Sharp Decline On Amsterdam Stock Exchange: 11% Drop In Three Days

Table of Contents

Analyzing the Causes of the Amsterdam Stock Exchange's Sharp Decline

The precipitous fall of the AEX is a multifaceted issue with roots in both global and domestic factors. Understanding these intertwined causes is crucial to navigating the current market volatility.

Global Economic Uncertainty and its Impact on the AEX

Global economic headwinds have significantly impacted investor confidence, contributing to the AEX's sharp decline. Rising inflation, aggressive interest rate hikes by central banks worldwide, and persistent geopolitical risks, particularly the ongoing war in Ukraine and the resulting energy crisis, have created a climate of uncertainty. These factors directly influence the performance of Dutch companies listed on the AEX.

- High Inflation: Erodes purchasing power and increases business costs, squeezing profit margins.

- Interest Rate Hikes: Increase borrowing costs for businesses, hindering investment and potentially slowing economic growth.

- Geopolitical Risks: Uncertainty surrounding the war in Ukraine and its impact on energy supplies and global trade negatively affects investor sentiment.

For example, Dutch energy companies, heavily reliant on global gas prices, have experienced significant losses, pulling down the overall AEX index. Similarly, companies with extensive international operations are vulnerable to disruptions in global supply chains and reduced consumer demand. The ripple effect of these global challenges on the Dutch economy has directly impacted investor confidence in the AEX.

Specific Sectoral Weakness within the Dutch Economy

The decline on the Amsterdam Stock Exchange isn't solely attributable to global factors; specific sectoral weaknesses within the Dutch economy also played a role. While the entire market suffered, some sectors experienced more significant declines than others.

- Energy Sector: High energy prices and supply chain disruptions heavily impacted this sector's performance.

- Technology Sector: Concerns about a potential global recession have led to decreased investment in technology companies.

- Financial Sector: Rising interest rates and increased economic uncertainty have pressured financial institutions.

Analyzing the performance of key AEX index components reveals that underperformance in specific sectors significantly contributed to the overall decline. For instance, the poor performance of major banks and energy companies heavily influenced the AEX's downward trajectory. A detailed sector-by-sector analysis is vital to understanding the nuances of this market crash.

Impact of Investor Sentiment and Market Psychology

Market psychology played a crucial role in exacerbating the AEX's decline. Fear, uncertainty, and doubt (FUD) fueled panic selling, driving down stock prices further. Herd behavior, where investors mimic each other's actions, amplified this downward trend.

- Panic Selling: Investors rushed to sell their holdings, creating a self-fulfilling prophecy.

- Herd Behavior: Investors followed the trend, exacerbating the decline.

- Increased Trading Volume: High trading volumes indicate increased market activity during the downturn.

Any news concerning potential economic slowdowns or specific company performance issues likely contributed to this negative investor sentiment. Understanding market psychology is critical to interpreting the rapid price fluctuations observed during the AEX's sharp decline.

Potential Consequences of the Amsterdam Stock Exchange's Fall

The 11% drop on the AEX has wide-ranging potential consequences for the Dutch economy and its citizens.

Impact on Dutch Businesses and the National Economy

The stock market decline can negatively impact Dutch businesses and the national economy in several ways:

- Reduced Investment: Businesses may postpone expansion plans due to decreased investor confidence and higher borrowing costs.

- Lower Corporate Earnings: Falling stock prices can reflect decreased profitability and impact future earnings.

- Potential Job Losses: Businesses facing financial strain may resort to cost-cutting measures, potentially leading to job losses.

- Decreased Consumer Spending: Economic uncertainty can cause consumers to reduce spending, impacting overall economic activity.

The impact on GDP growth is a significant concern, particularly considering the intertwined nature of the Dutch economy and the global market.

Implications for Investors and Retirement Savings

The AEX's fall significantly impacts individual investors, particularly those nearing retirement.

- Portfolio Losses: Investors holding AEX-listed stocks experienced substantial losses, impacting their retirement savings.

- Reduced Pension Fund Values: Pension funds invested in the AEX also suffered losses.

- Importance of Diversification: A diversified investment portfolio can help mitigate losses during market downturns.

This emphasizes the importance of long-term investment strategies, risk management, and the need for professional financial advice in times of market uncertainty.

Government Response and Potential Policy Interventions

The Dutch government may consider policy interventions to mitigate the consequences of the AEX's decline.

- Fiscal Policy: Government spending or tax cuts to stimulate economic activity.

- Monetary Policy: The Dutch central bank might adjust interest rates to support economic growth.

- Regulatory Changes: Possible adjustments to regulations to enhance market stability.

The effectiveness of these interventions depends on various factors and needs careful consideration to avoid unintended negative consequences.

Conclusion: Navigating the Sharp Decline on the Amsterdam Stock Exchange

The 11% drop on the Amsterdam Stock Exchange is a complex event stemming from a combination of global economic uncertainties, sectoral weaknesses within the Dutch economy, and the impact of investor sentiment. The consequences are far-reaching, affecting Dutch businesses, the national economy, and individual investors' portfolios. Understanding the interplay of global factors, sectoral trends, and market psychology is essential for navigating the complexities of the AEX and similar market fluctuations. Stay informed about the AEX and global market trends through continued monitoring and analysis of financial news and expert opinions to make informed investment decisions. Further research into risk management and appropriate investment strategies is crucial for mitigating the impact of future market declines. Don't hesitate to seek professional financial advice to protect your investments in the face of sharp declines on the Amsterdam Stock Exchange or other market volatility.

Featured Posts

-

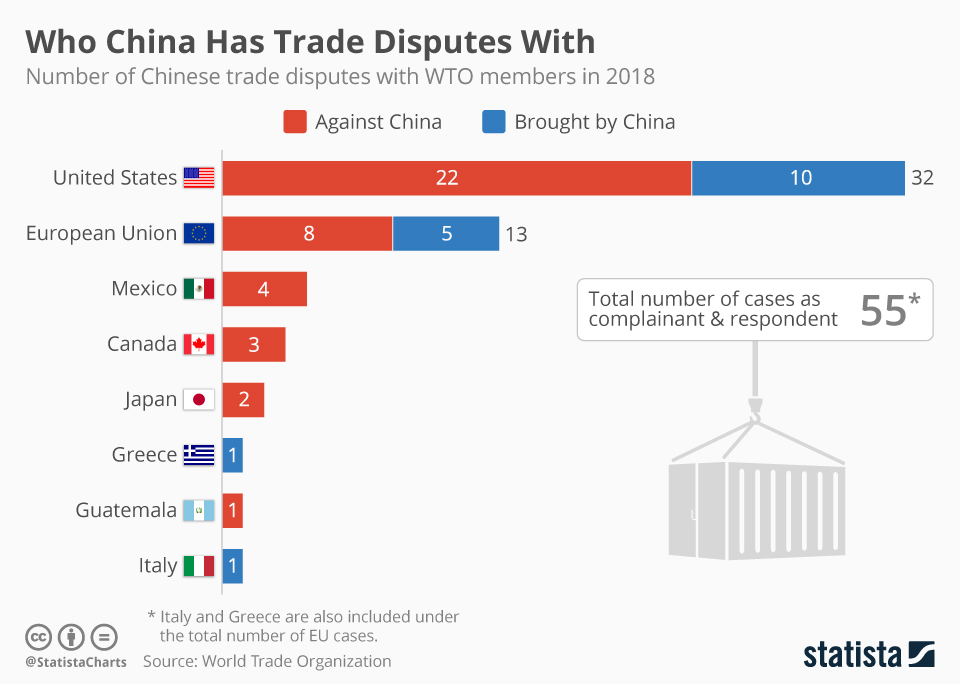

China And Us Trade Relations A Race Against The Clock

May 24, 2025

China And Us Trade Relations A Race Against The Clock

May 24, 2025 -

Evrovidenie 2014 Konchita Vurst Kaming Aut Devushka Bonda I Zhizn Posle Pobedy

May 24, 2025

Evrovidenie 2014 Konchita Vurst Kaming Aut Devushka Bonda I Zhizn Posle Pobedy

May 24, 2025 -

Avoid Memorial Day Travel Chaos Best And Worst Flight Days 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days 2025

May 24, 2025 -

Evrovidenie 2013 2023 Kuda Propali Pobediteli Konkursa

May 24, 2025

Evrovidenie 2013 2023 Kuda Propali Pobediteli Konkursa

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025