Shifting Sands: FTC's New Approach In Meta Monopoly Lawsuit

Table of Contents

The FTC's Revised Complaint: A Focus on Anticompetitive Acquisitions

The original complaint against Meta focused broadly on its monopolistic practices. The revised complaint, however, zeroes in on specific acquisitions, arguing they were made to eliminate potential competitors and stifle innovation. This targeted approach strengthens the FTC's case by presenting more direct evidence of anti-competitive behavior.

-

Detailed analysis of the acquisitions of Instagram and WhatsApp: The FTC argues that these acquisitions weren't merely strategic business moves, but rather calculated actions to neutralize emerging threats to Meta's dominance in the social media market. The acquisition of Instagram, a rising photo-sharing platform, and WhatsApp, a popular messaging app, effectively eliminated potentially disruptive competitors.

-

Evidence presented regarding Meta's intent to suppress competitive threats: The FTC has presented internal Meta communications, emails, and documents suggesting a deliberate strategy to acquire promising competitors before they could gain significant market share. This evidence directly addresses Meta's intent, a crucial element in proving anti-competitive behavior.

-

Expert testimony on the impact of these acquisitions on market competition: Economic experts have been called upon to testify on the impact of these acquisitions on market competition. Their analysis likely demonstrates how the acquisitions reduced competition, leading to higher prices or lower quality services for consumers.

-

Discussion of the "killer acquisition" theory and its application in this case: The FTC is likely arguing that Meta engaged in "killer acquisitions," acquiring potential rivals not to integrate them, but to eliminate them and prevent them from challenging Meta's market dominance. This legal theory is gaining traction in antitrust cases involving technology companies.

Shifting Legal Strategies: From Network Effects to Direct Evidence

The FTC initially relied heavily on arguments surrounding network effects – the idea that a larger user base makes a platform more valuable. The revised strategy incorporates far more direct evidence of anti-competitive behavior, moving beyond theoretical arguments to demonstrable actions.

-

Internal Meta communications demonstrating intent to suppress competition: Leaks and disclosed internal documents allegedly reveal conversations and strategies within Meta explicitly aimed at limiting the growth and success of rival companies.

-

Analysis of market share data showcasing Meta's dominance: The FTC uses market share data to illustrate Meta's overwhelming dominance in social networking, highlighting the lack of meaningful competition and the potential for abuse of that power.

-

Testimony from competitors detailing anti-competitive practices: Competitors have likely provided testimony detailing how Meta’s actions have hindered their ability to compete, potentially citing specific instances of unfair practices or exclusionary tactics.

-

Examination of Meta's algorithmic manipulation and its impact on market dynamics: The FTC is likely examining how Meta’s algorithms might unfairly favor its own products or services, suppressing the visibility of competitors in users' feeds and searches.

Implications for Future Antitrust Enforcement and Tech Regulation

This revised approach in the Meta Monopoly Lawsuit sets a precedent for future antitrust cases against tech giants. The emphasis on acquisitions and direct evidence will significantly influence how regulators approach similar monopolies.

-

Potential impact on future tech mergers and acquisitions: This case will dramatically increase scrutiny of tech mergers and acquisitions, leading to more thorough investigations and potentially stricter guidelines for approval.

-

Increased scrutiny of algorithmic practices and data manipulation: Regulators are now more likely to investigate how algorithms and data manipulation might be used to stifle competition, leading to greater transparency and accountability for tech companies.

-

Implications for the development of antitrust laws and regulations concerning digital markets: The outcome of this lawsuit will influence the evolution of antitrust laws to better address the unique challenges posed by digital markets and the power of tech giants.

-

Global implications, considering similar antitrust investigations in other jurisdictions: This case sets a global precedent, potentially influencing similar investigations and legal actions against tech monopolies in other countries.

The Role of Section 7 of the Clayton Act

The FTC's case increasingly relies on Section 7 of the Clayton Act, which prohibits mergers and acquisitions that substantially lessen competition. This legal provision is central to the FTC's argument against Meta's acquisitions.

-

How the FTC is applying Section 7 to Meta's acquisitions: The FTC argues that Meta's acquisitions of Instagram and WhatsApp substantially lessened competition in the social networking and messaging markets, violating Section 7.

-

The legal precedents used to support the FTC’s claims: The FTC will draw upon established legal precedents to support its claim that Meta's actions violate Section 7, citing similar cases where acquisitions were deemed anti-competitive.

-

The potential penalties if the FTC prevails: If the FTC prevails, Meta could face significant penalties, including potential divestiture of Instagram and WhatsApp, substantial fines, and other remedial measures.

Conclusion

The FTC's revised approach in the Meta Monopoly Lawsuit represents a significant shift in antitrust enforcement strategy. By focusing on specific acquisitions and presenting direct evidence of anti-competitive behavior, the FTC has set a new precedent that will likely influence future cases against tech giants. The outcome of this lawsuit will have far-reaching consequences for the regulation of digital markets and the future of competition in the tech industry. Understanding the evolving legal arguments and strategic shifts within the Meta Monopoly Lawsuit is crucial for anyone interested in antitrust law, tech regulation, and the future of digital competition. Stay informed about the developments in this landmark case, as it will undoubtedly shape the future landscape of tech monopolies and the ongoing debate surrounding tech antitrust.

Featured Posts

-

Macron Et Le Cameroun Debat Sur Le Troisieme Mandat Et Le Referendum

May 20, 2025

Macron Et Le Cameroun Debat Sur Le Troisieme Mandat Et Le Referendum

May 20, 2025 -

Agatha Christies Poirot Adaptations Influences And Critical Reception

May 20, 2025

Agatha Christies Poirot Adaptations Influences And Critical Reception

May 20, 2025 -

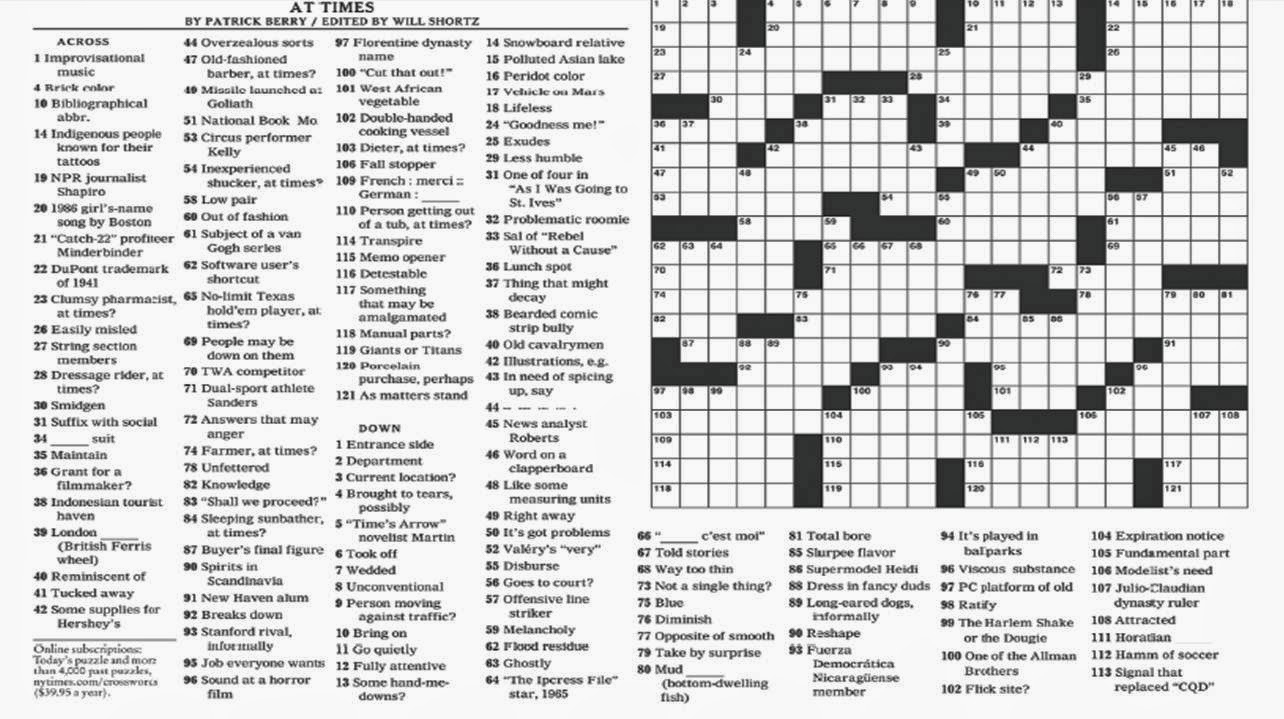

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025

March 16 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025 -

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League Analytiki Paroysiasi

May 20, 2025

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League Analytiki Paroysiasi

May 20, 2025 -

Huuhkajien Avauskokoonpano Naein Se Naeyttaeae Nyt

May 20, 2025

Huuhkajien Avauskokoonpano Naein Se Naeyttaeae Nyt

May 20, 2025