Sensex Today: LIVE Stock Market Updates - 700+ Point Surge

Table of Contents

Sensex Today's Key Drivers

Several factors contributed to the remarkable surge in the Sensex today. Let's delve into the key drivers behind this positive market momentum.

Global Market Influence

Positive cues from global markets significantly impacted the Sensex's performance.

- Positive cues from global markets (e.g., Dow Jones, Nasdaq): The strong performance of major global indices like the Dow Jones and Nasdaq instilled confidence among Indian investors. A positive global outlook often translates to increased foreign institutional investor (FII) participation in the Indian market.

- Impact of international trade developments: Favorable developments in international trade, such as easing trade tensions or positive trade agreements, can boost investor sentiment and lead to increased market activity.

- Effect of global economic data releases on investor confidence: Positive global economic data, such as stronger-than-expected GDP growth in major economies, can positively influence investor confidence and drive up stock prices. For example, robust US economic data often has a positive ripple effect on emerging markets like India.

The correlation between international market performance and the Sensex is undeniable. A strong performance in global markets typically signals a positive global economic outlook, encouraging investors to invest in emerging markets like India.

Domestic Economic Indicators

Strong domestic economic indicators also played a crucial role in the Sensex's surge.

- Positive GDP growth figures: Robust GDP growth figures indicate a healthy and expanding economy, attracting both domestic and foreign investments. Higher GDP growth often translates to increased corporate earnings, boosting investor confidence.

- Improved inflation data: Lower inflation rates indicate price stability and a healthy economy, making investments more attractive. Reduced inflation often leads to lower interest rates, which in turn boosts borrowing and investment.

- Strong corporate earnings reports: Positive corporate earnings reports from major Indian companies showcase the strength of the Indian economy and encourage further investment. Strong earnings translate to increased dividends and higher stock valuations.

- Government policy announcements affecting investor sentiment: Positive government policy announcements, such as reforms aimed at boosting economic growth or improving the business environment, can significantly influence investor sentiment and drive market performance. For example, infrastructure development initiatives can attract substantial investment.

The influence of positive domestic economic news on the Sensex is substantial. Quantifiable data from reliable sources, like the Reserve Bank of India (RBI) and the National Statistical Office (NSO), support the connection between positive economic indicators and market performance.

Sector-Specific Performances

The Sensex's rise wasn't uniform across all sectors. Certain sectors outperformed others, contributing significantly to the overall surge.

- Top performing sectors (e.g., IT, Pharma, Banking): The IT, Pharma, and Banking sectors, amongst others, experienced strong gains today. This sectoral performance highlights the diverse drivers of the market's growth.

- Analysis of individual stock movements within these sectors: Analyzing the individual stock movements within these sectors reveals the specific companies and events driving the positive performance. For example, strong quarterly results from a major IT company might boost the entire sector.

- Reasons for their strong performance: The reasons for the strong performance of these sectors vary. For example, positive global demand for IT services might drive the IT sector's growth, while positive regulatory changes might influence the Banking sector.

Live Sensex Data & Analysis

Let's look at the live Sensex data and analyze the key figures to understand the day's market movements. (Note: Replace the bracketed information below with the actual data for the day.)

Opening & Closing Values:

- Opening Value: [Insert Opening Value]

- Closing Value: [Insert Closing Value]

- Percentage Change: [Insert Percentage Change]

Intraday Highs & Lows:

- Intraday High: [Insert Intraday High]

- Intraday Low: [Insert Intraday Low]

Trading Volume & Volatility:

- Trading Volume: [Insert Trading Volume] – A high trading volume suggests significant investor activity and participation.

- Volatility: [Insert Volatility Analysis] – Analyze the volatility (e.g., high, low, moderate) to understand the market's stability.

Key Gainers & Losers:

- Top Gainers: [List top 3-5 gaining stocks and their percentage change]

- Top Losers: [List top 3-5 losing stocks and their percentage change]

Expert Opinions & Predictions

Understanding expert perspectives is crucial for navigating market trends.

Market Analyst Perspectives:

[Insert quotes or summaries from reputable financial analysts, citing sources. For example: "According to [Analyst Name] at [Financial Institution], the Sensex surge reflects a growing confidence in the Indian economy..." ]

Potential Risks & Opportunities:

While the current market outlook is positive, it's essential to acknowledge potential risks. [Discuss potential downside risks, such as global economic uncertainty, geopolitical events, or sector-specific challenges. Also highlight potential investment opportunities based on the current market situation and expert predictions.]

Conclusion

The Sensex today experienced a remarkable 700+ point surge, fueled by a combination of positive global and domestic factors. The strong performance across key sectors and positive investor sentiment indicate a bullish market outlook. However, it's crucial to remember that market fluctuations are inherent, and investors should always conduct thorough research before making any investment decisions. Stay informed about the latest updates on the Sensex today and continue to monitor market trends to make informed investment choices. For continuous updates and in-depth analysis of the Sensex Today, bookmark this page and check back regularly.

Featured Posts

-

The Unexpected Surge In Bitcoin Mining Whats Behind It

May 09, 2025

The Unexpected Surge In Bitcoin Mining Whats Behind It

May 09, 2025 -

Golden Knights Blank Blue Jackets 4 0 Hills Stellar Performance Leads Victory

May 09, 2025

Golden Knights Blank Blue Jackets 4 0 Hills Stellar Performance Leads Victory

May 09, 2025 -

Madeleine Mc Cann Parents To Receive Police Protection At Prayer Vigil Following Stalking Incidents

May 09, 2025

Madeleine Mc Cann Parents To Receive Police Protection At Prayer Vigil Following Stalking Incidents

May 09, 2025 -

Jesse Watters Branded A Hypocrite Following Controversial Wife Cheating Remarks

May 09, 2025

Jesse Watters Branded A Hypocrite Following Controversial Wife Cheating Remarks

May 09, 2025 -

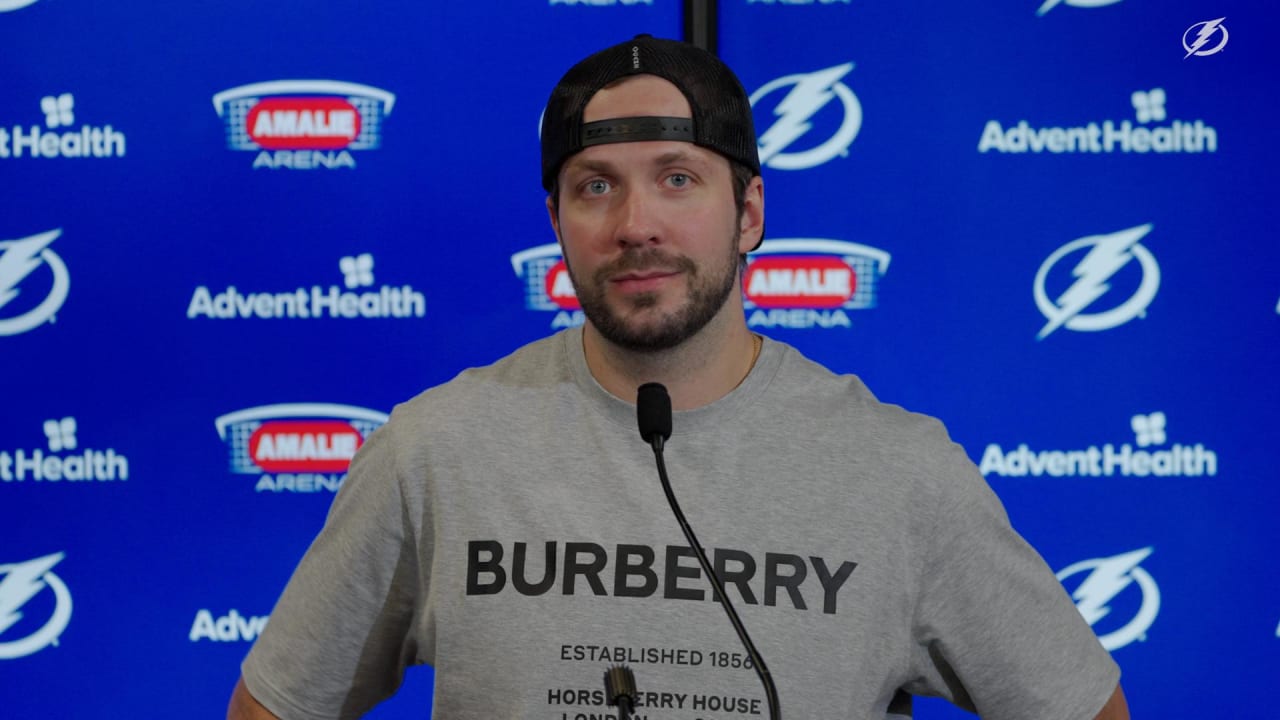

Kucherovs Brilliance Leads Lightning To 4 1 Victory Over Oilers

May 09, 2025

Kucherovs Brilliance Leads Lightning To 4 1 Victory Over Oilers

May 09, 2025