Should You Buy Palantir Stock Before May 5th? A Prudent Investor's Guide

Table of Contents

Palantir's Recent Performance and Future Outlook

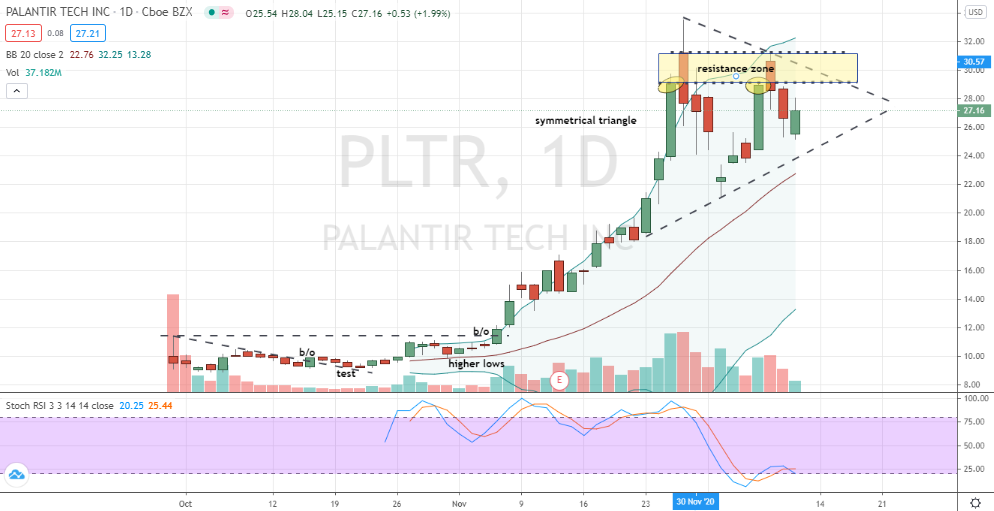

Palantir's recent performance has been a mixed bag, prompting much debate among investors regarding PLTR stock. Understanding this performance is crucial to assessing the potential of a Palantir investment before May 5th. Analyzing both the successes and challenges will provide a clearer picture.

- Revenue growth trajectory in the last few quarters: While Palantir has shown consistent revenue growth, the rate of that growth has fluctuated. Investors should examine the specific numbers to determine if the trajectory is sustainable and aligns with their expectations for PLTR stock.

- Profitability trends (margins, net income): Palantir's path to profitability is a key area of focus. Analyzing profit margins and net income trends reveals the company's efficiency and its ability to translate revenue into profits. A consistent improvement in these metrics is a positive sign for future Palantir investment.

- Key contract wins and losses: Palantir's success is heavily reliant on securing significant government and commercial contracts. Tracking recent wins and losses provides valuable insight into the company's competitive standing and future revenue streams. Large contract wins can significantly impact PLTR stock price.

- Analysis of the company's long-term growth potential: Palantir's long-term growth hinges on its ability to expand its commercial customer base while maintaining its strong government contracts. An assessment of its potential in these areas is crucial to any long-term Palantir investment strategy.

- Recent partnerships or acquisitions: Strategic partnerships and acquisitions can significantly boost Palantir's capabilities and market reach, influencing its future performance and the potential value of PLTR stock.

Analyzing the Risks Associated with Palantir Stock

Investing in Palantir stock, like any investment, carries inherent risks. A prudent investor must acknowledge and assess these risks before committing capital.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending and procurement policies, impacting the stability of PLTR stock.

- Competition in the data analytics market: Palantir faces stiff competition from established players and agile startups in the data analytics market. This competitive landscape requires careful evaluation of Palantir's competitive advantages and the potential for market share erosion.

- Valuation concerns compared to competitors: Palantir's valuation relative to its competitors is an important factor to consider. An overvalued stock might be vulnerable to price corrections, impacting any Palantir investment.

- Potential for negative earnings surprises: The market reacts strongly to earnings misses. The potential for Palantir to underperform expectations on May 5th presents a downside risk to your PLTR stock holding.

- Impact of macroeconomic factors on the stock price: Broader economic conditions, such as interest rate hikes or recessions, can negatively impact high-growth technology stocks like Palantir, creating volatility in PLTR stock.

Evaluating the May 5th Earnings Report's Significance

The May 5th earnings report is a critical event for Palantir. Its contents will significantly influence investor sentiment and the price of PLTR stock.

- Potential impact of exceeding or missing earnings expectations: Beating or missing earnings expectations can lead to substantial price swings. Understanding the market's sensitivity to these outcomes is crucial.

- Guidance for future quarters: Palantir's guidance for the coming quarters provides insights into the company's expectations for future growth and profitability. This is a significant factor in determining the long-term outlook for PLTR stock.

- Analyst reactions and price target adjustments: Analyst reactions and subsequent price target adjustments following the earnings report often directly impact the stock price. Monitoring analyst commentary is essential.

- Potential market response to the report: The overall market response to the earnings report can significantly influence the price of PLTR stock, regardless of the company's performance.

Comparing Palantir to Competitors in the Data Analytics Space

Understanding Palantir's competitive landscape is vital. Comparing its performance to its main competitors reveals its strengths and weaknesses.

- Comparison of market share: Analyzing market share helps determine Palantir's position and growth potential relative to its competitors.

- Comparison of revenue growth: Comparing revenue growth rates shows the pace of Palantir's expansion compared to its rivals.

- Comparison of profitability: Profitability comparisons reveal Palantir's efficiency and cost structure compared to the competition.

- Analysis of competitive strengths and weaknesses: A comprehensive analysis of competitive advantages and disadvantages helps determine Palantir's long-term viability and potential for continued success.

Developing a Prudent Investment Strategy for Palantir Stock

A prudent investment strategy considers your risk tolerance and financial goals.

- Diversification of your portfolio: Don't put all your eggs in one basket. Diversification reduces risk by spreading investments across different assets.

- Setting realistic investment goals and time horizon: Define your objectives and the timeframe for your Palantir investment. Short-term versus long-term goals impact your approach.

- Risk tolerance assessment: Honestly evaluate your capacity to withstand potential losses before investing in a volatile stock like Palantir.

- Importance of research and due diligence: Thorough research is essential. Don't rely solely on others' opinions; form your own informed perspective.

- Dollar-cost averaging strategy: Consider a dollar-cost averaging strategy to mitigate risk by investing smaller amounts over time rather than a lump sum.

Conclusion

Deciding whether to buy Palantir stock before May 5th requires careful consideration of its recent performance, future prospects, and inherent risks. Analyzing the upcoming earnings report, comparing Palantir to competitors, and developing a prudent investment strategy tailored to your risk tolerance are crucial steps. Remember, this analysis is for informational purposes only and should not be considered financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions regarding Palantir stock. Are you ready to evaluate your PLTR investment strategy?

Featured Posts

-

The Snl Impression That Left Harry Styles Devastated

May 09, 2025

The Snl Impression That Left Harry Styles Devastated

May 09, 2025 -

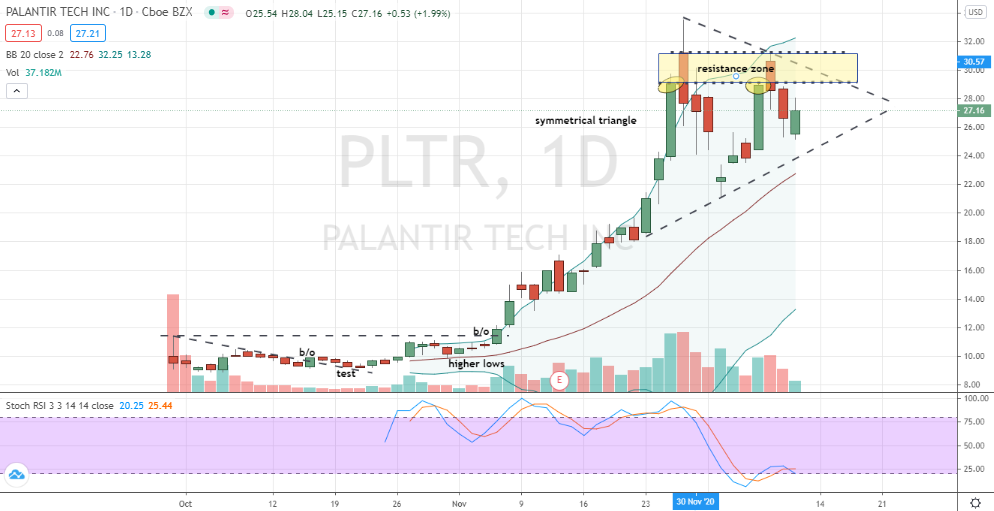

Mental Illness And Violent Crime Addressing Academic Shortcomings

May 09, 2025

Mental Illness And Violent Crime Addressing Academic Shortcomings

May 09, 2025 -

Sno Og Vanskelige Kjoreforhold I Sor Norges Fjellomrader

May 09, 2025

Sno Og Vanskelige Kjoreforhold I Sor Norges Fjellomrader

May 09, 2025 -

E Bays Liability For Banned Chemicals A Section 230 Case

May 09, 2025

E Bays Liability For Banned Chemicals A Section 230 Case

May 09, 2025 -

Razgromnaya Kritika Dakota Dzhonson I Filmy Nominirovannye Na Zolotuyu Malinu

May 09, 2025

Razgromnaya Kritika Dakota Dzhonson I Filmy Nominirovannye Na Zolotuyu Malinu

May 09, 2025