Should Investors Worry About Current Stock Market Valuations? BofA's Answer

Table of Contents

The question on every investor's mind: are current stock market valuations justified, or are we headed for a correction? Recent market volatility, fueled by inflation concerns and rising interest rates, has many wondering if it's time to reassess their portfolios. Bank of America (BofA), a major player in the financial world, has offered its perspective. This article delves into BofA's analysis of current stock market valuations and what it means for your investment strategy.

BofA's Stance on Current Market Valuations

BofA's overall assessment can be characterized as cautious optimism. While acknowledging elevated valuations in certain sectors, they don't necessarily predict an imminent crash. Their analysis emphasizes the need for a nuanced approach, considering individual asset classes and risk tolerance. While specific quotes require referencing BofA's official reports and publications, their general sentiment points towards selective investment and careful risk management rather than wholesale panic selling.

- Key factors BofA considers when evaluating valuations: BofA's valuation analysis incorporates several key metrics, including Price-to-Earnings (P/E) ratios, dividend yields, interest rate environments, inflation rates, and overall economic growth projections. They also consider sector-specific factors and future earnings estimates.

- BofA's predicted market trends: Predictions vary depending on the specific asset class and timeframe. BofA's analysts typically offer a range of scenarios rather than a single definitive forecast. Generally, they anticipate continued market volatility in the near term, with potential for both upside and downside surprises based on macroeconomic conditions.

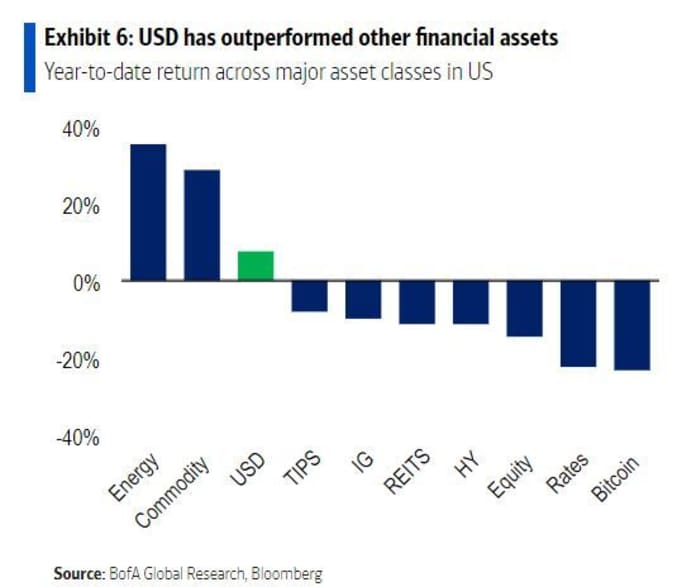

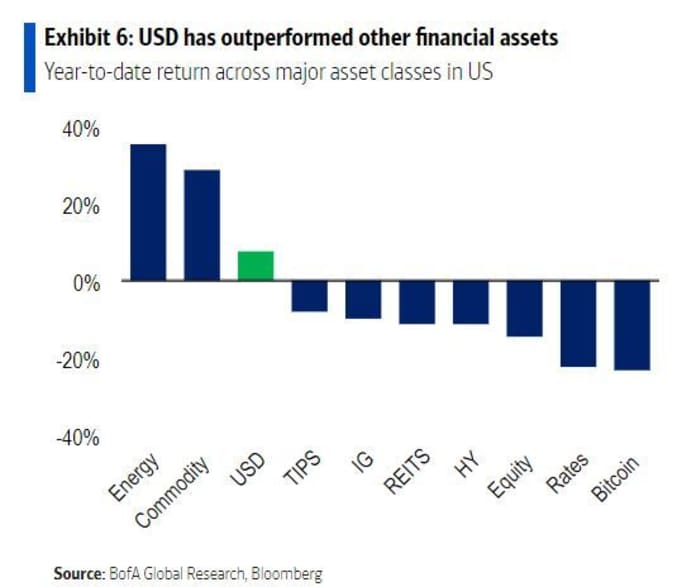

- Specific sectors or asset classes BofA highlights: BofA's research often highlights specific sectors as either overvalued or undervalued. For instance, during periods of high inflation, they might advise caution with sectors highly sensitive to interest rate changes. Conversely, sectors perceived as defensive or less sensitive to economic downturns may be seen as relatively better positioned. Specific details are usually found in their official publications and require careful monitoring.

Factors Contributing to Elevated (or Depressed) Valuations

Several macroeconomic factors influence stock market valuations. Understanding these factors is crucial for interpreting BofA's (and other analysts') assessments.

- Inflation's impact on stock prices: High inflation erodes purchasing power and increases the cost of borrowing, potentially impacting corporate profitability and investor sentiment. This often leads to higher interest rates, further affecting valuations.

- The role of interest rate hikes: The Federal Reserve's (and other central banks') interest rate hikes aim to curb inflation. However, higher interest rates increase borrowing costs for businesses, slowing economic growth and potentially impacting corporate earnings. This can lead to lower stock valuations.

- The influence of geopolitical events: Geopolitical instability, such as wars or trade disputes, creates uncertainty in the market, impacting investor confidence and leading to market volatility and adjustments to valuations.

- Impact of technological advancements and sector-specific growth: Rapid technological advancements can significantly impact valuations, creating opportunities in some sectors while disrupting others. For example, the growth of artificial intelligence (AI) can boost valuations in related technology companies but could negatively impact firms in less adaptable industries.

BofA's Recommendations for Investors

Based on their valuation analysis, BofA typically recommends a diversified and cautious approach.

- Suggested portfolio adjustments: BofA may suggest adjustments like sector rotation, moving investments from potentially overvalued sectors to those deemed undervalued, or increasing exposure to defensive assets during uncertain times.

- Recommendations for risk management strategies: This often includes diversification across asset classes (stocks, bonds, real estate) and geographies to mitigate risk. They might also advise setting stop-loss orders to limit potential losses.

- Advice on whether to buy, sell, or hold: This is highly context-dependent and depends on an investor's risk tolerance, investment horizon, and specific asset holdings. BofA's advice will differ based on the individual investor's circumstances.

- Importance of long-term investment strategies: BofA generally stresses the importance of long-term investing, encouraging investors to avoid making impulsive decisions based on short-term market fluctuations.

Alternative Perspectives and Counterarguments

It's crucial to consider alternative viewpoints. While BofA offers valuable insights, other financial institutions may hold different opinions.

- Arguments suggesting current valuations are justified: Some analysts might argue that current valuations are supported by strong corporate earnings growth, low unemployment rates, or technological innovation.

- Potential factors that could support continued market growth: Factors like further technological breakthroughs, sustained consumer spending, or government stimulus packages could support market growth.

- Risks associated with overreacting to market fluctuations: Panicking and making hasty investment decisions based on short-term market volatility can be detrimental to long-term investment goals.

Conclusion

BofA's analysis of current stock market valuations highlights the need for a cautious yet optimistic approach. Their recommendations emphasize diversification, risk management, and a long-term investment perspective. Factors like inflation, interest rates, and geopolitical events significantly influence their analysis. While BofA's insights provide a valuable framework, remember that the stock market is complex and unpredictable. Should you worry about current stock market valuations? Conduct your own thorough research, consider your personal risk tolerance, and consult a financial advisor before making any significant changes to your portfolio. Stay informed about stock market valuations and continue to monitor the market closely.

Featured Posts

-

Playing At The Best Online Casinos In New Zealand A Guide For Kiwis

May 17, 2025

Playing At The Best Online Casinos In New Zealand A Guide For Kiwis

May 17, 2025 -

12 Must Watch Sci Fi Shows Ranked

May 17, 2025

12 Must Watch Sci Fi Shows Ranked

May 17, 2025 -

Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Moi Nhat

May 17, 2025

Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Moi Nhat

May 17, 2025 -

Top Rated Online Casinos In New Zealand For Real Money In 2024

May 17, 2025

Top Rated Online Casinos In New Zealand For Real Money In 2024

May 17, 2025 -

The One Obstacle Facing Every Top 10 Nba Team

May 17, 2025

The One Obstacle Facing Every Top 10 Nba Team

May 17, 2025