Should You Buy Palantir Technologies Stock In 2024?

Table of Contents

Palantir Technologies' Financial Performance and Growth Prospects

Assessing Palantir's financial health is crucial for any investment decision. Analyzing recent quarterly and annual reports reveals key trends in its financial performance, providing insights into its growth trajectory. Examining metrics like revenue growth, profitability (gross margin, operating margin, net income), cash flow, and debt levels paints a picture of the company's financial strength and stability.

-

Revenue Growth Rate: Comparing Palantir's revenue growth rate to previous years and industry competitors reveals its competitive position and overall market performance. Sustained high growth rates suggest a healthy business model, while declining rates may signal potential challenges.

-

Profitability Analysis: Analyzing Palantir's profitability – gross margin, operating margin, and net income – helps gauge its efficiency and ability to generate profits. Improving profitability indicates stronger operational management and increasing market competitiveness.

-

Debt Levels and Cash Reserves: A review of Palantir's debt levels and cash reserves helps assess its financial stability and ability to withstand economic downturns. Healthy cash reserves provide a buffer against unexpected expenses and allow for strategic investments.

-

Future Revenue Growth: Analyst predictions for Palantir's future revenue growth offer a forward-looking perspective. These predictions, while not guarantees, provide valuable insights into the market's expectation of the company's future performance. However, it's crucial to remember that these predictions are subject to change based on various market factors. Careful analysis of these factors is crucial to making an informed decision. Considering Palantir financials in conjunction with these predictions will offer a comprehensive view on the potential of PLTR earnings.

Market Position and Competitive Landscape

Palantir's success hinges on its ability to maintain a competitive edge in the data analytics and AI market. Its proprietary technology, strong government contracts, and impressive customer base provide significant advantages. However, understanding the competitive landscape is equally important.

-

Key Competitors: Identifying key competitors such as AWS, Microsoft Azure, and Google Cloud helps to understand Palantir's market share and its relative strength.

-

Market Share: Assessing Palantir's market share in key sectors (government, commercial) provides insights into its dominance and potential for further growth.

-

Technological Advantage: Analyzing Palantir's technological advantage and its sustainability is vital. This includes evaluating the uniqueness of its platform, the difficulty of replication, and the potential for disruption by newer technologies.

-

Market Disruption: Evaluating the potential for market disruption and emergence of new competitive threats is essential for a complete risk assessment. New players entering the market could erode Palantir's market share and hinder its growth.

Risk Assessment and Potential Downsides of Investing in Palantir Stock

Investing in Palantir stock presents certain risks that potential investors must carefully consider. The company's inherent volatility, dependence on government contracts, and the competitive nature of the data analytics market all contribute to the overall risk profile.

-

Stock Price Volatility: PLTR stock has historically shown significant volatility. Investors need to be comfortable with potential fluctuations in stock price.

-

Government Contracts Risk: A significant portion of Palantir's revenue comes from government contracts, which are subject to changes in government priorities and regulatory hurdles.

-

Increased Competition: The data analytics and AI market is increasingly competitive. The entry of new players or the expansion of existing ones could negatively impact Palantir's market share and revenue.

-

Economic Downturns: Economic downturns can significantly impact Palantir's business, potentially reducing demand for its services.

Future Outlook and Long-Term Investment Potential

Despite the risks, the long-term growth potential of the big data and AI market remains considerable. Palantir's strategic initiatives, new product development, and expansion into new markets suggest significant potential for future growth.

-

Market Growth: The projected growth of the big data and AI market indicates the vast potential for companies like Palantir.

-

Strategic Initiatives: Palantir's strategic initiatives aimed at expanding its product offerings and market reach will significantly affect its future growth prospects.

-

New Product Launches and Market Expansions: New product launches and expansion into new markets will be important factors in Palantir's future growth.

-

Long-Term Stock Price Projections: Although long-term stock price projections are inherently uncertain, it’s important to study analyst projections to better understand the possible future scenarios.

Conclusion: Should You Invest in Palantir Technologies Stock in 2024?

Palantir Technologies presents a compelling investment opportunity due to its position in the rapidly expanding big data and AI market. However, the significant volatility and dependence on government contracts necessitate a cautious approach. While the company's financial performance and market position show potential for growth, investors must carefully weigh the potential benefits against the inherent risks. Based on the analysis presented, further research is recommended before making an investment decision. Remember to always consult a financial advisor before making investment decisions. Invest in Palantir wisely, considering your own risk tolerance and investment goals.

Featured Posts

-

Ostraya Polemika King Protiv Trampa I Maska

May 09, 2025

Ostraya Polemika King Protiv Trampa I Maska

May 09, 2025 -

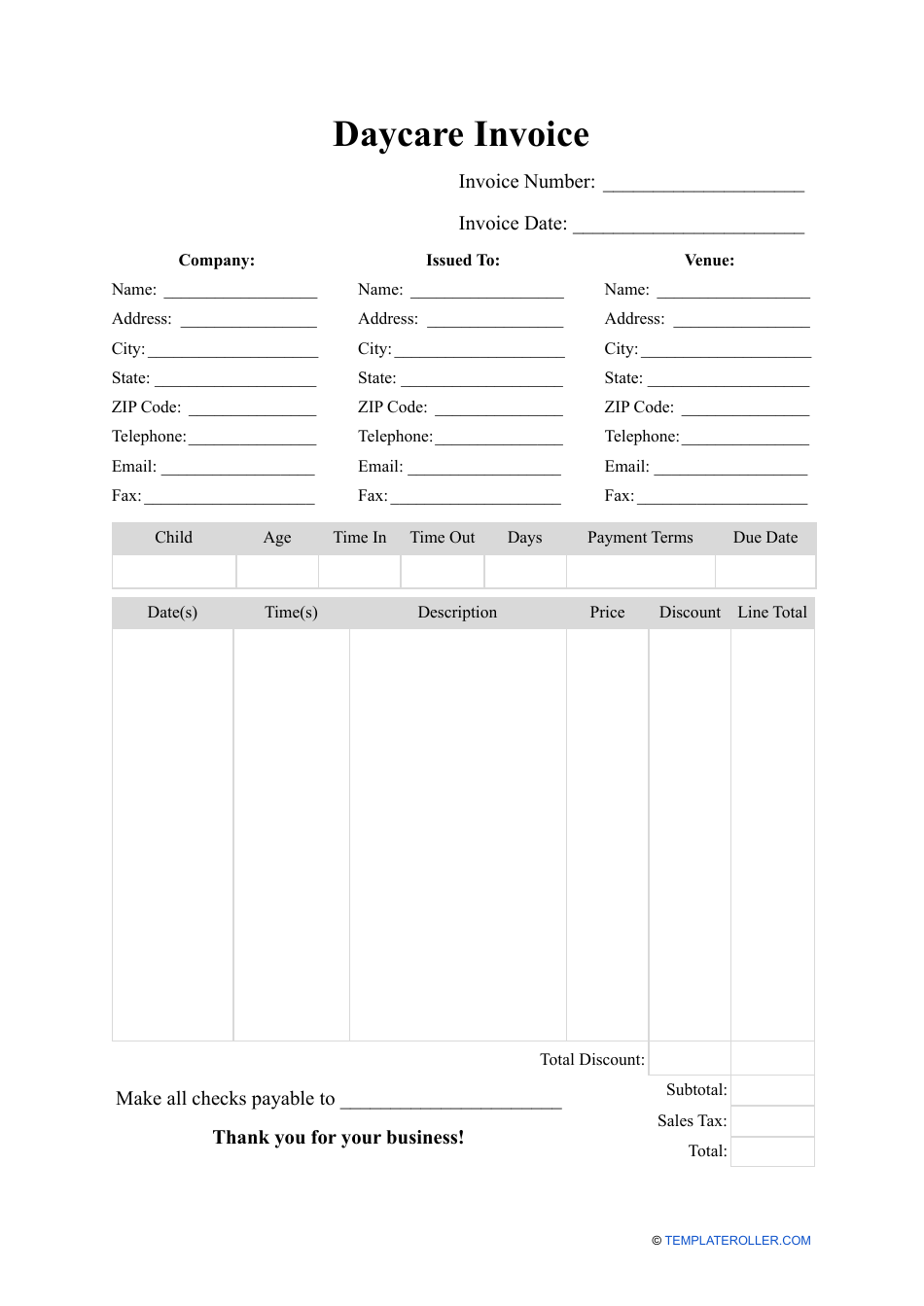

3 K Babysitter Cost Leads To 3 6 K Daycare Bill One Mans Expensive Lesson

May 09, 2025

3 K Babysitter Cost Leads To 3 6 K Daycare Bill One Mans Expensive Lesson

May 09, 2025 -

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025 -

Potential Uk Visa Crackdown Pakistan Nigeria And Sri Lanka Affected

May 09, 2025

Potential Uk Visa Crackdown Pakistan Nigeria And Sri Lanka Affected

May 09, 2025 -

Dali Bekam E Na Dobar Fudbaler Na Site Vreminja

May 09, 2025

Dali Bekam E Na Dobar Fudbaler Na Site Vreminja

May 09, 2025