Sharp Drop In Amsterdam: Stock Market Down 7% As Trade War Fears Rise

Table of Contents

The Severity of the Amsterdam Stock Market Decline

The 7% drop in the Amsterdam stock market, specifically the AEX index, represents the largest single-day decline in several years. This is a significant event, surpassing previous notable fluctuations seen in recent years. To put this into perspective, the AEX index fell by [insert precise numerical data, citing source, e.g., "150 points," referencing a reliable financial news source]. This dramatic decrease reflects a significant loss of value for investors and signals a considerable shift in market sentiment.

- Magnitude of the drop: The 7% decline surpasses the average daily fluctuation observed in the AEX index over the past [insert timeframe, e.g., five years], indicating an extraordinary event.

- Historical context: Comparing this drop to previous market crashes in Amsterdam provides crucial context, highlighting the severity of the current situation. (Include data points for comparison).

- AEX Index impact: The AEX index, a key indicator of the Amsterdam stock market's performance, experienced a severe downturn, reflecting a broader negative sentiment across various sectors.

The Role of Trade War Fears in the Market Drop

The primary catalyst for this stock market crash in Amsterdam is the growing concern surrounding escalating trade wars. The uncertainty surrounding global trade policies and potential retaliatory tariffs significantly impacts investor confidence. This anxiety translates directly into decreased investment, as businesses and investors hesitate to commit capital in an environment fraught with unpredictable economic headwinds.

- Trade dispute impact: Specific ongoing trade disputes (mention specific examples if applicable, e.g., US-EU trade tensions) fuel investor uncertainty and contribute to the market's volatility.

- Investor sentiment: The prevailing sentiment among investors is one of caution and risk aversion. Uncertainty about future profits and market stability leads to divestment and a shift towards safer assets.

- Vulnerable sectors: Export-oriented industries and technology companies, heavily reliant on international trade, are particularly vulnerable to the negative impacts of trade wars. These sectors have likely suffered disproportionately during this downturn.

Impact on Key Sectors within the Amsterdam Stock Market

The Amsterdam stock market decline hasn't affected all sectors equally. Certain industries are suffering more acutely than others due to their specific exposure to global trade and economic sensitivities.

- Technology sector losses: The technology sector, often a bellwether for market sentiment, has experienced significant losses, reflecting concerns about supply chain disruptions and reduced consumer demand. [Mention specific company examples and their percentage losses, if available].

- Export-oriented industries: Industries heavily reliant on exports, such as [mention specific examples relevant to the Amsterdam economy], have suffered considerable losses due to the potential impact of trade tariffs and reduced international trade.

- Financial sector ramifications: The financial sector is also experiencing instability, with decreased investment activity and rising concerns about credit risk.

Expert Opinions and Predictions

Financial experts offer varied opinions on the situation's short-term and long-term implications. Many believe the current market volatility is a direct result of heightened trade war anxieties. Predictions for the future remain uncertain.

- Short-term outlook: Several analysts predict continued market volatility in the short term, with the potential for further declines depending on the resolution of global trade tensions.

- Long-term outlook: The long-term outlook is more optimistic, with predictions of an eventual market recovery contingent on a de-escalation of trade disputes and increased global economic stability.

- Government intervention: Some experts suggest potential government or central bank interventions to stabilize the market and mitigate the negative economic consequences of this downturn. (Discuss possible intervention strategies).

Conclusion: Navigating the Sharp Drop in Amsterdam's Stock Market

The 7% drop in the Amsterdam stock market, largely driven by intensifying trade war fears, represents a significant challenge for investors. The impact on various sectors has been uneven, with export-oriented industries and the technology sector facing particularly tough headwinds. While the short-term outlook remains uncertain, experts anticipate a recovery contingent on easing trade tensions and renewed global economic confidence. Navigating this market volatility requires informed decision-making, diversification of investment portfolios, and a proactive approach to risk management. Stay updated on Amsterdam stock market trends and the ongoing impact of trade war fears. Regularly review your investment strategy and consider consulting a financial advisor for personalized guidance. Follow our future articles for continued updates and analysis of the Amsterdam stock market and its response to global economic developments.

Featured Posts

-

Finding Solace In Nature A Seattle Womans Pandemic Story

May 25, 2025

Finding Solace In Nature A Seattle Womans Pandemic Story

May 25, 2025 -

Burys Missing Link The Untold Story Of The M62 Relief Road

May 25, 2025

Burys Missing Link The Untold Story Of The M62 Relief Road

May 25, 2025 -

Melanie Thierry Biographie Et Filmographie Complete

May 25, 2025

Melanie Thierry Biographie Et Filmographie Complete

May 25, 2025 -

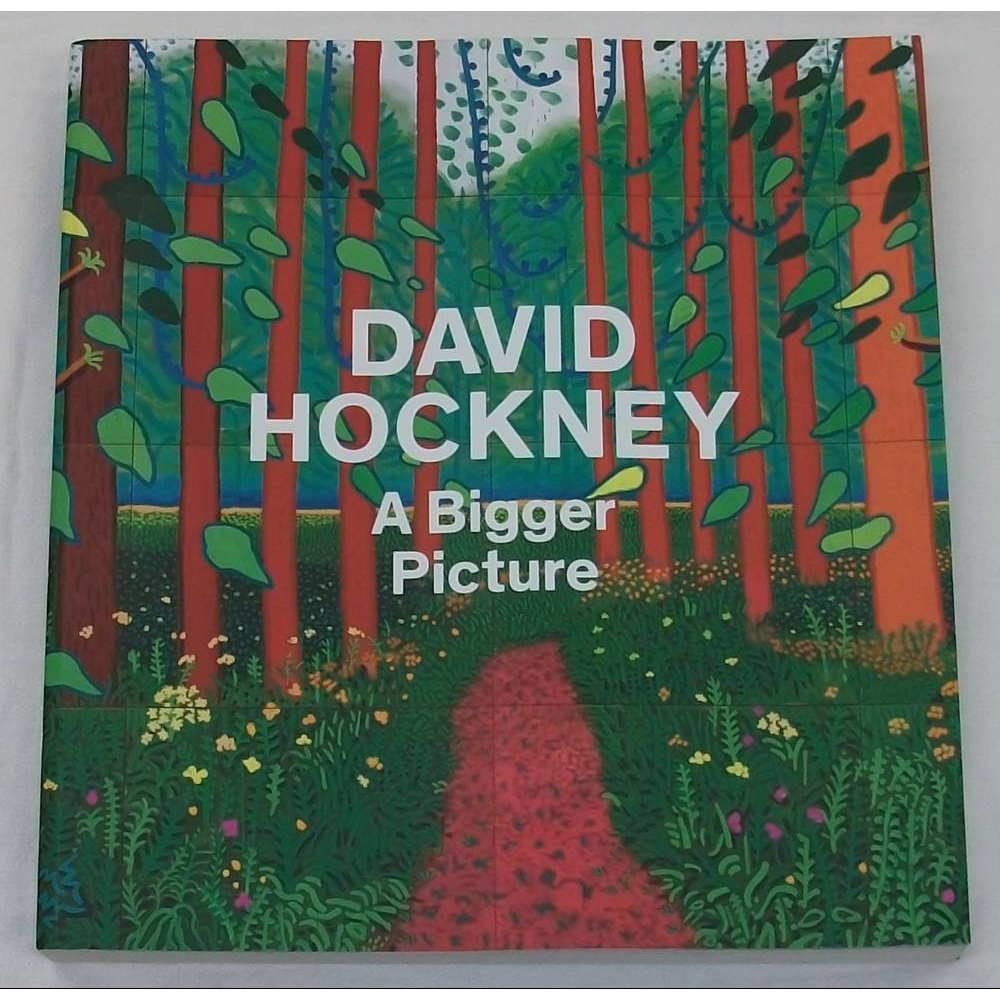

The Evolution Of Landscape In David Hockneys A Bigger Picture

May 25, 2025

The Evolution Of Landscape In David Hockneys A Bigger Picture

May 25, 2025 -

5 Must See Action Episodes Of Lock Up A Tv Guide

May 25, 2025

5 Must See Action Episodes Of Lock Up A Tv Guide

May 25, 2025