Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

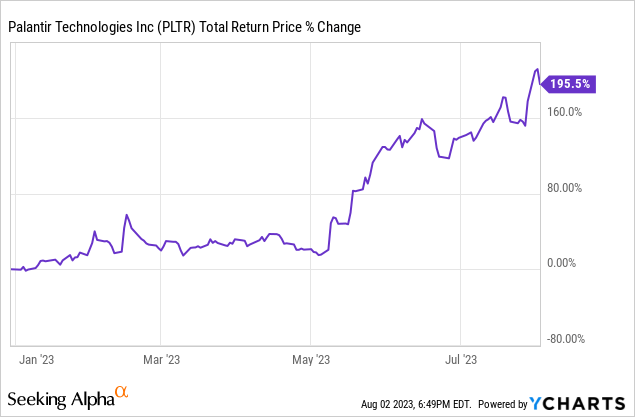

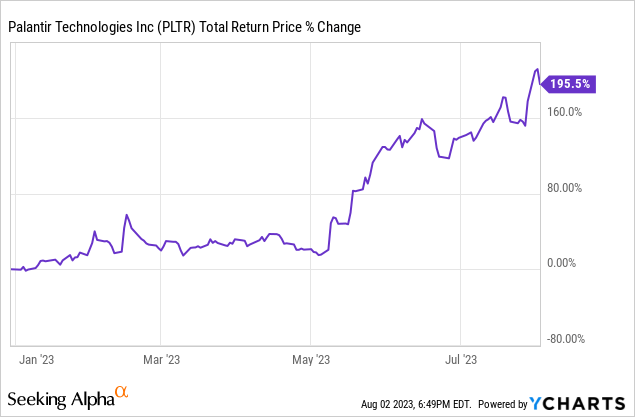

Palantir's Recent Performance and Market Sentiment

Q4 2022 Earnings and Key Takeaways

Palantir's Q4 2022 earnings report revealed a mixed bag. While revenue growth showed a positive trajectory, exceeding some analyst expectations, the earnings per share (EPS) fell short of projections. The market reacted with a temporary dip in the stock price, reflecting concerns about profitability and future growth. Analyzing the specific numbers – revenue growth percentage, EPS figures, and the overall financial picture – is crucial to understanding the current sentiment surrounding Palantir stock. Key factors to consider from the Q4 2022 results include:

- Revenue Growth: The percentage increase in revenue year-over-year provides insight into the company's ability to expand its customer base and sales.

- Profitability: Analyze the net income and profit margins to gauge the company's financial health and sustainability.

- Stock Price Performance: Examine the immediate market reaction to the Q4 2022 results to understand investor sentiment.

Analyzing Key Metrics and Growth Projections

Beyond the headline numbers, key metrics like customer acquisition, government contracts, and commercial revenue growth paint a clearer picture of Palantir's future trajectory. Strong growth in government contracts, coupled with expansion into the commercial sector, is vital for sustained growth. Analyst ratings and projections provide further insight, although it's important to remember that these are just predictions. Key metrics to watch:

- Customer Growth: The number of new customers acquired and the retention rate of existing customers are key indicators of long-term growth.

- Government Contracts: The value and duration of new government contracts significantly impact Palantir's revenue stream.

- Commercial Revenue: Expansion into the commercial sector is crucial for diversifying revenue streams and reducing reliance on government funding.

- Analyst Ratings: Review ratings from various financial analysts to gain a broad perspective on the stock's potential.

Competitive Landscape and Market Share

Palantir operates in a competitive landscape, with established players and emerging startups vying for market share in the data analytics and AI market. Analyzing Palantir's competitive advantages, such as its proprietary technology and strong government relationships, is vital to assessing its long-term prospects. Key competitors include companies like Snowflake, Databricks, and others, each with their strengths and weaknesses. Understanding the competitive dynamics will help investors evaluate Palantir's position in the market.

Factors to Consider Before Investing in Palantir Stock Before May 5th

Potential Risks and Challenges

Investing in Palantir stock carries inherent risks. Economic uncertainty, increased competition, and the company's reliance on government contracts all pose potential challenges. Geopolitical events can also impact the company's performance. Careful consideration of these factors is essential:

- Investment Risks: Fluctuations in the stock market can significantly impact your investment.

- Market Volatility: Palantir's stock price is known for its volatility, requiring a higher risk tolerance.

- Economic Downturn: A potential economic downturn could negatively impact demand for Palantir's services.

- Geopolitical Risks: Global political instability can affect government contracts and overall market sentiment.

Analyzing the May 5th Earnings Report Expectations

Investors eagerly anticipate the May 5th earnings report, hoping for clarity on Palantir's financial performance and future guidance. Analyzing revenue guidance, profit margin expectations, and the overall tone of the report will heavily influence the stock price reaction. Key elements to consider:

- Earnings Expectations: Review analyst predictions for revenue, EPS, and other key financial metrics.

- Revenue Guidance: The company's projections for future revenue growth are critical to understanding its outlook.

- Profit Margin: Improving profit margins demonstrate operational efficiency and profitability.

- Stock Price Reaction: Anticipate potential volatility in the stock price following the earnings announcement.

Long-Term Growth Potential and Investment Strategy

Despite the risks, Palantir's long-term prospects in the rapidly growing data analytics and AI market are promising. Its technology is well-suited for various sectors, and its government contracts provide a stable revenue base. However, the investment strategy should align with your risk tolerance.

- Long-Term Investment: Palantir could be a suitable investment for long-term investors with a higher risk tolerance.

- Risk Tolerance: Assess your individual risk tolerance before investing in Palantir stock.

- Growth Prospects: The long-term growth potential in the AI and data analytics market is a significant factor to consider.

Alternative Investment Options and Diversification

Diversification is key to managing investment risk. Exploring alternative investment opportunities in the tech sector or beyond can help reduce reliance on a single stock. Consider other promising companies or investment strategies to spread your risk across multiple asset classes.

- Portfolio Diversification: Diversify your portfolio to reduce overall risk.

- Investment Strategy: Develop an investment strategy aligned with your risk tolerance and financial goals.

- Risk Management: Implement effective risk management techniques to protect your investments.

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

This pre-earnings analysis highlights both the potential rewards and risks associated with investing in Palantir stock before May 5th. While the company shows promising long-term growth potential in the AI and data analytics market, the inherent volatility and reliance on government contracts require careful consideration. Ultimately, the decision to buy Palantir stock before the earnings report rests on your individual risk tolerance and investment strategy. Thoroughly research the company, review the May 5th earnings report, and consult with a financial advisor before making any investment decisions. Conduct further research and make informed decisions regarding your Palantir stock investment before May 5th. Remember, this is not financial advice; a comprehensive pre-earnings analysis for Palantir is crucial before making any investment decisions regarding Palantir stock before May 5th.

Featured Posts

-

The Controversy Surrounding Pam Bondis Statements On Killing American Citizens

May 09, 2025

The Controversy Surrounding Pam Bondis Statements On Killing American Citizens

May 09, 2025 -

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025 -

Anticipation Builds Young Thugs Back Outside Album Rollout Imminent

May 09, 2025

Anticipation Builds Young Thugs Back Outside Album Rollout Imminent

May 09, 2025 -

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 09, 2025

Nottingham Attacks Inquiry Retired Judge Appointed To Chair

May 09, 2025 -

3 6

May 09, 2025

3 6

May 09, 2025