Should You Buy This AI Quantum Computing Stock? One Key Reason

Table of Contents

The Technological Advantage: Assessing IonQ's Quantum Computing Capabilities

IonQ's success hinges on its technological prowess within the fiercely competitive AI quantum computing landscape. Let's examine its key strengths and weaknesses.

Quantum Algorithm Development & Patents

IonQ boasts a significant portfolio of quantum algorithms, crucial for realizing the practical applications of quantum computing. Their research and development efforts are evidenced by:

- A growing number of patents: Protecting their innovative approaches to quantum algorithm design.

- Strategic partnerships with leading research institutions: Facilitating collaborative research and development efforts.

- A strong publication record in peer-reviewed journals: Demonstrating their commitment to pushing the boundaries of the field and establishing credibility within the scientific community. This contributes significantly to their reputation and attractiveness as an AI quantum computing investment.

Hardware Infrastructure & Scalability

IonQ's trapped ion technology offers a compelling pathway towards building scalable and fault-tolerant quantum computers. Key features include:

- High-fidelity qubits: Achieving high qubit coherence times, essential for accurate computation.

- Modular architecture: Enabling scalability to a larger number of qubits.

- Significant investments in infrastructure: Supporting continuous improvement and expansion of their quantum computing hardware capabilities. This makes IonQ a compelling AI quantum computing stock for investors focused on hardware advancements.

Competitive Landscape

IonQ faces stiff competition from other players in the AI quantum computing market, including companies developing superconducting qubit technology and other approaches. However, IonQ's trapped ion technology offers several potential advantages:

- Superior qubit coherence times compared to some competitors: Leading to potentially more accurate calculations.

- Scalability potential through modular design: Offering a path towards larger, more powerful quantum computers.

- Strong intellectual property portfolio: Protecting its innovations and providing a competitive edge.

Market Potential and Disruption: The Future of AI Quantum Computing

The potential market for AI quantum computing is vast and rapidly expanding.

Addressable Market Size

Market research suggests that the global quantum computing market will experience substantial growth in the coming years, reaching hundreds of billions of dollars. This presents a significant opportunity for companies like IonQ.

- Multiple reports project exponential growth: Indicating a considerable market opportunity for early entrants like IonQ.

- Growing interest from various industries: Driving demand for quantum computing solutions in diverse sectors. This broad market appeal makes IonQ an attractive AI quantum computing stock.

Potential Applications

IonQ's technology holds immense potential across numerous industries:

- Drug discovery and materials science: Accelerating research and development through significantly faster simulations.

- Financial modeling and optimization: Improving efficiency and accuracy in financial markets.

- Artificial intelligence and machine learning: Boosting the capabilities of AI algorithms. This wide range of potential applications strengthens the case for IonQ as a leading AI quantum computing stock.

Early Adoption and First-Mover Advantage

IonQ's early entry into the market and strategic partnerships provide a potential first-mover advantage:

- Early establishment of a customer base: Providing valuable feedback and driving further development.

- Strong partnerships with key players in various industries: Expanding market reach and application development.

- Technological barriers to entry: Making it difficult for new entrants to quickly catch up.

Financial Performance and Risk Assessment

While IonQ's technological promise is enticing, a realistic assessment of financial health and associated risks is crucial for any potential investor.

Financial Health

IonQ, like many young technology companies, is currently operating at a loss. However, investors should analyze:

- Revenue growth trajectory: Looking for signs of increasing market acceptance and adoption of their technology.

- Strategic partnerships and funding rounds: Indicating ongoing support and investment in the company's growth.

- Operating expenses and efficiency improvements: Assessing the company's ability to manage costs effectively.

Investment Risks

Investing in IonQ, like any AI quantum computing stock, carries substantial risks:

- Technological uncertainty: The field is still in its early stages, and technological breakthroughs are not guaranteed.

- Intense competition: Several other companies are vying for market share in the quantum computing space.

- Regulatory hurdles: Government regulations and policies could impact the development and adoption of quantum computing technologies. This requires careful consideration before investing in any AI quantum computing stock.

Conclusion

IonQ's technological leadership, particularly its trapped ion technology and advanced quantum algorithm development, represents a compelling reason to consider this AI quantum computing stock. However, the significant market potential must be weighed against the considerable financial and technological risks inherent in this emerging field. While this analysis focuses on IonQ's technological leadership, remember to conduct thorough due diligence before investing in any AI quantum computing stock, including IonQ. Understanding the risks and rewards is crucial for smart investment decisions. The potential returns in the AI quantum computing sector are substantial, but only careful analysis of companies like IonQ will help you navigate the complexities of this exciting new market and find the best quantum computing investment opportunities.

Featured Posts

-

Uk Taxpayers Locked Out Major Hmrc Website Outage

May 20, 2025

Uk Taxpayers Locked Out Major Hmrc Website Outage

May 20, 2025 -

T Helei To Mls Ton Giakoymaki Eksetazontas Tin Pithanotita Epistrofis

May 20, 2025

T Helei To Mls Ton Giakoymaki Eksetazontas Tin Pithanotita Epistrofis

May 20, 2025 -

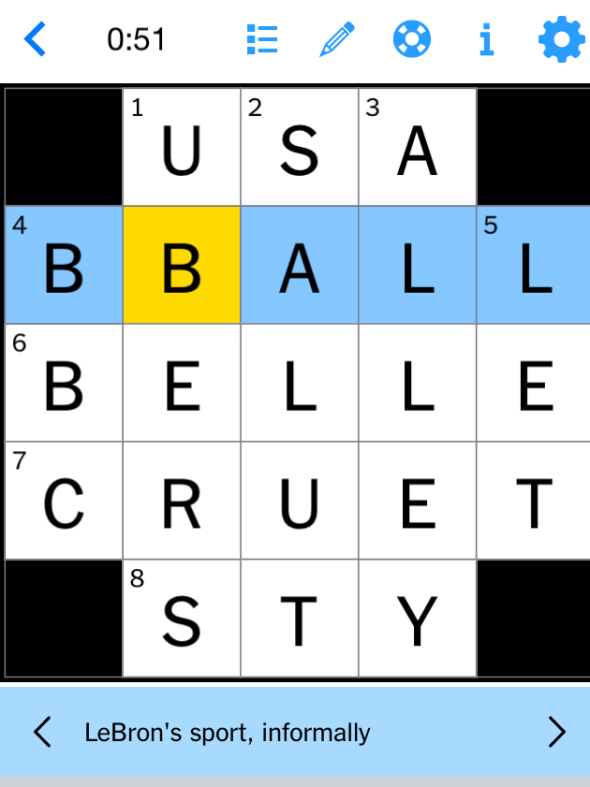

Get The Answers Nyt Mini Crossword March 26 2025

May 20, 2025

Get The Answers Nyt Mini Crossword March 26 2025

May 20, 2025 -

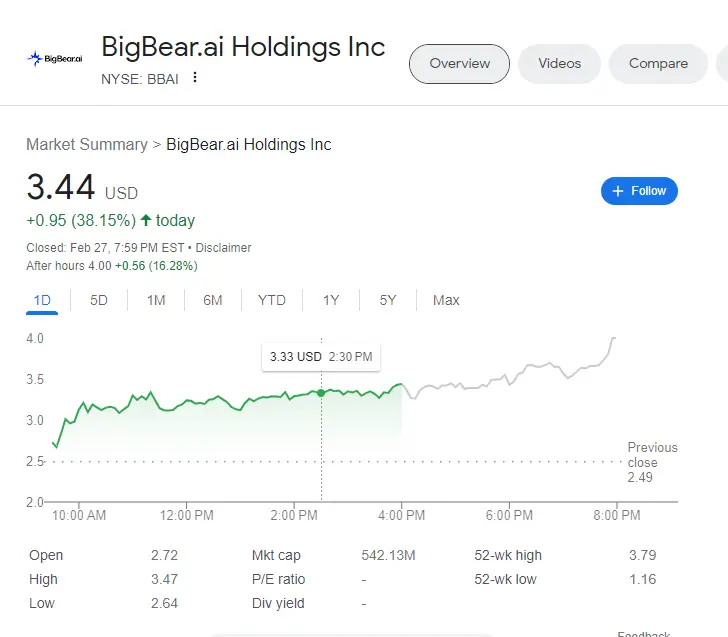

Big Bear Ai Stock Current Market Analysis And Future Outlook

May 20, 2025

Big Bear Ai Stock Current Market Analysis And Future Outlook

May 20, 2025 -

Patra Efimeries Giatron Gia To Savvatokyriako 10 11 Maioy 2024

May 20, 2025

Patra Efimeries Giatron Gia To Savvatokyriako 10 11 Maioy 2024

May 20, 2025