Should Investors Worry About Stretched Stock Market Valuations? BofA's View

Table of Contents

BofA's Current Market Valuation Assessment

Bank of America, a global financial giant with extensive market research capabilities, regularly publishes reports analyzing stock market valuation. Their assessments utilize a variety of metrics to gauge the health of the market and identify potential risks. These metrics often include, but are not limited to:

- Price-to-Earnings (P/E) ratios: Comparing a company's stock price to its earnings per share provides a fundamental valuation measure. High P/E ratios often suggest overvaluation.

- Shiller PE ratio (CAPE): This cyclically adjusted P/E ratio smooths out earnings fluctuations over a 10-year period, offering a more stable long-term valuation perspective. BofA often uses this to compare current valuations to historical averages.

- Market capitalization: The total market value of all listed companies provides a broad picture of overall market valuation. Rapid increases in market capitalization without corresponding growth in underlying fundamentals can signal overvaluation.

Recent BofA reports (specific report citations would go here, if available) have indicated (insert specific data points from BofA reports here, e.g., "a Shiller PE ratio exceeding historical averages by X%, suggesting a potential overvaluation"). Key indicators cited by BofA may include (insert key indicators, e.g., "rising market volatility, increasing investor sentiment divergence, and a widening gap between market valuations and economic fundamentals"). By comparing current valuation data to historical trends, BofA provides context to assess the extent of potential overvaluation or undervaluation.

Factors Contributing to Stretched Valuations

Several factors contribute to the current environment of potentially stretched stock market valuations. BofA's analysis likely considers the following:

- Low interest rates: Sustained low interest rates incentivize investors to seek higher returns in the stock market, driving up asset prices. This increases demand without a corresponding increase in underlying company value.

- Quantitative easing (QE): Central bank policies like QE inject liquidity into the market, further inflating asset prices. BofA's analysis likely assesses the extent to which QE has contributed to current valuations.

- Strong corporate earnings (or lack thereof): While strong corporate earnings can justify higher valuations, BofA will analyze whether earnings growth is sustainable and commensurate with the current market price. Conversely, weak earnings growth in the face of high valuations would be a significant warning sign.

- Investor sentiment and speculation: Optimistic investor sentiment and speculative trading can push stock prices beyond their fundamental value, creating a bubble-like situation. BofA's research likely includes measures of investor confidence and speculation levels.

- Technological advancements: Rapid technological advancements can drive significant growth in specific sectors, justifying higher valuations for leading companies. However, BofA would assess whether this growth is sustainable and if valuations reflect future potential accurately.

Potential Risks Associated with High Valuations

Investing in a market with potentially stretched valuations carries significant risks:

- Increased risk of market correction or crash: Overvalued markets are inherently unstable and vulnerable to sharp corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic event can trigger a significant sell-off.

- Potential for significant capital loss: Investors who buy at the peak of an overvalued market risk substantial losses if prices decline.

- Impact on investor portfolio returns: High valuations mean lower potential future returns, as the rate of appreciation is likely to slow or reverse.

- Vulnerability to unexpected economic downturns: An economic downturn could exacerbate the impact of an overvalued market, leading to more significant losses.

BofA's Recommendations for Investors

BofA likely advises investors to adopt a cautious approach in the current market environment. Their recommendations may include:

- Diversification strategies: Spreading investments across different asset classes, sectors, and geographies can mitigate risk.

- Sector-specific investment recommendations: BofA might suggest focusing on sectors with strong fundamentals and less exposure to overvaluation.

- Advice on risk management (e.g., hedging): Strategies like hedging can help protect portfolios from potential market declines.

- Suggestions on adjusting portfolio allocation based on risk tolerance: Investors should adjust their portfolios to align with their risk tolerance and investment goals.

Conclusion

BofA's analysis of stretched stock market valuations likely highlights the potential for both significant gains and substantial losses. While some sectors may continue to experience strong growth, the overall elevated valuation levels present a considerable risk. The key takeaway is the need for investors to exercise caution and conduct thorough research before committing capital. Understanding BofA's perspective on stretched stock market valuations is crucial for making informed investment choices. Stay updated on market trends and consult with a financial advisor to manage your portfolio effectively, considering your own risk tolerance and the potential for fluctuations in the current market environment. Remember to regularly re-evaluate your investment strategy in light of evolving market conditions and expert analysis, including ongoing insights from BofA and other reputable sources on stretched stock market valuations.

Featured Posts

-

Tesla Earnings Plunge 71 In First Quarter Analysis Of Political Impact

Apr 24, 2025

Tesla Earnings Plunge 71 In First Quarter Analysis Of Political Impact

Apr 24, 2025 -

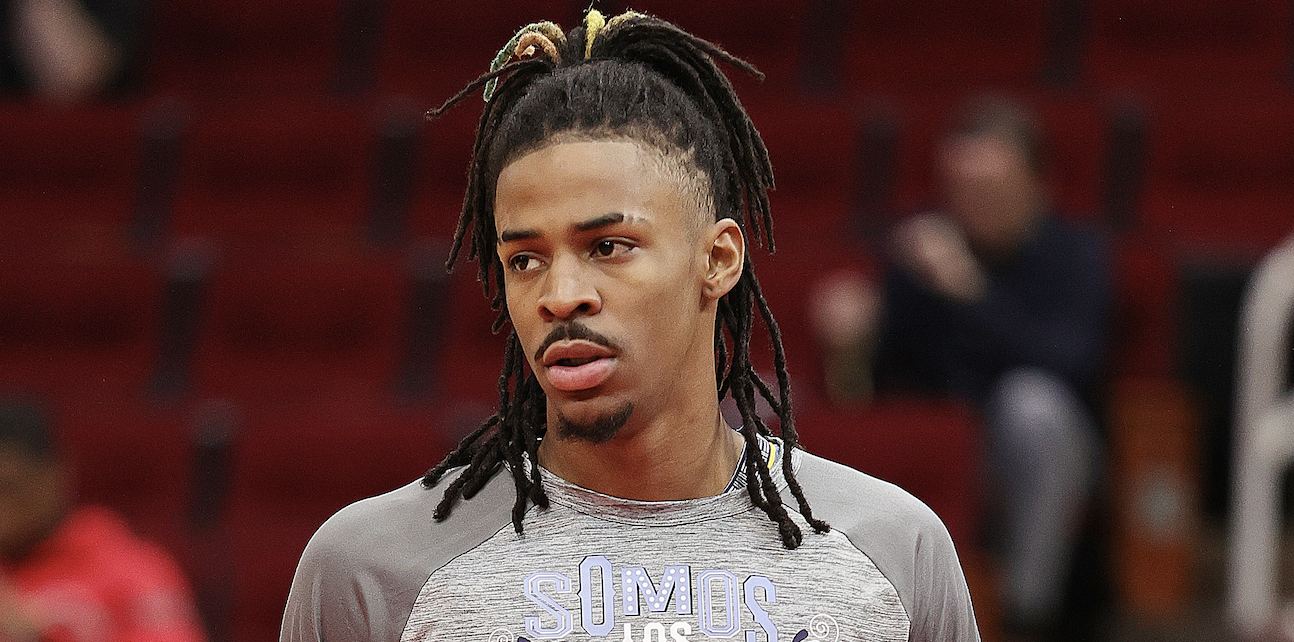

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts To Follow

Apr 24, 2025

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts To Follow

Apr 24, 2025 -

Nba Launches Formal Investigation Into Ja Morants Conduct

Apr 24, 2025

Nba Launches Formal Investigation Into Ja Morants Conduct

Apr 24, 2025 -

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025

The Truth About Chalet Girls Serving Europes Wealthy Skiers

Apr 24, 2025