Sensex Surges 1,400 Points, Nifty Above 23,800: Top 5 Reasons For Today's Market Rise

Table of Contents

Positive Global Cues Boost Investor Sentiment

Positive global market trends played a significant role in today's Indian stock market rally. The strength of international markets, particularly in the US and Europe, significantly influenced investor sentiment. These positive global cues had a ripple effect, boosting confidence and driving investment.

-

Strong US Economic Indicators: Lower-than-expected inflation figures in the US injected a dose of optimism into global markets. This suggests that the aggressive interest rate hikes by the Federal Reserve might be nearing an end, potentially easing pressure on global growth.

-

Robust European Corporate Earnings: Several major European companies reported better-than-anticipated Q1 earnings, further bolstering investor confidence and contributing to the positive global market trends. This positive news flow helped to alleviate some of the concerns surrounding the global economic outlook.

-

Increased FII Investment: The positive global cues led to a significant inflow of Foreign Institutional Investor (FII) money into the Indian stock market. FIIs, often seen as key drivers of market momentum, are highly sensitive to global economic conditions and their increased participation contributed significantly to today’s Sensex gains and Nifty 50 performance. This influx of FII investment is a clear indicator of growing confidence in the Indian economy.

Strong Q1 Earnings Reports Fuel Market Confidence

Strong corporate earnings reports from Indian companies across various sectors played a pivotal role in today's market rally. Exceeding expectations in profit growth fueled investor confidence and drove up stock prices.

-

IT Sector Excellence: The IT sector reported exceptionally strong Q1 earnings, exceeding analysts' projections. This strong performance reflects continued high demand for IT services globally.

-

Banking Sector Strength: Leading Indian banks also showcased robust financial performance, driven by increased lending and improved asset quality. This positive trend signals a healthy banking sector, contributing positively to overall market sentiment.

-

FMCG Sector Resilience: Even amidst inflationary pressures, the Fast-Moving Consumer Goods (FMCG) sector demonstrated resilience, showcasing strong earnings and demonstrating its ability to navigate economic challenges. This stability and growth in a crucial sector boosted overall market confidence. This robust sectoral performance paints a picture of a healthy and growing Indian economy.

Reduced Inflation Concerns Ease Investor Anxiety

Easing inflation concerns significantly impacted investor sentiment. Recent inflation data indicated a moderation in price increases, leading to increased optimism and reducing investor anxiety.

-

Moderating Inflation Rate: The latest inflation figures released by the Reserve Bank of India (RBI) showed a continued decline in the inflation rate, easing concerns about aggressive monetary policy tightening. This positive data point indicates that the RBI might be less inclined to further increase interest rates.

-

Impact on Monetary Policy: The reduced inflation concerns led to speculation that the RBI may pause or slow down its interest rate hikes. This expectation of a less hawkish monetary policy stance fueled investor confidence, enabling the market rally. Lower interest rates generally stimulate economic growth and investor activity.

Government's Positive Economic Policies and Announcements

The Indian government's positive economic policies and announcements also played a crucial role in today's market surge. These initiatives created a positive outlook for the economy, attracting investor interest and fueling market confidence.

-

Infrastructure Development Push: The government's continued focus on infrastructure development, with significant investments planned in various sectors, boosted investor confidence. This commitment to infrastructure development projects stimulates economic growth and creates opportunities for various sectors.

-

Pro-Growth Economic Reforms: Several recent policy announcements, focusing on economic reforms and streamlining regulations, further contributed to the positive market sentiment. These reforms create a more favorable environment for business and investment.

Short Covering and Margin Buying Contribute to the Rally

Technical factors, including short covering and margin buying, amplified the upward market movement. These actions often accelerate existing trends, contributing to the magnitude of the rally.

-

Short Covering Explained: Short covering involves investors buying back securities they previously sold short, to limit potential losses. This buying pressure pushes prices higher.

-

Margin Buying Amplified Gains: Margin buying involves borrowing funds from brokers to invest in stocks. When prices rise, the returns on margin investments are amplified, leading to increased buying pressure and further price increases. This magnifies the impact of other positive factors contributing to the market rally.

Conclusion: Understanding and Navigating the Sensex and Nifty Surge

Today's significant Sensex surge of 1400 points, pushing the Nifty 50 above 23,800, was driven by a confluence of factors: positive global cues, strong Q1 earnings, reduced inflation concerns, supportive government policies, and technical factors like short covering and margin buying. Understanding these interconnected elements is crucial for navigating the Indian stock market effectively. To make informed investment decisions related to the Sensex and Nifty, stay informed about market trends, conduct thorough research, and consider consulting with a financial advisor before making any investment choices. Conduct your own Sensex analysis and Nifty outlook to make the best investment strategies. Remember that market volatility is inherent and a comprehensive market analysis is vital for successful stock market investment.

Featured Posts

-

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025 -

Edmonton Oilers Leon Draisaitl Suffers Injury Leaves Game

May 10, 2025

Edmonton Oilers Leon Draisaitl Suffers Injury Leaves Game

May 10, 2025 -

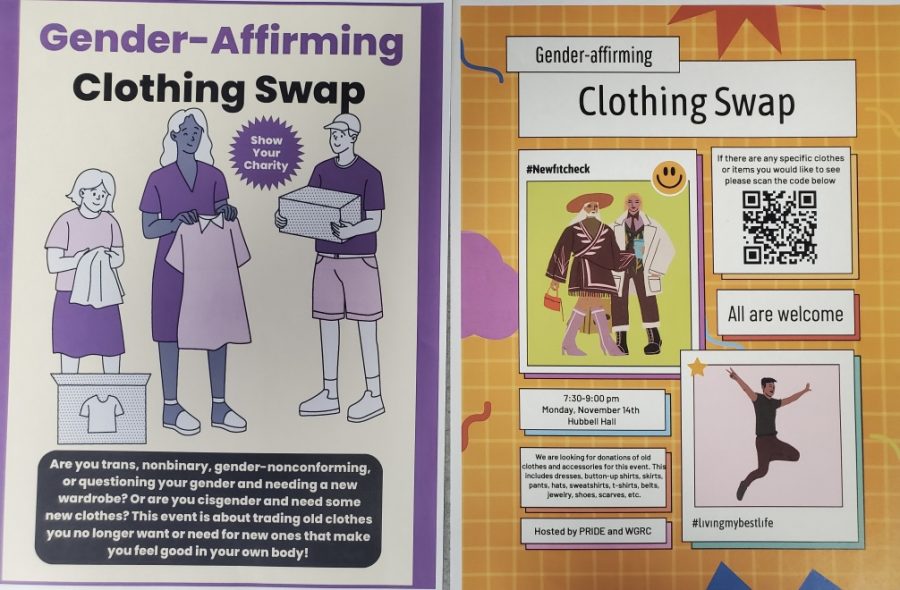

Thailands Transgender Community A Fight For Equality In The Spotlight Bangkok Post

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight Bangkok Post

May 10, 2025 -

Bolsos Hereu La Eleccion De Dakota Johnson Y Otras It Girls

May 10, 2025

Bolsos Hereu La Eleccion De Dakota Johnson Y Otras It Girls

May 10, 2025 -

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025

Njwm Krt Alqdm Waltbgh Qst Idman Wanhraf

May 10, 2025