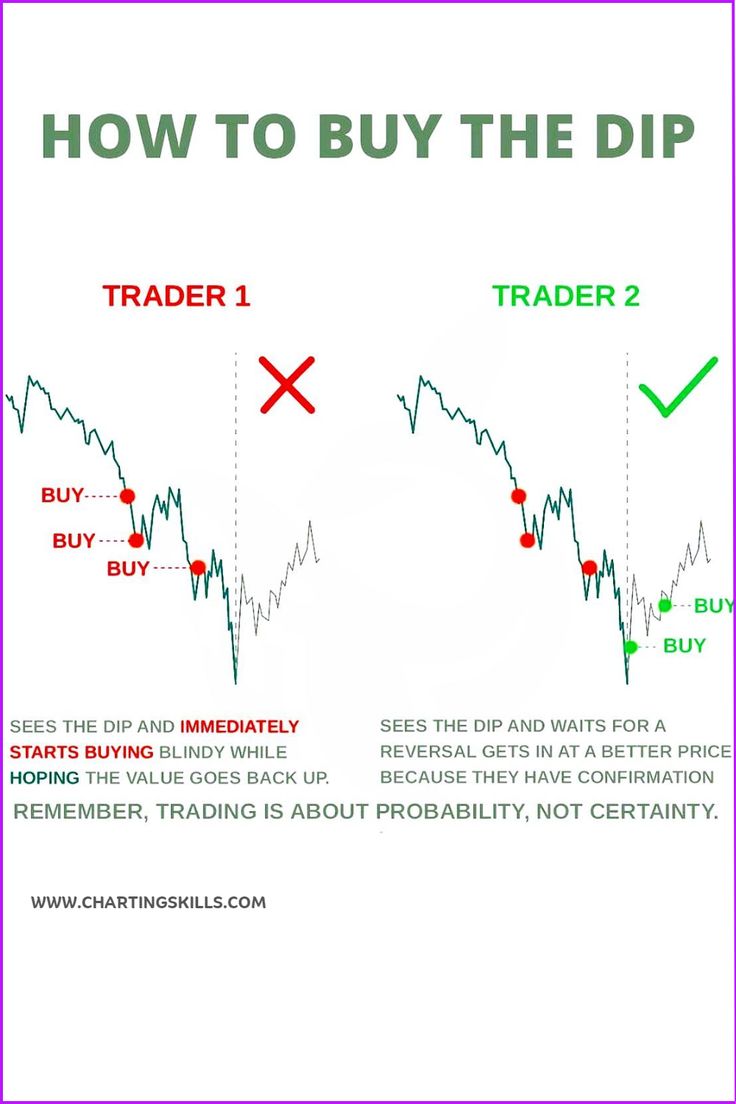

Should You Buy The Dip In This Promising Entertainment Stock?

Table of Contents

Understanding the Current Market Conditions for Entertainment Stocks

Macroeconomic Factors

Broader economic trends significantly influence the entertainment industry's performance. Current macroeconomic headwinds, such as persistent inflation and lingering recession fears, impact consumer spending. This decreased discretionary income directly affects entertainment consumption, including movie tickets, streaming subscriptions, and video game purchases.

- Inflation's Impact: Rising prices reduce consumer purchasing power, potentially leading to a decrease in demand for entertainment services. For example, a recent report from the Bureau of Labor Statistics showed a X% increase in entertainment costs year-over-year.

- Recessionary Concerns: Uncertainty surrounding a potential recession causes consumers to tighten their budgets, prioritizing essential spending over entertainment. This can negatively impact subscription renewals and new customer acquisition for streaming platforms.

- Interest Rate Hikes: Increased interest rates impact the cost of borrowing for entertainment companies, potentially hindering investment in new projects and expansions.

Industry-Specific Trends

The entertainment sector is dynamic, shaped by ongoing trends like the "streaming wars" and evolving consumer preferences.

- Streaming Competition: Intense competition among streaming platforms impacts subscriber growth and profitability for individual companies. XYZ Entertainment faces competition from established giants like Netflix and Disney+, as well as newer entrants. Their success hinges on delivering high-quality content that differentiates them.

- Box Office Performance: The recovery of box office revenue post-pandemic remains uneven. Successful theatrical releases are crucial for generating revenue and building brand awareness for studios. XYZ Entertainment's recent box office performance will be a key factor to consider.

- Advertising Revenue: Advertising revenue is another important revenue stream for many entertainment companies. Economic downturns can lead to reduced advertising spending, impacting overall revenue.

Competitor Analysis

XYZ Entertainment competes with several major players in the entertainment industry.

- Netflix: A dominant player with a massive subscriber base and extensive content library.

- Disney+: A strong competitor with a portfolio of popular franchises and family-friendly content.

- Amazon Prime Video: A growing competitor offering original content and leveraging its vast e-commerce ecosystem.

Analyzing their market share, recent financial performance, and strategic initiatives helps to gauge XYZ Entertainment's relative position and future prospects within the competitive landscape.

Analyzing the Promising Entertainment Stock's Fundamentals

Financial Performance

A thorough examination of XYZ Entertainment's financial health is crucial.

- Revenue Growth: Consistent revenue growth indicates strong performance and market demand for its products. Analysis of year-over-year and quarter-over-quarter revenue changes is essential.

- Profitability: Profit margins reveal the company's efficiency in generating profits from its revenue. Key metrics include gross profit margin and net profit margin.

- Debt Levels: High debt levels can indicate financial risk. Analyzing the company's debt-to-equity ratio and interest coverage ratio helps assess its financial stability. A visual representation of these metrics through charts and graphs is highly beneficial.

Future Growth Prospects

XYZ Entertainment's future growth depends on several factors.

- Upcoming Releases: Highly anticipated movie releases and new streaming content can significantly impact future revenue.

- Strategic Partnerships: Collaborations with other companies can expand market reach and generate new revenue streams.

- Expansion Plans: Plans for international expansion or diversification into new areas can contribute to growth.

- Technological Advancements: Investment in new technologies, such as immersive experiences or AI-powered content creation, can drive future growth.

Risk Assessment

Potential risks and challenges must be considered.

- Competition: The intense competition in the entertainment industry poses a significant risk.

- Regulatory Changes: Changes in regulations related to streaming content or intellectual property can impact operations.

- Production Delays: Delays in production can lead to missed revenue opportunities.

- Economic Downturn: A prolonged economic downturn could significantly impact consumer spending on entertainment.

Determining if Buying the Dip is the Right Strategy

Valuation

Determining whether the current stock price reflects the company's true value is crucial.

- Price-to-Earnings Ratio (P/E): Comparing XYZ Entertainment's P/E ratio to its historical average and to industry peers provides insight into its valuation.

- Discounted Cash Flow (DCF) Analysis: A more sophisticated valuation method that considers future cash flows to estimate the intrinsic value of the stock.

Investment Timeline

The appropriate investment timeframe depends on individual risk tolerance and investment goals.

- Short-Term Investment: A short-term investment strategy involves buying the stock expecting a quick price rebound. This entails higher risk.

- Long-Term Investment: A long-term strategy focuses on the company's long-term growth potential. This approach mitigates short-term market volatility.

Diversification

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket! Spread your investments across various asset classes and sectors to reduce overall portfolio volatility.

Conclusion

Deciding whether to buy the dip in XYZ Entertainment's stock requires a careful consideration of the current market conditions, the company's fundamentals, and individual investment goals. While the recent downturn presents a potential buying opportunity for long-term investors, thorough due diligence is crucial. The analysis reveals both opportunities and challenges, highlighting the need to assess the company's growth prospects, risk factors, and valuation relative to its peers. Before you decide to buy the dip in this promising entertainment stock, conduct your own thorough research and consider seeking advice from a qualified financial advisor. Remember, investing always involves risk, and long-term prospects and risk tolerance should guide your investment decisions.

Featured Posts

-

Billboards Guide To The Top Music Lawyers In 2025

May 29, 2025

Billboards Guide To The Top Music Lawyers In 2025

May 29, 2025 -

Altfawl Alardny Drast Latfaqyat Almyah Almubrmt Me Swrya

May 29, 2025

Altfawl Alardny Drast Latfaqyat Almyah Almubrmt Me Swrya

May 29, 2025 -

Kreuzung Mit Kick Verkehrschaos Am Westcenter In Bickendorf

May 29, 2025

Kreuzung Mit Kick Verkehrschaos Am Westcenter In Bickendorf

May 29, 2025 -

Joshlin Sale Smiths Denial And Accusations Against Lombaard And Letoni

May 29, 2025

Joshlin Sale Smiths Denial And Accusations Against Lombaard And Letoni

May 29, 2025 -

Pokemon Tcg Game Stop Imposes One Per Customer Buying Restriction

May 29, 2025

Pokemon Tcg Game Stop Imposes One Per Customer Buying Restriction

May 29, 2025