Shein's London IPO On Hold: Analysis Of US Tariff Implications

Table of Contents

Shein's Global Expansion Strategy and the UK as a Launchpad

Shein's rapid global growth is undeniable. Its strategic choice of London for its initial public offering (IPO) was a calculated move, aiming to leverage the UK's robust financial markets and establish a strong foothold in Europe. The company’s dominance in the fast fashion market, fueled by its ultra-low prices and rapid product turnover, makes a successful IPO crucial for its continued expansion.

- Shein's dominance in the fast fashion market: Shein has disrupted the industry with its incredibly low prices and vast product selection, capturing a significant market share globally.

- The advantages of a London listing: A London IPO offers access to a deep pool of capital and a sophisticated investor base, crucial for a company of Shein's scale and ambition.

- The UK's strategic importance as a European gateway: The UK serves as an ideal springboard for further expansion into the European Union market.

- Shein's potential for further European expansion post-IPO: A successful IPO in London would have provided the financial resources and investor confidence needed to accelerate Shein’s expansion across Europe.

The Threat of US Tariffs and Their Potential Impact on Shein's Business Model

Ongoing investigations into Shein's business practices, particularly concerning allegations of intellectual property infringement and labor practices, have cast a long shadow over its IPO plans. The potential imposition of substantial US tariffs represents a significant threat to its business model.

- Explanation of the potential tariffs and their percentage rates: While specific tariff rates haven't been finalized, the potential for substantial increases in import duties on Shein's products is very real, potentially ranging from tens to hundreds of percentage points depending on the product categories affected.

- Analysis of how these tariffs could significantly increase the cost of Shein's goods in the US market: Higher tariffs would directly translate into increased prices for consumers, potentially impacting Shein's competitive edge and profitability.

- Impact on Shein's profitability and market share in a crucial market: The US is a hugely important market for Shein. Increased prices could significantly reduce its market share and profitability in this region.

- Discussion of potential responses from Shein (e.g., price adjustments, sourcing changes): Shein may need to consider price increases (reducing its competitive advantage), shifting sourcing to other countries, or even lobbying efforts to influence US trade policy.

The Uncertainty Surrounding US Trade Policy and Its Influence on Investor Confidence

The uncertainty surrounding US trade policy is a major factor influencing investor decisions. Potential investors are inherently risk-averse, and the threat of significant tariffs introduces substantial uncertainty into the equation.

- The role of political and economic volatility in impacting investment decisions: Geopolitical uncertainty and economic volatility make investors wary of committing substantial capital to companies facing potential trade disruptions.

- The risk-averse nature of investors in the face of potential tariff-related losses: Investors are likely to prioritize less risky investment opportunities in the face of potential tariff-related losses for Shein.

- The implications for Shein's valuation and the overall success of the IPO: The threat of tariffs has directly impacted Shein's valuation, making a successful IPO more challenging.

Alternative Strategies for Shein: Navigating the Tariff Challenges

To mitigate the negative effects of potential US tariffs, Shein needs to consider several strategic alternatives.

- Diversification of sourcing and manufacturing locations: Reducing reliance on single sourcing locations by diversifying manufacturing across multiple countries can help mitigate the impact of tariffs imposed on goods from a specific region.

- Negotiation with the US government to address tariff concerns: Shein could engage in direct negotiations with the US government to address specific concerns and potentially avoid or reduce the impact of tariffs.

- Adjustments to the Shein business model to minimize reliance on the US market: Shein might explore expanding its focus to other, less tariff-sensitive markets to lessen its dependence on the US.

- Potential for lobbying efforts to influence US trade policy: Investing in lobbying efforts to influence US trade policy could help Shein advocate for more favorable trade conditions.

The Future of Shein's IPO: Timeline and Potential Outcomes

The future of Shein's IPO remains uncertain. Several scenarios are possible.

- Possible scenarios: A delayed IPO while Shein addresses tariff concerns, revised IPO plans with a lower valuation, or exploring alternative listing locations outside of London are all possibilities.

- The impact of resolving or escalating tariff concerns on Shein’s timeline: A resolution of the tariff issue could significantly accelerate Shein's IPO timeline, while further escalation could result in indefinite postponement.

- Long-term implications for Shein's growth and global presence: The outcome of these trade challenges will significantly affect Shein's long-term growth trajectory and its global presence.

Conclusion:

The postponement of Shein's London IPO underscores the significant challenges posed by the threat of US tariffs. The uncertainty surrounding these tariffs has dampened investor confidence, forcing Shein to reassess its strategy. While the future of the Shein's London IPO remains uncertain, the company's ability to effectively navigate these trade complexities will be critical to its long-term success. Further updates and analysis regarding Shein's London IPO and its response to US tariff implications are highly recommended for anyone interested in the fast fashion industry. Stay informed about the latest developments surrounding Shein's London IPO.

Featured Posts

-

Portuguesa Vs Corinthians Transmissao Ao Vivo Do Paulistao

May 05, 2025

Portuguesa Vs Corinthians Transmissao Ao Vivo Do Paulistao

May 05, 2025 -

May 3rd The Return Of A Ufc Legend After A Year Away

May 05, 2025

May 3rd The Return Of A Ufc Legend After A Year Away

May 05, 2025 -

Ufc Des Moines Predictions A Fighter By Fighter Breakdown

May 05, 2025

Ufc Des Moines Predictions A Fighter By Fighter Breakdown

May 05, 2025 -

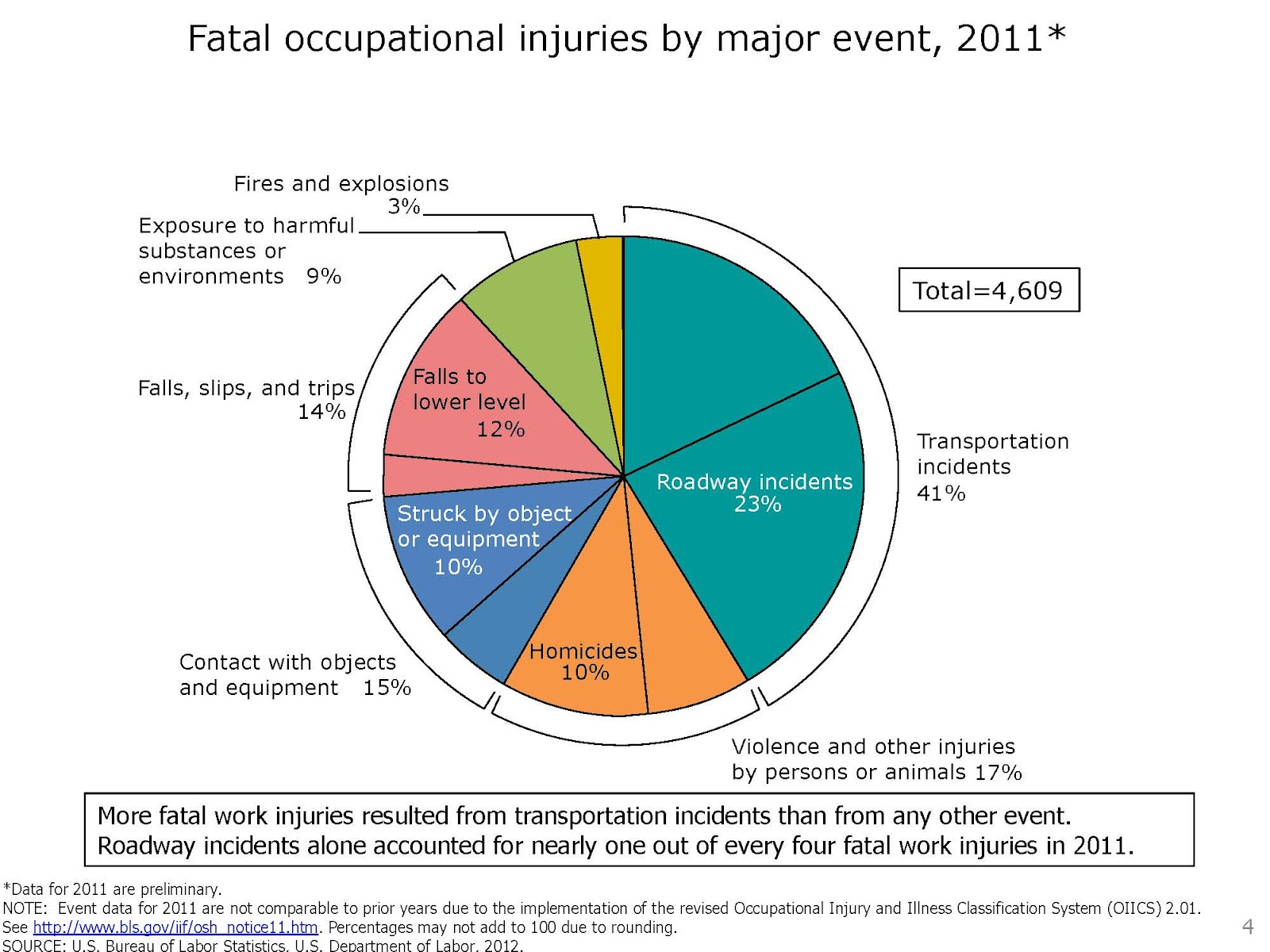

Transportation Department Facing Staff Cuts By End Of May

May 05, 2025

Transportation Department Facing Staff Cuts By End Of May

May 05, 2025 -

Sandhagen Vs Figueiredo Ufc Fight Night In Depth Predictions And Analysis

May 05, 2025

Sandhagen Vs Figueiredo Ufc Fight Night In Depth Predictions And Analysis

May 05, 2025