Should I Refinance My Federal Student Loans In 2024? (or Relevant Year)

Table of Contents

Understanding the Benefits of Refinancing Federal Student Loans

Refinancing your federal student loans can offer several compelling advantages, particularly in a potentially favorable interest rate environment. Let's examine the key benefits:

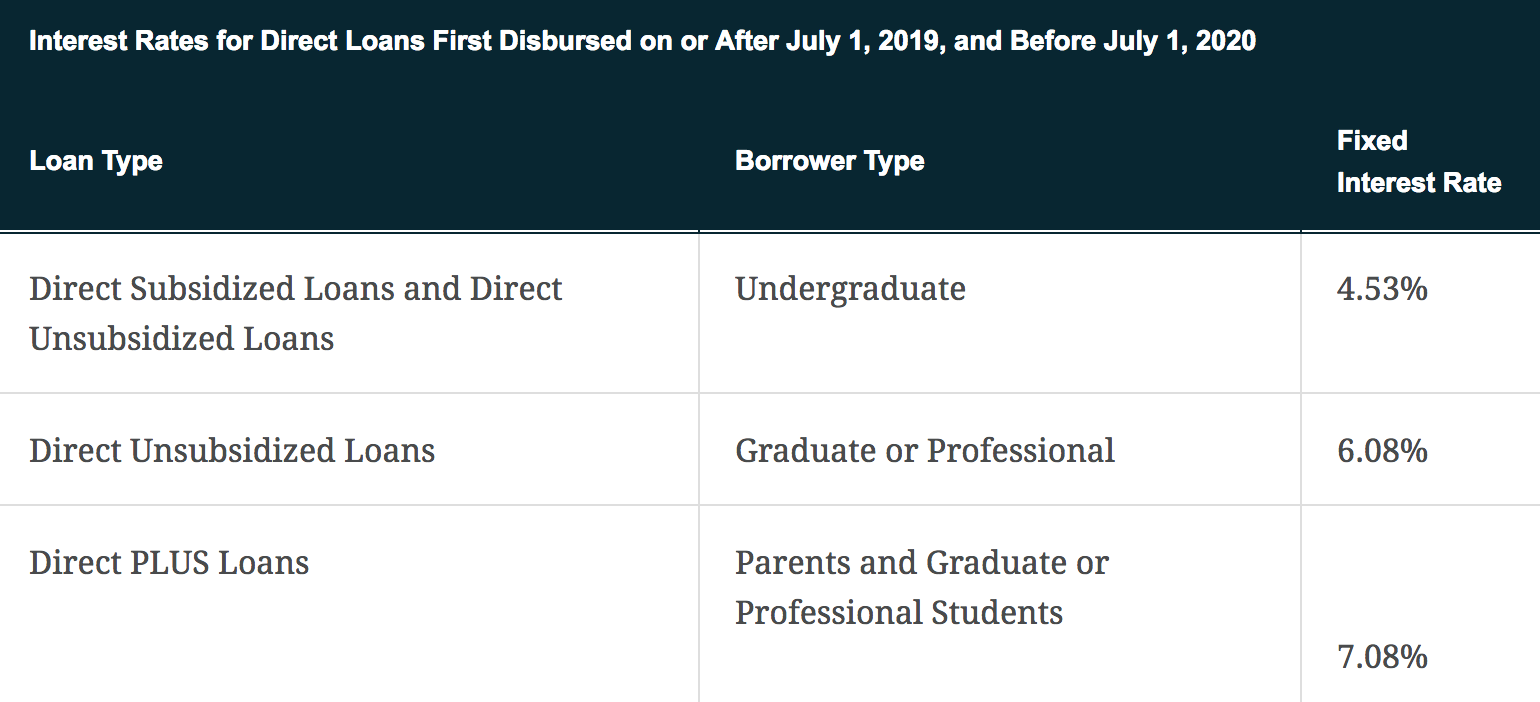

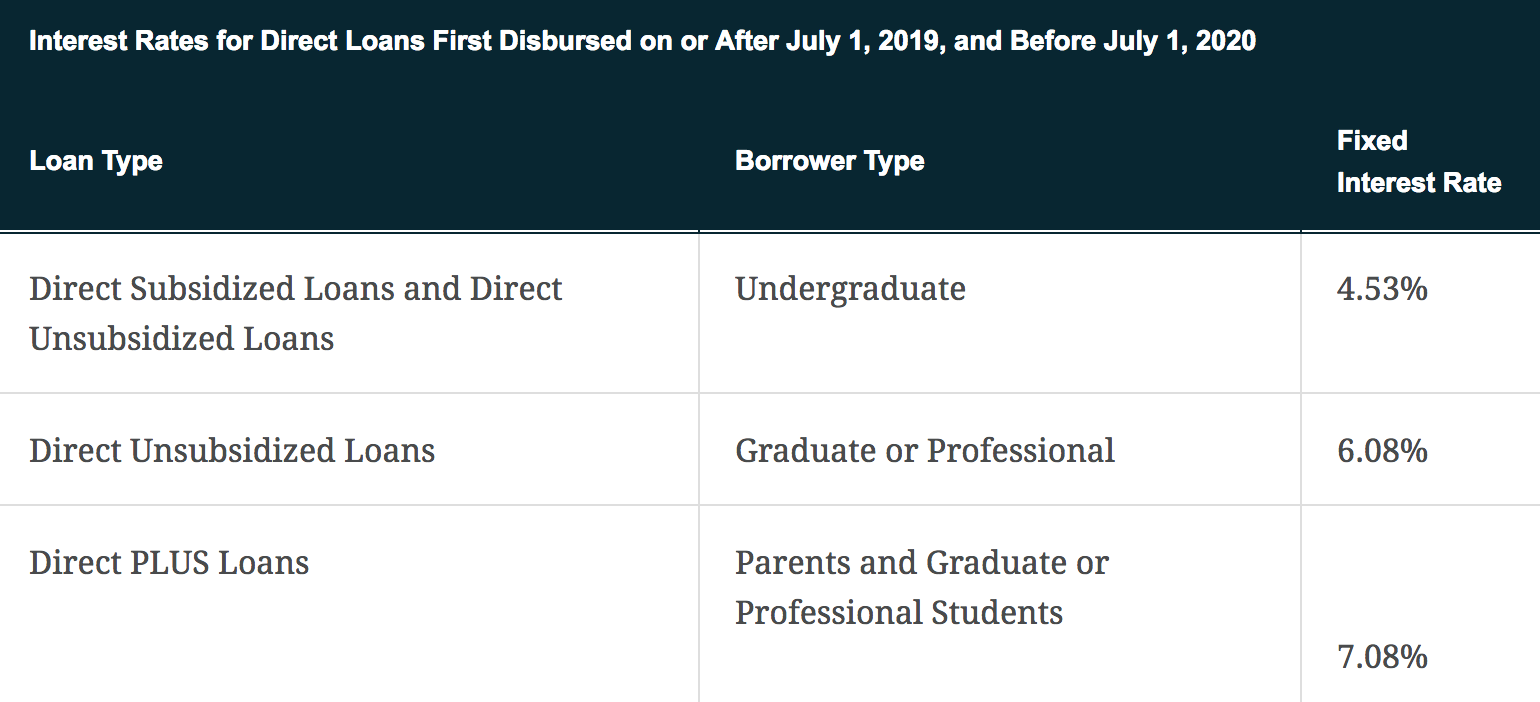

Lower Interest Rates

One of the most significant draws of student loan refinancing is the potential for significantly lower interest rates. By refinancing, you could potentially secure a lower rate than your current federal loans, leading to substantial savings over the life of the loan.

- Example: Let's say you have $30,000 in federal student loans at 7% interest. Refinancing to a 5% interest rate could save you thousands of dollars in interest payments over the loan term. A specific calculation would depend on the loan term, but savings can be significant.

- Current Market Rates: It's crucial to research current market interest rates for student loan refinancing before making a decision. These rates fluctuate, so staying informed is key.

Streamlined Payments

Managing multiple student loans with varying interest rates and due dates can be a headache. Refinancing allows you to consolidate these loans into a single, manageable monthly payment.

- Advantages: A single payment simplifies budgeting, reduces the risk of missed payments, and streamlines your financial administration.

- Reduced Administrative Burden: Instead of tracking multiple payments, you only need to remember one due date and payment amount.

Different Repayment Options

Refinancing often presents a range of repayment options to suit your financial circumstances.

- Fixed vs. Variable Interest Rates: A fixed interest rate offers predictable monthly payments, while a variable rate can fluctuate, potentially leading to lower payments initially but higher payments later if rates rise.

- Loan Terms: Refinancing can allow you to choose a longer or shorter loan term. A longer term lowers your monthly payment but increases the total interest paid, while a shorter term increases monthly payments but reduces the total interest paid. Carefully weigh the pros and cons of each.

The Drawbacks of Refinancing Federal Student Loans

While refinancing offers attractive benefits, it's essential to understand the potential downsides. Let's consider some crucial drawbacks:

Loss of Federal Protections

This is perhaps the most significant disadvantage. Refinancing your federal student loans with a private lender means losing access to crucial federal protections and benefits.

- Income-Driven Repayment Plans: These plans tie your monthly payments to your income, offering relief during periods of financial hardship. These are lost upon refinancing.

- Deferment and Forbearance Options: Federal loans often provide options to temporarily postpone payments during times of unemployment or financial distress. These are usually unavailable with private loans.

- Forgiveness Programs: Certain professions or circumstances qualify for federal student loan forgiveness programs. Refinancing forfeits eligibility for these programs. This is a crucial consideration.

Credit Score Requirements

Private lenders typically have stricter credit score requirements for refinancing than the federal government.

- Credit Score Ranges: A higher credit score generally translates to lower interest rates and better loan terms.

- Improving Credit Scores: If your credit score is below the required threshold, improving it before applying for refinancing can improve your chances of securing favorable terms.

Potential for Higher Costs

In some cases, refinancing might not be financially beneficial.

- Higher Interest Rates: If you secure a higher interest rate than your current federal loan, refinancing will actually increase your total cost.

- Prepayment Penalties: Some private loans carry prepayment penalties, making it costly to pay off the loan early.

How to Determine if Refinancing is Right for You

Deciding whether to refinance your federal student loans requires careful consideration of your individual financial circumstances.

Assess Your Financial Situation

Before considering refinancing, thoroughly evaluate your current financial situation.

- Debt-to-income ratio: Understand your total debt, including student loans, credit card debt, and other obligations.

- Income stability: Assess your current income and its stability to ensure you can comfortably manage higher monthly payments.

- Credit score: Check your credit score to determine your eligibility for refinancing and the interest rates you can expect.

Compare Interest Rates and Offers

Once you've assessed your financial standing, it's time to compare offers from different lenders.

- Shop around: Don't settle for the first offer you receive. Compare rates, fees, and repayment terms from multiple lenders.

- Reputable sources: Use reputable online resources to compare loan offers and research lender reviews.

Consider Long-Term Implications

Don't solely focus on the immediate benefit of lower monthly payments.

- Total interest paid: Consider the total interest you'll pay over the life of the loan, not just the monthly payment.

- Future financial goals: Think about how refinancing might impact your ability to achieve other financial goals, such as buying a house or investing.

Conclusion

Refinancing federal student loans in 2024 presents a complex decision with both significant advantages and potential drawbacks. Lower interest rates and streamlined payments are enticing, but the loss of federal protections is a major consideration. Carefully consider if refinancing your federal student loans is the right choice for your financial situation in 2024. Before making a decision about refinancing federal student loans, thoroughly research your options and consult with a financial advisor to ensure you make the best choice for your long-term financial well-being. Remember to weigh the potential benefits against the risks before proceeding with refinancing your federal student loans.

Featured Posts

-

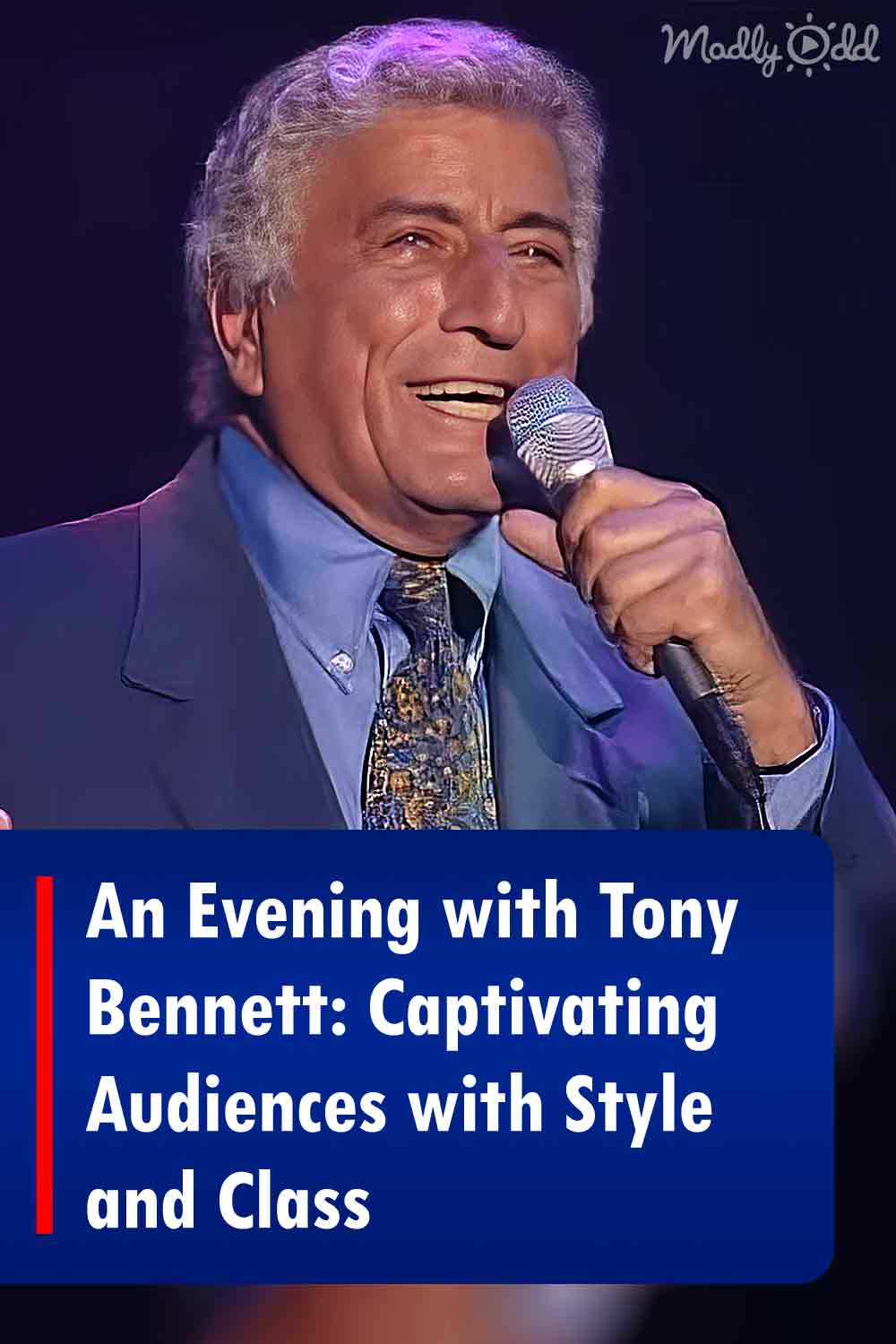

Understanding Tony Bennetts Vocal Style And Technique

May 17, 2025

Understanding Tony Bennetts Vocal Style And Technique

May 17, 2025 -

Below Deck Down Under Meet Anthonys Replacement In Season 2

May 17, 2025

Below Deck Down Under Meet Anthonys Replacement In Season 2

May 17, 2025 -

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025

The Doors Jim Morrison A New York Maintenance Man Fans Claim Investigated

May 17, 2025 -

Boston Celtics Sold Private Equity Buyout Sparks Fan Uncertainty

May 17, 2025

Boston Celtics Sold Private Equity Buyout Sparks Fan Uncertainty

May 17, 2025 -

Ky Tich Indian Wells Nu Than 17 Tuoi Xu Bach Duong Dang Quang

May 17, 2025

Ky Tich Indian Wells Nu Than 17 Tuoi Xu Bach Duong Dang Quang

May 17, 2025