Should You Buy Palantir Stock In 2024? Investment Analysis And Outlook

Table of Contents

Palantir's Financial Performance and Growth Projections

H3: Revenue Growth and Profitability:

Palantir's financial performance reveals a company experiencing significant growth, albeit with fluctuating profitability. Analyzing its historical data provides crucial insights into its potential.

- Revenue Growth: Palantir has consistently shown strong revenue growth over the past few years, though the rate has varied. While specific numbers fluctuate, reliable sources like Palantir's financial reports and SEC filings should be consulted for the most up-to-date figures. Looking at year-over-year comparisons provides a clearer picture of the trend.

- Profitability Margins: Palantir's profitability, measured by operating margins and net income, has been a point of focus for investors. While not consistently profitable in its early years, the company has shown improvements in profitability margins. Again, consulting their financial statements is crucial for accurate data.

- Key Financial Ratios: Investors should analyze key financial ratios such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio to assess Palantir's valuation relative to its competitors and the broader market. These ratios, readily available from financial news sources and investment platforms, help gauge whether the Palantir investment is currently overvalued or undervalued.

- Future Growth Projections: Several reputable analysts provide growth projections for Palantir. While these projections should be considered with caution, they offer a valuable perspective on the potential for future revenue growth and profitability. It's important to consult multiple sources and understand the underlying assumptions behind these projections before incorporating them into your investment decision.

H3: Government vs. Commercial Contracts:

Palantir's revenue streams are divided between government contracts and commercial applications. Understanding the contribution and future potential of each sector is critical for a comprehensive Palantir investment analysis.

- Government Contracts: This sector historically formed a larger part of Palantir's revenue, providing consistent income streams. However, the nature of government contracts involves potential risks associated with budget cuts and political changes.

- Commercial Applications: The commercial sector presents significant growth potential for Palantir, offering opportunities to expand into various industries and diversify its revenue sources. This sector's growth is essential for reducing reliance on government contracts.

- Risk and Opportunity: While government contracts provide stability, they're less flexible than commercial deals. Conversely, commercial contracts offer greater growth potential but involve greater competition and market volatility. A balanced approach, considering both sectors, is crucial for a robust Palantir investment strategy.

Competitive Landscape and Market Position

H3: Key Competitors and Market Share:

Palantir operates in a competitive market dominated by tech giants. Understanding its competitive landscape is crucial for any Palantir investment decision.

- Major Players: Palantir faces stiff competition from established players like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure, each with extensive resources and market share.

- Competitive Advantages: Palantir's unique selling proposition lies in its sophisticated data integration and analysis capabilities, focusing on complex data sets. This specialized approach differentiates it from general-purpose cloud platforms.

- Market Share Analysis: While precise market share figures are difficult to obtain, analyzing industry reports and analyst estimates provides a general understanding of Palantir's position relative to its competitors.

H3: Market Size and Growth Potential:

The big data analytics market is expanding rapidly, presenting a huge opportunity for Palantir and its competitors.

- Market Growth Projections: Market research firms regularly publish projections on the size and growth rate of the big data analytics market. These reports often highlight the increasing demand for sophisticated data analysis capabilities across various industries.

- Palantir's Market Capture: Palantir's ability to capitalize on this market growth depends on its ability to continue innovating, expanding its customer base, and maintaining a competitive edge against larger, better-funded competitors.

Risks and Challenges Facing Palantir

H3: Dependence on Government Contracts:

A significant risk for Palantir is its reliance on government contracts, making it vulnerable to shifts in government spending.

- Budget Cuts: Changes in government budgets or priorities could directly impact Palantir's revenue streams, making this a crucial factor to consider when assessing the Palantir investment risk.

- Regulatory Changes: Regulatory hurdles and changes in government procurement processes could also affect Palantir's ability to secure and execute government contracts.

- Geopolitical Uncertainty: Global political instability can create uncertainty in government spending, particularly in areas where Palantir operates.

H3: Competition and Technological Disruption:

The data analytics market is dynamic, with new entrants and technological disruptions posing a constant threat.

- New Entrants: The market is attractive to new players, potentially increasing competition and putting pressure on Palantir's market share and pricing.

- Technological Advancements: Rapid advancements in artificial intelligence (AI), machine learning (ML), and other technologies could render Palantir's current offerings obsolete, requiring significant investments in research and development to stay ahead.

H3: Valuation and Stock Price Volatility:

Palantir's stock price has shown significant volatility. Understanding its valuation is crucial for mitigating risk.

- Valuation Metrics: Analyze the P/E ratio, P/S ratio, and other relevant valuation metrics to determine if Palantir's stock is fairly valued relative to its growth prospects and risk profile.

- Market Sentiment: Investor sentiment and broader market conditions significantly influence Palantir's stock price, adding to its volatility.

Conclusion: Should You Invest in Palantir Stock in 2024? A Final Verdict

Based on our analysis, Palantir stock presents a moderate-to-high risk investment opportunity in 2024. While the company exhibits strong revenue growth and operates in a rapidly expanding market, its dependence on government contracts, intense competition, and stock price volatility present significant challenges. The potential rewards are substantial, but so are the risks. Palantir’s future success depends heavily on its ability to diversify its revenue streams, maintain its technological edge, and navigate the complexities of the government and commercial sectors.

Ultimately, the decision of whether to buy Palantir stock in 2024 rests with you. Conduct further research, carefully consider your risk tolerance, and consult with a financial advisor before making any investment decisions. Remember that investing in Palantir stock, or any stock, involves inherent risk, and past performance is not indicative of future results. Thorough due diligence is essential before committing to a Palantir investment.

Featured Posts

-

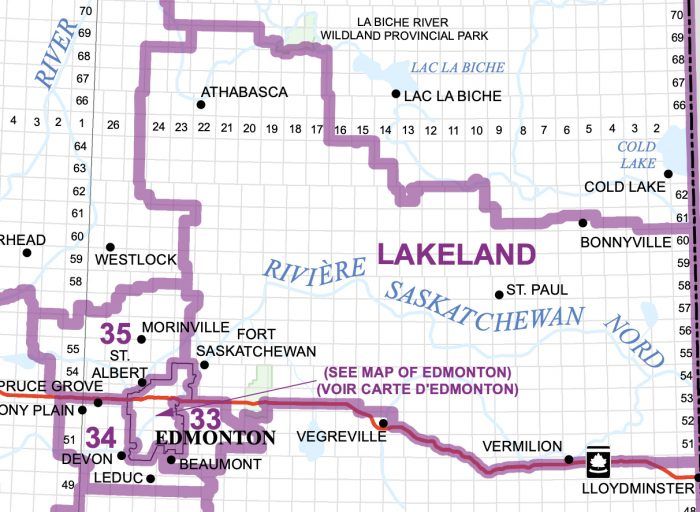

How Federal Riding Redistributions Will Impact Edmonton Voters

May 09, 2025

How Federal Riding Redistributions Will Impact Edmonton Voters

May 09, 2025 -

Franco Colapintos Drive To Survive Controversy The Deleted Message Revealed

May 09, 2025

Franco Colapintos Drive To Survive Controversy The Deleted Message Revealed

May 09, 2025 -

Anchorage Welcomes Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

Anchorage Welcomes Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025 -

U S And China Seek Trade De Escalation Key Developments This Week

May 09, 2025

U S And China Seek Trade De Escalation Key Developments This Week

May 09, 2025 -

Beyonces Cowboy Carter Streams Double Following Tour Kickoff

May 09, 2025

Beyonces Cowboy Carter Streams Double Following Tour Kickoff

May 09, 2025