays a crucial role in reflecting the overall economic performance. Its movements influence investor confidence, investment decisions, and the overall economic sentiment of the nation. Understanding its trends is crucial for anyone invested in or observing the Indian economy. Currently, the global economic climate presents a complex picture, with varying degrees of uncertainty in different regions. However, today's Sensex LIVE performance indicates a resilient and positive response from the Indian market to both domestic and global factors.

Sensex Gains and Key Contributing Factors

The Sensex experienced a remarkable surge today, registering a [Insert Percentage]% increase. This impressive rally pushed the closing value of the Sensex to [Insert Closing Value]. Several key factors contributed to this bullish market sentiment and the significant market rally:

- Positive Global Cues: Improved US economic data and easing inflation concerns globally injected a wave of optimism into international markets, creating a positive ripple effect on the Indian stock market.

- Strong Corporate Earnings Reports: Several major Indian companies released robust quarterly earnings reports, exceeding market expectations and boosting investor confidence. This positive news fueled further buying pressure.

- Government Policy Announcements: [Mention any recent supportive government policies or announcements, e.g., new infrastructure projects, tax incentives, etc., and their impact on the market].

- Increased Foreign Institutional Investor (FII) Inflows: Significant inflows of capital from foreign institutional investors demonstrated strong confidence in the Indian market and further fueled the Sensex surge. This FII investment is a key driver of the bullish sentiment.

- Positive Investor Sentiment: A general improvement in investor sentiment, driven by a combination of the above factors, contributed to increased buying activity and pushed the market higher. The overall positive economic indicators boosted confidence levels.

Sector-Wise Performance: All Sectors in Green

The remarkable Sensex surge was a broad-based rally, with all major sectors showing significant gains. This "all sectors in green" scenario highlights the widespread positive sentiment. Let's analyze the performance of some key sectors:

- Banking Sector: The banking index experienced a strong rally, driven by [mention specific reasons like improved credit growth, NPA reduction, positive regulatory changes etc.].

- IT Sector: The IT sector continued its strong performance, with gains fueled by increasing demand for technology services, successful deal wins, and robust software exports.

- FMCG Sector: The FMCG sector showcased steady growth, reflecting sustained consumer demand despite inflationary pressures.

- Auto Sector: The auto stocks rally was driven by [mention specific factors such as increased vehicle sales, positive industry outlook, etc.].

- Pharmaceutical Sector: The pharmaceutical sector gains reflect [mention factors such as strong export demand, new drug approvals etc.].

Banking Sector's Robust Performance

The banking sector played a significant role in driving the Sensex rise. Improved credit growth, positive trends in Non-Performing Assets (NPA) reduction, and supportive regulatory changes all contributed to the strong performance of banking stocks. The bank index performance was particularly impressive, showcasing the sector's resilience and growth potential. This banking stocks rally indicates increased investor confidence in the sector's future prospects.

IT Sector's Continued Strength

The IT sector's continued strength underlines its importance in the Indian economy. Increasing demand for technology services globally, coupled with successful deal wins by Indian IT companies, fueled this sector's robust performance. The growth in software exports and the ongoing digital transformation across various industries further contributed to the IT stocks rally.

Expert Opinions and Market Outlook

Market analysts are largely optimistic about the current market situation. [Insert quote from a market analyst about the Sensex's current performance and predictions]. The general consensus points towards a positive short-term outlook, driven by continued positive economic indicators and strong corporate earnings. However, the long-term Sensex outlook remains subject to global economic conditions and geopolitical factors. Market analyst predictions suggest that cautious optimism is warranted. Monitoring the Sensex outlook closely and staying informed about future market trends is essential for making informed investment decisions. Regularly reviewing stock market forecasts can help navigate the changing market landscape.

Sensex LIVE Update and Call to Action

Today's Sensex LIVE update showcases a remarkable market soar, with all sectors in green and significant gains across the board. The positive performance is driven by a confluence of positive global cues, strong corporate earnings, government policies, and increased FII investment. Understanding these Sensex trends is crucial for informed decision-making.

To stay updated on the latest Sensex movements and market trends, subscribe to our newsletter and follow us on social media for regular Sensex LIVE updates. Utilize reliable tools for tracking Sensex and other relevant live market data to make informed investment choices. Stay informed on stock market updates and leverage live market data to navigate the dynamic Indian stock market effectively. Keep a close watch on the Sensex LIVE for timely information to make well-informed decisions.

Featured Posts

-

Sensex And Nifty Today Live Stock Market Updates And Analysis

May 10, 2025

Sensex And Nifty Today Live Stock Market Updates And Analysis

May 10, 2025 -

King Zvinuvachuye Maska Ta Trampa V Zradi Stiven King Pro Pidtrimku Putina

May 10, 2025

King Zvinuvachuye Maska Ta Trampa V Zradi Stiven King Pro Pidtrimku Putina

May 10, 2025 -

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025

Remembering Americas First Nonbinary Person A Life Cut Short

May 10, 2025 -

Did Pam Bondi Possess The Epstein Client List Examining The Evidence

May 10, 2025

Did Pam Bondi Possess The Epstein Client List Examining The Evidence

May 10, 2025 -

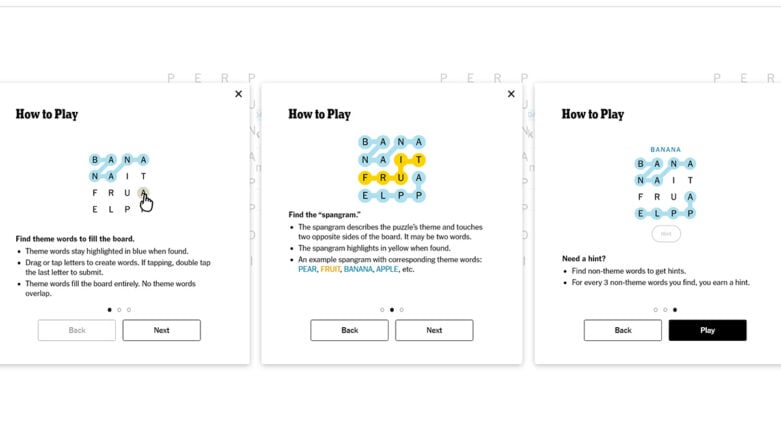

Strands Nyt Game 366 March 4th Complete Answers And Hints

May 10, 2025

Strands Nyt Game 366 March 4th Complete Answers And Hints

May 10, 2025