Should You Follow Wedbush's Bullish Apple Stance After Price Target Drop?

Table of Contents

Wedbush's Initial Bullish Prediction and its Rationale

Wedbush Securities initially held a highly bullish Apple stock prediction, citing several key factors driving their optimistic forecast. Their original Wedbush Apple Price Target was significantly higher than the current market price, reflecting a strong belief in Apple's continued growth. This bullish Apple outlook stemmed from a confluence of positive indicators within Apple's business model.

- Key factors cited by Wedbush for their initial bullish stance: Strong iPhone sales, particularly within the premium segment; robust growth in Apple's services revenue, including subscriptions like Apple Music and iCloud; and anticipated success of new product launches.

- Specific sales figures or market projections used in their analysis: While the exact figures may vary depending on the specific report, Wedbush's projections generally pointed toward continued year-over-year growth in key product categories. Their analysis likely incorporated market share data and projected consumer spending patterns.

- Mention any specific Apple products or services that drove their prediction: The iPhone consistently remained a focal point, with the expectation of strong sales of the latest models driving a large portion of their bullish Apple Price Target. The ongoing expansion and increasing profitability of Apple's Services segment were also highlighted. New product categories like wearables (Apple Watch and AirPods) were also contributing factors in their initial Apple Stock Prediction.

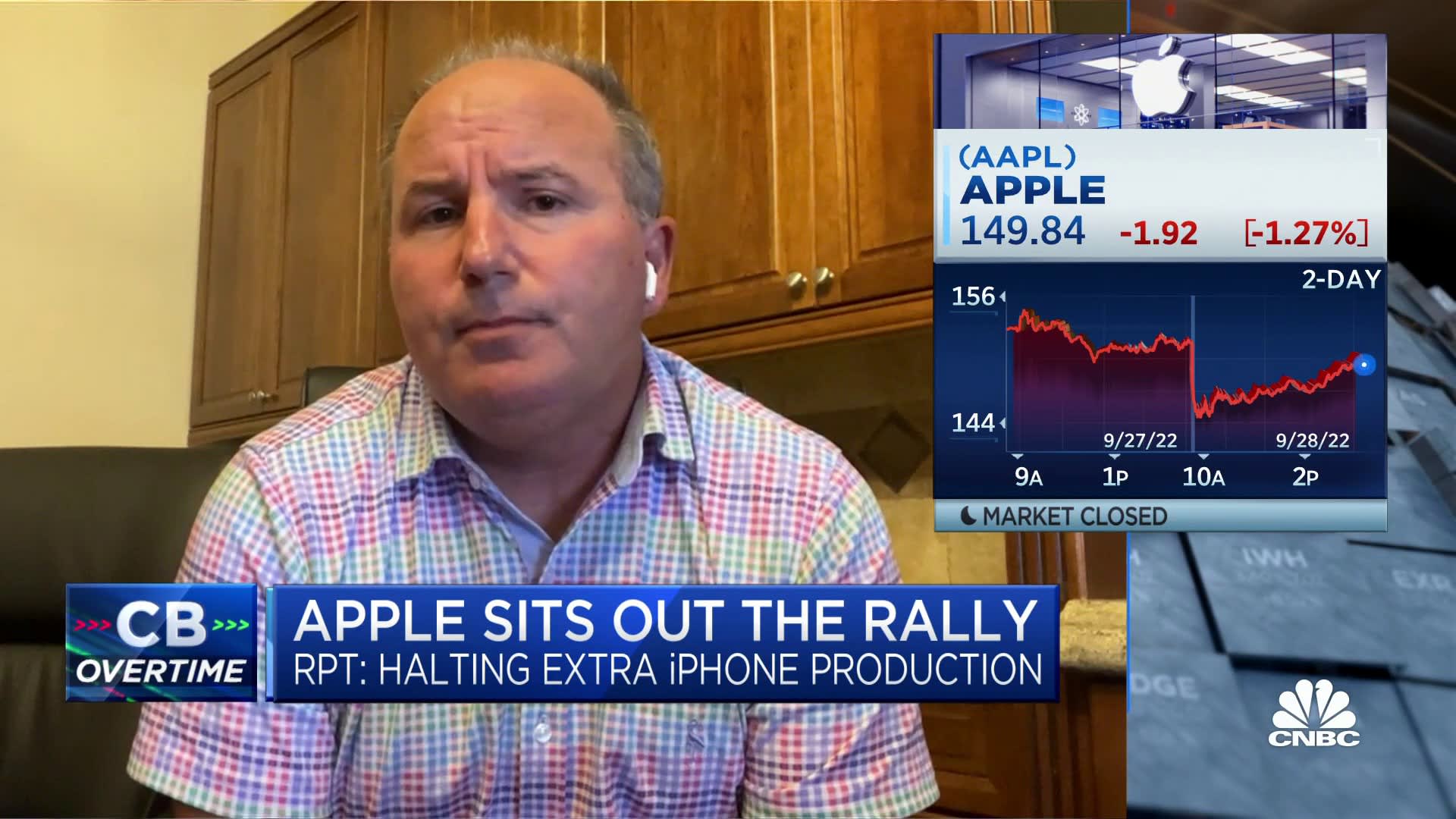

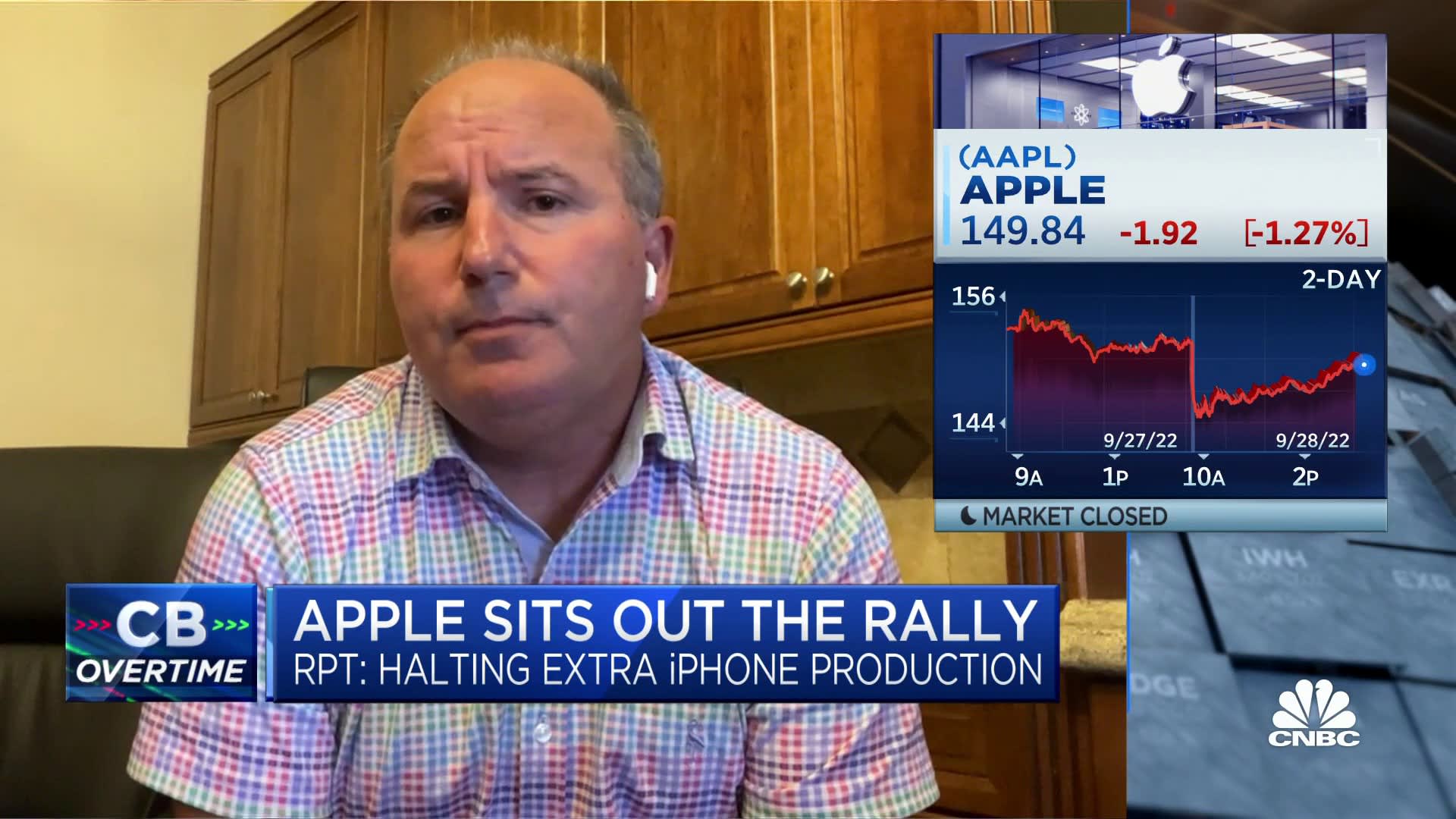

The Recent Price Target Drop: Reasons and Implications

Wedbush's recent decision to lower their Apple price target represents a significant shift in their outlook. This Apple Price Target Drop signals a more cautious stance towards the company's near-term prospects. The reduction reflects several factors that have emerged since their initial bullish prediction.

- Specific factors that contributed to the price target reduction: Macroeconomic headwinds, including inflation and potential recessionary concerns, played a significant role. Supply chain disruptions and increased competition in certain market segments also likely factored into their revised prediction.

- Impact on investor sentiment and trading volume: The downward revision had a noticeable impact on investor sentiment, leading to increased volatility in Apple's stock price. Trading volume likely spiked around the announcement, reflecting investors' reaction to the news.

- Comparison with other analyst predictions: It's crucial to compare Wedbush's revised Apple Stock Price Forecast with the predictions of other prominent analysts. A divergence in opinions can provide a more nuanced understanding of the overall market sentiment.

Evaluating the Long-Term Outlook for Apple

Despite the recent price target drop, Apple’s long-term fundamentals remain relatively strong. Analyzing Apple's long-term growth potential requires a balanced perspective, considering both the current challenges and the company’s inherent strengths.

- Strengths of Apple's business model: Apple benefits from a powerful brand, a loyal customer base, and a strong ecosystem of products and services. Its high profit margins and substantial cash reserves provide a cushion against economic downturns.

- Potential risks and challenges for Apple: Increased competition, particularly from Android manufacturers, and potential regulatory scrutiny pose significant challenges. Economic slowdowns could also dampen consumer spending, affecting Apple's sales.

- Long-term growth projections and market analysis: Despite near-term headwinds, Apple's long-term growth prospects remain promising, driven by continued innovation in existing product categories and the exploration of new markets and technologies.

Should You Still Maintain a Bullish Stance? Weighing the Risks and Rewards

The question of whether to maintain a bullish stance on Apple after Wedbush's price target revision is complex and depends heavily on individual risk tolerance and investment strategy.

- Arguments for maintaining a bullish position: Apple’s long-term fundamentals remain strong, and the price drop may present a buying opportunity for long-term investors. The company's history of innovation and market leadership suggests a potential rebound.

- Arguments for adopting a more cautious approach: The current macroeconomic environment poses risks, and Apple is not immune to economic slowdowns. Competitor activity and potential regulatory challenges warrant caution.

- Recommendations based on different risk profiles: Conservative investors may want to adopt a wait-and-see approach, while more aggressive investors might view the price drop as an attractive entry point. Diversification is always recommended to mitigate risk.

Conclusion: Making Informed Decisions about Wedbush's Apple Stance

Should you follow Wedbush's bullish Apple stance after the price target drop? The answer is nuanced. While Wedbush's initial bullish Apple outlook was compelling, the subsequent price target reduction reflects legitimate concerns. It's crucial to consider both the bullish and bearish arguments, understand the risks and rewards, and conduct thorough due diligence. This requires examining Apple’s financial reports, considering the broader macroeconomic environment, and understanding your own risk tolerance. Before making any investment decisions related to Wedbush's Apple stance or Apple stock in general, perform your own in-depth research, perhaps consulting with a financial advisor. Don't solely rely on a single analyst's prediction; develop your own informed perspective on the future of Apple.

Featured Posts

-

Understanding Flash Floods Flood Warnings And Safety Measures

May 25, 2025

Understanding Flash Floods Flood Warnings And Safety Measures

May 25, 2025 -

Escape To The Country Financing Your Rural Property Purchase

May 25, 2025

Escape To The Country Financing Your Rural Property Purchase

May 25, 2025 -

Zheng Returns To Rome Last 16 Victory Against Frech

May 25, 2025

Zheng Returns To Rome Last 16 Victory Against Frech

May 25, 2025 -

Kyle And Teddis Explosive Argument A Dog Walker Dispute

May 25, 2025

Kyle And Teddis Explosive Argument A Dog Walker Dispute

May 25, 2025 -

Myrtle Beach Welcomes Worlds Largest Rubber Duck A Special Announcement

May 25, 2025

Myrtle Beach Welcomes Worlds Largest Rubber Duck A Special Announcement

May 25, 2025